Wednesday, March 13, 2019

The supply and logistics situation in the propane industry is strong — perhaps the best in 10 years — but marketers must remain vigilant and watch for changes. Complacency can be dangerous. Those were messages delivered last February during a meeting of the National Propane Gas Association (NPGA) Propane Supply and Logistics Committee in Charleston, S.C.

“It’s been a good year, really good,” Stephen Kossuth, operations vice president at AmeriGas Propane LP and chair of the committee, said during the meeting. “In terms of supply and logistics, it’s been almost a boring year. There is more supply and the logistics market is handling the challenge of moving it the last mile. For the first time in 10 years, there have been no problems to talk about when it comes to the three tenets of propane: that it’s a safe, reliable, affordable product.”

At the same time, he and others at the meeting said, marketers must watch for problems that may arise in the future. Among the concerns raised were the possibility that more supply could go to exports and use as chemical feedstock and that logistics could be complicated by a shortage of commercial truck drivers.

In a U.S. Supply Update presented at the meeting by Debnil Chowdhury, executive director, IHS Markit, oil, midstream, downstream, and chemicals research, he too said supply and inventory have been sufficient to handle demand. Summarizing current trends he sees, Chowdhury said supply will continue to grow, chemical demand will increase, and exports will rise. But, in sum, supply will overtake demand.

In his presentation, Chowdhury summarized the key propane topics for 2019-2020 as follows:

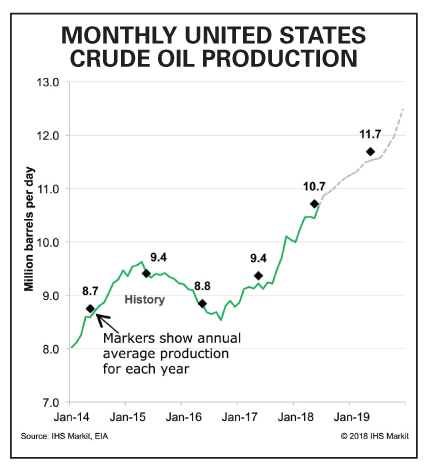

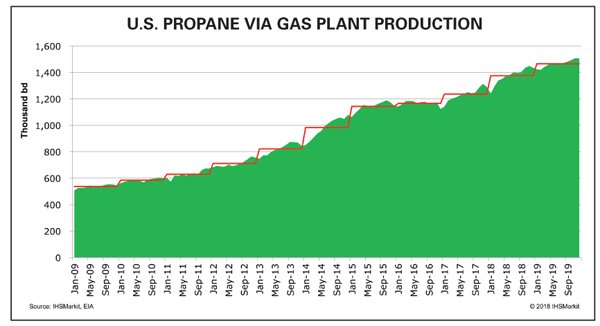

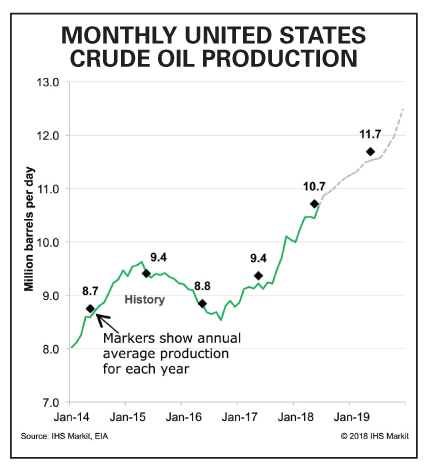

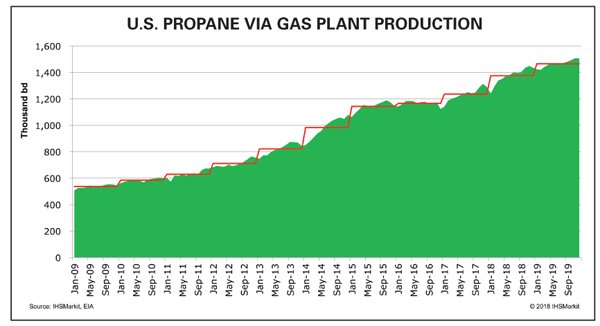

Supply: U.S. crude oil production saw a record surge in 2018, and IHS Markit forecasts that output will continue to grow through 2020. “We are often asked if lower crude prices are going to cause slower supply growth. No, not at $50 to $60/bbl,” Chowdhury said. “At $35 to $40/bbl, that is where we see less production of crude.” The production of natural gas, too, is expected to keep growing. Permian gas supply is expected to more than double from 2017 to 2023. “Propane production in gas plants is expected to continue to grow through 2020 and beyond,” he said.

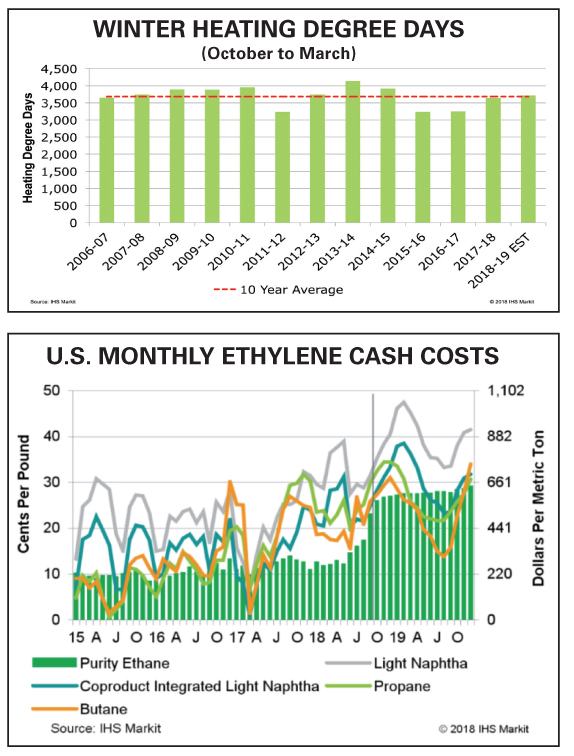

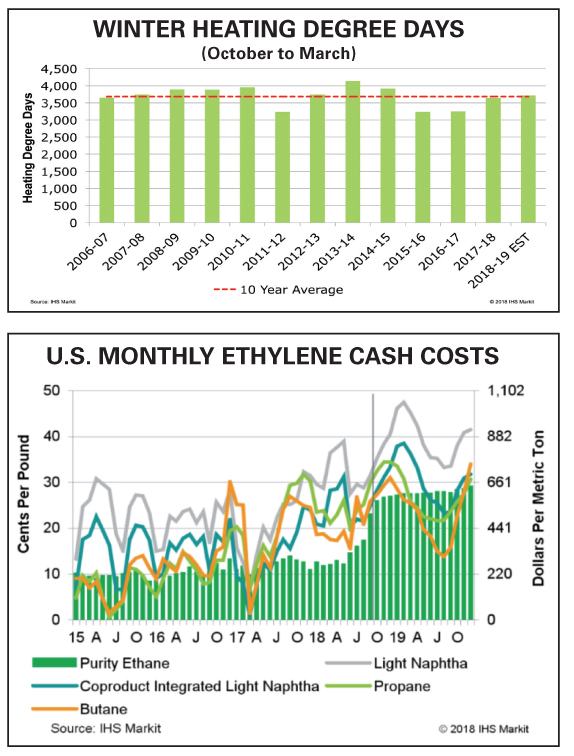

Demand: The winter of 2018-2019 is expected to be cooler than average. The number of winter (October to March) heating degree days are expected to be higher than the 10-year average and the highest since the winter of 2014-2015. Crop drying demand is forecast to be relatively average this harvest season, as it was this past season. Demand for propane as a chemical feedstock is expected to increase as the cost of ethane rises over the summer. “The real demand is from chemicals,” Chowdhury said. “Strong demand for propane as a feedstock is expected in the second half of the year.”

Exports: Global demand continues to increase. LPG terminal export capacity had been getting tight, but that concern has been pushed out in time by Enterprise Products’ announcement that it intends to increase its export capacity by 30% by the second half of this year.

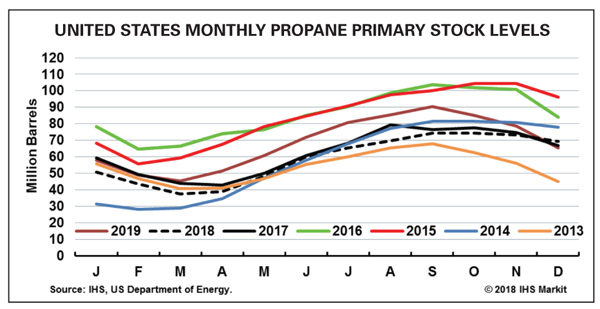

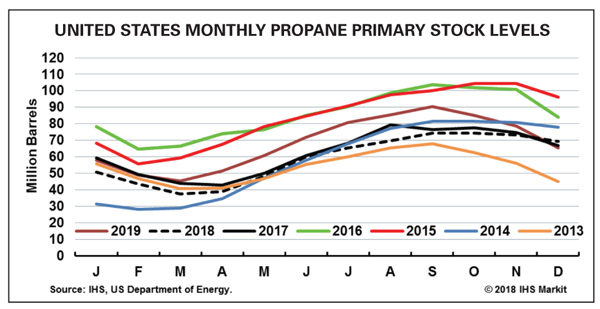

Inventories: East Coast (PADD 1) propane stocks should be monitored as new export capacity comes online. “Many ask us for our view of Mariner East 2,” Chowdhury said. “I think we should watch what is happening with that terminal. If you are in PADD 1, keep your inventory high in case the terminal increases exports.” A rise in exports will increase the need for interPADD transfers. Nationwide, propane stocks are in the middle of the range and are expected to be replenished by new supply. “Overall,” he said, “the U.S. is in a relatively safe space in terms of primary stock levels.”

After this presentation, Kossuth added, “We’ve experienced a good winter as an industry, but there is a danger in that. It’s important not to get complacent. Having healthy demand and getting through it unscathed doesn’t mean there’s not work to do.” Both he and Chowdhury said the industry has been making better use of information and is better prepared for challenges in the future.

“We as an industry are having better discussions,” Kossuth explained. “Gone are the days where we used to just show up at a terminal to buy gas; now we have access to more granular data and it is driving improved decisions.” —Steve Relyea

(Butane-Propane News, March 2019)

“It’s been a good year, really good,” Stephen Kossuth, operations vice president at AmeriGas Propane LP and chair of the committee, said during the meeting. “In terms of supply and logistics, it’s been almost a boring year. There is more supply and the logistics market is handling the challenge of moving it the last mile. For the first time in 10 years, there have been no problems to talk about when it comes to the three tenets of propane: that it’s a safe, reliable, affordable product.”

At the same time, he and others at the meeting said, marketers must watch for problems that may arise in the future. Among the concerns raised were the possibility that more supply could go to exports and use as chemical feedstock and that logistics could be complicated by a shortage of commercial truck drivers.

In a U.S. Supply Update presented at the meeting by Debnil Chowdhury, executive director, IHS Markit, oil, midstream, downstream, and chemicals research, he too said supply and inventory have been sufficient to handle demand. Summarizing current trends he sees, Chowdhury said supply will continue to grow, chemical demand will increase, and exports will rise. But, in sum, supply will overtake demand.

In his presentation, Chowdhury summarized the key propane topics for 2019-2020 as follows:

Supply: U.S. crude oil production saw a record surge in 2018, and IHS Markit forecasts that output will continue to grow through 2020. “We are often asked if lower crude prices are going to cause slower supply growth. No, not at $50 to $60/bbl,” Chowdhury said. “At $35 to $40/bbl, that is where we see less production of crude.” The production of natural gas, too, is expected to keep growing. Permian gas supply is expected to more than double from 2017 to 2023. “Propane production in gas plants is expected to continue to grow through 2020 and beyond,” he said.

Demand: The winter of 2018-2019 is expected to be cooler than average. The number of winter (October to March) heating degree days are expected to be higher than the 10-year average and the highest since the winter of 2014-2015. Crop drying demand is forecast to be relatively average this harvest season, as it was this past season. Demand for propane as a chemical feedstock is expected to increase as the cost of ethane rises over the summer. “The real demand is from chemicals,” Chowdhury said. “Strong demand for propane as a feedstock is expected in the second half of the year.”

Exports: Global demand continues to increase. LPG terminal export capacity had been getting tight, but that concern has been pushed out in time by Enterprise Products’ announcement that it intends to increase its export capacity by 30% by the second half of this year.

Inventories: East Coast (PADD 1) propane stocks should be monitored as new export capacity comes online. “Many ask us for our view of Mariner East 2,” Chowdhury said. “I think we should watch what is happening with that terminal. If you are in PADD 1, keep your inventory high in case the terminal increases exports.” A rise in exports will increase the need for interPADD transfers. Nationwide, propane stocks are in the middle of the range and are expected to be replenished by new supply. “Overall,” he said, “the U.S. is in a relatively safe space in terms of primary stock levels.”

After this presentation, Kossuth added, “We’ve experienced a good winter as an industry, but there is a danger in that. It’s important not to get complacent. Having healthy demand and getting through it unscathed doesn’t mean there’s not work to do.” Both he and Chowdhury said the industry has been making better use of information and is better prepared for challenges in the future.

“We as an industry are having better discussions,” Kossuth explained. “Gone are the days where we used to just show up at a terminal to buy gas; now we have access to more granular data and it is driving improved decisions.” —Steve Relyea

(Butane-Propane News, March 2019)