Tuesday, November 12, 2019

(November 12, 2019) — Heading into winter, the industry is in a well-supplied situation. The recent attacks on Saudi oil facilities had no long-term effect and the current supply situation in the U.S. and in each PADD is within recent norms.

So said Darryl Rogers, vice president, midstream oil and NGL at IHS Markit, who presented a U.S. Propane Market Outlook Sept. 29 during the National Propane Gas Association (NPGA) 2019 fall board of directors meetings.

Rogers delivered his presentation 15 days after the Sept. 14 attacks in Saudi Arabia. In it, he looked at the Saudi oil situation and its implications to U.S. propane. He also displayed a history and forecast of five factors that affect the U.S. propane market.

No Long-Term Effects

The Sept. 14 attacks targeted Abqaiq, the world’s largest oil processing facility, and Khurais, Saudi Arabia’s second largest oil field. The initial production loss at the two facilities was 5.7 MMbbld. Abqaiq had a processing capacity of 6 MMbbld to 7 MMbbld and was operating at a rate of 4.5 MMbbld before the attacks. Khurais had a capacity of 1.5 MMbbld and was operating at a rate of 1.2 MMbbld before the attacks.

At the time of Rogers’ presentation, repairs were underway and official estimates were that there would be no reduction of flows of crude to customers.

“Unlike past disruptions, there are now significant supplies and reserves, and a different economic situation,” Rogers told those attending the meeting of NPGA’s propane supply and logistics committee.

The impact to NGL production, based on crude oil wellhead production and IHS Markit’s assessment of the impacted facilities and overall capabilities, was expected to be a loss of 305,000 bbld in September and possibly 208,000 bbld in October depending on the expected timing of a full recovery. The October NGL production impact could be even lower if production ramps up from other supply sources within Saudi Arabia.

“From an NGL perspective, the Saudis say they will ramp up production outside the affected areas,” Rogers explained.

Other production streams/facilities and inventory draws have been offsetting production losses and working toward meeting all export obligations.

In the days immediately after the attacks, Brent oil spiked, as did Mont Belvieu, Middle East, and Far East propane to Brent price ratio. However, the propane market is global, and the Mont Belvieu price after the attacks has been less affected because there are other market factors applying downward pressure on prices. These U.S. market factors include ample storage and U.S. LPG capacity constraints.

Summing up, Rogers said, “How will this affect the price in the U.S.? Overall, there will be some small changes, but nothing long term.”

A Well-Supplied Situation

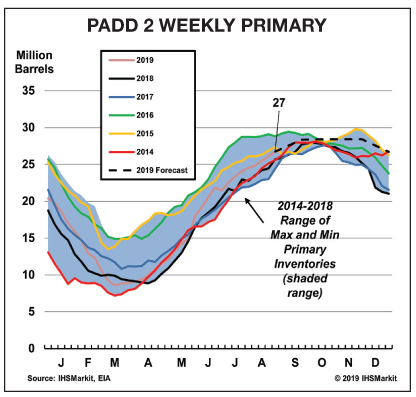

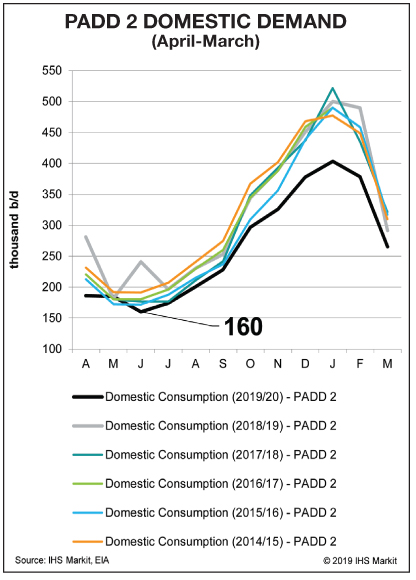

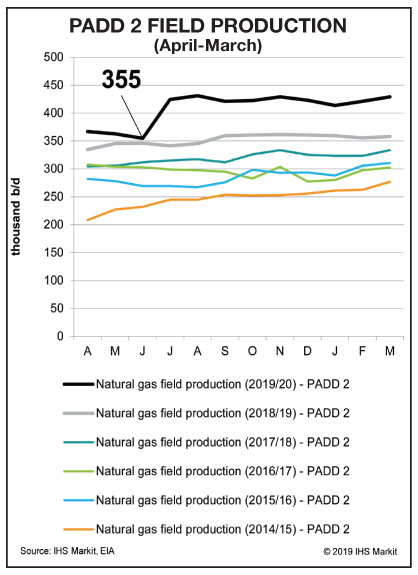

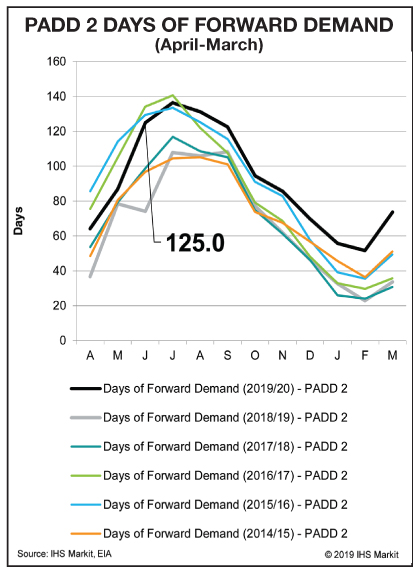

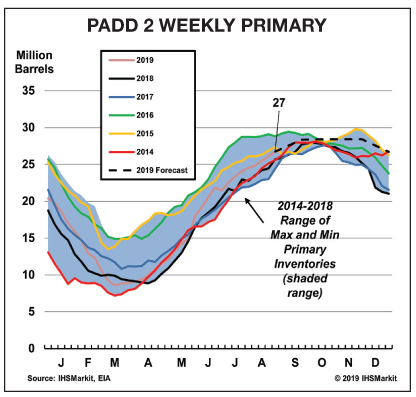

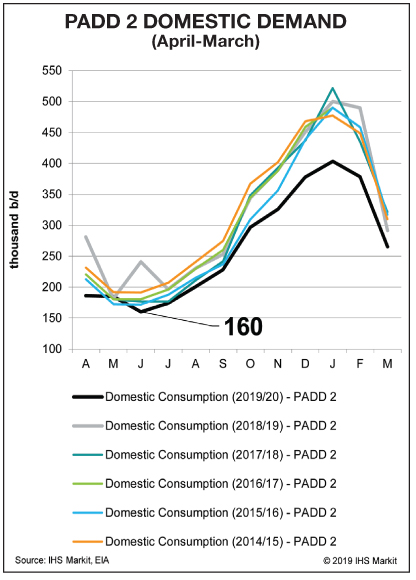

In the second half of his presentation, Rogers looked at the history and forecast for five factors that affect the U.S. propane market: absolute inventory, days of forward demand, field production, domestic demand, and exports. These data were given for the U.S. as a whole and for each of the five PADDs.

In a series of slides, Rogers presented graphs showing the historical data from 2014 through the present as well as forecast data through March 2020.

“We are in a well-supplied situation through 2020, but there are some pockets we need to watch,” Rogers said. “The U.S. is well supplied, but the PADD level could deviate.”

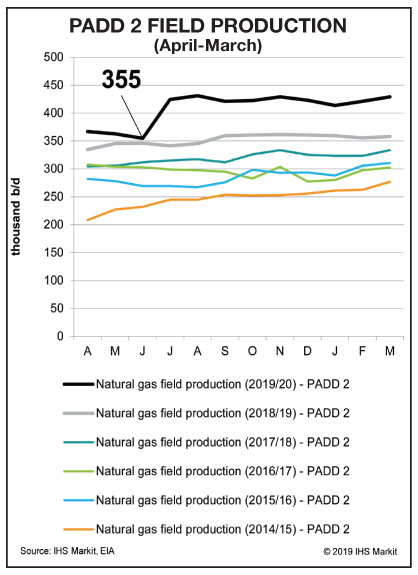

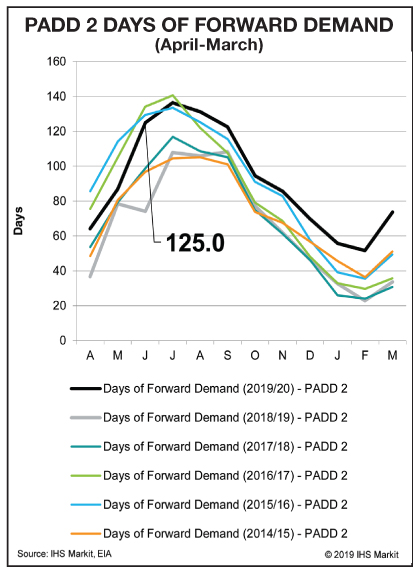

The areas of possible concern are in PADD 2, the Midwest. There, days of forward demand seems well supplied, but in certain scenarios could be lower than expected. Should that be the case, though, it would not be significantly lower than what has been seen historically, Rogers explained. In addition, PADD 2 field production expectation is relatively high, but if it’s not, inventory will be lower than expected.

“That is the only PADD with a higher level of uncertainty as we look from today through the current inventory cycle ending in March 2020,” Rogers said. “It is the only PADD with a slight risk, when we compare today to history.”

The only other forecast that is different from what has been seen in recent years is in PADD 1, the East Coast. There, the days of forward demand is higher than normal. “PADD 1 is extremely oversupplied,” Rogers noted.

“The other PADDs are within historical trends; we don’t see any anomalies,” he concluded.

More Granular Data

The breakdown by PADD was a first for the supply updates presented by representatives of IHS Markit at NPGA board of directors meetings; previous presentations gave figures for the U.S. as a whole. This offering of more granular data is meant to help provide members of the industry with the level of detail that matters to them.

Rogers welcomes feedback on this and other aspects of the supply updates provided to NPGA members by IHS Markit: “We want to hear from members what information they need to be prepared for uncertainty at the PADD level.”

Rogers may be contacted at This email address is being protected from spambots. You need JavaScript enabled to view it.. He also invites BPN readers to email him to receive a free brochure and sample report from IHS Markit’s U.S. NGL Markets Weekly service. The report includes market analysis, supply, demand, and pricing information. For more information about IHS Markit, visit ihsmarkit.com. — Steve Relyea

So said Darryl Rogers, vice president, midstream oil and NGL at IHS Markit, who presented a U.S. Propane Market Outlook Sept. 29 during the National Propane Gas Association (NPGA) 2019 fall board of directors meetings.

Rogers delivered his presentation 15 days after the Sept. 14 attacks in Saudi Arabia. In it, he looked at the Saudi oil situation and its implications to U.S. propane. He also displayed a history and forecast of five factors that affect the U.S. propane market.

No Long-Term Effects

The Sept. 14 attacks targeted Abqaiq, the world’s largest oil processing facility, and Khurais, Saudi Arabia’s second largest oil field. The initial production loss at the two facilities was 5.7 MMbbld. Abqaiq had a processing capacity of 6 MMbbld to 7 MMbbld and was operating at a rate of 4.5 MMbbld before the attacks. Khurais had a capacity of 1.5 MMbbld and was operating at a rate of 1.2 MMbbld before the attacks.

At the time of Rogers’ presentation, repairs were underway and official estimates were that there would be no reduction of flows of crude to customers.

“Unlike past disruptions, there are now significant supplies and reserves, and a different economic situation,” Rogers told those attending the meeting of NPGA’s propane supply and logistics committee.

The impact to NGL production, based on crude oil wellhead production and IHS Markit’s assessment of the impacted facilities and overall capabilities, was expected to be a loss of 305,000 bbld in September and possibly 208,000 bbld in October depending on the expected timing of a full recovery. The October NGL production impact could be even lower if production ramps up from other supply sources within Saudi Arabia.

“From an NGL perspective, the Saudis say they will ramp up production outside the affected areas,” Rogers explained.

Other production streams/facilities and inventory draws have been offsetting production losses and working toward meeting all export obligations.

In the days immediately after the attacks, Brent oil spiked, as did Mont Belvieu, Middle East, and Far East propane to Brent price ratio. However, the propane market is global, and the Mont Belvieu price after the attacks has been less affected because there are other market factors applying downward pressure on prices. These U.S. market factors include ample storage and U.S. LPG capacity constraints.

Summing up, Rogers said, “How will this affect the price in the U.S.? Overall, there will be some small changes, but nothing long term.”

A Well-Supplied Situation

In the second half of his presentation, Rogers looked at the history and forecast for five factors that affect the U.S. propane market: absolute inventory, days of forward demand, field production, domestic demand, and exports. These data were given for the U.S. as a whole and for each of the five PADDs.

In a series of slides, Rogers presented graphs showing the historical data from 2014 through the present as well as forecast data through March 2020.

“We are in a well-supplied situation through 2020, but there are some pockets we need to watch,” Rogers said. “The U.S. is well supplied, but the PADD level could deviate.”

The areas of possible concern are in PADD 2, the Midwest. There, days of forward demand seems well supplied, but in certain scenarios could be lower than expected. Should that be the case, though, it would not be significantly lower than what has been seen historically, Rogers explained. In addition, PADD 2 field production expectation is relatively high, but if it’s not, inventory will be lower than expected.

“That is the only PADD with a higher level of uncertainty as we look from today through the current inventory cycle ending in March 2020,” Rogers said. “It is the only PADD with a slight risk, when we compare today to history.”

The only other forecast that is different from what has been seen in recent years is in PADD 1, the East Coast. There, the days of forward demand is higher than normal. “PADD 1 is extremely oversupplied,” Rogers noted.

“The other PADDs are within historical trends; we don’t see any anomalies,” he concluded.

More Granular Data

The breakdown by PADD was a first for the supply updates presented by representatives of IHS Markit at NPGA board of directors meetings; previous presentations gave figures for the U.S. as a whole. This offering of more granular data is meant to help provide members of the industry with the level of detail that matters to them.

Rogers welcomes feedback on this and other aspects of the supply updates provided to NPGA members by IHS Markit: “We want to hear from members what information they need to be prepared for uncertainty at the PADD level.”

Rogers may be contacted at This email address is being protected from spambots. You need JavaScript enabled to view it.. He also invites BPN readers to email him to receive a free brochure and sample report from IHS Markit’s U.S. NGL Markets Weekly service. The report includes market analysis, supply, demand, and pricing information. For more information about IHS Markit, visit ihsmarkit.com. — Steve Relyea