Tuesday, January 23, 2018

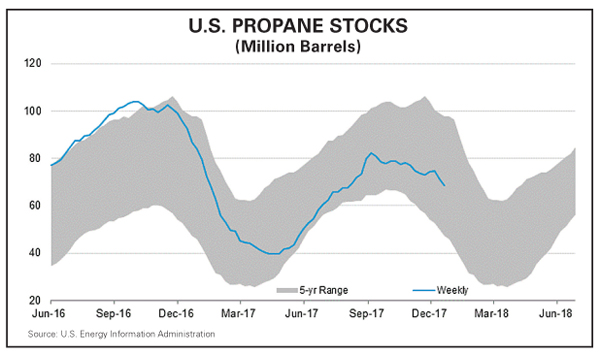

The heating season is well underway into late January 2018 and continued OPEC and non-OPEC crude oil production cuts, combined with strong demand for propane in the U.S. and overseas, have all eyes focused on wholesale supply issues. While OPEC and non-OPEC countries confirmed their expected plans on November 30 to keep their output curtailment strategy in place through the end of 2018, propane has more of its own fundamentals also supporting it this season. In late November, we saw propane top 100.00 cents/gal. for the first time since November 2014. Crude futures back then were at around $75/bbl. Propane was trading near 47% of crude, a far cry from the 76% in late November 2017.

By mid-December 2017 propane had backed off to 68% of crude, with Mont Belvieu propane at 93 cents/gal. and crude oil at $57/bbl. Mont Belvieu propane prices over $1 per gallon caused some shipping cancellations in late November and brought exports down to just 681,000 bbld for the week ended Dec. 1. A week earlier exports stood at 1.127 MMbbld. While the sharp drop off in exports was the key factor in a 1.316-MMbbl build the last week of November, stronger U.S. production and slower domestic demand were also in play. Petrochemical use slightly under 300,000 bbld in October and November was at the low end of that sector’s typical requirement, and the heating season started off a little stronger than the previous two.

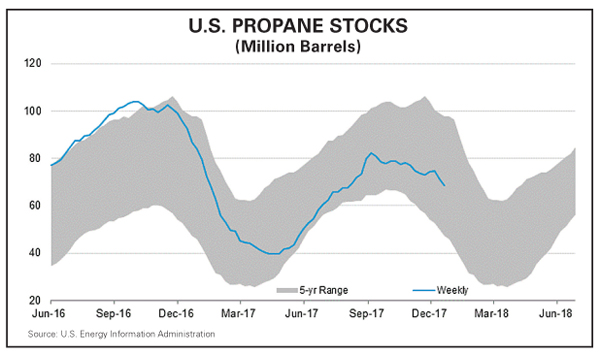

By December 20, the Energy Information Administration (EIA) was reporting propane exports ramping back up to 1.2 MMbbld. With 71.3 MMbbl in primary U.S. storage, propane was a full 21.2 MMbbl behind previous-year levels on the heels of a 3.3-MMbbl draw. Of that drawdown, 1.9 MMbbl were depleted from the Gulf Coast. The 500,000 bbld shifts from week to week underscore just how unpredictable propane exports can be. And keep in mind the Mariner 2 East pipeline, which will facilitate more exports from the East Coast, is not yet operational. It will likely be commissioned by next winter. Once in place, U.S. export capacity for propane will be nearly double what has shipped this year.

Hurricane Harvey

Hurricane Harvey added drama to what was already shaping up to be a winter of uncertainty. Knocking exports down to under 200,000 bbld for two weeks in September, Harvey did allow U.S. propane inventories to enter the season at 82 MMbbl, which was above the target of 80 MMbbl many hoped for. Harvey’s impact, especially the inability to export much propane, made it the first storm in the U.S. to rattle propane prices throughout the world. With propane mostly inaccessible from the Gulf, Japan and other countries that rely on U.S. imports instead sourced it from the Middle East at a premium. Japan has strict guidelines requiring 40 days’ supply be always in place. But Gulf exports bounced back quickly since world prices remained higher than the U.S. and shippers took advantage of the opportunity to profit from the going market.

With U.S. export capacity as high as it is, we often see an uptick in exports occur in tandem with propane trading at a higher percentage to crude oil. Last winter, despite the mild temperatures, we had a 50-MMbbl drop in U.S. propane from the beginning of December to the end of January, mostly due to strong export levels. Propane, which had been trading at levels below 50% of crude oil, suddenly moved up as high as 70% in early 2017. As the heating season came to an end, propane faded back closer to 50%.

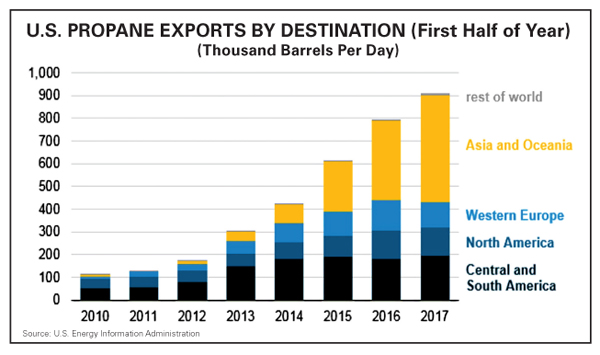

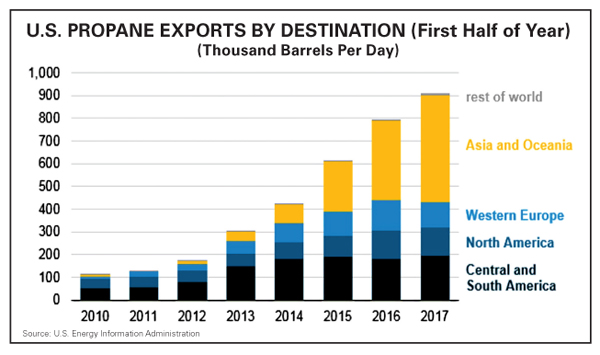

With lower inventory levels and concerns about strong demand for exports, propane has been near the 75% mark of crude for most of the first half of the winter season. Capacity and the economics of shipping favor increased exports as time goes on. Consider that the Panama Canal was widened last year and now 35% of the expanded traffic traversing is represented by propane cargos, mostly on very large gas carriers (VLGCs). The widened canal has dramatically shortened shipping routes to Asia, and more competition from a robust buildout of VLGCs has cut freight rates. Demand from Asia, Europe, Central America, South America, and other regions of the world is expected to remain strong.

Extended Cuts

The outcomes of OPEC meetings are never certain. Pundits and prognosticators always have their predictions, but the last few years have proven that no one can be certain what direction the Saudi-led producer group will choose. And since output levels lead interest, no one knows until later just how compliant members will be with their agreed-upon production quotas. Until last year, OPEC had not agreed to production cuts for eight years. At November meetings in 2014 and 2015, OPEC could not reach a production curtailment agreement. Members focused instead on expanding individual market shares, which drove collective production levels higher. As EIA data shows, OPEC raked in a record $920 billion in 2012, earned $753 billion in 2014, and garnered $341 billion from oil export sales in 2016. The price of crude oil fell to $27/bbl in February 2016 and spent most of the year in the mid $40/bbl range. Oil economics help show how a crude cartel and other global producers frequently in conflict, or even at war, can still gather and agree to strategies of mutual concern.

The agreement last November was to cut production by 1.2 MMbbld to 32.5 MMbbld. There were a few exceptions to quotas due to unique circumstances that had already slowed output in some countries, but OPEC-led producer group members each agreed to volumes they would cut to meet the reduction targets. Saudi Arabia, the de facto leader of OPEC with double the output of the second-highest OPEC producer, Iraq, produced nearly 11 MMbbld in 2016. Meanwhile, Russia was producing 11.2 MMbbld by November of 2016. As part of last November’s agreement, Saudi Arabia agreed to the biggest cut of 486,00 bbld to 10.058 MMbbld. Russia, which originally was willing to freeze production levels at 11.2 MMbbld, ultimately agreed to a cut of 300,000 bbld. While there were concerns about OPEC compliance in early 2017, Saudi Arabia helped make up for it with deeper cuts. During the first few months of the agreed-to quotas, crude oil prices moved higher and spurred a recovery in American drilling that challenged the OPEC goal of balancing the market. Nonetheless, compliance among producer group members was reported at an impressive 120% by fall 2017.

Both Russia and Saudi Arabia made statements in October supportive of extending supply cuts from March 2018 to the end of 2018. Relations between the two countries were improving and they were reported to have signed more that $4 billion in arms and energy deals. The market gained confidence in an extension and factored its likelihood into trading decisions. Despite this, concerns did arise as several oil company chief executives in Russia were said to be unhappy with the cap on supply and wanted Russia to break up its pact with Saudi Arabia. There were also concerns continued reductions could boost the ruble and harm Russian exports. Some Russian officials said they believed extending the cuts would raise values to a level to further encourage additional U.S. output, which ultimately would push prices lower and give the U.S. more market share. Despite those concerns, Russia stayed onboard and the cuts are scheduled to run through the end of this year.

Planning for the Future

With a 5.2-MMbbl draw on U.S. crude stockpiles reported in December 20 EIA data, there was talk of OPEC needing a possible early exit strategy from cuts. Such a strategy will be on the June 2018 meeting agenda. At the time cuts were extended, the Saudi Arabian energy minister, Khalid al Falih, said, “When we get to an exit, we are going to do it very gradually….to make sure we don’t shock the market.”

With OPEC serious about keeping production levels lower and balancing the market, propane production in the U.S. is ready to jump on the nearest ship and leave the country, and with inventory levels already about 12% lower than the five-year average, it is again important to have a solid supply plan. As always, strong relationships with trusted wholesale providers who have assets close to your operation are paramount. Make sure wholesale suppliers understand your marketing plan. The ones who work closely with you to meet your unique needs are the ones worth staying with, even if they are occasionally a penny or two higher than someone else. —Pat Thornton

By mid-December 2017 propane had backed off to 68% of crude, with Mont Belvieu propane at 93 cents/gal. and crude oil at $57/bbl. Mont Belvieu propane prices over $1 per gallon caused some shipping cancellations in late November and brought exports down to just 681,000 bbld for the week ended Dec. 1. A week earlier exports stood at 1.127 MMbbld. While the sharp drop off in exports was the key factor in a 1.316-MMbbl build the last week of November, stronger U.S. production and slower domestic demand were also in play. Petrochemical use slightly under 300,000 bbld in October and November was at the low end of that sector’s typical requirement, and the heating season started off a little stronger than the previous two.

By December 20, the Energy Information Administration (EIA) was reporting propane exports ramping back up to 1.2 MMbbld. With 71.3 MMbbl in primary U.S. storage, propane was a full 21.2 MMbbl behind previous-year levels on the heels of a 3.3-MMbbl draw. Of that drawdown, 1.9 MMbbl were depleted from the Gulf Coast. The 500,000 bbld shifts from week to week underscore just how unpredictable propane exports can be. And keep in mind the Mariner 2 East pipeline, which will facilitate more exports from the East Coast, is not yet operational. It will likely be commissioned by next winter. Once in place, U.S. export capacity for propane will be nearly double what has shipped this year.

Hurricane Harvey

Hurricane Harvey added drama to what was already shaping up to be a winter of uncertainty. Knocking exports down to under 200,000 bbld for two weeks in September, Harvey did allow U.S. propane inventories to enter the season at 82 MMbbl, which was above the target of 80 MMbbl many hoped for. Harvey’s impact, especially the inability to export much propane, made it the first storm in the U.S. to rattle propane prices throughout the world. With propane mostly inaccessible from the Gulf, Japan and other countries that rely on U.S. imports instead sourced it from the Middle East at a premium. Japan has strict guidelines requiring 40 days’ supply be always in place. But Gulf exports bounced back quickly since world prices remained higher than the U.S. and shippers took advantage of the opportunity to profit from the going market.

With U.S. export capacity as high as it is, we often see an uptick in exports occur in tandem with propane trading at a higher percentage to crude oil. Last winter, despite the mild temperatures, we had a 50-MMbbl drop in U.S. propane from the beginning of December to the end of January, mostly due to strong export levels. Propane, which had been trading at levels below 50% of crude oil, suddenly moved up as high as 70% in early 2017. As the heating season came to an end, propane faded back closer to 50%.

With lower inventory levels and concerns about strong demand for exports, propane has been near the 75% mark of crude for most of the first half of the winter season. Capacity and the economics of shipping favor increased exports as time goes on. Consider that the Panama Canal was widened last year and now 35% of the expanded traffic traversing is represented by propane cargos, mostly on very large gas carriers (VLGCs). The widened canal has dramatically shortened shipping routes to Asia, and more competition from a robust buildout of VLGCs has cut freight rates. Demand from Asia, Europe, Central America, South America, and other regions of the world is expected to remain strong.

Extended Cuts

The outcomes of OPEC meetings are never certain. Pundits and prognosticators always have their predictions, but the last few years have proven that no one can be certain what direction the Saudi-led producer group will choose. And since output levels lead interest, no one knows until later just how compliant members will be with their agreed-upon production quotas. Until last year, OPEC had not agreed to production cuts for eight years. At November meetings in 2014 and 2015, OPEC could not reach a production curtailment agreement. Members focused instead on expanding individual market shares, which drove collective production levels higher. As EIA data shows, OPEC raked in a record $920 billion in 2012, earned $753 billion in 2014, and garnered $341 billion from oil export sales in 2016. The price of crude oil fell to $27/bbl in February 2016 and spent most of the year in the mid $40/bbl range. Oil economics help show how a crude cartel and other global producers frequently in conflict, or even at war, can still gather and agree to strategies of mutual concern.

The agreement last November was to cut production by 1.2 MMbbld to 32.5 MMbbld. There were a few exceptions to quotas due to unique circumstances that had already slowed output in some countries, but OPEC-led producer group members each agreed to volumes they would cut to meet the reduction targets. Saudi Arabia, the de facto leader of OPEC with double the output of the second-highest OPEC producer, Iraq, produced nearly 11 MMbbld in 2016. Meanwhile, Russia was producing 11.2 MMbbld by November of 2016. As part of last November’s agreement, Saudi Arabia agreed to the biggest cut of 486,00 bbld to 10.058 MMbbld. Russia, which originally was willing to freeze production levels at 11.2 MMbbld, ultimately agreed to a cut of 300,000 bbld. While there were concerns about OPEC compliance in early 2017, Saudi Arabia helped make up for it with deeper cuts. During the first few months of the agreed-to quotas, crude oil prices moved higher and spurred a recovery in American drilling that challenged the OPEC goal of balancing the market. Nonetheless, compliance among producer group members was reported at an impressive 120% by fall 2017.

Both Russia and Saudi Arabia made statements in October supportive of extending supply cuts from March 2018 to the end of 2018. Relations between the two countries were improving and they were reported to have signed more that $4 billion in arms and energy deals. The market gained confidence in an extension and factored its likelihood into trading decisions. Despite this, concerns did arise as several oil company chief executives in Russia were said to be unhappy with the cap on supply and wanted Russia to break up its pact with Saudi Arabia. There were also concerns continued reductions could boost the ruble and harm Russian exports. Some Russian officials said they believed extending the cuts would raise values to a level to further encourage additional U.S. output, which ultimately would push prices lower and give the U.S. more market share. Despite those concerns, Russia stayed onboard and the cuts are scheduled to run through the end of this year.

Planning for the Future

With a 5.2-MMbbl draw on U.S. crude stockpiles reported in December 20 EIA data, there was talk of OPEC needing a possible early exit strategy from cuts. Such a strategy will be on the June 2018 meeting agenda. At the time cuts were extended, the Saudi Arabian energy minister, Khalid al Falih, said, “When we get to an exit, we are going to do it very gradually….to make sure we don’t shock the market.”

With OPEC serious about keeping production levels lower and balancing the market, propane production in the U.S. is ready to jump on the nearest ship and leave the country, and with inventory levels already about 12% lower than the five-year average, it is again important to have a solid supply plan. As always, strong relationships with trusted wholesale providers who have assets close to your operation are paramount. Make sure wholesale suppliers understand your marketing plan. The ones who work closely with you to meet your unique needs are the ones worth staying with, even if they are occasionally a penny or two higher than someone else. —Pat Thornton