Saturday, March 3, 2018

Gathering in early February 2018 for the National Propane Gas Association (NPGA) meetings in temperate Santa Barbara, Calif., board members and guests alike admitted they were ready for a break from the cold. Furthermore, industry members who have weathered two warm winters following the unnerving Polar Vortex of 2013-2014 seemed very satisfied with how the winter of 2017-2018 was unfolding. Propane leaders were eager to head to meetings to discuss the cold winter and plot the future direction of the industry.

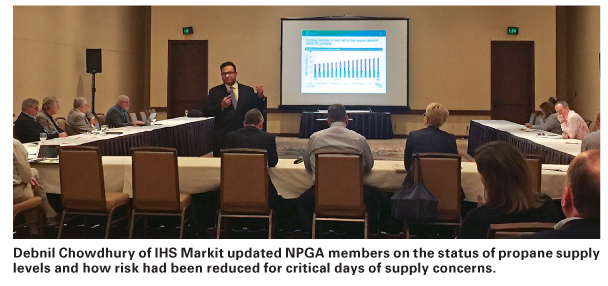

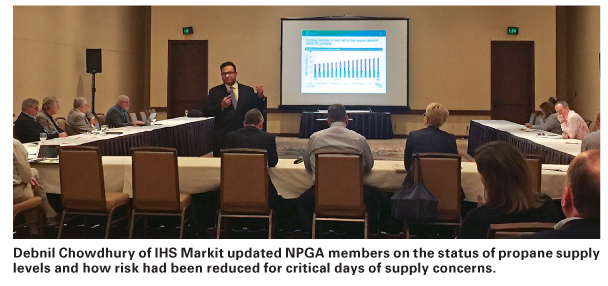

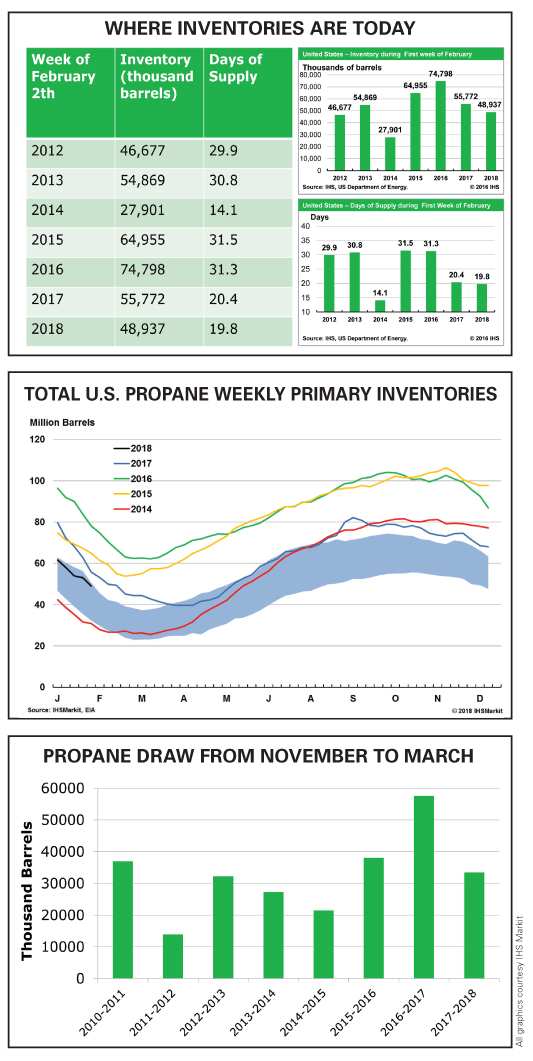

Beginning with the NPGA Propane Supply and Logistics committee meeting, always one to draw a large crowd due to its relevance to most in the industry, members gathered for an update from Debnil Chowdhury, U.S. NGL research and consulting lead at IHS Markit (London). Chowdhury began his presentation, “Outlook for U.S. Propane Markets: Impact of Higher Production and New Export Capacity,” by acknowledging NPGA’s success in convincing the Energy Information Administration (EIA) to begin factoring the greatly expanded U.S. export levels into its calculation of estimated days of supply. He proceeded to review PowerPoint slides that had been part of the presentation used to convince EIA of the need to make the change. While EIA was not opposed to the concept, it still took pressure from a group of U.S. senators who were lobbied by NPGA to prompt the agency to finally agree to implement the change.

EIA defines days of supply for all refined products as a measure of the adequacy of inventories. It is calculated by taking the current stock level and dividing by product supplied (used as an estimate of demand) averaged over the most recent four-week period. While this formula was adequate when the U.S. was a net importer of propane, as the U.S. moved to exporting more than 1 MMbbld, NPGA made the case that exports should be included as a “demand” category when calculating days of supply. Prior to the revision, NPGA was calculating days of supply at least 20 days lower than EIA and advising industry members not to interpret EIA’s calculations as the actual days of supply.

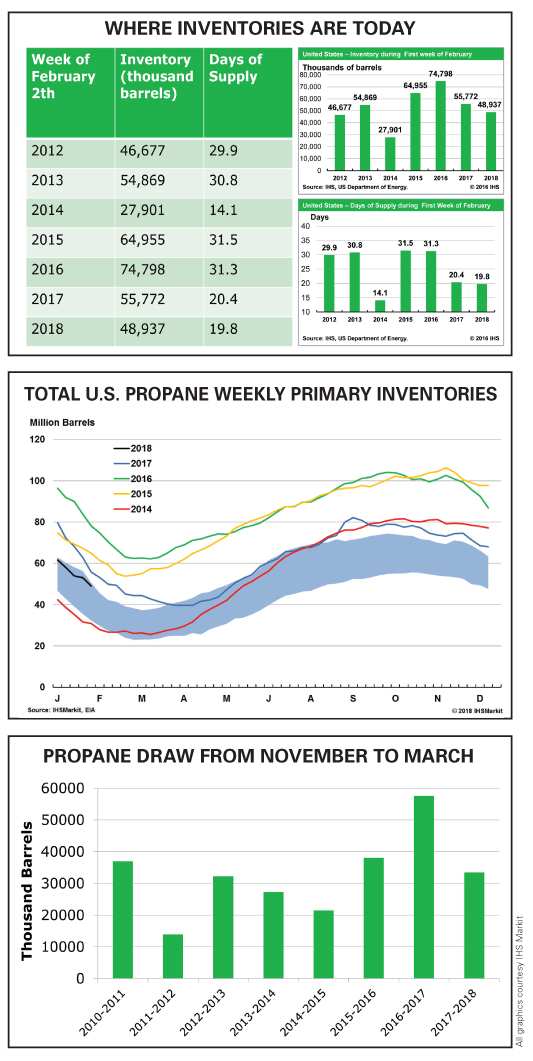

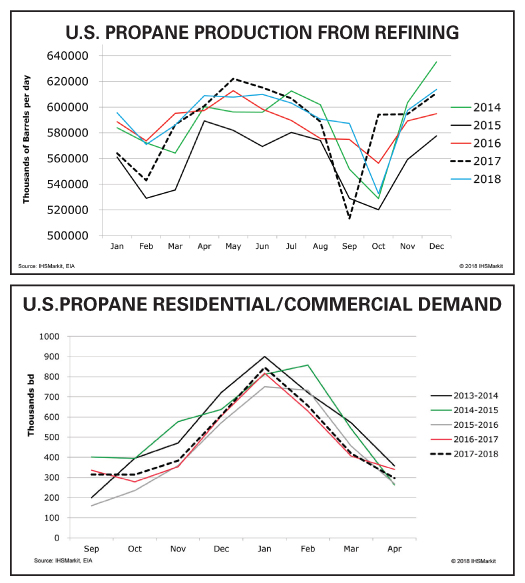

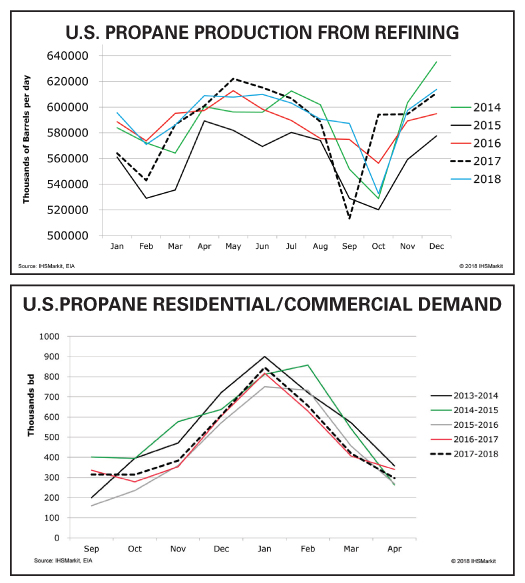

At the time of Chowdhury’s presentation, the U.S. had just experienced eight weeks of severely cold temperatures. However, inventories were not being depleted as quickly as during the previous winter, which was one of the warmest on record. He explained that exports were much lower in December and January as Japan changed its minimum days of imports. In addition, strong growth in crude production is resulting in faster growth of propane, especially in the Permian Basin in Texas. While petrochemical demand in the U.S. has increased significantly since 2014 when crude prices fell, ethane was the preferred feedstock in 2016 and 2017 due to lower values. This significantly curtailed propane demand from the chemical sector.

Although concerns about lower propane supply levels were strong going into winter 2017-2018, Chowdhury pointed out factors that have slowed exports and increased propane production, and in turn reduced the risk for critical days of supply. As propane prices have traded at a higher percentage of crude oil for most of the early half of the winter, they have more recently created an interesting dynamic by moving to a lower percentage of crude, this despite the cold temperatures and strong domestic demand. IHS expects propane to trade at a lower percentage to crude oil as production increases over the next two years.

Crude oil production in the U.S. is expected to grow by an average of 1.1 MMbbld day to 10.4 MMbbld in 2018 and a further 800,000 bbld to 11.2 MMbbld in 2019. The Permian Basin in Texas will account for more than 70% of net annual average growth in 2018-2019, with Eagle Ford and Bakkan plays accounting for 12% and 8%, respectively.

The expected growth in crude to 10.4 MMbbld will surpass the record level of 9.6 MMbbld set in 1970 and move U.S. supply above the output levels of Saudi Arabia and Russia. It should be noted that these two large producers do have the capacity to produce more, but are honoring agreed-to OPEC and non-OPEC production cuts through the end of 2018.

As U.S. crude oil production ramps up significantly, crude production in Venezuela is plummeting. Declining investment in producing fields and heavy oil upgrading units is having an impact as the Venezuelan economy collapses. Production there declined by more than 600,000 bbld to 1.75 MMbbld in fourth quarter 2017. IHS expects demand to decline by an additional 450,000 bbld in 2018 and 220,000 bbld in 2019.

Propane prices in the U.S. are expected to decline to the 60-cent/gal. range during the second quarter as domestic demand slows and production ramps up. Looking toward next winter, while exports from the Gulf continue to be a significant factor to watch, expanded export capacity from the Mariner East 2 terminal on the East Coast is expected to move 60,000 to 80,000 bbld out of the U.S. This could create new challenges for the Northeast portion of the country, which is already the area farthest from most high concentrations of U.S. storage. The Northeast region is expected to add 20,000 to 30,000 bbld in new production. Meanwhile, U.S. propane will likely become more competitive with ethane as a feedstock for the chemical industry by winter 2018-2019.

2018-2020 NPGA Strategic Plan

A full day of meetings on February 12 commenced with discussion of the NPGA Strategic Plan 2018-2020. NPGA president and CEO Rick Roldan noted that through several revisions of the strategic plan in recent years, the mission of NPGA has remained, “To advance safety and increase the use of propane through sound public policy.” Successful organizations need to revise their strategic plan every few years to make sure they are on the right track with current organization needs, he added. “The plan will be most successful with a wide variety of stakeholders all playing a role in creating and implementing the new plan.” In addition to using information gathered from in-depth interviews with 25 industry stakeholders, members of every membership type and level within the organization played a role in the strategic planning process. Four webinars were held during the run-up to the meetings in Santa Barbara to allow all NPGA members a chance to dive deeper into the strategic plan.

An outline of the strategic objectives includes:

I. Initiate an Advocacy Outreach Program to ensure that the environmental, economic, and energy security benefits of propane compared to other energy sources are understood by policymakers.

II. Create a favorable business environment for NPGA members through regulatory relief, policies that ensure reliable supply and distribution, and initiatives to promote workforce development.

III. Promote industry cohesion through coordination with industry organizations and collaborating with industries that have common objectives.

IV. Ensure effective communications with both external policymakers and internal industry stakeholders.

Roldan commented, “With an approach of ‘electrify everything’ driving many federal and state programs, it was a strong feeling among many that flawed policy initiatives are grounded in a lack of awareness or a misunderstanding of the benefits of the direct use of propane gas. A communications offensive directed at energy thought leaders will be initiated, and it is recognized that many who need to be reached are at the state level.” NPGA will work to accelerate the application of Full Fuel Cycle (FFC) analysis — measuring energy usage through the full fuel cycle rather than only at the point of use. A study conducted by the Department of Energy and the National Academy of Sciences, published in 2005, was very favorable to propane and natural gas. Unfortunately, delay tactics by the electric utility association have stalled acceptance of full fuel cycle provisions.

Noting that President Trump’s successful campaign was helped by his understanding that unnecessary federal regulations threaten job creation and impede economic growth, Roldan said NPGA needs to take advantage of a pro-business president and Congress while the window of opportunity exists. He stressed the importance of industry leaders or organizations communicating and working together, and he called for ongoing effective communication between industry stakeholders and external, as well as internal, policymakers. The board of directors adopted the new strategic plan the following day. —Pat Thornton

Beginning with the NPGA Propane Supply and Logistics committee meeting, always one to draw a large crowd due to its relevance to most in the industry, members gathered for an update from Debnil Chowdhury, U.S. NGL research and consulting lead at IHS Markit (London). Chowdhury began his presentation, “Outlook for U.S. Propane Markets: Impact of Higher Production and New Export Capacity,” by acknowledging NPGA’s success in convincing the Energy Information Administration (EIA) to begin factoring the greatly expanded U.S. export levels into its calculation of estimated days of supply. He proceeded to review PowerPoint slides that had been part of the presentation used to convince EIA of the need to make the change. While EIA was not opposed to the concept, it still took pressure from a group of U.S. senators who were lobbied by NPGA to prompt the agency to finally agree to implement the change.

EIA defines days of supply for all refined products as a measure of the adequacy of inventories. It is calculated by taking the current stock level and dividing by product supplied (used as an estimate of demand) averaged over the most recent four-week period. While this formula was adequate when the U.S. was a net importer of propane, as the U.S. moved to exporting more than 1 MMbbld, NPGA made the case that exports should be included as a “demand” category when calculating days of supply. Prior to the revision, NPGA was calculating days of supply at least 20 days lower than EIA and advising industry members not to interpret EIA’s calculations as the actual days of supply.

At the time of Chowdhury’s presentation, the U.S. had just experienced eight weeks of severely cold temperatures. However, inventories were not being depleted as quickly as during the previous winter, which was one of the warmest on record. He explained that exports were much lower in December and January as Japan changed its minimum days of imports. In addition, strong growth in crude production is resulting in faster growth of propane, especially in the Permian Basin in Texas. While petrochemical demand in the U.S. has increased significantly since 2014 when crude prices fell, ethane was the preferred feedstock in 2016 and 2017 due to lower values. This significantly curtailed propane demand from the chemical sector.

Although concerns about lower propane supply levels were strong going into winter 2017-2018, Chowdhury pointed out factors that have slowed exports and increased propane production, and in turn reduced the risk for critical days of supply. As propane prices have traded at a higher percentage of crude oil for most of the early half of the winter, they have more recently created an interesting dynamic by moving to a lower percentage of crude, this despite the cold temperatures and strong domestic demand. IHS expects propane to trade at a lower percentage to crude oil as production increases over the next two years.

Crude oil production in the U.S. is expected to grow by an average of 1.1 MMbbld day to 10.4 MMbbld in 2018 and a further 800,000 bbld to 11.2 MMbbld in 2019. The Permian Basin in Texas will account for more than 70% of net annual average growth in 2018-2019, with Eagle Ford and Bakkan plays accounting for 12% and 8%, respectively.

The expected growth in crude to 10.4 MMbbld will surpass the record level of 9.6 MMbbld set in 1970 and move U.S. supply above the output levels of Saudi Arabia and Russia. It should be noted that these two large producers do have the capacity to produce more, but are honoring agreed-to OPEC and non-OPEC production cuts through the end of 2018.

As U.S. crude oil production ramps up significantly, crude production in Venezuela is plummeting. Declining investment in producing fields and heavy oil upgrading units is having an impact as the Venezuelan economy collapses. Production there declined by more than 600,000 bbld to 1.75 MMbbld in fourth quarter 2017. IHS expects demand to decline by an additional 450,000 bbld in 2018 and 220,000 bbld in 2019.

Propane prices in the U.S. are expected to decline to the 60-cent/gal. range during the second quarter as domestic demand slows and production ramps up. Looking toward next winter, while exports from the Gulf continue to be a significant factor to watch, expanded export capacity from the Mariner East 2 terminal on the East Coast is expected to move 60,000 to 80,000 bbld out of the U.S. This could create new challenges for the Northeast portion of the country, which is already the area farthest from most high concentrations of U.S. storage. The Northeast region is expected to add 20,000 to 30,000 bbld in new production. Meanwhile, U.S. propane will likely become more competitive with ethane as a feedstock for the chemical industry by winter 2018-2019.

2018-2020 NPGA Strategic Plan

A full day of meetings on February 12 commenced with discussion of the NPGA Strategic Plan 2018-2020. NPGA president and CEO Rick Roldan noted that through several revisions of the strategic plan in recent years, the mission of NPGA has remained, “To advance safety and increase the use of propane through sound public policy.” Successful organizations need to revise their strategic plan every few years to make sure they are on the right track with current organization needs, he added. “The plan will be most successful with a wide variety of stakeholders all playing a role in creating and implementing the new plan.” In addition to using information gathered from in-depth interviews with 25 industry stakeholders, members of every membership type and level within the organization played a role in the strategic planning process. Four webinars were held during the run-up to the meetings in Santa Barbara to allow all NPGA members a chance to dive deeper into the strategic plan.

An outline of the strategic objectives includes:

I. Initiate an Advocacy Outreach Program to ensure that the environmental, economic, and energy security benefits of propane compared to other energy sources are understood by policymakers.

II. Create a favorable business environment for NPGA members through regulatory relief, policies that ensure reliable supply and distribution, and initiatives to promote workforce development.

III. Promote industry cohesion through coordination with industry organizations and collaborating with industries that have common objectives.

IV. Ensure effective communications with both external policymakers and internal industry stakeholders.

Roldan commented, “With an approach of ‘electrify everything’ driving many federal and state programs, it was a strong feeling among many that flawed policy initiatives are grounded in a lack of awareness or a misunderstanding of the benefits of the direct use of propane gas. A communications offensive directed at energy thought leaders will be initiated, and it is recognized that many who need to be reached are at the state level.” NPGA will work to accelerate the application of Full Fuel Cycle (FFC) analysis — measuring energy usage through the full fuel cycle rather than only at the point of use. A study conducted by the Department of Energy and the National Academy of Sciences, published in 2005, was very favorable to propane and natural gas. Unfortunately, delay tactics by the electric utility association have stalled acceptance of full fuel cycle provisions.

Noting that President Trump’s successful campaign was helped by his understanding that unnecessary federal regulations threaten job creation and impede economic growth, Roldan said NPGA needs to take advantage of a pro-business president and Congress while the window of opportunity exists. He stressed the importance of industry leaders or organizations communicating and working together, and he called for ongoing effective communication between industry stakeholders and external, as well as internal, policymakers. The board of directors adopted the new strategic plan the following day. —Pat Thornton