Editor’s Note: This article was published Feb. 6. The status of tariffs reflects what was true and current at that time.

A few weeks into President Donald Trump’s administration’s far-sweeping reversal of transitional proceedings, many people and businesses across the country — and the globe — are now tasked with assessing their legal and financial standing. Whether the changes are viewed as promising or costly, one thing that most can agree on is a spike in unpredictability.

Assessing the Current Administration’s Relationship With Propane

Many in gas- and oil-related industries welcomed the Trump administration’s Unleashing American Energy executive order, a broad call for the country to maximize land use for the gas and oil industry and for states to loosen emissions-based regulations around energy sources. Time will determine the full impact that this order will have in legal proceedings and public policy; however, there is a consensus that on the legal front, the new administration is a welcome change to prior policies favoring electrification mandates.

In light of this, although the industry has been preparing for the real possibility of tariffs for several months, it can be disorienting that on the heels of a favorable outlook for propane in the eyes of the law, there is now concern about the potential impact tariffs can have on the gas and oil market.

After it was announced that imports from Canada and Mexico would face a steep 25% tariff — with the exception of “energy resources from Canada,” which would face a 10% tariff — news came about shortly thereafter that there would be a 30-day pause in the implementation of tariffs for both countries, dependent on their pledge to commit to boosting border enforcement.

However, in response to President Trump’s 10% tariffs on Chinese products, China announced retaliatory tariffs, including 15% on U.S. coal and liquefied natural gas and 10% on crude oil, in addition to tariffs on essential propane-related manufacturing and production components.

The Impact of Tariffs on the Gas Industry

At this time, it is difficult to assess the full impact the “tariff war” will have on the domestic market, especially as the key players are continually shifting in their commitments and negotiations. However, economic experts attest that tariffs consistently have negative consequences on the economy.

Speaking about the implementation of significantly higher U.S.-China tariffs in 2018 under President Trump’s first administration, the economists Colin A. Carter and Sandro Steinbach at the CATO Institute wrote that “the tariff increases had substantial effects on economic welfare and employment in the United States.” They continued, stating “research shows that the 2018 tariffs on steel, aluminum, washing machines, solar panels and other products imposed by the United States against its foreign trading partners resulted in a reduction of real income by $1.4 billion per month.”

It's difficult to determine the impact that tariffs against Mexico and Canada could play if they should be implemented.

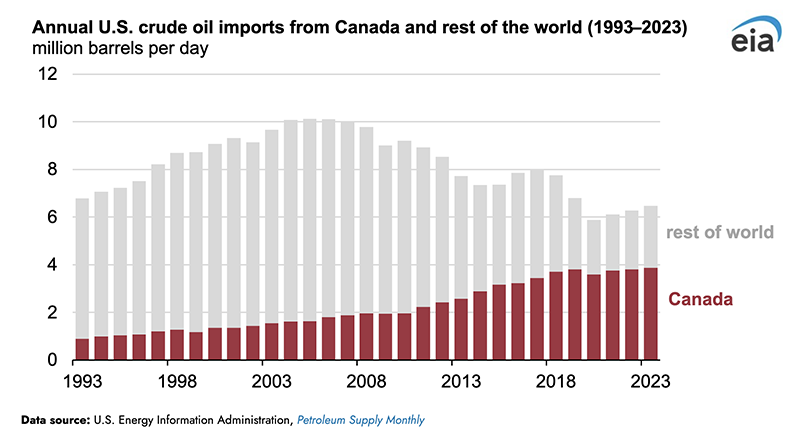

According to the Energy Information Administration, 97% of hydrocarbon gas liquids imports were from Canada in 2022. Additionally, “in 2023, 60% of U.S. crude oil imports originated in Canada,” a continuation of a yearly upward trend of crude oil imports originating from Canada. In 2023, crude oil exports from Canada accounted for 24% of U.S. refinery throughput.

Addressing the concerns of many working within the propane sector — an industry that enjoys a tight-knit and mutually beneficial relationship between members in both the United States and Canada — the National Propane Gas Association (NPGA) and the Canadian Propane Association (CPA) released a joint statement affirming their commitment to working together to keep costs as low as possible for both those in the industry and its consumers:

“Canada supplies one of every seven barrels of propane used in the United States. And equipment and parts vital to keeping costs down on both sides of the border are sourced from around the world. The National Propane Gas Association and Canadian Propane Association are committed to working with American and Canadian leaders to ensure that our citizens continue to have access to affordable and reliable energy, especially during the coldest American winter in a decade.”

It is essential for businesses in the propane industry at every level to keep an informed eye on current public policy. Both NPGA and CPA are great resources to consult in this ever-shifting landscape.