Thursday, October 18, 2018

By JD Buss… A tectonic shift has taken place in the propane market the last couple years. The shift occurred in the latter part of the fourth quarter in 2016 when traditional price methodologies began to be turned upside down as the propane forward price curve did an about-face, flipping from the consistent contango price spread to the world of backwardation.

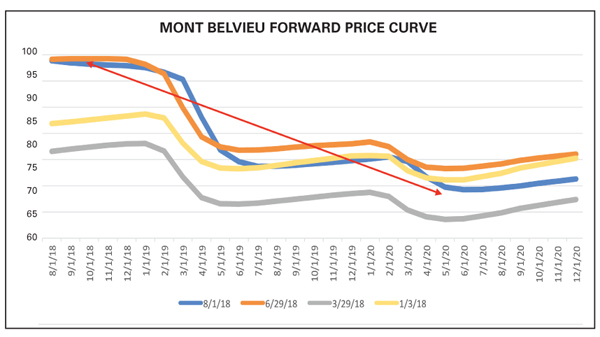

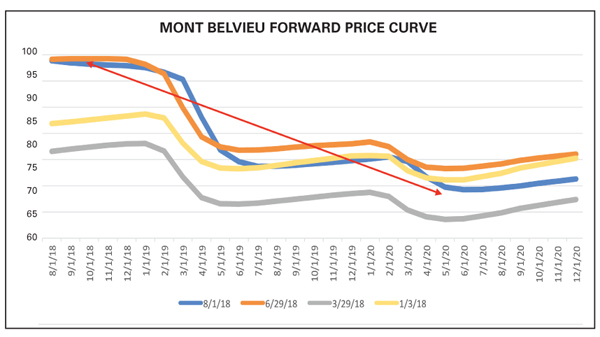

In the “Futures and Options” study guide provided by the Institute for Financial Markets (copyright 2003, 2009) backwardation is defined as the “market situation in which futures prices are progressively lower in the distant delivery months, also termed an inverted market.” We have a snapshot below of the Mont Belvieu propane forward price curve for several dates during 2018:

We see in the graph that prices in the current periods are higher than the values in the future period—a classic example of a backwardated market. Why does this occur?

Going back to the “Futures and Options” study guide we see the institute’s answer to this question: “In future markets for physical goods…inverted markets sometimes occur when there is a current shortage of a commodity, and those in need bid nearby supplies to a premium over the deferred contracts whose supply will not become available for some time.” Backwardation typically occurs when the present need exceeds that of the future, thereby creating a bullish environment for prices.

Such a shift in the price curve has drastically changed the overall economics of Mont Belvieu propane, as well as changing the purpose of most of the propane storage situated in the Gulf Coast.

The following example may be the best way to explain the economic shift taking place in the Mont Belvieu market. For this example, we will refer to the dark orange line in the graph.

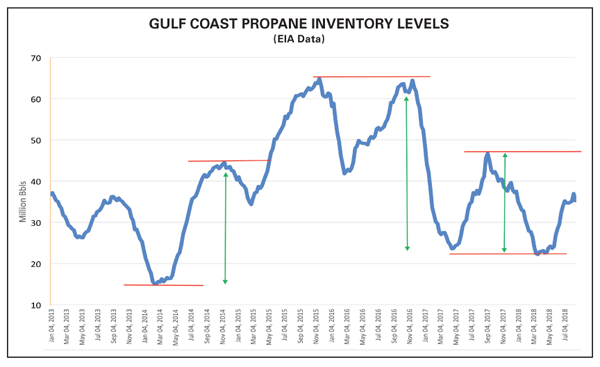

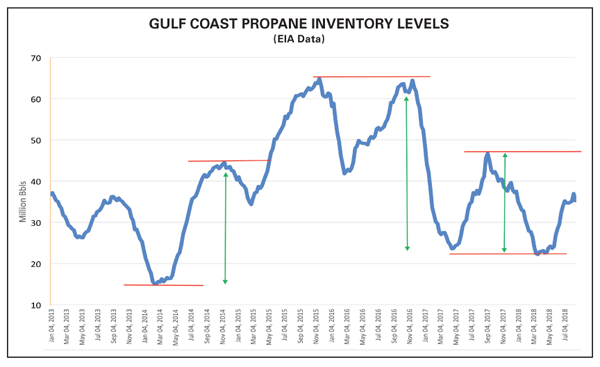

The three green arrows in the graph show a changing volatility level of the Gulf inventory levels. Back in the winter of 2014-2015, the Gulf inventory levels had a 29-MMbbl swing from high to low. Then, in the latter part of 2016 to early 2017, inventory levels saw a 41-MMbbl swing. Recently, Gulf inventory saw a 24.5-MMbbl high to low movement.

This time period highlights a few quick points:

1. The inventory highs are getting lower

2. The inventory lows are getting higher

3. The overall inventory swing from high to low is declining

These quick observations show that Gulf propane storage—the largest storage facilities in North America—is transforming Mont Belvieu into a just-in-time stock facility.

With the Mont Belvieu forward price flipping to backwardation and then changing the overall purpose of Mont Belvieu storage, we have to ask the question, What has driven this tectonic shift?

A one-word answer: Exports.

Look at data from 2012 forward and you will see that exports have almost a 1:1 summer-to-winter ratio. The demand for exports has been steady and strong. Export demand has dwarfed the once dominant cyclical retail segment and has turned storage into something that is only needed for a 30- to 60-day window. Changing the need for storage then helps shift the economic incentives that are displayed through forward price curves, creating backwardation.

At this juncture exports are here to stay and will keep on growing. That trend seems to support backwardated price curves for the foreseeable future.

Since the market isn’t supporting the traditional contango scenario, it necessitates that retailers adapt to backwardation. One method of adapting is taking a longer-term view on the market—two to three years—and using that to widen your margins on your own customer sales. Turn a future-year discount of 10 cents/gal. to 20 cents/gal. into a margin benefit for your company.

Another method may be closely evaluating what physical infrastructure is vital for your business. Storage at Mont Belvieu may no longer have any economic incentive, but that doesn’t mean regional storage is worthless. There is an even stronger need now to evaluate your storage situation within your own region and know how to optimize the value from that storage.

Finally, the rise of exports in the last seven or eight years has attracted the focus of production and midstream firms. As the retail segment has lost its position of prominence on the demand side, it may be time to look at gaining more control over certain parts of the supply chain. Do you gain more control through more storage, infrastructure optimization, transportation, or more?

The tectonic shift in propane has occurred globally and the markets are not likely to return to the days of yesteryear. Don’t be frustrated by the market changes; learn more about them and use them to extract more value for you and your company.

JD Buss, is a CPA and former small business owner who works with propane clients to devise and implement hedging strategies and optimize supply. He joined Overland Park, Kan.-based Twin Feathers Consulting in 2008 after having prior experience at Koch Industries and Enron in risk management, marketing, and trading. Previous experience also includes the crude oil and natural gas markets.

In the “Futures and Options” study guide provided by the Institute for Financial Markets (copyright 2003, 2009) backwardation is defined as the “market situation in which futures prices are progressively lower in the distant delivery months, also termed an inverted market.” We have a snapshot below of the Mont Belvieu propane forward price curve for several dates during 2018:

We see in the graph that prices in the current periods are higher than the values in the future period—a classic example of a backwardated market. Why does this occur?

Going back to the “Futures and Options” study guide we see the institute’s answer to this question: “In future markets for physical goods…inverted markets sometimes occur when there is a current shortage of a commodity, and those in need bid nearby supplies to a premium over the deferred contracts whose supply will not become available for some time.” Backwardation typically occurs when the present need exceeds that of the future, thereby creating a bullish environment for prices.

Such a shift in the price curve has drastically changed the overall economics of Mont Belvieu propane, as well as changing the purpose of most of the propane storage situated in the Gulf Coast.

The following example may be the best way to explain the economic shift taking place in the Mont Belvieu market. For this example, we will refer to the dark orange line in the graph.

- Price of the August 2018 Mont Belvieu contract (6/29/18) = $.94/gallon

- Assumed cost of Mont Belvieu storage for a 12-month period = $.08/gallon

- Total cost of propane 1 year in the future = $1.02/gallon

- LESS: Cost of Propane in July 2019 = ($.7675/gallon)

- Difference: = $.2525/gallon

In this example, the person who stored propane for a year can incur a loss of more than $0.25/gal. based on future prices. Even if we shorten this example to look at prices in February 2019 ($0.915/gal.), there is still more than a dime loss per gallon based on future prices. Neither of these situations (nor any future month for that matter) results in a positive gain based on future prices to those who put propane into Mont Belvieu storage. With backwardation removing the economic incentive to store propane in Mont Belvieu, we also see the overall purpose of Gulf Coast storage beginning to change. To see this change in purpose, we will look at the Gulf inventory fluctuations from

2015 forwa rd:

rd:

2015 forwa

rd:

rd:The three green arrows in the graph show a changing volatility level of the Gulf inventory levels. Back in the winter of 2014-2015, the Gulf inventory levels had a 29-MMbbl swing from high to low. Then, in the latter part of 2016 to early 2017, inventory levels saw a 41-MMbbl swing. Recently, Gulf inventory saw a 24.5-MMbbl high to low movement.

This time period highlights a few quick points:

1. The inventory highs are getting lower

2. The inventory lows are getting higher

3. The overall inventory swing from high to low is declining

These quick observations show that Gulf propane storage—the largest storage facilities in North America—is transforming Mont Belvieu into a just-in-time stock facility.

With the Mont Belvieu forward price flipping to backwardation and then changing the overall purpose of Mont Belvieu storage, we have to ask the question, What has driven this tectonic shift?

A one-word answer: Exports.

Look at data from 2012 forward and you will see that exports have almost a 1:1 summer-to-winter ratio. The demand for exports has been steady and strong. Export demand has dwarfed the once dominant cyclical retail segment and has turned storage into something that is only needed for a 30- to 60-day window. Changing the need for storage then helps shift the economic incentives that are displayed through forward price curves, creating backwardation.

At this juncture exports are here to stay and will keep on growing. That trend seems to support backwardated price curves for the foreseeable future.

Since the market isn’t supporting the traditional contango scenario, it necessitates that retailers adapt to backwardation. One method of adapting is taking a longer-term view on the market—two to three years—and using that to widen your margins on your own customer sales. Turn a future-year discount of 10 cents/gal. to 20 cents/gal. into a margin benefit for your company.

Another method may be closely evaluating what physical infrastructure is vital for your business. Storage at Mont Belvieu may no longer have any economic incentive, but that doesn’t mean regional storage is worthless. There is an even stronger need now to evaluate your storage situation within your own region and know how to optimize the value from that storage.

Finally, the rise of exports in the last seven or eight years has attracted the focus of production and midstream firms. As the retail segment has lost its position of prominence on the demand side, it may be time to look at gaining more control over certain parts of the supply chain. Do you gain more control through more storage, infrastructure optimization, transportation, or more?

The tectonic shift in propane has occurred globally and the markets are not likely to return to the days of yesteryear. Don’t be frustrated by the market changes; learn more about them and use them to extract more value for you and your company.

JD Buss, is a CPA and former small business owner who works with propane clients to devise and implement hedging strategies and optimize supply. He joined Overland Park, Kan.-based Twin Feathers Consulting in 2008 after having prior experience at Koch Industries and Enron in risk management, marketing, and trading. Previous experience also includes the crude oil and natural gas markets.