Monday, October 21, 2019

(October 21, 2019) — By J.D. Buss…

In October 2018 we wrote about a “tectonic shift” that had taken place in the propane markets during the last two years. What was that shift? The forward propane price curve changed from a traditional contango market—meaning future prices are higher than current prices—to a backwardated market, where current prices are higher than future prices.

Fast-forward to the current situation and we view another shift in the propane forward-price market, where a traditional asset has come back into prominence and a slew of infrastructure plays are helping to give a future view on the propane marketplace.

“Follow the Money!”

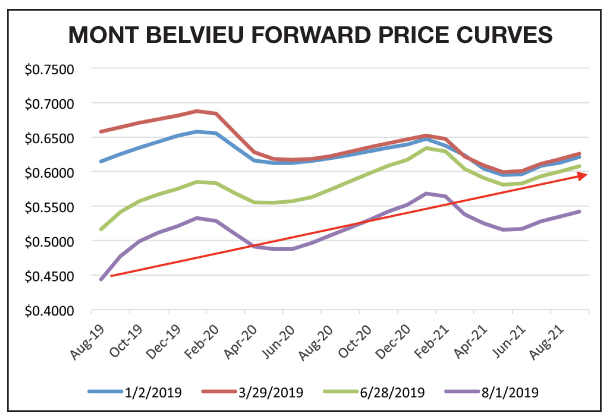

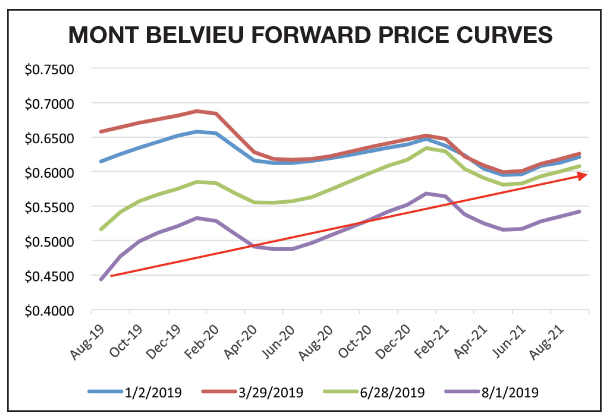

The oft-used expression, “follow the money,” can help explain where domestic propane product is moving and the economic value of that move. The Mont Belvieu graph shows a series of propane forward-price curves for several dates during 2019.

As we moved through calendar year 2019 we see that the propane forward-price curve became more and more contango. A traditional contango market has returned for propane!

Reviewing this in more detail, we see that at the first of August the price for the January 2020 Mont Belvieu contract came in at 53.25 cents/gal. while the August 2019 contract was at 44.50 cents/gal. That differential is 8.75 cents/gal. over only five months. If storage costs for a year are 8 cents/gal.—or 0.66 cents/gal. per month—then the five-month cost of storage would equal 3.3 cents/gal.

When we put all that information together, we see how an individual can make money by placing propane into storage:

“Storage Still Rules!”

For at least a decade, our team has been advocating storage to our client base. Over that same time, we’ve seen reports and recommendations from trade groups that support propane retail firms adding to their storage capacity. The U.S. propane market has also seen a proliferation of tank monitoring systems with one of the express purposes being to optimize stored volumes.

The backwardated markets that took place in 2017 and 2018 were starting to cause doubt that storage would remain a quality asset for the retail market segment. But the reversal of the price curve to contango, plus the growing levels of exports, continue to support storage as a quality investment.

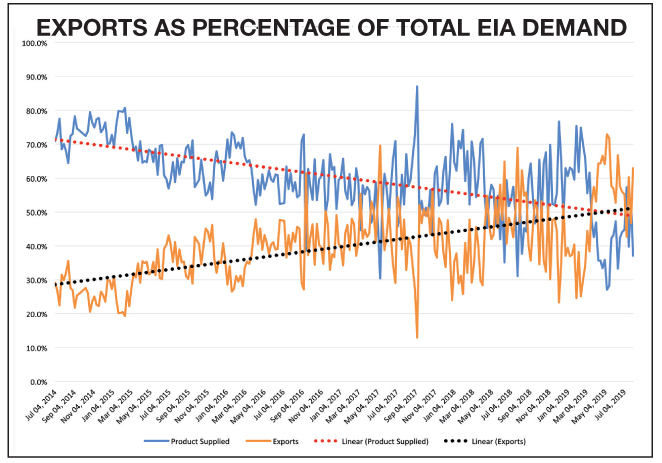

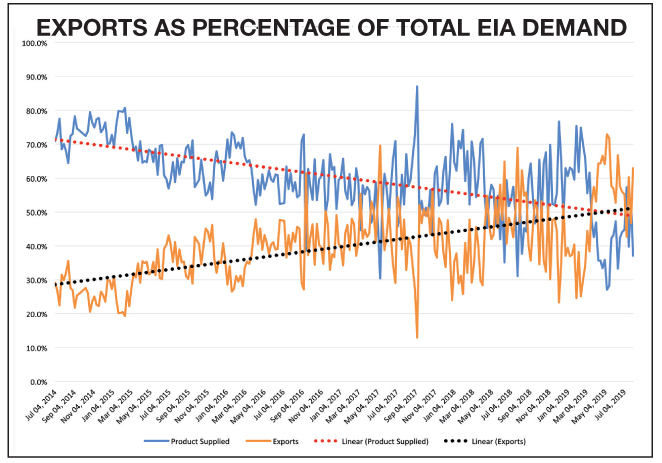

Over the past five-plus years the mantra of “Growing Exports!” has been heard throughout the propane industry. The question, though, remains how this export growth will impact the retail segment of the domestic U.S. market. The graph below helps to show the overall export growth since 2014 forward using EIA data:

Combining EIA weekly export and product supplied data, we can create a total weekly demand value for propane. Since 2014, we see that exports have been a larger and larger percentage of the overall weekly demand, while the product-supplied segment has become a smaller and smaller percentage of total demand. What was more intriguing is the fact that the linear uptrend of exports crossed over the linear downtrend of product supplied earlier this year. At the present time, both trends have been in place for multiple years and have not shown any signs of reversing.

Why does this trend support storage assets for retailers? Exports are almost a ratable consumption for all 12 months of the year, they move massive volumes in each transaction, and they garner more of the focus from the producing and midstream markets. In order for retailers to continue to facilitate the traditionally low-summer/high-winter demand of their client base, they will need to rely more heavily on their own asset base—of which storage is a huge part—rather than lean on the historical asset base that has served the U.S. market in prior decades.

“Infrastructure Tells All!”

Following is a very brief outline of upcoming infrastructure projects that will impact the propane and broader NGL markets:

In this extremely brief list, we see three major factors:

In this extremely brief list, we see three major factors:

A year ago the propane price curve was backwardated, and bullish sentiment had driven prices to increase nearly 300% from the January 2016 low. Fast-forward 12 months, prices have lost almost all of that previous gain and the price curve has flipped back to traditional contango. Exports are not showing any signs of stopping and massive investment dollars are pointing to huge future propane supplies. As the domestic retail demand segment shrinks further into the background, it is becoming vital for retailers to focus on the following:

J.D. Buss, CPA and CTA, of Overland Park, Kan.-based Twin Feathers Consulting, has been working with propane clients over the last 10-plus years to devise and implement both hedging and supply strategies. Buss' extensive industry experience includes working at Koch Industries and Enron in risk management and marketing/trading roles. A former small business owner, he brings accounting knowledge and operational experience to the Twin Feathers team and client base. He may be contacted at This email address is being protected from spambots. You need JavaScript enabled to view it..

In October 2018 we wrote about a “tectonic shift” that had taken place in the propane markets during the last two years. What was that shift? The forward propane price curve changed from a traditional contango market—meaning future prices are higher than current prices—to a backwardated market, where current prices are higher than future prices.

Fast-forward to the current situation and we view another shift in the propane forward-price market, where a traditional asset has come back into prominence and a slew of infrastructure plays are helping to give a future view on the propane marketplace.

“Follow the Money!”

The oft-used expression, “follow the money,” can help explain where domestic propane product is moving and the economic value of that move. The Mont Belvieu graph shows a series of propane forward-price curves for several dates during 2019.

As we moved through calendar year 2019 we see that the propane forward-price curve became more and more contango. A traditional contango market has returned for propane!

Reviewing this in more detail, we see that at the first of August the price for the January 2020 Mont Belvieu contract came in at 53.25 cents/gal. while the August 2019 contract was at 44.50 cents/gal. That differential is 8.75 cents/gal. over only five months. If storage costs for a year are 8 cents/gal.—or 0.66 cents/gal. per month—then the five-month cost of storage would equal 3.3 cents/gal.

When we put all that information together, we see how an individual can make money by placing propane into storage:

- Price of August 2019 Belvieu contract (8/1/19) = 44.50 cents/gal.

- Assumed cost of five months of storage = 3.30 cents/gal.

- Total cost of propane in January 2020 = 47.80 cents/gal.

- Sale price in January 2020 on 8/1/19 = 53.25 cents/gal.

- Difference: = 5.45 cents/gal.

“Storage Still Rules!”

For at least a decade, our team has been advocating storage to our client base. Over that same time, we’ve seen reports and recommendations from trade groups that support propane retail firms adding to their storage capacity. The U.S. propane market has also seen a proliferation of tank monitoring systems with one of the express purposes being to optimize stored volumes.

The backwardated markets that took place in 2017 and 2018 were starting to cause doubt that storage would remain a quality asset for the retail market segment. But the reversal of the price curve to contango, plus the growing levels of exports, continue to support storage as a quality investment.

Over the past five-plus years the mantra of “Growing Exports!” has been heard throughout the propane industry. The question, though, remains how this export growth will impact the retail segment of the domestic U.S. market. The graph below helps to show the overall export growth since 2014 forward using EIA data:

Combining EIA weekly export and product supplied data, we can create a total weekly demand value for propane. Since 2014, we see that exports have been a larger and larger percentage of the overall weekly demand, while the product-supplied segment has become a smaller and smaller percentage of total demand. What was more intriguing is the fact that the linear uptrend of exports crossed over the linear downtrend of product supplied earlier this year. At the present time, both trends have been in place for multiple years and have not shown any signs of reversing.

Why does this trend support storage assets for retailers? Exports are almost a ratable consumption for all 12 months of the year, they move massive volumes in each transaction, and they garner more of the focus from the producing and midstream markets. In order for retailers to continue to facilitate the traditionally low-summer/high-winter demand of their client base, they will need to rely more heavily on their own asset base—of which storage is a huge part—rather than lean on the historical asset base that has served the U.S. market in prior decades.

“Infrastructure Tells All!”

Following is a very brief outline of upcoming infrastructure projects that will impact the propane and broader NGL markets:

- Grand Prix pipeline—Targa Resources’ pipeline running from Stack, Texas to Mont Belvieu with a capacity total of 300,000 bbld

- Elk Creek pipeline—ONEOK’s pipeline running from the Bakken area to Colorado with a capacity of 400,000 bbld

- Arbuckle II pipeline—ONEOK’s pipeline running from Oklahoma to Mont Belvieu with a 500,000-bbld capacity

- Enterprise export expansion—a buildout in Q3 2019 of 175,000 bbld and then a projected expansion of another 260,000 bbld in Q3 2020. Total capacity would be approximately 1.1 MMbbld.

- Targa export expansion—adding another 130,000 to 140,000 bbl/month of capacity in Q3 2020

- Targa fractionation expansion—an additional 320,000 bbld of capacity at Mont Belvieu

- Phillips 66 fractionation expansion—an additional 300,000 bbld of capacity at Sweeney, Texas in 2020

In this extremely brief list, we see three major factors:

In this extremely brief list, we see three major factors:- Large amount of investment dollars.

- Large amount of new capacity volume—regardless of whether it is pipeline, fractionation, or export.

- All these projects point to getting more volumes to the U.S. Gulf Coast region, specifically Texas.

A year ago the propane price curve was backwardated, and bullish sentiment had driven prices to increase nearly 300% from the January 2016 low. Fast-forward 12 months, prices have lost almost all of that previous gain and the price curve has flipped back to traditional contango. Exports are not showing any signs of stopping and massive investment dollars are pointing to huge future propane supplies. As the domestic retail demand segment shrinks further into the background, it is becoming vital for retailers to focus on the following:

- Gain a better understanding of the influence of global markets on U.S. propane supply and cost.

- Gain greater control over their supply chain.

J.D. Buss, CPA and CTA, of Overland Park, Kan.-based Twin Feathers Consulting, has been working with propane clients over the last 10-plus years to devise and implement both hedging and supply strategies. Buss' extensive industry experience includes working at Koch Industries and Enron in risk management and marketing/trading roles. A former small business owner, he brings accounting knowledge and operational experience to the Twin Feathers team and client base. He may be contacted at This email address is being protected from spambots. You need JavaScript enabled to view it..