The European autogas market is mature, strong and diversified. Due to its size, it is also deeply integrated. Some of the largest manufacturers of autogas fuel systems and storage equipment work with vehicle manufacturers (OEMs) developing autogas innovations on the newest engines.

Countries such as Italy, Poland and Turkey have adopted autogas on the largest scale, and they represent the majority of the European market. Italy has a diversified market and success in all segments, with a steady year-over-year growth from approximately 150,000 new autogas registrations in 2023 to an expectation of more than 200,000 additions in 2025 — potentially an annual all-time high.

In Turkey, over 30% of the total consumer car fleet is running on autogas and is growing to an expected market share of 40% in the near future. In the rest of Europe, autogas is present in most countries because of its maturity and size. In some of those countries, autogas’ market share decreased, while in other countries, it’s a completely new, emerging fuel option.

Autogas Demographics in Europe

With a vast network of public fuel stations and the economic price of autogas, most autogas users are consumers who drive often or wish to save on fuel costs. Consumer-typical vehicles include passenger cars of all sorts, ranging from economical brands and smaller engines to luxury SUVs with large displacement engines. Pickup trucks that are manufactured in the United States and sold in Europe are usually driven on autogas — about 80% of them, regardless of brand or size.

In Eastern Europe, where wages are lower compared to the west, there is a strong desire to use an economical fuel option. Used cars with autogas are imported out of Western Europe, and a substantial number of vehicles from the U.S. find their way annually to this region. Because the U.S. traditionally has larger displacement engines, it is desirable to run these on autogas.

Autogas by OEMs Is On the Rise

A number of OEMs in the world are using the potential of autogas by annually selling hundreds of thousands of cars, SUVs and trucks that come off the factory lines with autogas as the main fuel or as bi-fuel.

In Europe, there are two large brands that offer a variety of models with several engine options on autogas. These bi-fuel models are sold throughout Europe and serve a community that is conscious of fuel costs. It is not uncommon that the autogas bi-fuel car is sold for the same price as the gasoline version. Sales figures are strong and increasing, with future outlooks being very positive.

Korean OEMs, including Kia and Hyundai, maintain course in offering autogas in a variety of models off the factory line. Korea has one of the largest autogas fleets in the world — it is, in fact, the largest per capita. The industry in Korea is also mature and well-integrated.

Traditionally, autogas cars are used in the taxi industry, running autogas as a single fuel, but because of regulation changes in 2019, the market has spread more to consumers and businesses.

Since 2024, Kia and Hyundai have also released commercial vehicles with autogas. These small commercial vehicles were mainly diesel trucks in the past, but since 2024, the options have been electric vehicle (EV) or autogas, with autogas taking the lion’s share. Considering that more than 100,000 commercial vehicles such as these were sold annually, the autogas fleet in Korea is continuing to grow.

In these two autogas regions in the world, the OEMs are contributing over half a million autogas vehicles every single year.

Autogas for the Consumer’s Car

Even though the OEM numbers are impressive, the range of vehicles that OEMs release with autogas is somewhat limited. The public is looking for more options, different models and newer engines. Therefore, car manufacturers, national importers and car dealer organizations have teamed up with autogas fuel system manufacturers to bring more offerings to the table.

It’s usually faster and less costly for OEMs or national importers to work with autogas fuel system manufacturers to develop and release new vehicles according to specific market or customer demand. In this case, autogas becomes an option to add to the vehicle, as it is being ordered at the dealership. With these new vehicles, autogas fuel systems are not installed in the OEM factories.

Instead, this role is performed by channel partners in the industry, commonly using the same technology and delivering the bi-fuel autogas vehicles to the dealerships before they are delivered to the customer. Consumers appreciate this added option, as year-over-year sales growth is showing in Europe, the Middle East and Asia.

What About Commercial Vehicles?

If the European car industry was not so addicted to diesel for the small- and medium-duty commercial vehicles, autogas would surely be growing in this segment as well. With the existing distribution network of fuel — the service network of the industry — we must conclude that opportunities for immediate cleaner fuel adoption are left on the table there.

The taxi industry is the main commercial autogas driver in Europe, with the addition of U.S.-made trucks that are occasionally being used as work vehicles instead of European-made diesel vans. In the U.S. and Canada, however, this is completely different. Here, we see the main users for autogas are commercial fleets. There are various reasons why this is the case.

Commercial vehicles in North America are a great fit for autogas; the types of vehicles and engine specifications as seen in U.S. pickup trucks, vans, SUVs and box trucks are suited for autogas and readily available with certified technology. The operational use of certain types of businesses and fleets makes autogas the best and most sensical alternative fuel to use.

On top of that, it is proven to offer fuel cost savings to the businesses, including governmental fleets where cost savings are a service to the public. Even though the scale of adoption is nowhere near Europe, when looking at the U.S., there is stable, proven autogas technology available with an expanding network. It is no surprise it has shown continuous growth in the past several years.

There is continued progress in the school bus market segment, where OEMs have long embraced autogas. It is a pillar of confidence to drive people’s children to school daily on autogas.

No matter the location — Europe, Asia, North America or Africa — taxis use autogas in some capacity around the world. This shows it’s not a gamble at all; you can’t drive around the Strip for more than two minutes without seeing a propane autogas taxi.

In the transit sector — again a vital industry that is bringing people to work, hotels or their doctor appointments every single day — autogas is even beating the future technology on usability and preference.

Autogas or EV?

Autogas can make existing vehicles run on a cleaner fuel and reduce fuel costs at the same time. You don’t need to buy a new or different vehicle. It can make a big impact today — not just tomorrow or sometime in the future.

In some parts of the world, the infrastructure is already there; why not use and expand it more? There is a reason why approximately 80% of the new commercial vehicles in Korea are sold as the autogas version and not the EV — the usability for the owner or operator being the main one.

What impact does the weight of a battery electric vehicle (BEV) work truck or van have on the operational use? This — and the range of BEVs — are an issue. Transit companies are choosing autogas over a BEV van, even if the BEV is heavily subsidized. Unless new battery technology is developed and implemented, BEVs are not expected to play a significant role in the commercial vehicle space.

What about hybrids? The good news is that autogas and hybrids go hand in hand. With the increase of hybrid engines in vehicles all over the world, the adaptation of the same vehicles with autogas has increased as well. It makes the vehicle more economical and cleaner to operate.

Hybrid engines are likely to become more common in commercial fleet vehicles as emission reduction efforts continue; autogas is expected to benefit from this shift, which some view as a more logical alternative to a politically driven push for BEVs.

Renewable Propane Autogas

Besides autogas being cleaner than gasoline and diesel, there is another opportunity for autogas to play a role in the reduction of emissions for fleets and car owners. Using renewable autogas — derived from biodiesel and sustainable aviation fuel production — has also proved effective.

Using the same fuel system technology, large quantities of this type of renewable fuel have been used, and it has proved effective in both blended and full content applications. The U.S. holds a leading role in the development and adoption of renewable propane autogas. Canada is following suit, showing the same promising results in fleets that began testing it in 2024.

In Europe, the process and adaptation are slower in automotive use. There, the use of renewable autogas is applied more to power generation or industrial applications. As of 2025, production volume in Europe is falling behind demand. In Italy, there are regulations implemented that promise a blended use of 20% renewable autogas, but the goals will not be met if production is not increased.

In Belgium, about 10% is already being blended across the board by regulation. Using renewable autogas and increasing its production is an opportunity for the entire autogas industry. The public and political focus on cleaner emissions will continue, and this solution has proved that it works with existing fuel systems and engines. With the choice for blending, it is possible to impact a larger quantity of fuel, minimizing cost differential and broadening the reach and places of adoption at the same time.

The Continuing Evolution of Autogas Technology

The automotive industry is reducing emissions on internal combustion engines; vehicles emit much less than a couple decades ago. The evolution of engines has resulted in technologies such as direct injection engines and hybrid engines. Autogas fuel system manufacturers have shown the ability to adapt to these ever-changing conditions.

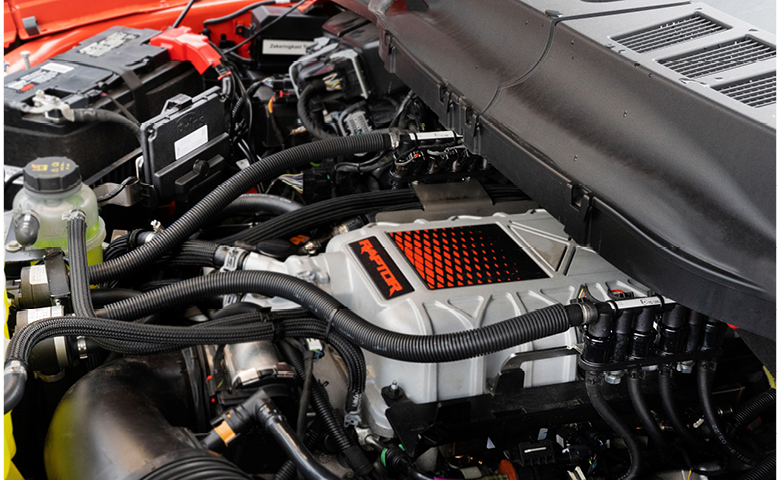

In 2025, from a technology standpoint, any relevant direct injection engine can be outfitted with an autogas fuel system. The adoption of hybrid engines and autogas is going in the same direction. Strides are being taken to make autogas fuel systems more efficient and more powerful, improving electronics and reducing size without compromise, where engine compartments are getting crowded.

Simplifying hardware components while still retaining all technological features to improve ease of installation and control or reduce costs where possible is an ongoing effort that can be expected from the industry. Despite the ongoing political push for BEVs and EVs, autogas should not be discounted as a viable fuel source for the global fleet. Using existing autogas networks and the opportunity to expand them is more cost-efficient and scalable than other solutions. The current status of the market shows that autogas’ success and potential continues to grow. In the U.S., autogas use by fleets is expected to increase. The pace in which this growth happens is merely dependent on the industry itself.