Sunday, July 9, 2017

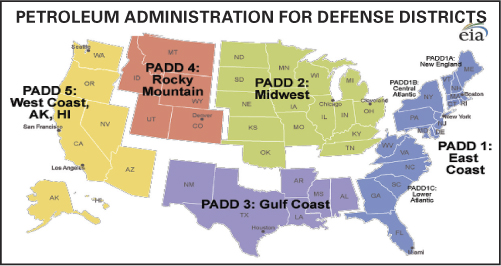

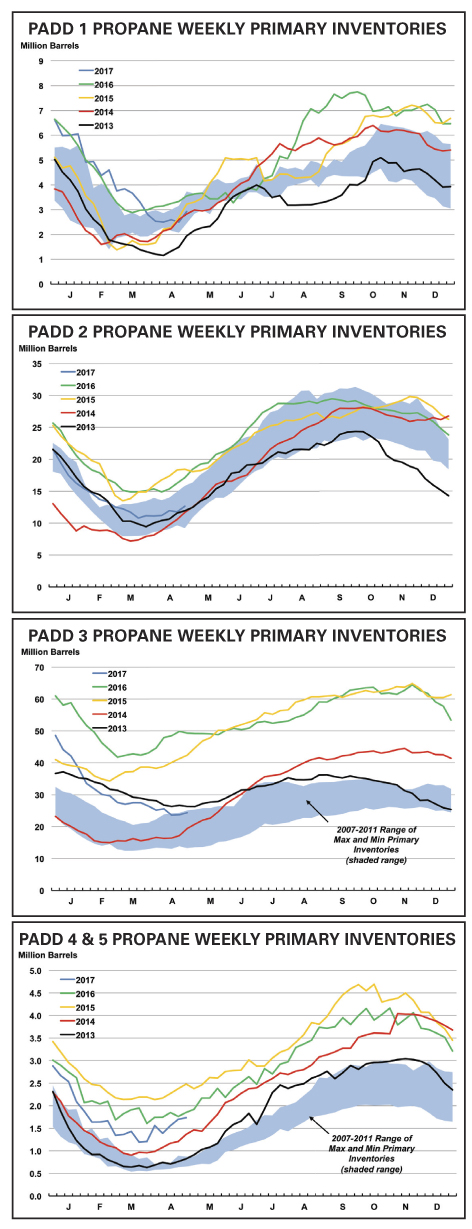

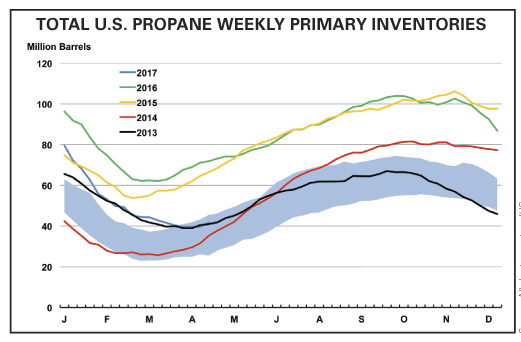

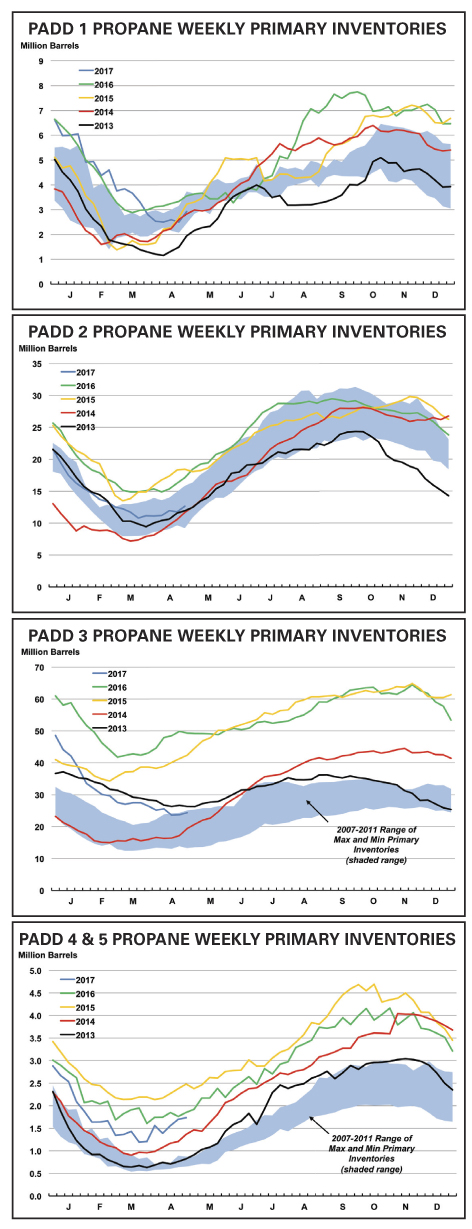

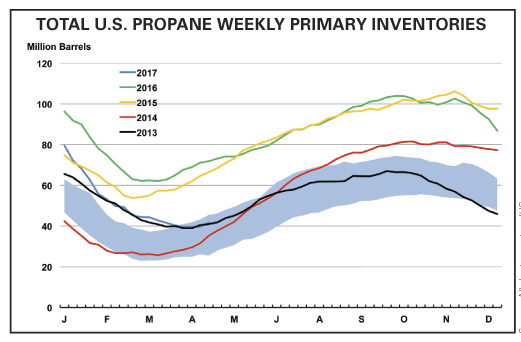

With inventory levels in mid-2017 close to mid-2013 levels, retail marketers continue to be concerned — as they have been for several months — that the winter of 2017-2018 could present similar challenges to the winter of 2013-2014. As most recall extremely vividly, that winter saw a major supply shortage, especially in the Midwest, and extreme wholesale price spikes as high as $5/gallon in the Heartland.

That year, a big demand for crop drying in the fall and then an extremely cold period across most of the country created a shortage, again, especially in the Midwest. These issues then combined with a shutdown of the Cochin Pipeline on short notice for several months and a leak at Todhunter, Ohio, that closed down that usually busy terminal. With exports moving out in larger and larger numbers, the industry faced a perfect storm as a lot of product from the Midwest was suddenly needed in the Northern and Eastern U.S. while product kept flowing toward the Gulf for export.

After a Federal Energy Regulatory Commission ruling that was sought for several weeks, 500,000 bbl of propane were prioritized for movement to the Midwest. This brought some relief to retail propane marketers who had been struggling to obtain supply and were rationing the product they had to desperate customers. That winter caused most retailers to evaluate how to prevent the challenges they faced from affecting them again. On the national level, the National Propane Gas Association (NPGA) formed a task force to evaluate and recommend action steps for the future to prevent the challenges faced from hitting the industry again.

An email to marketers in late April from the National Propane Gas Association (NPGA) outlined several steps it was taking at federal, state, and industry levels, including:

According to Jeff Petrash, NPGA vice president and general counsel, the Association does not want to alarm people, but it wants individual marketers as well as the industry as a whole to take necessary steps to avoid problems from a shortage. “We need better data to include exports in days-of-supply calculations,” he said, noting that NPGA has been lobbying for EIA to amend the way it presents data. Petrash joined the association in March 2013 because of his extensive knowledge of federal and state regulations of the energy industry. His strong background in natural gas policy was seen as critical as the shale revolution meant at least 63% of propane was coming from the natural gas stream and the industry wanted favorable parity with natural gas in public policy. During 2014, Petrash ended up spending most of the year focused on supply issues following the winter of 2013-2014.

“There is cause for concern,” he told those attending the Mid-States Convention in Kansas City on June 14. “The Houston Ship Channel has added more terminals, which has increased exports. Inventory levels are similar to where they were leading up to the winter of 2013-2014.” He said NPGA will be monitoring the situation very closely and keeping lawmakers and other government leaders informed. Regular calls are being held with Midwestern governors to keep them apprised of the propane inventory situation.

On a conference call with industry leaders ahead of Propane Days in Washington, D.C., NPGA staff coached participants on how to discuss the issue with legislators. While the NPGA Executive Committee has not endorsed cutting off or restricting exports, it is focused on convincing EIA to more accurately report propane levels. In addition, participants were encouraged to convince legislators that the Jones Act, which prohibits foreign ships from shipping products from one U.S. port to another, should be waived in emergency situations. There are currently no Jones Act-compliant U.S. ships that carry propane, so allowing shipments in emergency situations should not impact the U.S. negatively. A waiver to the Jones Act would have been useful in early 2014, when propane from the Gulf was desperately needed quickly in the northeastern U.S.

Squair also noted that prospective hours-of-service waivers are appropriate. “Such waivers, if issued after a supply or weather emergency, come too late and only help the industry play catch-up,” he said.

The concept of cutting or restricting exports is one that NPGA sees as a tough sell in Washington. Petrash explained to BPN that recently the federal government has been more willing to release crude oil and natural gas exports. Therefore, it is unlikely restricting propane exports would gain support, especially considering there have been no major supply issues since 2013-2014. Many have also expressed concern that cutting or restricting exports can cause producers to cut or restrict production and cause an even bigger shortage.

So what are individual propane retailers doing to minimize fallout from a shortage? A discussion was held on the final day of the Mid-States Convention in June, in which representatives from Missouri, Kansas, Iowa, and other Midwest states, most of which were hit as hard as anyone by the shortage of 2014, shared their plans. These questions, prepared by the PERC Supply Task Force, were distributed for retail marketers to ask themselves:

These questions from the PERC committee were distributed for retail marketers to discuss with their propane suppliers:

Many retailers at the Mid-States Convention said they have taken steps since 2014 to alleviate supply shortage problems from affecting them again, including adding a lot of additional storage. Tim Schweppe of Arrow Tank and Engineering told BPN that companies are now able to add much larger tanks — up to 45,000-gal. — without a lot of additional cost. In addition, several marketers shared they are switching many customers from 500-gal. tanks to 1000-gal. tanks. “As long as the customer is on a monthly billing plan that doesn’t penalize them for taking more gallons all at once, it improves our efficiencies as well as our ability to ensure supply security,” one marketer explained.

Retailers discussed the need for lifting hours-of-service regulations in emergency situations. “All of the Midwest states need to be on the same page,” one said. Greg Noll, executive vice president of the Propane Marketers Association of Kansas, encouraged marketers to be proactive and not reactive. “Some have no delivery system to customers,” he said. “Companies need to have a plan for keeping their own storage tanks and customer tanks full.” He encouraged companies not to just wait around for the customers to call.

There were also concerns about LIHEAP programs for low-income households. It was noted that Congress has not yet budgeted for LIHEAP, and customers may not have dollars if the program is not funded until September. This could present supply challenges in certain areas.

For now, it appears that after starting the last two winters at more than 100 MMbbl of propane in inventory and then experiencing warm winters, we are likely to enter October 2017 with only 75 MMbbl in the United States. Seaborne LPG grew by 0.5% in the first quarter of 2017 versus the first quarter of 2016. India’s LPG import growth was up by 40% last year and imports were up by 21% in India. In the first quarter of 2017, LPG production in the U.S. was down by 1.2% and the key factor that has allowed some builds in 2017 has been domestic consumption, down by 4.5%. The Panama Canal was widened in June 2016 and 21 very large gas carriers (VLGCs) can now travel through the new canal, each with 21 MMgal. of propane, enough to provide annual supply to 21 retailers that sell a million gallons a year. An additional 13 VLGCs are expected to be added by 2020.

There is no doubt there are plenty of factors that will keep the exports flowing to the rest of the world. This may cause an increase in price as U.S. retailers have more economic competition with the rest of the world for propane produced here. As one retail marketer conceded, “If the price goes up the same for all of us, are we really drastically affected if we do everything we can to guarantee our supply and keep our margins in place?” Proper planning can go a long way to guaranteeing a retail company will have propane, as well as peace of mind and guaranteed margins. — Pat Thornton

That year, a big demand for crop drying in the fall and then an extremely cold period across most of the country created a shortage, again, especially in the Midwest. These issues then combined with a shutdown of the Cochin Pipeline on short notice for several months and a leak at Todhunter, Ohio, that closed down that usually busy terminal. With exports moving out in larger and larger numbers, the industry faced a perfect storm as a lot of product from the Midwest was suddenly needed in the Northern and Eastern U.S. while product kept flowing toward the Gulf for export.

After a Federal Energy Regulatory Commission ruling that was sought for several weeks, 500,000 bbl of propane were prioritized for movement to the Midwest. This brought some relief to retail propane marketers who had been struggling to obtain supply and were rationing the product they had to desperate customers. That winter caused most retailers to evaluate how to prevent the challenges they faced from affecting them again. On the national level, the National Propane Gas Association (NPGA) formed a task force to evaluate and recommend action steps for the future to prevent the challenges faced from hitting the industry again.

An email to marketers in late April from the National Propane Gas Association (NPGA) outlined several steps it was taking at federal, state, and industry levels, including:

- Rail and pipeline prioritization: Communicating with the Association of Oil Pipelines and the Association of American Railroads to ensure that product is flowing to key supply points in the U.S. during peak usage times.

- Hours-of-service waivers: Working with the U.S. Department of Transportation to review regional hours-of-service waivers.

- Energy Information Administration (EIA) data: Connecting with the Department of Energy’s EIA to expand its supply notifications to include exports in its days-of-supply calculations.

- Research and data: Updating and expanding a 2015 infrastructure study to reveal changes in how, when, and by what means propane is moving through the supply chain.

- Evaluation of strategic propane reserve: Collaborating on a study to determine the feasibility for potential strategic reserves based on regional supply dynamics.

- Regional energy office communications: At the state level, coordinating energy officials and policymakers with the goal of educating them about regional propane supply factors.

According to Jeff Petrash, NPGA vice president and general counsel, the Association does not want to alarm people, but it wants individual marketers as well as the industry as a whole to take necessary steps to avoid problems from a shortage. “We need better data to include exports in days-of-supply calculations,” he said, noting that NPGA has been lobbying for EIA to amend the way it presents data. Petrash joined the association in March 2013 because of his extensive knowledge of federal and state regulations of the energy industry. His strong background in natural gas policy was seen as critical as the shale revolution meant at least 63% of propane was coming from the natural gas stream and the industry wanted favorable parity with natural gas in public policy. During 2014, Petrash ended up spending most of the year focused on supply issues following the winter of 2013-2014.

“There is cause for concern,” he told those attending the Mid-States Convention in Kansas City on June 14. “The Houston Ship Channel has added more terminals, which has increased exports. Inventory levels are similar to where they were leading up to the winter of 2013-2014.” He said NPGA will be monitoring the situation very closely and keeping lawmakers and other government leaders informed. Regular calls are being held with Midwestern governors to keep them apprised of the propane inventory situation.

On a conference call with industry leaders ahead of Propane Days in Washington, D.C., NPGA staff coached participants on how to discuss the issue with legislators. While the NPGA Executive Committee has not endorsed cutting off or restricting exports, it is focused on convincing EIA to more accurately report propane levels. In addition, participants were encouraged to convince legislators that the Jones Act, which prohibits foreign ships from shipping products from one U.S. port to another, should be waived in emergency situations. There are currently no Jones Act-compliant U.S. ships that carry propane, so allowing shipments in emergency situations should not impact the U.S. negatively. A waiver to the Jones Act would have been useful in early 2014, when propane from the Gulf was desperately needed quickly in the northeastern U.S.

Squair also noted that prospective hours-of-service waivers are appropriate. “Such waivers, if issued after a supply or weather emergency, come too late and only help the industry play catch-up,” he said.

The concept of cutting or restricting exports is one that NPGA sees as a tough sell in Washington. Petrash explained to BPN that recently the federal government has been more willing to release crude oil and natural gas exports. Therefore, it is unlikely restricting propane exports would gain support, especially considering there have been no major supply issues since 2013-2014. Many have also expressed concern that cutting or restricting exports can cause producers to cut or restrict production and cause an even bigger shortage.

So what are individual propane retailers doing to minimize fallout from a shortage? A discussion was held on the final day of the Mid-States Convention in June, in which representatives from Missouri, Kansas, Iowa, and other Midwest states, most of which were hit as hard as anyone by the shortage of 2014, shared their plans. These questions, prepared by the PERC Supply Task Force, were distributed for retail marketers to ask themselves:

- Do I employ diversification with multiple suppliers and supply points and originations?

- Do I contract for all my anticipated supply needs or do I plan on accessing the spot market to fulfill my delivery commitments? If I use the spot market for winter needs, do I have firm commitments from suppliers?

These questions from the PERC committee were distributed for retail marketers to discuss with their propane suppliers:

- Where is my propane supply produced, and where does my propane supplier store it before delivery to my business?

- How long does this propane supply take to be delivered from the production source to my business? What transportation modes are used?

- Does my supplier have enough propane supply from these production sources (See No. 1) to meet my supply needs in a colder-than-normal winter?

- Does my propane supplier’s terminal or storage facility have the capacity to meet the winter propane supply needs and delivery rates for my business and the other propane marketers it serves?

- Do I have a plan to procure incremental or alternative propane supply in case of increased demand or supply interruption? (Repeat questions 1-4 for this incremental supply.)

- How does this incremental supply plan (No. 5) affect truck transport to my business? Is trucking capacity available to meet those needs? If not, how will I remedy?

- What can my business do to mitigate peak winter supply needs with additional propane storage or early customer-fill programs?

- What tools can my propane supplier offer to insulate my business from propane price volatility?

Many retailers at the Mid-States Convention said they have taken steps since 2014 to alleviate supply shortage problems from affecting them again, including adding a lot of additional storage. Tim Schweppe of Arrow Tank and Engineering told BPN that companies are now able to add much larger tanks — up to 45,000-gal. — without a lot of additional cost. In addition, several marketers shared they are switching many customers from 500-gal. tanks to 1000-gal. tanks. “As long as the customer is on a monthly billing plan that doesn’t penalize them for taking more gallons all at once, it improves our efficiencies as well as our ability to ensure supply security,” one marketer explained.

Retailers discussed the need for lifting hours-of-service regulations in emergency situations. “All of the Midwest states need to be on the same page,” one said. Greg Noll, executive vice president of the Propane Marketers Association of Kansas, encouraged marketers to be proactive and not reactive. “Some have no delivery system to customers,” he said. “Companies need to have a plan for keeping their own storage tanks and customer tanks full.” He encouraged companies not to just wait around for the customers to call.

There were also concerns about LIHEAP programs for low-income households. It was noted that Congress has not yet budgeted for LIHEAP, and customers may not have dollars if the program is not funded until September. This could present supply challenges in certain areas.

For now, it appears that after starting the last two winters at more than 100 MMbbl of propane in inventory and then experiencing warm winters, we are likely to enter October 2017 with only 75 MMbbl in the United States. Seaborne LPG grew by 0.5% in the first quarter of 2017 versus the first quarter of 2016. India’s LPG import growth was up by 40% last year and imports were up by 21% in India. In the first quarter of 2017, LPG production in the U.S. was down by 1.2% and the key factor that has allowed some builds in 2017 has been domestic consumption, down by 4.5%. The Panama Canal was widened in June 2016 and 21 very large gas carriers (VLGCs) can now travel through the new canal, each with 21 MMgal. of propane, enough to provide annual supply to 21 retailers that sell a million gallons a year. An additional 13 VLGCs are expected to be added by 2020.

There is no doubt there are plenty of factors that will keep the exports flowing to the rest of the world. This may cause an increase in price as U.S. retailers have more economic competition with the rest of the world for propane produced here. As one retail marketer conceded, “If the price goes up the same for all of us, are we really drastically affected if we do everything we can to guarantee our supply and keep our margins in place?” Proper planning can go a long way to guaranteeing a retail company will have propane, as well as peace of mind and guaranteed margins. — Pat Thornton