Tuesday, March 8, 2016

Exiting what has been described as the worst December on record for the propane industry, and generally a winter heating season that has not been exciting, marketers are nonetheless being cautioned to prepare for changes that could be just around the corner. Propane inventories in the U.S. are much higher than domestic demand requires, a major reason why exports are soaring. But production levels and stockpiles must remain elevated in order to maintain U.S. propane’s lower-price advantage over other exporters, thereby maintaining American waterborne arbitrage. And high volumes in primary storage, especially on the Gulf Coast, can be drawn down quickly when exports ramp up. Plus, the ability to ship even more from U.S. shores is coming online.

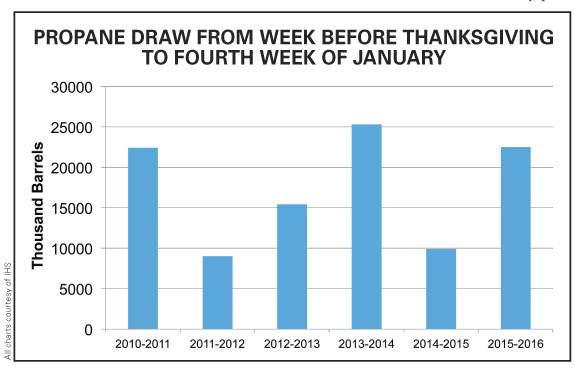

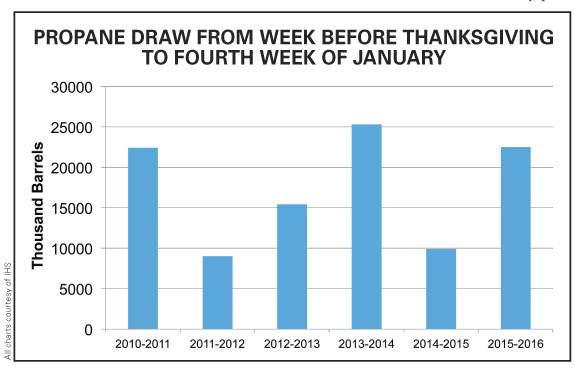

Kicking off the National Propane Gas Association’s Board of Directors winter meeting in Savannah, Ga., Jan. 31-Feb. 2, the Supply & Logistics Committee heard a report from IHS emphasizing that, while many may think U.S. propane inventories are high, export factors should remain squarely in the spotlight. Supply complacency is ill-advised. IHS director Debnil Chowdhury, manager of the consultancy’s North American natural gas liquids service, noted that although residential/commercial demand has been low due to the warmer 2015-2016 winter, in January inventories were nevertheless drawn down rapidly. He underscored that while stocks appear to be high, they need to be to maintain adequate days of demand.

He tendered an analogy: “Suppose a propane retailer has 1200 residential customers. To serve the market the retailer holds 1200 cylinders. Two years later the propane retailer has 2400 customers. Would the retailer still hold 1200 cylinders to serve double the amount of customers?” Obviously not. To be able to serve the increased number of customers, the retailer would need to hold more inventory to avoid running out. As well, the inventory would need to be in the region where the demand increased. In the case of U.S. propane exports, that inventory needs to be in the Gulf Coast.

High U.S. exports are reshuffling the deck in international trade flows, displacing traditional propane suppliers from Africa and the Middle East, he observed. Recently, Japan decided to import less from the Middle East in order to diversify its supply and lessen its dependence on the volatile region. The American ally has turned to the U.S. Gulf to source propane. In addition, higher U.S. exports have all but eliminated imports into Latin America and the Caribbean from Africa, and the competitiveness of U.S. exports to Asia, where volumes have already soared, promises to rise even more following the opening of the Panama Canal expansion. That expansion, expected early this year, will significantly cut gas carrier travel time and freight rates and make importing U.S. propane even more attractive. And that arbitrage is not easily closed. Most waterborne cargos are under long-term contracts, some extending 20 years.

Again, although total U.S. propane stocks are at record-high levels, and even though winter 2015-2016 has had low residential and commercial demand, inventory has drawn at rates similar to bitter cold winters, Chowdhury pointed out. All the record inventory is in PADD 3, where it needs to be for export demand. And, in preparation for launch, Gulf Coast stocks were especially high just prior to Enterprise Products recently commissioning expanded export terminal capacity at its Houston Ship Channel facility. Finally, days of demand are much more in line with historical figures than the inventory number would indicate. “Propane supplies you’re now selling to your customers could be destined to travel to the other side of the world,” Chowdhury advised marketers. “Propane in the U.S. is still a very seasonal market, and the export number keeps getting bigger and bigger.”

Regionally, the IHS director reported that PADD 1 (East Coast) propane stocks have fluctuated wildly over the past year, while PADD 2 (Midwest) inventories remain above the average range, partly due to lower to normal crop drying demand prior to the heating season, which itself had a late start. As outlined, PADD 3 (Gulf Coast) stocks remain high, while PADDs 4 (Rockies) and 5 (West Coast) supplies are high because of new storage capacity in PADD 4, the 10-MMbbl Magnum rail and truck terminal southwest of Salt Lake City, Utah. Inventories in Canada, a traditional source of U.S. supply, Chowdhury said, have moved back to near the five-year average. While lower import volumes continue to flow from Canada to the U.S. in 2015-2016, waterborne imports have not been necessary.

Moreover, he concluded that primary propane stocks in every region of the U.S. have fluctuated wildly over the past three years: record-high volumes in winter 2012-2013; record-low stocks in winter 2013-2014; and new, higher-record stocks over the 2014-2016 period. “These fluctuations are the result of both new dynamics and short-term anomalies—weather and supply outages—in the U.S. market,” he explained, adding that there have been rapid increases in supplies from gas processing due to shale gas production, as well as reduced use of propane as a feedstock to ethylene plants in the first half of 2014.

Looking ahead, IHS forecasts propane stocks on the East Coast remaining on the high side of the historical range through this year. Although inventory levels were depressed in PADD 1 in 2015, propane production from gas processing continues at elevated levels as Marcellus and Utica production continues to grow. The consultancy expects the pace of growth to be strong and lead to higher inventory in 2016.

Mid-Continent stocks are expected to remain high, but could decline depending on Gulf Coast drivers—cracking and exports. PADD 2 production growth will be lower in 2016 due to lower crude prices. But even with that potential slowdown, the region’s production level is at twice that of 2008. Again, pull from PADD 3 will be a major factor on stock levels. As stated, U.S. Gulf Coast propane stocks will be dependent on cracking rates and exports. Propane in the Rocky Mountain region should remain high due to new storage capacity, and stocks on the West Coast should remain above average, with about 80% of PADD 5 propane supply coming from refining and no cracking facilities in the region.

With an eye on 2017, Chowdhury said although supply has recently seemed high based on inventory, on a days-of-supply basis the situation has remained close to normal during the winter months. However, days of supply are seen being higher next year as crude oil production climbs due to price triggers. He emphasized that high propane stocks are the new normal. They must remain elevated or there is a strong risk of reaching a dangerously low days-of-demand threshold. He does not see supply dropping anywhere near 2013-2014 levels. Rather, the forecast calls for stronger oil demand growth, which thereafter will result in propane prices strengthening to a higher percentage to crude and the world market becomes more dependent on U.S. propane.

World oil (liquids) demand growth is expected to average 1.2 MMbbld in 2016 and 1.5 MMbbld in 2017. A global balance is seen occurring this year, but the market has completely changed. Meanwhile, the call on OPEC is an anachronism in light of its static policy action thus far to curb production, calling into question whether the U.S. is now the new swing producer. Regardless, OPEC’s thin spare capacity will become an issue late this year. And although international benchmark Brent crude will be lower this year, it is seen rising above $58/bbl by 2017 as low prices put pressure on U.S. production. Assumed is that OPEC maintains production and incremental Iranian barrels begin entering the market, an additional 400,000 bbld by mid-2016. Demand growth slows relative to 2015’s strong growth, but remains above 1 MMbbld. Propane prices are thereafter expected to recover over the next two years.

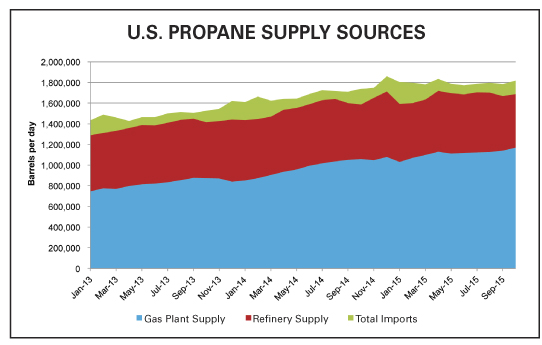

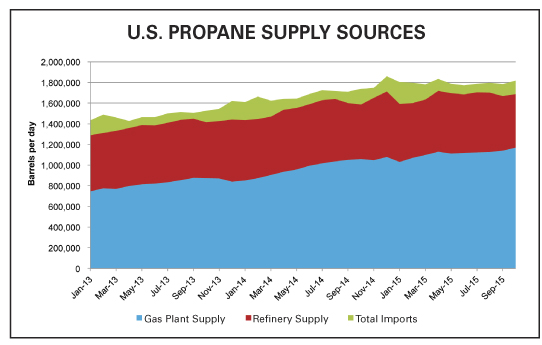

Outlining ongoing domestic propane supply factors, Chowdhury commented that while crude production is now falling and gas production is flattening, propane production is still growing. Tepid gas processing margins have strengthened, and rising production of all NGLs, including propane, has increased due to the natural gas going to gas plants being relatively wetter and processors maximizing recovery of liquids, with the exception of ethane. However, the trend of continued rising propane production is at risk because low crude prices are leading to a decline in associated production growth. Meanwhile, refinery production of propane has not changed appreciably, and imports are flat. “The risk is that there will be less propane because there is less crude and gas drilling,” he cautioned.

Under that scenario, a plunge in rig count would slow U.S. natural gas production growth, but only temporarily since production can ramp back up quickly once prices rebound. Crude oil’s value continues to underpin overall energy production, highlighting that the oil price remains important. Cheap crude also means more naphtha—an oil-derived substitute for propane—can be run for petrochemical cracking, and feed slates can be changed handily in many facilities. But even as crude oil production has declined, propane has been supported by non-associated gas production from reservoirs that contain little or no crude oil. Going forward, IHS sees Lower 48 propane production growth from natural gas sources remaining strong, but slowing in pace.

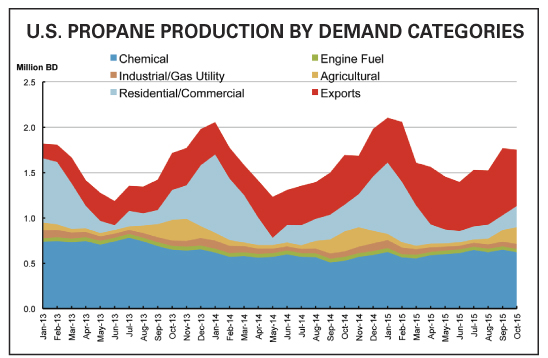

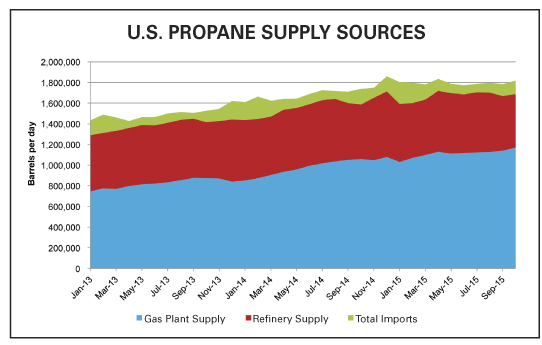

Although U.S. refineries are running hard, and with the door opened to U.S. crude oil exports, gas plant supply is where propane supply growth is centered. The U.S. refining margin advantage in the U.S. lags other regions. Refinery propane supply is also lower than it could be because refiners are using more of it for internal operations such as power generation and cracking, Chowdhury said. Looking beyond U.S. shores, he added that there are no new refineries planned for Latin America, extending a longer-term outlook for production in a region that is increasingly becoming more interconnected with the U.S. energy market.

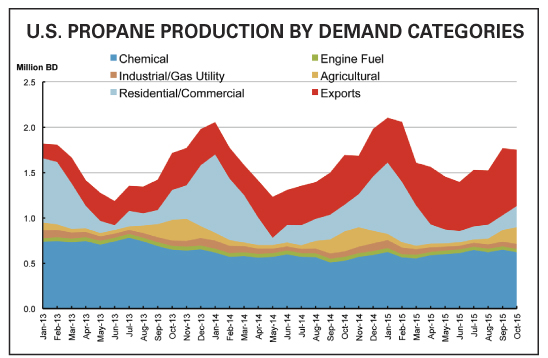

Characterizing winter 2015-2016 as being warmer than normal due to El Niño effects, Chowdhury remarked the pattern could next switch to La Niña, increasing the risk of hurricanes, which would rattle world markets. But for now, the warmer winter has weighed on residential and commercial demand, which has been lower than average. Agricultural demand for propane was also lower than in the past two years in spite of a strong harvest as precipitation levels kept the need for crop drying low.

At the same time, cracker demand for propane is rising. The U.S. is one of the cheapest sources of ethylene in the world — third after the Middle East and Western Canada — and ethylene plants are running at high rates. While over the past few years ethane has generally been a much cheaper feedstock, and ethane has displaced some propane as a cracker feed, higher prices for another petrochemical product, propylene, occasionally increases cracker demand for propane, Chowdhury explained.

However, lower crude prices, and the associated negative pull on propane prices, led some cracker operators to change feed slates, with propane demand increasing due to the narrowing of cash costs. Overall, propane-cracking rates, which were rising after the recession, plunged in 2014, but they are recovering once again because of low crude oil prices. Furthermore, propane demand is supported by both onshore and offshore propane dehydrogenation (PDH) plants, and in turn Asian PDH facilities support exports, which will see strong growth as new U.S. waterborne capacity is brought online—if production continues to grow.

With domestic residential/commercial demand flat, propane produced in the U.S. is now headed to Japan, to China for PDH, the Caribbean, and Latin America, Chowdhury said, adding that an emerging export market is the Indian Subcontinent. He characterized the region as being ripe for more LPG trade with its vast un-served and underserved population, and with the Indian Oil Corp. now planning and constructing infrastructure to set the stage for a bigger market.

He recounted that, although U.S. exports to Latin America were not expected to grow significantly, American waterborne trade has recently pushed out European, Middle Eastern, and African barrels, while Japan was much less dependent on Middle East suppliers thanks to imports from the U.S. Displaced Middle East barrels are now going to South Asia, Southeast Asia, and India, he said.

Meanwhile, most global propane supply growth is from North America. Worldwide, propane demand is flat in North America but growing in the Far East, Southeast Asia, the Indian Subcontinent, and in the Middle East. That demand growth is leading to more trade. He detailed that Far East propane demand will see growth in both residential/commercial and in chemicals. One residential/commercial product is town gas, which refers to propane blended with natural gas to increase Btu content, or propane blended with air. Southeast Asia propane demand will primarily experience growth in the residential and commercial area, and the Indian Subcontinent will have strong residential/commercial growth and some increase in propane use for chemical production.

Latin America, a mature propane demand market, nonetheless is expected to experience some residential/commercial growth, and the region has shifted its supply source from North Africa to the U.S. Middle East propane demand will be relatively steady over the next five years after seeing strong chemical demand growth in the past five years, Chowdhury said. Propane demand in the Commonwealth of Independent States (CIS), also known as the Russian Commonwealth, a regional organization formed after the breakup of the Soviet Union, is expected to grow due to increased chemical demand. Lastly, European demand will remain flat.

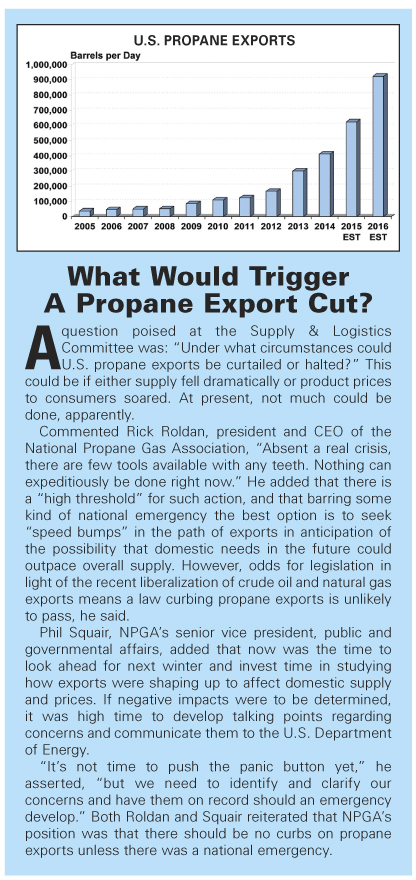

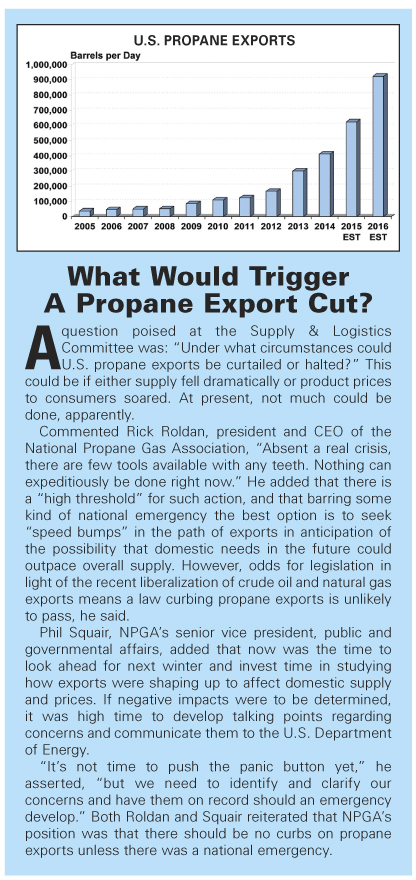

The IHS natural gas liquids service manager remarked that U.S. propane exports have set new record highs every year since 2008, and have risen from under 100,000 bbld in 2005 to about 900,000 bbld today. That total is expected to approach and exceed 1.1 MMbbld soon. More terminal capacity is coming, next up being the Phillips 66 facility in Freeport, Texas. Nearly half of U.S. LPG exports are now moving to Asia and Europe. He reiterated that the U.S. now dominates LPG trade to Latin America, with product from Africa, Europe, and the Middle East pushed out. And while increased European demand has emerged from the chemical sector, Russian supply has also increased.

Japan, China, Taiwan, and South Korea have been getting more of their LPG imports from outside the Middle East, namely from the U.S., while more Middle East volumes have been consumed in South Asia and Southeast Asia. The dramatic increases in U.S. exports have resulted in major changes to global LPG flows. Simultaneously, very large gas carrier (VLGC) fleet capacity is being added rapidly over the next two to three years, although the total will be impacted somewhat by some scrapping. And despite a tightening of U.S. versus world LPG prices, IHS expects Mont Belvieu propane to remain discounted relative to other international benchmarks in order to maintain arbitrage.

Chowdhury concluded that propane inventories in the U.S. need to be well stocked. If days of demand fall too low, propane prices would ultimately rise and deter exports. Since propane and butane are used internationally as feedstocks for ethylene production, a weak petrochemical market would put downward pressure on LPG prices, whereas a strong petrochemical market would support prices. A weak or strong global economy would have the same effect. In addition, competitiveness is characterizing the global LPG market, with every player with excess production targeting similar regions for exports. Finally, higher or lower crude oil prices will affect global LPG prices. Substantially higher or lower crude prices will also effect propane production. —John Needham

Kicking off the National Propane Gas Association’s Board of Directors winter meeting in Savannah, Ga., Jan. 31-Feb. 2, the Supply & Logistics Committee heard a report from IHS emphasizing that, while many may think U.S. propane inventories are high, export factors should remain squarely in the spotlight. Supply complacency is ill-advised. IHS director Debnil Chowdhury, manager of the consultancy’s North American natural gas liquids service, noted that although residential/commercial demand has been low due to the warmer 2015-2016 winter, in January inventories were nevertheless drawn down rapidly. He underscored that while stocks appear to be high, they need to be to maintain adequate days of demand.

He tendered an analogy: “Suppose a propane retailer has 1200 residential customers. To serve the market the retailer holds 1200 cylinders. Two years later the propane retailer has 2400 customers. Would the retailer still hold 1200 cylinders to serve double the amount of customers?” Obviously not. To be able to serve the increased number of customers, the retailer would need to hold more inventory to avoid running out. As well, the inventory would need to be in the region where the demand increased. In the case of U.S. propane exports, that inventory needs to be in the Gulf Coast.

High U.S. exports are reshuffling the deck in international trade flows, displacing traditional propane suppliers from Africa and the Middle East, he observed. Recently, Japan decided to import less from the Middle East in order to diversify its supply and lessen its dependence on the volatile region. The American ally has turned to the U.S. Gulf to source propane. In addition, higher U.S. exports have all but eliminated imports into Latin America and the Caribbean from Africa, and the competitiveness of U.S. exports to Asia, where volumes have already soared, promises to rise even more following the opening of the Panama Canal expansion. That expansion, expected early this year, will significantly cut gas carrier travel time and freight rates and make importing U.S. propane even more attractive. And that arbitrage is not easily closed. Most waterborne cargos are under long-term contracts, some extending 20 years.

Again, although total U.S. propane stocks are at record-high levels, and even though winter 2015-2016 has had low residential and commercial demand, inventory has drawn at rates similar to bitter cold winters, Chowdhury pointed out. All the record inventory is in PADD 3, where it needs to be for export demand. And, in preparation for launch, Gulf Coast stocks were especially high just prior to Enterprise Products recently commissioning expanded export terminal capacity at its Houston Ship Channel facility. Finally, days of demand are much more in line with historical figures than the inventory number would indicate. “Propane supplies you’re now selling to your customers could be destined to travel to the other side of the world,” Chowdhury advised marketers. “Propane in the U.S. is still a very seasonal market, and the export number keeps getting bigger and bigger.”

Regionally, the IHS director reported that PADD 1 (East Coast) propane stocks have fluctuated wildly over the past year, while PADD 2 (Midwest) inventories remain above the average range, partly due to lower to normal crop drying demand prior to the heating season, which itself had a late start. As outlined, PADD 3 (Gulf Coast) stocks remain high, while PADDs 4 (Rockies) and 5 (West Coast) supplies are high because of new storage capacity in PADD 4, the 10-MMbbl Magnum rail and truck terminal southwest of Salt Lake City, Utah. Inventories in Canada, a traditional source of U.S. supply, Chowdhury said, have moved back to near the five-year average. While lower import volumes continue to flow from Canada to the U.S. in 2015-2016, waterborne imports have not been necessary.

Moreover, he concluded that primary propane stocks in every region of the U.S. have fluctuated wildly over the past three years: record-high volumes in winter 2012-2013; record-low stocks in winter 2013-2014; and new, higher-record stocks over the 2014-2016 period. “These fluctuations are the result of both new dynamics and short-term anomalies—weather and supply outages—in the U.S. market,” he explained, adding that there have been rapid increases in supplies from gas processing due to shale gas production, as well as reduced use of propane as a feedstock to ethylene plants in the first half of 2014.

Looking ahead, IHS forecasts propane stocks on the East Coast remaining on the high side of the historical range through this year. Although inventory levels were depressed in PADD 1 in 2015, propane production from gas processing continues at elevated levels as Marcellus and Utica production continues to grow. The consultancy expects the pace of growth to be strong and lead to higher inventory in 2016.

Mid-Continent stocks are expected to remain high, but could decline depending on Gulf Coast drivers—cracking and exports. PADD 2 production growth will be lower in 2016 due to lower crude prices. But even with that potential slowdown, the region’s production level is at twice that of 2008. Again, pull from PADD 3 will be a major factor on stock levels. As stated, U.S. Gulf Coast propane stocks will be dependent on cracking rates and exports. Propane in the Rocky Mountain region should remain high due to new storage capacity, and stocks on the West Coast should remain above average, with about 80% of PADD 5 propane supply coming from refining and no cracking facilities in the region.

With an eye on 2017, Chowdhury said although supply has recently seemed high based on inventory, on a days-of-supply basis the situation has remained close to normal during the winter months. However, days of supply are seen being higher next year as crude oil production climbs due to price triggers. He emphasized that high propane stocks are the new normal. They must remain elevated or there is a strong risk of reaching a dangerously low days-of-demand threshold. He does not see supply dropping anywhere near 2013-2014 levels. Rather, the forecast calls for stronger oil demand growth, which thereafter will result in propane prices strengthening to a higher percentage to crude and the world market becomes more dependent on U.S. propane.

World oil (liquids) demand growth is expected to average 1.2 MMbbld in 2016 and 1.5 MMbbld in 2017. A global balance is seen occurring this year, but the market has completely changed. Meanwhile, the call on OPEC is an anachronism in light of its static policy action thus far to curb production, calling into question whether the U.S. is now the new swing producer. Regardless, OPEC’s thin spare capacity will become an issue late this year. And although international benchmark Brent crude will be lower this year, it is seen rising above $58/bbl by 2017 as low prices put pressure on U.S. production. Assumed is that OPEC maintains production and incremental Iranian barrels begin entering the market, an additional 400,000 bbld by mid-2016. Demand growth slows relative to 2015’s strong growth, but remains above 1 MMbbld. Propane prices are thereafter expected to recover over the next two years.

Outlining ongoing domestic propane supply factors, Chowdhury commented that while crude production is now falling and gas production is flattening, propane production is still growing. Tepid gas processing margins have strengthened, and rising production of all NGLs, including propane, has increased due to the natural gas going to gas plants being relatively wetter and processors maximizing recovery of liquids, with the exception of ethane. However, the trend of continued rising propane production is at risk because low crude prices are leading to a decline in associated production growth. Meanwhile, refinery production of propane has not changed appreciably, and imports are flat. “The risk is that there will be less propane because there is less crude and gas drilling,” he cautioned.

Under that scenario, a plunge in rig count would slow U.S. natural gas production growth, but only temporarily since production can ramp back up quickly once prices rebound. Crude oil’s value continues to underpin overall energy production, highlighting that the oil price remains important. Cheap crude also means more naphtha—an oil-derived substitute for propane—can be run for petrochemical cracking, and feed slates can be changed handily in many facilities. But even as crude oil production has declined, propane has been supported by non-associated gas production from reservoirs that contain little or no crude oil. Going forward, IHS sees Lower 48 propane production growth from natural gas sources remaining strong, but slowing in pace.

Although U.S. refineries are running hard, and with the door opened to U.S. crude oil exports, gas plant supply is where propane supply growth is centered. The U.S. refining margin advantage in the U.S. lags other regions. Refinery propane supply is also lower than it could be because refiners are using more of it for internal operations such as power generation and cracking, Chowdhury said. Looking beyond U.S. shores, he added that there are no new refineries planned for Latin America, extending a longer-term outlook for production in a region that is increasingly becoming more interconnected with the U.S. energy market.

Characterizing winter 2015-2016 as being warmer than normal due to El Niño effects, Chowdhury remarked the pattern could next switch to La Niña, increasing the risk of hurricanes, which would rattle world markets. But for now, the warmer winter has weighed on residential and commercial demand, which has been lower than average. Agricultural demand for propane was also lower than in the past two years in spite of a strong harvest as precipitation levels kept the need for crop drying low.

At the same time, cracker demand for propane is rising. The U.S. is one of the cheapest sources of ethylene in the world — third after the Middle East and Western Canada — and ethylene plants are running at high rates. While over the past few years ethane has generally been a much cheaper feedstock, and ethane has displaced some propane as a cracker feed, higher prices for another petrochemical product, propylene, occasionally increases cracker demand for propane, Chowdhury explained.

However, lower crude prices, and the associated negative pull on propane prices, led some cracker operators to change feed slates, with propane demand increasing due to the narrowing of cash costs. Overall, propane-cracking rates, which were rising after the recession, plunged in 2014, but they are recovering once again because of low crude oil prices. Furthermore, propane demand is supported by both onshore and offshore propane dehydrogenation (PDH) plants, and in turn Asian PDH facilities support exports, which will see strong growth as new U.S. waterborne capacity is brought online—if production continues to grow.

With domestic residential/commercial demand flat, propane produced in the U.S. is now headed to Japan, to China for PDH, the Caribbean, and Latin America, Chowdhury said, adding that an emerging export market is the Indian Subcontinent. He characterized the region as being ripe for more LPG trade with its vast un-served and underserved population, and with the Indian Oil Corp. now planning and constructing infrastructure to set the stage for a bigger market.

He recounted that, although U.S. exports to Latin America were not expected to grow significantly, American waterborne trade has recently pushed out European, Middle Eastern, and African barrels, while Japan was much less dependent on Middle East suppliers thanks to imports from the U.S. Displaced Middle East barrels are now going to South Asia, Southeast Asia, and India, he said.

Meanwhile, most global propane supply growth is from North America. Worldwide, propane demand is flat in North America but growing in the Far East, Southeast Asia, the Indian Subcontinent, and in the Middle East. That demand growth is leading to more trade. He detailed that Far East propane demand will see growth in both residential/commercial and in chemicals. One residential/commercial product is town gas, which refers to propane blended with natural gas to increase Btu content, or propane blended with air. Southeast Asia propane demand will primarily experience growth in the residential and commercial area, and the Indian Subcontinent will have strong residential/commercial growth and some increase in propane use for chemical production.

Latin America, a mature propane demand market, nonetheless is expected to experience some residential/commercial growth, and the region has shifted its supply source from North Africa to the U.S. Middle East propane demand will be relatively steady over the next five years after seeing strong chemical demand growth in the past five years, Chowdhury said. Propane demand in the Commonwealth of Independent States (CIS), also known as the Russian Commonwealth, a regional organization formed after the breakup of the Soviet Union, is expected to grow due to increased chemical demand. Lastly, European demand will remain flat.

The IHS natural gas liquids service manager remarked that U.S. propane exports have set new record highs every year since 2008, and have risen from under 100,000 bbld in 2005 to about 900,000 bbld today. That total is expected to approach and exceed 1.1 MMbbld soon. More terminal capacity is coming, next up being the Phillips 66 facility in Freeport, Texas. Nearly half of U.S. LPG exports are now moving to Asia and Europe. He reiterated that the U.S. now dominates LPG trade to Latin America, with product from Africa, Europe, and the Middle East pushed out. And while increased European demand has emerged from the chemical sector, Russian supply has also increased.

Japan, China, Taiwan, and South Korea have been getting more of their LPG imports from outside the Middle East, namely from the U.S., while more Middle East volumes have been consumed in South Asia and Southeast Asia. The dramatic increases in U.S. exports have resulted in major changes to global LPG flows. Simultaneously, very large gas carrier (VLGC) fleet capacity is being added rapidly over the next two to three years, although the total will be impacted somewhat by some scrapping. And despite a tightening of U.S. versus world LPG prices, IHS expects Mont Belvieu propane to remain discounted relative to other international benchmarks in order to maintain arbitrage.

Chowdhury concluded that propane inventories in the U.S. need to be well stocked. If days of demand fall too low, propane prices would ultimately rise and deter exports. Since propane and butane are used internationally as feedstocks for ethylene production, a weak petrochemical market would put downward pressure on LPG prices, whereas a strong petrochemical market would support prices. A weak or strong global economy would have the same effect. In addition, competitiveness is characterizing the global LPG market, with every player with excess production targeting similar regions for exports. Finally, higher or lower crude oil prices will affect global LPG prices. Substantially higher or lower crude prices will also effect propane production. —John Needham