Wednesday, January 22, 2020

(January 22, 2020) — Recent supply challenges in Iowa and across the Midwest serve as a reminder that retail propane marketers can enjoy much greater success if they are making decisions based on real-time market knowledge. “Buying the cheapest posted price on a given day isn’t always the best strategy,” said Marty Lerum, managing partner at Propane Resources (Mission, Kan.). “Supply security is also extremely important, even if it means paying a little extra.”

Lerum feels that retail marketers need to be aware that with a changing marketing environment, some producer/wholesalers are opting out of doing small contracts and spot loads for retail propane marketers. “They are focusing more on selling larger volumes to larger buyers that will guarantee a rate of return on their investment,” he said. “This puts more risk on the retail propane marketer. While we produce more propane than ever before in the U.S., the propane distribution system is actually less flexible to deliver to the ‘retail propane industry.’ Investments have been made to redirect the flow of propane to the export market and the retail propane market and the companies that have made those investments need a return on those investments! Now in December we have propane prices in Conway and Mont Belvieu at 50 cents per gallon and propane postings in parts of the Midwest from $1.00 to $1.90 per gallon. There is a reason for that and if you are a propane retailer and don’t understand why, we’d advise finding someone that can explain to you how to avoid the latter in the future.”

Lerum feels that retail marketers need to be aware that with a changing marketing environment, some producer/wholesalers are opting out of doing small contracts and spot loads for retail propane marketers. “They are focusing more on selling larger volumes to larger buyers that will guarantee a rate of return on their investment,” he said. “This puts more risk on the retail propane marketer. While we produce more propane than ever before in the U.S., the propane distribution system is actually less flexible to deliver to the ‘retail propane industry.’ Investments have been made to redirect the flow of propane to the export market and the retail propane market and the companies that have made those investments need a return on those investments! Now in December we have propane prices in Conway and Mont Belvieu at 50 cents per gallon and propane postings in parts of the Midwest from $1.00 to $1.90 per gallon. There is a reason for that and if you are a propane retailer and don’t understand why, we’d advise finding someone that can explain to you how to avoid the latter in the future.”

Managing supply both for retail companies operated by Propane Resources as well for as other clients, Lerum believes that while there are key numbers, such as EBITDA (earnings before interest, taxes, depreciation, and amortization), that every business owner should track, the key numbers for retail propane marketers will vary, usually based on the level of sophistication of the company and the type of customers they serve. “For retailers, business goals should tie to key numbers that should be monitored. Each strategy for growing revenue will have key numbers that should be monitored.”

Gross Margin

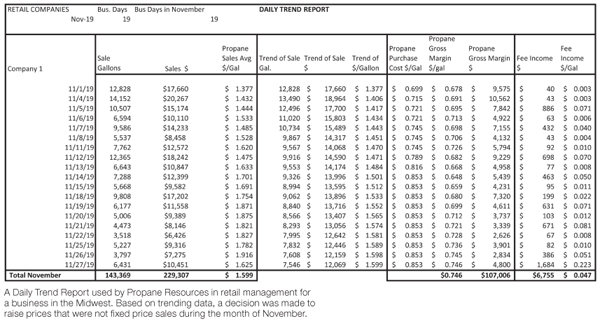

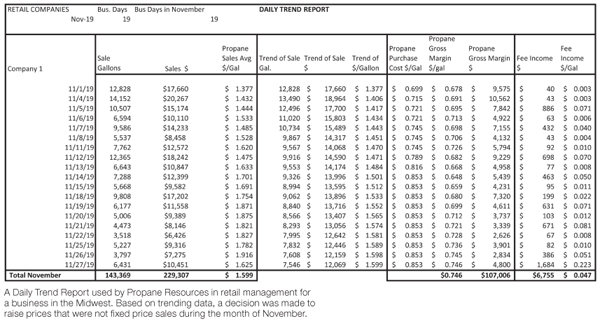

“Gross margin is king,” said Walt Colburn, an analyst who assists Lerum in tracking key numbers. “By the time you are doing annual financials, it is too late to learn that you are losing money.” Colburn tracks the gross margin for all profit centers for each retail operation. “The recent grain drying demand is a good example of a profit center that should be tracked,” he said. “It is easy for retailers to get caught up in the quick demand and needs of the farmers. All costs, including the propane, delivery, administrative expenses, tanks in the field, and other equipment, must be considered. This will help in deciding on future marketing programs for grain drying. It may be determined that your cost to service a customer is not allowing for enough gross margin to make some grain drying accounts worthwhile. Sometimes it’s better to let a customer find another supplier so you can focus on the profitability in other areas of your business.”

“Too much investment in high-volume, low-margin accounts often can cause problems in the retail propane industry,” Lerum said. “The desire to increase gallons regardless of gross margin is a common bad habit.” He noted that many successful retailers have mastered the importance of owning the tanks at the customer site and being able to fill them at any time. “Let’s say a retailer has 1400 residential customers, each with a 500-gallon tank. Considering you could fill each tank to 85%, you can control about 600,000 storage gallons in the field instead of working with only 30,000 to 60,000 gallons of plant storage,” he explained. “The control over 600,000 gallons of customer storage will lower a propane retailer’s delivered cost! For propane retailers, getting to the point where they can control their customer’s storage will take marketing programs that their employees can quickly and easily explain the benefits to their customers, such as Budget Plans with an incentive for the customer to join. Tracking key numbers in getting to this point is important. There are many benefits to building company value and increasing efficiency associated with owning and controlling the delivery schedule to tanks at customer sites.”

“Having key numbers at your fingertips in real time can help you when faced with the possible need for a new employee, a new bobtail, or many other investments,” Lerum said. “If you can’t justify the investment, it is better to know that on the front end and avoid wasting time and money.”

Customer Retention

In Michigan, Chris Caywood, president of Caywood Propane Gas, Inc. (Albion, Coldwater, and Hudson, Mich.) says tying the key numbers he looks at to his goals has been a strategy since he came back to run the family business six years ago. “We have shifted our focus more heavily toward customer service, digital migration, and value-pricing,” Caywood said. “We believe that sustainable, profitable growth ultimately depends more on customer retention than new customer growth. That’s why run-outs, delivery performance, on-time service call arrival, answering the phone, first-call resolution, and the convenience of online options are so important. Almost every retailer says they have great service at great prices. Fact is, most retailers really have no empirical idea whether they do.”

“Data is helpful only if it helps you understand whether you’re making progress toward your goals. For example, most retailers have a basic idea of their gallons/delivery and gallons/hour,” Caywood said. “We know exactly how much our margin improves when we improve our gallons/hour, so we can evaluate the financial return on investments that drive gallon/hour increases. Our ultimate goal is to empirically connect these metrics to customer service performance and customer retention using some basic regression models.”

Caywood acknowledges that this all sounds kind of nerdy, but he doesn’t feel there is anything nerdy at all about figuring out how much each operating button he and his staff push moves the customer retention needle. “We’re excited about figuring out which buttons are more important, but we’re even more excited about discovering which buttons really don’t move the needle at all or, worse yet, adversely impact retention.”

“The key tools are technology, engaged employees, and staying on message,” Caywood said. “When we started down this road five years ago, we did not have the technology tools or level of employee engagement that we have today. We invested heavily in both. Five years ago, we did not have a health care plan, retirement plan matching, profit-sharing contributions, or paid time off. You can spend a fortune on technology, but you’re not going to get much out of it if you don’t have the talent to use it to its fullest. You also need to spend time cheering, coaching, and reminding the team why you’re doing it. We’ve only recently recognized the importance of the cheering, coaching, and reminding and have started investing more time in it.” — Pat Thornton

Lerum feels that retail marketers need to be aware that with a changing marketing environment, some producer/wholesalers are opting out of doing small contracts and spot loads for retail propane marketers. “They are focusing more on selling larger volumes to larger buyers that will guarantee a rate of return on their investment,” he said. “This puts more risk on the retail propane marketer. While we produce more propane than ever before in the U.S., the propane distribution system is actually less flexible to deliver to the ‘retail propane industry.’ Investments have been made to redirect the flow of propane to the export market and the retail propane market and the companies that have made those investments need a return on those investments! Now in December we have propane prices in Conway and Mont Belvieu at 50 cents per gallon and propane postings in parts of the Midwest from $1.00 to $1.90 per gallon. There is a reason for that and if you are a propane retailer and don’t understand why, we’d advise finding someone that can explain to you how to avoid the latter in the future.”

Lerum feels that retail marketers need to be aware that with a changing marketing environment, some producer/wholesalers are opting out of doing small contracts and spot loads for retail propane marketers. “They are focusing more on selling larger volumes to larger buyers that will guarantee a rate of return on their investment,” he said. “This puts more risk on the retail propane marketer. While we produce more propane than ever before in the U.S., the propane distribution system is actually less flexible to deliver to the ‘retail propane industry.’ Investments have been made to redirect the flow of propane to the export market and the retail propane market and the companies that have made those investments need a return on those investments! Now in December we have propane prices in Conway and Mont Belvieu at 50 cents per gallon and propane postings in parts of the Midwest from $1.00 to $1.90 per gallon. There is a reason for that and if you are a propane retailer and don’t understand why, we’d advise finding someone that can explain to you how to avoid the latter in the future.”Managing supply both for retail companies operated by Propane Resources as well for as other clients, Lerum believes that while there are key numbers, such as EBITDA (earnings before interest, taxes, depreciation, and amortization), that every business owner should track, the key numbers for retail propane marketers will vary, usually based on the level of sophistication of the company and the type of customers they serve. “For retailers, business goals should tie to key numbers that should be monitored. Each strategy for growing revenue will have key numbers that should be monitored.”

Gross Margin

“Gross margin is king,” said Walt Colburn, an analyst who assists Lerum in tracking key numbers. “By the time you are doing annual financials, it is too late to learn that you are losing money.” Colburn tracks the gross margin for all profit centers for each retail operation. “The recent grain drying demand is a good example of a profit center that should be tracked,” he said. “It is easy for retailers to get caught up in the quick demand and needs of the farmers. All costs, including the propane, delivery, administrative expenses, tanks in the field, and other equipment, must be considered. This will help in deciding on future marketing programs for grain drying. It may be determined that your cost to service a customer is not allowing for enough gross margin to make some grain drying accounts worthwhile. Sometimes it’s better to let a customer find another supplier so you can focus on the profitability in other areas of your business.”

“Too much investment in high-volume, low-margin accounts often can cause problems in the retail propane industry,” Lerum said. “The desire to increase gallons regardless of gross margin is a common bad habit.” He noted that many successful retailers have mastered the importance of owning the tanks at the customer site and being able to fill them at any time. “Let’s say a retailer has 1400 residential customers, each with a 500-gallon tank. Considering you could fill each tank to 85%, you can control about 600,000 storage gallons in the field instead of working with only 30,000 to 60,000 gallons of plant storage,” he explained. “The control over 600,000 gallons of customer storage will lower a propane retailer’s delivered cost! For propane retailers, getting to the point where they can control their customer’s storage will take marketing programs that their employees can quickly and easily explain the benefits to their customers, such as Budget Plans with an incentive for the customer to join. Tracking key numbers in getting to this point is important. There are many benefits to building company value and increasing efficiency associated with owning and controlling the delivery schedule to tanks at customer sites.”

“Having key numbers at your fingertips in real time can help you when faced with the possible need for a new employee, a new bobtail, or many other investments,” Lerum said. “If you can’t justify the investment, it is better to know that on the front end and avoid wasting time and money.”

Customer Retention

In Michigan, Chris Caywood, president of Caywood Propane Gas, Inc. (Albion, Coldwater, and Hudson, Mich.) says tying the key numbers he looks at to his goals has been a strategy since he came back to run the family business six years ago. “We have shifted our focus more heavily toward customer service, digital migration, and value-pricing,” Caywood said. “We believe that sustainable, profitable growth ultimately depends more on customer retention than new customer growth. That’s why run-outs, delivery performance, on-time service call arrival, answering the phone, first-call resolution, and the convenience of online options are so important. Almost every retailer says they have great service at great prices. Fact is, most retailers really have no empirical idea whether they do.”

“Data is helpful only if it helps you understand whether you’re making progress toward your goals. For example, most retailers have a basic idea of their gallons/delivery and gallons/hour,” Caywood said. “We know exactly how much our margin improves when we improve our gallons/hour, so we can evaluate the financial return on investments that drive gallon/hour increases. Our ultimate goal is to empirically connect these metrics to customer service performance and customer retention using some basic regression models.”

Caywood acknowledges that this all sounds kind of nerdy, but he doesn’t feel there is anything nerdy at all about figuring out how much each operating button he and his staff push moves the customer retention needle. “We’re excited about figuring out which buttons are more important, but we’re even more excited about discovering which buttons really don’t move the needle at all or, worse yet, adversely impact retention.”

“The key tools are technology, engaged employees, and staying on message,” Caywood said. “When we started down this road five years ago, we did not have the technology tools or level of employee engagement that we have today. We invested heavily in both. Five years ago, we did not have a health care plan, retirement plan matching, profit-sharing contributions, or paid time off. You can spend a fortune on technology, but you’re not going to get much out of it if you don’t have the talent to use it to its fullest. You also need to spend time cheering, coaching, and reminding the team why you’re doing it. We’ve only recently recognized the importance of the cheering, coaching, and reminding and have started investing more time in it.” — Pat Thornton