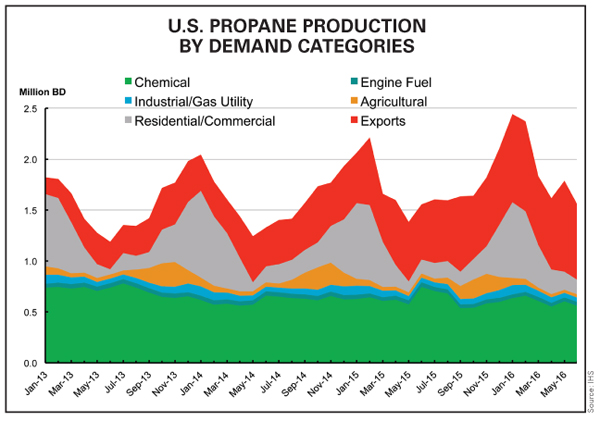

The Supply and Logistics Committee meeting was up first. Reported was that oil rig counts in the U.S. have started to recover, and it appears the natural gas rig count is close to bottoming and should turn around. Lower-48 propane production growth from natural gas sources will be strong, but slower in pace as the nation enters the winter heating season.

Debnil Chowdhury, director of the IHS North American NGL Service, noted that propane production from gas plants flattened in 2016, but it is now stronger than crude and gas production data indicate. Meanwhile, refinery propane production is higher than last year now that prices versus crude have recovered. Among other domestic propane supply factors: with crude production now falling and gas production flattening, propane production is showing signs of also flattening. But tepid gas processing margins have strengthened, and production of all NGLs, including propane, has increased due to natural gas into gas plants being relatively wetter and processors maximizing the recovery of liquids. However, the trend of continued rising production is at risk because low crude prices could lead to a decline in associated production growth.

Again, refinery propane production is higher this year versus 2015 owing to stronger prices. U.S. refinery runs have been stronger than average in 2016 but slightly lower than 2015 since April. Propane production from refineries was depressed in 2015 despite strong runs, and production has also recovered this year because of less internal burning of propane for power generation.

Further indicated is that the National Oceanic and Atmospheric Administration believes there will be a winter with close-to-average heating degree days (HDD) this year. The heating season is seen as being slightly warmer than average but nonetheless 13% cooler than last winter, when residential/commercial propane demand was low due to warmer temperatures. Chowdhury said “93% of residential/commercial demand can be explained by the HDD count,” and that winter 2016-2017, although colder, is expected to be below the 10-year average for heating degree days.

With high domestic primary inventories the new normal because of ramped-up export capability, and with inventories into October similar to the record highs seen last year, days of supply are nevertheless about five days lower this year, Chowdhury said. He added that days of demand are much more in line with history than the inventory number would indicate, and record stock levels, however high, can still be drawn down quickly if rising export volumes kick in.

In addition, chemical propane demand has seen a strong increase since 2014 after crude prices fell, although ethane has been favored for much of 2016. And because of unfavorable cash cost economics compared to ethane, propane chemical demand has fallen. Agricultural demand for crop drying does not appear to be developing significance this year due to overall dry weather in growing regions. Finally, propane prices versus crude oil have been among the strongest in recent memory and have hardened substantially despite record-high inventories.

“It’s predicted to be cooler this winter, but ag demand feels weak because of dry conditions,” Chowdhury said. “Exports have tailed off, but prices have gone from their weakest compared to crude to their strongest. There has been pressure in the second half of this year on gas plant supply, although refinery propane production is up. Refiners are using less in their internal operations now that stronger prices are more available.” He added that a continued flattening of U.S. propane production growth through 2020 will depend on crude prices either rising or declining.

NPGA’s Trend Report indicates a lower draw rate on stocks this winter than last, but that forecast could be adjusted higher if exports regain strength and production weakens. Meanwhile, East Coast propane stocks have steadily increased since May and are now much higher than normal; Midwest inventories are above the normal range; Gulf Coast volumes were flat from April to June, veering from trends seen recently, but they have grown substantially over the summer, Chowdhury reported. Rocky Mountain region and West Coast propane supplies are high because of new storage capacity in PADD 4.

At the same time, Chowdhury said Canadian inventories are above last year and near the five-year maximum. On the U.S. side, he outlined that East Coast propane stocks should remain on the high side of the historical range in 2016. Although stock levels were depressed in PADD 1 in 2015, production from gas processing continues at high levels as Marcellus and Utica production continues to grow. IHS expects the pace of growth to be strong and lead to higher inventory this year and in 2017. Midcontinent propane stocks are expected to remain high, but could drop lower depending on drivers in PADD 3, the Gulf Coast. Gulf Coast volumes will depend on petrochemical cracking rates and exports.

Regarding the global crude oil market, IHS sees a modest oil-production deficit supporting a shallow, rising price trend in 2017-2018. After falling this year, world liquids production will begin rising again in 2017, although world refined product demand growth is unlikely to pick up appreciably until the global economy improves. Further, despite moderate refined product demand growth, world liquids demand gains in 2017-2018, buoyed by NGLs. Overall, the Big 3 global oil producers — Russia, Saudi Arabia, and the U.S. — are likely to boost output. Together, the three nations represented nearly 40% of global crude production in August 2016 and are expected to contribute more than 70% of net world crude annual output growth in 2017-2018.

Chowdhury noted that thin, declining spare capacity means that prices can spike if major supply disruptions hit. Global spare capacity is expected to erode further as Saudi Arabia, the primary holder of idle capacity, boosts output. The kingdom’s annual crude output is expected to rise by 350,000 bbld in 2017-2018 as domestic demand rises and as the nation seeks to keep its share of a growing world oil market.

In tandem, higher or lower crude oil prices would affect global LPG prices, and substantially higher or lower crude prices would also effect propane production. And since propane and butane are used internationally as feedstocks for ethylene production, a weak petrochemical market would tend to put downward pressure on LPG prices, whereas a strong petrochemical market would support prices. A weak or strong global economy would have the same effect.

Specifically, the U.S. is one of the cheapest sources of ethylene in the world, third after the Middle East and Western Canada. U.S. ethylene plants are running at high rates, but over the past few years ethane has generally been a much cheaper feedstock, and cheap ethane has been displacing some propane use as a cracker feedstock. But ethane’s cash cost favorability fell when the crude and LPG supply glut made propane extremely cheap. However, this trend is reversing, and because of the unfavorable cash cost economics to ethane, propane chemical demand has fallen.

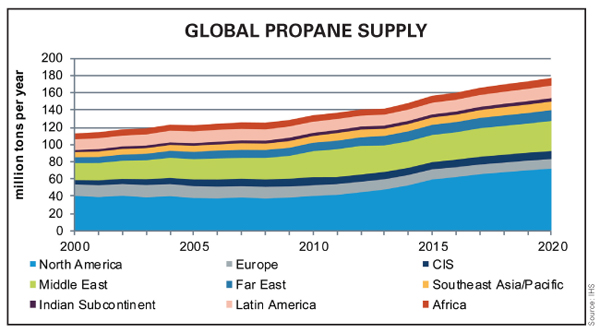

Adding to the demand side, propane produced in the U.S. is now headed to Latin America, the Caribbean, Asia, and even India. Although the pace of exports is expected to slow after 2016, they have set new record highs every year since 2008 and they will see strong growth as new terminal capacity is brought online if production continues to grow. Dramatic increases in exports have resulted in major changes in global LPG trade flows. “U.S. exports have filled Latin America, pushing out imports from North Africa,” said Chowdhury. “Exports targeted Europe, with the result that Russia and the Middle East were pushed out. Export growth now depends on China and India, and residential and commercial demand is on the rise in China.”

He added that, worldwide, most global propane supply growth is from North America, where demand is flat. Conversely, demand is growing in the Far East, Southeast Asia, the Indian Subcontinent, and the Middle East, leading to more trade. Far East propane demand will see growth in both the residential and commercial sectors and chemicals, while Southeast Asia will experience growth in residential/commercial demand. On the Indian Subcontinent, growth will be sustained by strong residential/commercial demand and some chemical demand growth. Latin America, a mature propane demand market where the supply source has shifted from North Africa to the U.S., will nevertheless experience some residential/commercial growth. Chowdhury said Middle East propane demand will be relatively steady over the next five years after seeing strong chemical demand growth over the previous five years. In the Commonwealth of Independent States (CIS), the former Soviet Union, propane demand is expected to grow due to increased chemical demand. Finally, Europe’s propane demand will remain flat.

Chowdhury observed that, at present, there is too much U.S. export capacity, which is putting pressure on terminal fees, but that most LPG maritime terminal capacity will be needed eventually. However, that capacity is expected not to be fully utilized over the next few years owing to flattening production, but as crude oil prices and production recovers, new export capacity will eventually be required. He said IHS has stepped up efforts to track export terminal utilization rates.

“U.S. propane exports grew the most between 2005 and 2015, but are still expected to increase by another 14 million tonnes between 2015 and 2025,” he said. “As natural gas production in the U.S. flattens out in the later years, propane exports will only increase by another three million tonnes from 2025 through 2040. Growth in propane exports from the Middle East, Africa, and Oceania are also expected to increase from 2015 through 2025.”

The IHS director outlined that, prior to 2010, world propane exports increased slowly and averaged about 40 million tonnes annually over the 2005-2010 period. The Middle East was the major supplier and accounted for most of the growth historically. “However, as shale oil and gas resources began to be developed in the U.S. beginning in 2010, propane production expanded rapidly, reaching 60 million tonnes in 2015. The U.S. switched from being a net importer to becoming the largest exporting country. However, the Middle East is still the largest exporting region.” Propane exports will continue to increase and are expected to approach 80 million tonnes by 2025. The U.S. will represent most of the increase, but the Middle East, Africa, and the CIS will also expand production and exports. Propane exports from Europe will decline modestly as production in the North Sea falls and recovery from refineries is reduced as crude runs retreat.

While U.S. propane stocks look strong, NPGA took a proactive approach in Asheville and agreed to develop materials to help the industry and policymakers address unanticipated issues that may arise over the winter heating season. The association again empaneled a Supply and Infrastructure Task Force tasked with rapidly transmitting data and guidance regarding inventory status. NPGA is also developing a white paper describing all federal and state legal authorities that exist, and also the various policy changes it could pursue in the event of distribution disruptions during winter.

Natural Gas Threats

The Government Affairs Committee received an update on natural gas expansion threats that continue in 2017. The New Mexico Propane Gas Association, working with assistance from NPGA’s State Engagement Initiative, defeated H.B. 140 and S.B. 213, bills that would have allowed for subsidized expansion of natural gas lines. A targeted media campaign produced 150,000 digital ad impressions and reached more than 225,000 via radio ads. A customized three-panel brochure was also created that highlighted the cost of conversion to consumers and urged no votes on the legislation.

Underscored was that natural gas utilities should not be allowed to make existing ratepayers shoulder the cost for expanding into new areas and that such extensions often require new local pipes “costing as much as $1 million per mile or more. Costs go even higher in congested areas or where there is challenging terrain.” The Rio Arriba County treasurer credited failure of the bills’ passage to the good job propane industry officials did on speaking out on the proposed measures. Lesley Garland, NPGA state affairs director, commented that engaging in the legislative battle produced the equivalent of a David and Goliath complex, but that, with limited resources and time, the propane industry nonetheless carried the victory. Mollie O’Dell, vice president of communications, asserted that some of the biggest fights facing the industry “are not going to happen in Washington, D.C., but in the states.”

In August, NPGA’s Executive Committee approved a $10,000 request from the West Virginia Propane Gas Association to hire an expert witness to testify on behalf of the industry at a subsidized natural gas hearing before the state’s Public Service Commission. While the effort to turn back the effort seemed nearly impossible, on Oct. 5 a settlement was submitted to the commission providing that Mountaineer Gas can only move forward with a trunk line to connect its system to an interstate pipeline in order to improve safety and reliability. Mountaineer’s proposal to expand service in West Virginia’s Eastern Panhandle was not allowed to go forward, and the company was prohibited from filing an expansion proposal again until 2018. In addition, its policy of granting new customers 300 feet of free line will be eliminated in 2017.

Regarding such victories, NPGA observes that while the propane industry has won and learned, such wins cannot be taken for granted. Industry response must be nimble and messages adjusted. States were advised to be prepared and build a list of association members ready to respond and legislators willing to help.

Further, Maryland was the recipient of an NPGA State Engagement grant to help fight S.B. 778, a bill promoting subsidized natural gas expansion. Following a hearing, the bill died for 2016. However, NPGA anticipates the issue will return in the 2017 legislative session. In North Dakota, industry members testified multiple times in the spring at legislative hearings targeting subsidized expansion of natural gas to “unserved and underserved areas” of the state in the name of economic development. Due to state budget shortfalls, officials determined they would not seek state incentives. In Virginia, the Economic Development Infrastructure Act of 2016 (S.B. 748) was amended significantly by the Virginia Senate the day before a major legislative deadline to include expansion subsidization. NPGA’s biggest win was being able to persuade legislators in the Virginia Assembly to pass a substitute bill that eliminated subsidization.

But such trends continue into 2017 in states such as Michigan, Illinois, and West Virginia, and NPGA is expecting battles in Georgia and Maryland, among others. Public Utilities Commission activities are rampant across the nation, along with efforts to pass carbon taxes and cap and trade in such states as Vermont, California, Oregon, and Washington. Action materials are being developed in coordination with the Propane Gas Association of New England. Existing resources, including a customizable marketer toolkit that can be used in a variety of states, can be viewed at npga.org/stateengagement. Featured is a testimony template, op-ed template, a one-pager, talking points, and a PowerPoint presentation, as well as an issue analysis.

NPGA reports that its State Engagement Initiative continues to assist the Illinois and Michigan propane gas associations in their efforts to defeat legislative and regulatory proposals allowing subsidized natural gas expansion. Unfortunately, despite assistance from NPGA to the North Carolina Propane Gas Association, a subsidization bill passed at the end of the legislative session and was signed by the governor. The association cautions that the natural gas industry continues to aggressively push subsidized expansion proposals in the legislative and regulatory arenas, but that the propane industry is fighting back — and winning — using integrated communication and political strategies.

In news out of California, the only state with a cap and trade program so far, the Western Propane Gas Association is closely monitoring an amendment to the California Energy Commission’s Title 24 building energy standards regarding zero net energy — buildings produce as much energy as they consume. Proposed is that new residential buildings come under zero net energy requirements by 2020, and new commercial structures by 2030. All existing homes would have to demonstrate a 17% energy improvement by 2020, and a 34% improvement by 2030 at resale. Draft language is expected in the spring of 2017 with the code finalized by mid-2018.

Western PGA notes the Title 24 amendment proposal has builders weighing their energy choices and eyeing prescriptive models on how to build with offsets and credits. Some are already offering zero net energy homes for sale and others are displaying model homes.

For propane, there may be opportunities for tankless water heaters, combined heat and power systems, generators, and gas appliances. Joy Alafia, association executive director, said the industry is rallying to demonstrate propane’s value to regulators using the California Energy Commission’s own time dependent value (TDV) valuation. TDV has been used in the cost-effectiveness calculation for Title 24, and it is an energy efficiency measurement for savings depending on which hours of the year savings occur. The TDV method encourages building designers to design buildings that perform better during periods of high energy cost.

Alafia added that data used by the California Energy Commission for propane TDV has limitations, namely that forecast pricing is too high, seasonal pricing variability was missed, and that value chain parity with natural gas should be in place. While the commission has since adopted a seasonal price curve for propane, its pricing designation is still high versus the market forecast. Observed was that 17 states besides California, among them Massachusetts, have Title 24-type statutes that are in the process of being amended. And while previous amendments to California’s Title 24 have been favorable to propane, this iteration may prove more challenging. —John Needham

ENERGY IS NOT A VILLAIN!

Energy is not a villain, asserted Steve Goreham during the NPGA Marketer, State and District Directors meeting in Asheville. “There is no evidence of rising pollution from energy use. Humans are not destroying earth’s climate. Carbon dioxide is not a pollutant, and centuries of low-cost oil and gas are available. It’s time for businesses to push back.” Goreham, a speaker, author, researcher on environmental issues, and an independent columnist, characterized propane as non-polluting, clean and inexpensive, counter to the characterization of a Hillary for America campaign briefing: “Phase out heating oil over the long term. High cost and polluting fuel oil and propane are still used for home heating in much of the country….”

Goreham, executive director of the Climate Science Coalition of America, is the author of the books “The Mad, Mad, Mad World of Climatism: Mankind and Climate Change Mania,” and “Climatism! Science, Common Sense, and the 21st Century’s Hottest Topic.” He ruefully observed that “now that we can control the weather, we won’t need plastic raincoats.” He emphasizes that in the war on hydrocarbons — remove the fossil from the fuel — and in the rush to fight so-called climate change, companies such as Apple and Google don’t seem to realize there is no evidence that earth’s surface temperatures today are abnormally warm when compared to historical temperatures. Temperature proxy data from many sources shows that earth’s temperatures have actually been declining for the past 8000 years. Temperatures have been rising for the last century, but earth experienced warmer times when the Romans conquered the Mediterranean 2000 years ago and when the Vikings settled southwest Greenland 1000 years ago.

“Ever notice how actual climate results are never part of the claimed benefits of green energy?” he queried. “Measures of success are always carbon emission reduced, houses powered, kilowatts generated, and carbon credits purchased. No one ever talks about actual reductions in temperature or about droughts, floods, or hurricanes to be averted by using renewable energy. Adoption of green policies is as hollow as building a hospital and never curing a patient or raising any arm and never taking a hill.”

Goreham maintained that changes in earth’s climate are dominated by natural factors. Earth’s greenhouse effect is dominated by water vapor, by far the largest greenhouse gas, and natural emissions of carbon dioxide. History shows that hurricanes, floods, droughts, and heat waves are neither more numerous nor extreme than those of the past. “There is no empirical evidence that human emissions have a measureable influence on earth’s climate. All of the green measures by global businesses will have a negligible effect on global temperatures.”

Meanwhile, he observed that as renewable energy is promoted and arguments about energy policy proceed in the U.S., a renewable energy disaster has unfolded in Europe. Driven by a desire to halt climate change, Europe has created a high-cost energy system where everyone loses. Goreham explained that European energy policy is dominated by the European Climate Change Program (ECCP), which was established in 2000. The program called for the nations of Europe to adopt measures to cut greenhouse gas emissions collectively to meet the targets of the Kyoto Protocol climate treaty signed in 1997.

Subsidies and mandates were put in place, and feed-in tariffs were enacted in most nations that provided a payment to homeowners and businesses for electricity fed into the grid from solar or wind facilities. Governments paid a fixed subsidy of four to 10 times the wholesale electricity price, guaranteed for up to 20 years, for generated electricity. Electricity from renewables was also granted grid priority. Goreham says the results of Europe’s green energy measures have been bizarre. Feed-in tariffs in Germany stimulated more than one million rooftop solar installations, but Germany is not exactly the sun belt. The latitude of central Germany is the same as Calgary, Canada. German solar installations generate electricity at less than 10% of rated output, and more than one million solar installations provide only 6% of Germany’s electricity and 1% of the nation’s energy.

The price of adopting such policies is that consumer electricity prices have doubled over the last 10 years. Countries with the largest percentage of renewable energy also have the highest electricity prices. Citizens of Spain pay three times the U.S. price, and citizens of Germany and Denmark pay four times the U.S. price. And European industry’s electricity rates have risen more than 50% since 2007, while U.S. industrial rates have been flat. European firms also pay double the U.S. price for natural gas.

Among Goreham’s conclusions is that climatists “love inclement weather. Every hurricane, tornado, drought, flood, and even snowstorm has become evidence of the theory of man-made global warming. But a look at history shows that current weather events are neither more frequent than past events nor more violent than weather of the past.” — John Needham