Wednesday, April 12, 2017

(April 12, 2017) By J.D. Buss . . . It’s not your parents’ — or grandparents’ —propane market.” We’ve heard and used that phrase many times in the past few years. Days of buying in the summer, seeing prices rise in winter, and the whole continental U. S. propane market hoping for a cold winter appear to be things of the past. What was the catalyst for shifting from these historical norms? One could say massive propane supply growth that was spurred by strong natural gas production was the beginning. That, however, only created the foundation for a massive market shift. The true item that has changed the landscape of the U.S. propane market is exports.

Step back to any prior decade when domestic U.S. residential/commercial propane demand was the dominant component. At certain times domestic petrochemical demand would be the tail wagging the dog, but rarely did that consistently unseat the prominence of the residential/commercial sector. Over the last three to five years, though, there has been a massive change taking place.

Looking at the Percentage of Total Demand By Category graph, we see that the daily growth of export volumes, as a percentage of total demand, have grown dramatically in the last several years. During that same time frame, we see that domestic residential/commercial volumes as a percentage of total demand have dropped. To help demonstrate the overall trend for both categories (exports and residential/commercial) we’ve input a linear trend line. Exports are clearly trending higher while the residential/commercial sector trends lower as a percentage of total demand.

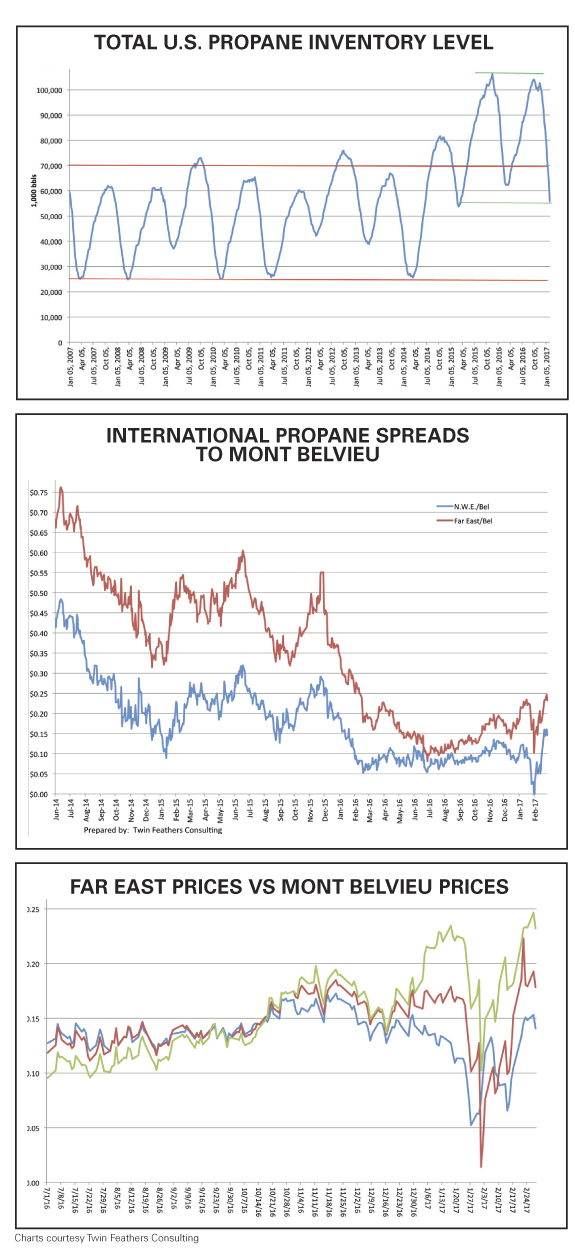

Exports’ impact can be seen even more clearly when we look at historical movements in inventory levels. The Total U.S. Propane Inventory Level graph shows historical movements in U.S. inventory levels for prior years. Before the last two winters, primary inventory levels saw traditional high-to-low movements of anywhere from 70 MMbbl to 80 MMbbl at the beginning of winter and then moving down to 30 MMbbl at the end of winter. That mold was clearly broken during the last two winters — exiting the winter of 2016-2017 we see the most extreme movement in inventory levels, with a potential decrease of anywhere from 55 MMbbl to 58 MMbbl for this past year.

Talk to anyone in the residential propane business over the last two years and the most common theme is, “Worst two winters in years!” Yet, even with incredibly warm weather dampening heating demand, propane inventory levels have seen strong declines. For the cause we come again to exports. The extremely high shift in start-of-winter inventory levels has been caused by a timing discrepancy. Production of propane was already full speed ahead in 2014 and 2015, but not all of the export capacity expansions had hit the market. In the first and fourth quarter of 2016, additional capacity for exports came online. This has helped to rapidly draw down excess inventory levels while also giving the U.S. domestic market a hint of what is to come in future years.

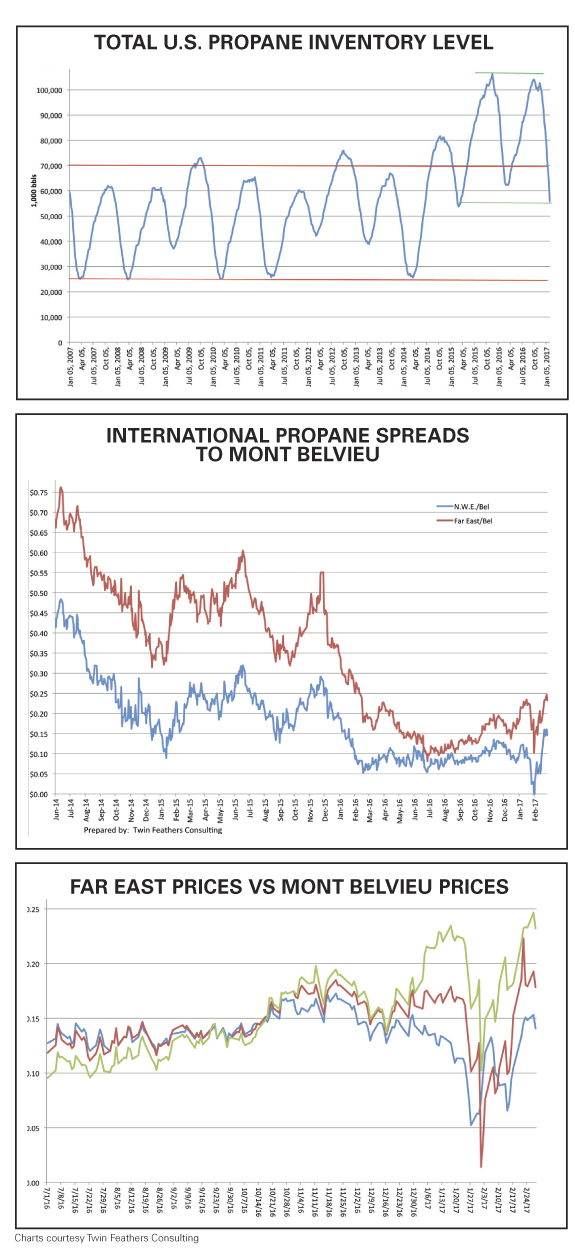

Through our demand and inventory charts we clearly see how exports have impacted the U.S. market, but in order to fully understand the “why” of export growth, we must look at prices. The International Propane Spreads to Mont Belvieu graph highlights the major international spreads for global propane prices. Looking from the middle of 2014 through early 2017, we see that spreads — price differences between the international delivery point and the U.S. propane hub, Mont Belvieu — have narrowed significantly. The singular largest narrowing took place in the middle of 2016, when the U.S. market started to experience higher levels of vessel cancellations and/or moving cargos into forward months. However, this view nonetheless highlights the fact that there clearly has been value to ship domestic propane to international buyers.

A natural question after reviewing this data is, “Will the export trend continue?” The short answer is Yes. A longer answer revolves around multiple points. In 2016, the U.S. took over as the largest global exporter of propane and clearly is on a path to hold that title again in 2017. Many international export supply deals have been sealed for

multiple years, further ensuring that both domestic U.S. production and exports will remain strong. From a ratio perspective, exports come out to a summer/winter ratio of roughly 1:1.5, which is much more in line with production levels and more conducive for suppliers and wholesalers. Finally, securing a profit margin on a vessel of 500,000 barrels will likely mean less work than selling roughly 2900 truckloads into the domestic U.S. market.

Since we see the trend continuing, a natural result is more volatility in supply and prices while also demanding more diligence by the retail propane community in how they maintain supply security. Our company, Twin Feathers Consulting, has been taking several strategic steps to assist clients. First, we have developed our own future-looking price analysis to indicate when export volumes are likely to see higher and lower fluctuations. A snapshot of that graph can be seen at left. While the graph of International Propane Spreads (first price graph) shows only the contract prices in the current month, we have developed a future-looking view (both the blue and red line in the Far East Prices vs Mont Belvieu Prices graph) that gives early indications of when futures export volumes will change.

Second, we have been advising clients for many years to increase storage positions, either via third-party facilities or their own bulk plants, in an effort to help manage higher supply volatility that does, and will, occur. Emphatically, there must be the realization that the U.S. propane market is, and will be, strongly connected to the international market. This now requires strong due diligence in studying the market and realizing when international factors may provide opportunities for U.S. domestic players.

The domestic U.S. propane market has shifted from what your parents or grandparents became accustomed to and has morphed into a globally interconnected propane marketplace. In order to continue to be successful at the domestic level, retailers in the U.S. will need to adapt to this change.

J.D. Buss joined Twin Feathers Consulting in 2008 after working at Koch Industries and Enron in risk management, marketing, and trading.

Step back to any prior decade when domestic U.S. residential/commercial propane demand was the dominant component. At certain times domestic petrochemical demand would be the tail wagging the dog, but rarely did that consistently unseat the prominence of the residential/commercial sector. Over the last three to five years, though, there has been a massive change taking place.

Looking at the Percentage of Total Demand By Category graph, we see that the daily growth of export volumes, as a percentage of total demand, have grown dramatically in the last several years. During that same time frame, we see that domestic residential/commercial volumes as a percentage of total demand have dropped. To help demonstrate the overall trend for both categories (exports and residential/commercial) we’ve input a linear trend line. Exports are clearly trending higher while the residential/commercial sector trends lower as a percentage of total demand.

Exports’ impact can be seen even more clearly when we look at historical movements in inventory levels. The Total U.S. Propane Inventory Level graph shows historical movements in U.S. inventory levels for prior years. Before the last two winters, primary inventory levels saw traditional high-to-low movements of anywhere from 70 MMbbl to 80 MMbbl at the beginning of winter and then moving down to 30 MMbbl at the end of winter. That mold was clearly broken during the last two winters — exiting the winter of 2016-2017 we see the most extreme movement in inventory levels, with a potential decrease of anywhere from 55 MMbbl to 58 MMbbl for this past year.

Talk to anyone in the residential propane business over the last two years and the most common theme is, “Worst two winters in years!” Yet, even with incredibly warm weather dampening heating demand, propane inventory levels have seen strong declines. For the cause we come again to exports. The extremely high shift in start-of-winter inventory levels has been caused by a timing discrepancy. Production of propane was already full speed ahead in 2014 and 2015, but not all of the export capacity expansions had hit the market. In the first and fourth quarter of 2016, additional capacity for exports came online. This has helped to rapidly draw down excess inventory levels while also giving the U.S. domestic market a hint of what is to come in future years.

Through our demand and inventory charts we clearly see how exports have impacted the U.S. market, but in order to fully understand the “why” of export growth, we must look at prices. The International Propane Spreads to Mont Belvieu graph highlights the major international spreads for global propane prices. Looking from the middle of 2014 through early 2017, we see that spreads — price differences between the international delivery point and the U.S. propane hub, Mont Belvieu — have narrowed significantly. The singular largest narrowing took place in the middle of 2016, when the U.S. market started to experience higher levels of vessel cancellations and/or moving cargos into forward months. However, this view nonetheless highlights the fact that there clearly has been value to ship domestic propane to international buyers.

A natural question after reviewing this data is, “Will the export trend continue?” The short answer is Yes. A longer answer revolves around multiple points. In 2016, the U.S. took over as the largest global exporter of propane and clearly is on a path to hold that title again in 2017. Many international export supply deals have been sealed for

multiple years, further ensuring that both domestic U.S. production and exports will remain strong. From a ratio perspective, exports come out to a summer/winter ratio of roughly 1:1.5, which is much more in line with production levels and more conducive for suppliers and wholesalers. Finally, securing a profit margin on a vessel of 500,000 barrels will likely mean less work than selling roughly 2900 truckloads into the domestic U.S. market.

Since we see the trend continuing, a natural result is more volatility in supply and prices while also demanding more diligence by the retail propane community in how they maintain supply security. Our company, Twin Feathers Consulting, has been taking several strategic steps to assist clients. First, we have developed our own future-looking price analysis to indicate when export volumes are likely to see higher and lower fluctuations. A snapshot of that graph can be seen at left. While the graph of International Propane Spreads (first price graph) shows only the contract prices in the current month, we have developed a future-looking view (both the blue and red line in the Far East Prices vs Mont Belvieu Prices graph) that gives early indications of when futures export volumes will change.

Second, we have been advising clients for many years to increase storage positions, either via third-party facilities or their own bulk plants, in an effort to help manage higher supply volatility that does, and will, occur. Emphatically, there must be the realization that the U.S. propane market is, and will be, strongly connected to the international market. This now requires strong due diligence in studying the market and realizing when international factors may provide opportunities for U.S. domestic players.

The domestic U.S. propane market has shifted from what your parents or grandparents became accustomed to and has morphed into a globally interconnected propane marketplace. In order to continue to be successful at the domestic level, retailers in the U.S. will need to adapt to this change.

J.D. Buss joined Twin Feathers Consulting in 2008 after working at Koch Industries and Enron in risk management, marketing, and trading.