Monday, May 11, 2020

Despite the volatility in the oil and gas markets, and in spite of expected declines, albeit slowly, in production, propane inventories should be in good condition for the remainder of 2020. So said an industry analyst, reporting on the supply situation after the first few weeks of turmoil caused by the oil price war and the COVID-19 pandemic.

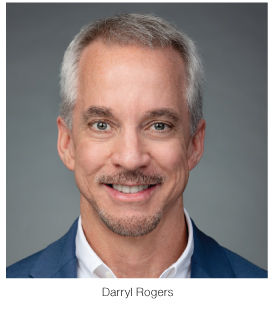

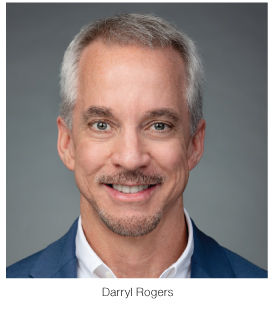

Darryl Rogers, vice president, midstream oil and NGL, at IHS Markit, spoke with BPN April 21. The oil price war between the Saudis and the Russians had begun in early March, evidenced by a surge in production. At the same time, the COVID-19 pandemic was expanding, leading to a drop-off in consumption.

Darryl Rogers, vice president, midstream oil and NGL, at IHS Markit, spoke with BPN April 21. The oil price war between the Saudis and the Russians had begun in early March, evidenced by a surge in production. At the same time, the COVID-19 pandemic was expanding, leading to a drop-off in consumption.

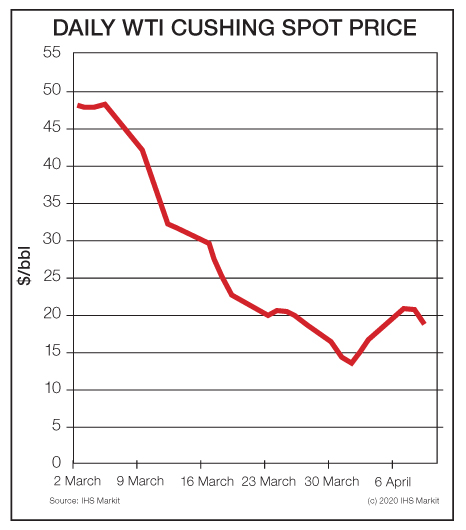

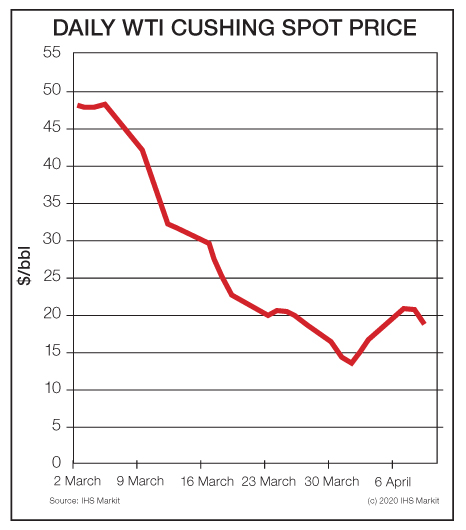

The results could be seen in the price of crude oil.

As a point of reference, Rogers pointed to an earlier U.S. crude oil production peak and oversupply situation that occurred in 2015. At the peak, in April of that year, the price was $60/barrel. A correction followed, and by February 2016, the price was $30. That was down 50% in eight months, or roughly 6% per month.

Compare that to this year’s turmoil. When the oil price war started March 6, the price of crude oil was $46/barrel. A month later, on April 5, it was $13/barrel. The price had plummeted 72% in one month. On April 20, the March WTI contract price fell to negative pricing and as this was written, April 21, it was trading at around $4/barrel.

“This is just a crazy time,” Rogers noted. “The market is significantly out of balance.”

The price of propane fell too, although not as much, having been pulled down along with crude oil pricing. Propane and crude had been somewhat disconnected; propane had been at 30% of the value of crude in early March, but it was at 50% in early April.

END-USE MARKETS

The turmoil caused by the dramatic changes in both supply and demand will continue to resonate in propane’s end-use markets, Rogers said.

In the residential market, demand may uptick as consumers stay indoors during stay-at-home orders.

However, in the commercial market, there may be less demand as many businesses are shut down due to COVID-19.

In both residential and commercial, though, demand is lower anyway because the heating season is over.

In propane’s third end-use market, chemical consumption, demand is expected to fall. Propane has become a favored feedstock versus ethane, because its price fell with crude, but at the same time overall chemical demand will be down.

The decline in chemical consumption resonates in exports, propane’s fourth end-use market, so exports will decrease too.

“We may have more propane available here for the balance of this year, if there is less demand outside the U.S.,” Rogers noted.

UPSTREAM PRODUCTION

On the supply side, with lower prices and less demand for oil, U.S. upstream oil production is being reduced and is some cases shut-in. The current view at IHS Markit is that U.S. crude oil production, which is at 13 million barrels a day, will be at 10 million barrels a day by the end of 2020 and approaching 8.5 million barrels a day by the end of 2021.

Propane being a by-product of oil and gas production, its production will decrease by 200,000 or 300,000 barrels a day. The propane production will be relatively flat for the remainder of the year, though, because it will take time to drop.

“When upstream activity is halted, it takes months before we see a fall of production,” Rogers explained. “We won’t see that until 2021. Having said that, it will be down some in 2020 since refineries are shutting down because of reduced refinery production demand. Refinery propane is decreasing because there is less demand for refined product, like jet fuel, but that will come back.”

“Net-net, we expect a flat 2020 to slightly declining propane production. It’s a balance,” he added. “This leaves inventories in a relatively good condition for the rest of 2020.”

One thing to watch is exports. If chemical demand comes back and the arbitrage is such that the Asian market is willing to pay for propane, exports could rise while production remains lower.

Summing up, Rogers said, “In propane, there are low prices, but demand is off. How quickly will the demand markets come back? If they snap back, and there is less production, we could see the price rise. That is the key thing to watch.” — Steve Relyea

Darryl Rogers, vice president, midstream oil and NGL, at IHS Markit, spoke with BPN April 21. The oil price war between the Saudis and the Russians had begun in early March, evidenced by a surge in production. At the same time, the COVID-19 pandemic was expanding, leading to a drop-off in consumption.

Darryl Rogers, vice president, midstream oil and NGL, at IHS Markit, spoke with BPN April 21. The oil price war between the Saudis and the Russians had begun in early March, evidenced by a surge in production. At the same time, the COVID-19 pandemic was expanding, leading to a drop-off in consumption.The results could be seen in the price of crude oil.

As a point of reference, Rogers pointed to an earlier U.S. crude oil production peak and oversupply situation that occurred in 2015. At the peak, in April of that year, the price was $60/barrel. A correction followed, and by February 2016, the price was $30. That was down 50% in eight months, or roughly 6% per month.

Compare that to this year’s turmoil. When the oil price war started March 6, the price of crude oil was $46/barrel. A month later, on April 5, it was $13/barrel. The price had plummeted 72% in one month. On April 20, the March WTI contract price fell to negative pricing and as this was written, April 21, it was trading at around $4/barrel.

“This is just a crazy time,” Rogers noted. “The market is significantly out of balance.”

The price of propane fell too, although not as much, having been pulled down along with crude oil pricing. Propane and crude had been somewhat disconnected; propane had been at 30% of the value of crude in early March, but it was at 50% in early April.

END-USE MARKETS

The turmoil caused by the dramatic changes in both supply and demand will continue to resonate in propane’s end-use markets, Rogers said.

In the residential market, demand may uptick as consumers stay indoors during stay-at-home orders.

However, in the commercial market, there may be less demand as many businesses are shut down due to COVID-19.

In both residential and commercial, though, demand is lower anyway because the heating season is over.

In propane’s third end-use market, chemical consumption, demand is expected to fall. Propane has become a favored feedstock versus ethane, because its price fell with crude, but at the same time overall chemical demand will be down.

The decline in chemical consumption resonates in exports, propane’s fourth end-use market, so exports will decrease too.

“We may have more propane available here for the balance of this year, if there is less demand outside the U.S.,” Rogers noted.

UPSTREAM PRODUCTION

On the supply side, with lower prices and less demand for oil, U.S. upstream oil production is being reduced and is some cases shut-in. The current view at IHS Markit is that U.S. crude oil production, which is at 13 million barrels a day, will be at 10 million barrels a day by the end of 2020 and approaching 8.5 million barrels a day by the end of 2021.

Propane being a by-product of oil and gas production, its production will decrease by 200,000 or 300,000 barrels a day. The propane production will be relatively flat for the remainder of the year, though, because it will take time to drop.

“When upstream activity is halted, it takes months before we see a fall of production,” Rogers explained. “We won’t see that until 2021. Having said that, it will be down some in 2020 since refineries are shutting down because of reduced refinery production demand. Refinery propane is decreasing because there is less demand for refined product, like jet fuel, but that will come back.”

“Net-net, we expect a flat 2020 to slightly declining propane production. It’s a balance,” he added. “This leaves inventories in a relatively good condition for the rest of 2020.”

One thing to watch is exports. If chemical demand comes back and the arbitrage is such that the Asian market is willing to pay for propane, exports could rise while production remains lower.

Summing up, Rogers said, “In propane, there are low prices, but demand is off. How quickly will the demand markets come back? If they snap back, and there is less production, we could see the price rise. That is the key thing to watch.” — Steve Relyea