One can learn a lot from Rusty Braziel, founder and chief executive officer of RBN Energy, about the United States propane market and the prospects for the combination of cold weather and ever-increasing propane exports to move prices up during the 2020-2021 winter. Recorded on Dec. 3, 2020, when Belvieu propane was at 58 cents/gal., the “NOW YOU SEE IT” video contained information based on “NOW YOU SEE IT” Part 1 and Part 2 on RBN Energy’s popular blog regarding a variety of energy sources.

By late December 2020, shortly after Braziel’s video was placed on the BPN website, Belvieu propane was at 72 cents/gal. and a third part of “Now You See It” was published on RBN Energy’s blog. At that time, subscribers needed to look no further than daily postings to see that Braziel’s forecast that there could still be some “Gotchas” out there were spot on. The factors he talked about that could drive up propane prices were playing out. As propane prices continued to strengthen into January, the January 13 blog “Big Panama With a Purple Hat Band—Propane Prize Squeeze, Panama Canal Rules Fluster Market” further explained the spike to almost a dollar a gallon at Belvieu and subsequent decline in price—moves that were playing out as this issue of BPN was headed to press.

Excerpt FROM RBN ENERGY’S “NOW YOU SEE IT” PART 3

It’s been a wild and woolly December in the U.S. propane market. The Mont Belvieu propane price is up by almost 40%, blasting past 70 [cents/gal.] on Friday—a level not seen since February 2019, when WTI at Cushing was trading at $57/bbl, $8/bbl above where that price sits today. Is it simply cold weather goosing demand? Sure, that’s one factor. But it’s really all about exports. Just as 2020 cold weather finally arrived in U.S. propane country, exports hit the highest levels ever recorded.

December Gulf Coast export volumes—92% of the U.S. total—are up 21% over last month, and 39% above December 2019. So both international and domestic demand are pulling hard on supplies at the same time. No wonder propane prices are soaring. We started this series on winter 2020-21 supply/demand in late November by suggesting that there could be a few gotchas still out there that were not being reflected in the forward propane market. Well, we’ve now seen one of those gotchas. But there’s a lot of winter left to go—in fact, the official start of winter is this morning! In this blog we’ll review what’s happened so far and what could be coming next to propane markets.

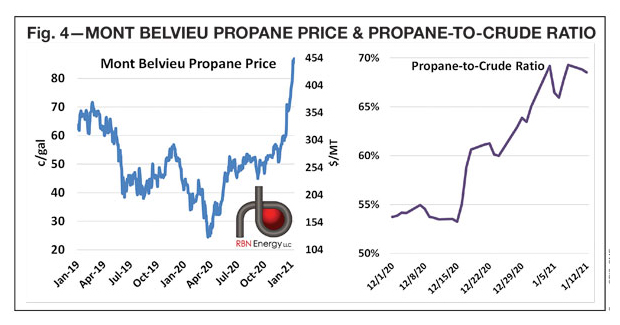

In Part 1 of this series, we started by showing how strong propane prices have been this year on a relative basis, meaning in comparison to crude oil. Focusing on the period between June and November, in 2019 the price of propane was only 34% of crude, while this year it has averaged a much higher 53%. (As a general rule, propane is considered to be expensive relative to crude when that ratio is above 50%, and cheaper when the ratio is below 50%.) Which begged the question, why would propane prices be so strong in 2020 when in 2019 prices were weak relative to crude?

We answered that question in Part 2. The primary culprit is exports, which as of November were up to 1.3 MMbbld from only 0.6 MMbbldd in 2015. Actually, propane exports now exceed average U.S. domestic demand, even in the winter season—an extraordinary thing, when you think about it. We then explored the relationship between total demand (domestic plus exports), inventories, and prices. Bottom line: with exports so high, it just takes more inventory in the ground to keep the system running smoothly during the winter.

That level of inventory can be measured by calculating average days-supply (i.e., inventories divided by demand) and including both domestic and export demand in the equation. In our calculation of that statistic, it showed that average days-supply has been skating along the bottom of the five-year range for the past few weeks. And when the market perceives that stocks might be getting tight, prices increase.

Commentary

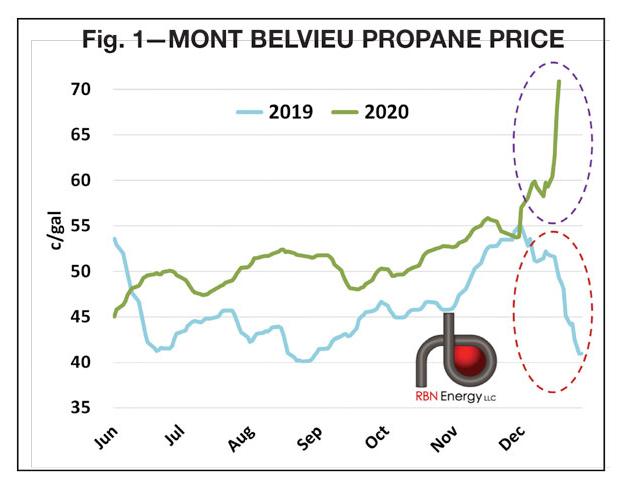

“That is exactly what happened in December. Mont Belvieu propane prices (non-TET), spiked from the low 50s cents/gal. range in late November to 70.9 cents/gal. on the Friday before Christmas,” Braziel told BPN. “This was a gain of almost 40% in less than a month.” He noted that half of the increase had just happened in the previous week. Sharing Fig. 1, Braziel showed the price of propane this year after the market meltdown this spring (green line) held relatively steady until this month, when he said the price took off like an Elon Musk rocket (dashed purple oval). “Of course, it is winter, so that always happens with propane, right? Wrong,” Braziel said. “As shown by the blue line, just last year the price of propane was in the mid-40s-cents/gal. range for most of the summer and fall, moved into the 50-cents/gal. range only briefly, then dropped like a rock in December (dashed red oval).”

“That is exactly what happened in December. Mont Belvieu propane prices (non-TET), spiked from the low 50s cents/gal. range in late November to 70.9 cents/gal. on the Friday before Christmas,” Braziel told BPN. “This was a gain of almost 40% in less than a month.” He noted that half of the increase had just happened in the previous week. Sharing Fig. 1, Braziel showed the price of propane this year after the market meltdown this spring (green line) held relatively steady until this month, when he said the price took off like an Elon Musk rocket (dashed purple oval). “Of course, it is winter, so that always happens with propane, right? Wrong,” Braziel said. “As shown by the blue line, just last year the price of propane was in the mid-40s-cents/gal. range for most of the summer and fall, moved into the 50-cents/gal. range only briefly, then dropped like a rock in December (dashed red oval).”

“The moral to this story is that propane prices rarely match seasonal expectations,” Braziel said. “Instead, they respond to good, old-fashioned supply/demand fundamentals. And in 2020, one aspect of the fundamentals equation has seen a major shift: exports.”

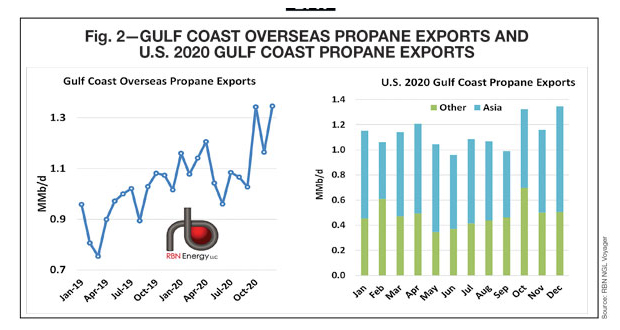

Braziel shared the left graph in Fig. 2 showing overseas propane exports from the Gulf Coast; it excludes truck and rail exports to Mexico. “As we’ve noted, over 90% of U.S. exports move out of terminals along the Gulf Coast, and volumes have been growing steadily since 2012, when exports were a paltry 100,000 bbld,” he said. “By midyear 2019, Gulf Coast exports were up to 1.0 MMbbld and they kept on increasing into 2020 until the market meltdown, when exports backed off for a few months. But since October (coincidentally when the domestic propane winter contract season kicks in), propane exports have roared back with a vengeance.”

Gulf Coast exports have hit an all-time high. RBN’s NGL Voyager Report and companion LPG Vessel Data Excel file show propane exports jumped from less than 1.1 MMb/d in June through September, up to an astronomical 1.4 MMbbld in the first half of December (right graph). The graph shows the volumes moving out of each of the Gulf Coast terminals, with Enterprise Products Partners still in the lead with 41%, but Energy Transfer, Phillips 66, and Targa Resources all moving more cargoes, with 18%, 15%, and 24% of total volumes, respectively.

Gulf Coast exports have hit an all-time high. RBN’s NGL Voyager Report and companion LPG Vessel Data Excel file show propane exports jumped from less than 1.1 MMb/d in June through September, up to an astronomical 1.4 MMbbld in the first half of December (right graph). The graph shows the volumes moving out of each of the Gulf Coast terminals, with Enterprise Products Partners still in the lead with 41%, but Energy Transfer, Phillips 66, and Targa Resources all moving more cargoes, with 18%, 15%, and 24% of total volumes, respectively.

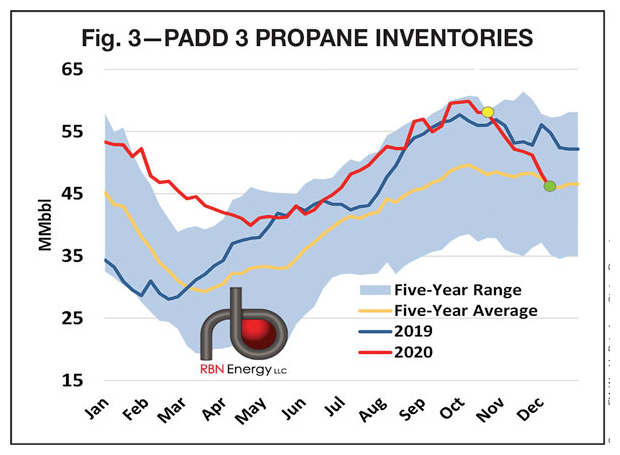

“Fig. 3 shows what all those exports have done to Gulf Coast (PADD 3) propane inventories. Back in late October, PADD 3 stocks were sitting at a healthy 58 MMbbl (yellow dot),” Braziel said. “That was higher than in October 2019 (blue line) and essentially equal to the five-year high (top of blue-shaded area). Fast forward to mid-December and PADD 3 inventories (green dot) are down to only 46 MMbbl, about 20% below where they stood this time last December, right on the five-year average (orange line), and from our vantage point today, headed south on a relatively steep decline. Clearly it is exports that have sucked those barrels out of storage and into ships bound mostly to Asia.”

PADD I (East Coast) and PADD II (Midwest/Mid-Continent) represent 60% of U.S. propane consumer demand. Milder weather prevented a price spike which did not materialize until December.

“In mid December, we saw propane reach 61% of crude,” Braziel said. “That’s the expensive zone, a high ratio of Mont Belvieu propane to WTI Cushing crude oil.” As petrochemical demand and prices shot up as well, propane days supply (based on both domestic demand and export in the equation) were down in mid-December from 37 days to only 27 days. “We typically see days-supply decline further as winter draws to a close. The historic five year low for March is 16 days.”

Excerpt FROM RBN ENERGY’S “BIG PANAMA WITH A PURPLE HAT BAND—PROPANE PRICE SQUEEZE, PANAMA CANAL RULES FLUSTER MARKET”

It’s been a chaotic start to the new year for propane. In the past twelve days, the Mont Belvieu price is up over 15%, closing on [Jan. 12] at 87 cents/gallon—the highest since October 2018. The usual culprit of winter weather has something to do with it, but not just in North America. Over the past couple of weeks, frigid temperatures in Asia, along with supply cutbacks from the Saudis, have supported U.S. propane exports to those markets, further tightening the U.S. supply/demand balance.

But as is often the case these days, the market has another complicating factor. Delays transiting the Panama Canal have stacked up VLGCs—the vessels carrying U.S. propane to Asia—on both the Atlantic and Pacific sides of the waterway, pushing up charter rates to levels not seen in years. And on top of that, new transit-scheduling rules from the Panama Canal Authority will shove VLGCs to the back of the line, potentially making it even more difficult to get through the canal without significant delays. Today, we’ll explore these developments and what they may portend for the remaining weeks of winter.

As we blogged about in November and December (Now You See It), the possibility for a propane price squeeze has been coming at us for several weeks. Even though the U.S. entered the propane winter season with healthy inventories, exports have been running at all-time highs and stocks have been declining rapidly. We were concerned that average days-supply, when calculated using both domestic demand and exports, had dropped to a five-year low, and that the market could get very tight, warning that “the wild ride for propane prices seen in the fourth quarter could get wilder still.”

As we blogged about in November and December (Now You See It), the possibility for a propane price squeeze has been coming at us for several weeks. Even though the U.S. entered the propane winter season with healthy inventories, exports have been running at all-time highs and stocks have been declining rapidly. We were concerned that average days-supply, when calculated using both domestic demand and exports, had dropped to a five-year low, and that the market could get very tight, warning that “the wild ride for propane prices seen in the fourth quarter could get wilder still.”

And it did. In Mont Belvieu, the price of propane blasted into the stratosphere during the first few days of the New Year, reflecting not only cold weather in the U.S., but skyrocketing prices in Asia due not only to record- or near-record-low temperatures in Japan, South Korea, and northeastern China. But first, let’s consider how propane prices have behaved so far in 2021.

As shown in the left graph in Fig. 4, the price of Mont Belvieu non-TET propane on Tuesday was 87 cents/gal., up almost 12 cents/gal. since New Year’s Eve. Way back in mid-November, propane was only 51 cents/gal., so the price since then is up a whopping 70%. Note that cents/gal. prices are on the left scale. We’ve also included prices in dollars per metric ton ($/MT) on the right scale, since that’s the way prices are quoted in the global market. In those terms, Mont Belvieu propane is up from $265/MT in mid-November to $452/MT [Jan. 12]. The right graph in Fig. 4 puts those prices in the context of crude oil, which is the best way to assess just how expensive propane really is. And the answer: expensive. Propane is now almost 70% of crude oil, the highest it’s been since 2017 if you carve out the 12 days of crude price insanity in April 2020. Anything over 50% is on the high side.

Commentary

“Even though Mont Belvieu propane prices are expensive, propane exports have continued to sail from Gulf Coast ports to international destinations at record rates,” Braziel told BPN. The left graph in Fig. 2 shows overseas propane exports from the Gulf Coast; it excludes trucked and railed volumes to Mexico. As described in Now You See It, over 90% of U.S. exports move out of terminals along the Gulf Coast. Since mid-year 2019, Gulf Coast propane exports are up from about 1.0 MMbbld to about 1.35 MMbbld in December. The right graphic shows where those barrels have gone: 60% to Asia (blue bar segments), with the balance mostly to Europe and Latin America. “And those exports to Asia have held up even though the price of transporting U.S. propane has also hit the roof, due primarily to congestion at the Panama Canal,” Braziel said.

“Transit delays at the Panama Canal have been worsening for months,” Braziel said. “In December we were starting to see delays of a week or more for Canal transits. This forced many carriers to go around Africa’s Cape of Good Hope. They do avoid Canal tolls, but travel 10 to 12 days longer. COVID effects on tugboat staffing, other operational issues, fog, and lower water levels in Gaton Lake were also factors. In addition, there were shipment delays from earlier hurricanes causing more ships to arrive at the same time.”

Lately, with exports soaring, LPG has represented nearly 25% of all VLGCs moving through the Neopanamax Locks. Only container ships had more at 43%. And, to further add to challenges for LPG shippers, new rules taking effect in 2021 put shippers of LPG in a less desirable booking period, 81-365 days out, behind ships carrying passengers and container ships. This is only adding more challenges for shippers.

“Considering the steep climb in shipping costs in recent weeks from $25,000/day to $110,000/day, propane prices would have likely seen a significantly steeper climb if shipping costs had not skyrocketed, curtailing some shipments,” Braziel said.

WHERE DO PRICES GO FROM HERE?

“As always with the propane market, a lot depends on the weather,” Braziel said. “But propane is also a slave to the calendar, and therein lies what likely will be the next turn in this market. It may not feel it outside, but spring is just around the corner, especially for propane exporters. Leaving the Gulf Coast in February, it’s going to be March before the ship gets to Asia—or even into April, depending on the loading date and any potential delays.”

“As always with the propane market, a lot depends on the weather,” Braziel said. “But propane is also a slave to the calendar, and therein lies what likely will be the next turn in this market. It may not feel it outside, but spring is just around the corner, especially for propane exporters. Leaving the Gulf Coast in February, it’s going to be March before the ship gets to Asia—or even into April, depending on the loading date and any potential delays.”

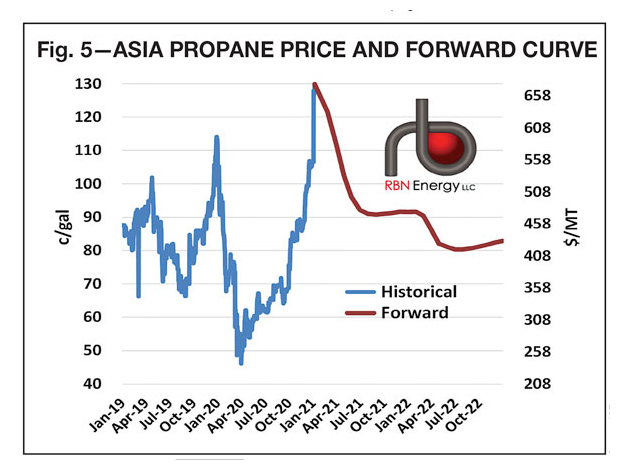

Check out what that means in Fig. 5. “The blue line is propane’s historical price in Asia for the past two years, showing the astronomical price increase that Asia propane has experienced since April, up to $675/MT, or about 130 cents/gal.,” Braziel said. “The forward curve for Asia propane (red line) is steeply backwardated, however. By March the forward price is lower by 18 cents/gal., and by April, another 10 cents/gal. Which means loading a cargo in February and not getting it to market until April could be a very expensive proposition.”

“The big run-up in propane prices has probably run its course for this season,” Braziel said. “This is despite exports still running at all-time record levels. Season demand in Asia is coming off, and the market looks to be regaining some kind of equilibrium, so exports should be settling down in the coming weeks. Of course, a spell of cold weather here in the U.S. could run prices up one more time. But otherwise, the spike to almost $1/gal. in Mont Belvieu is probably behind us.”