Tuesday, November 13, 2018

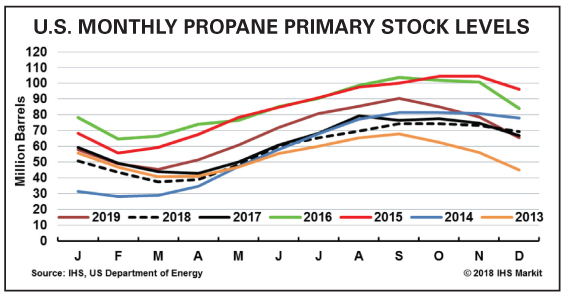

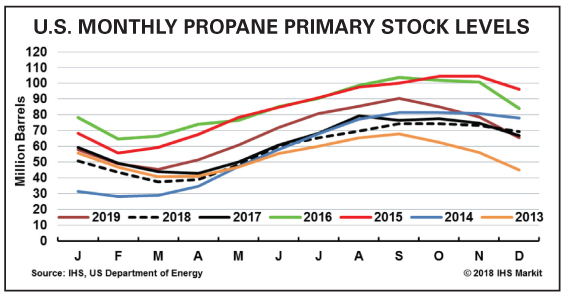

Primary U.S. propane inventories are expected to shrink to low days of supply in February and March and exit winter at low volumes as calculated against daily demand. But stocks are forecast to reload thereafter, largely due to a lack of new needed export capacity in 2019 to accommodate rising domestic output. Noteworthy is that the risk of substantial critical days of supply this winter is primarily a Gulf Coast anomaly, with other regions standing within or above the average range as the peak heating season rolls up. Those conclusions, among others, were forwarded at the National Propane Gas Association’s (NPGA) Supply & Logistics Committee meeting Sept. 30 in Houston.

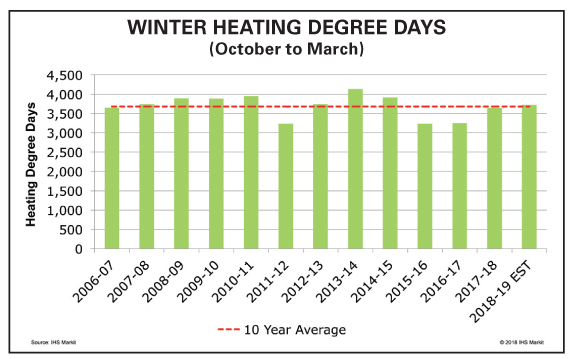

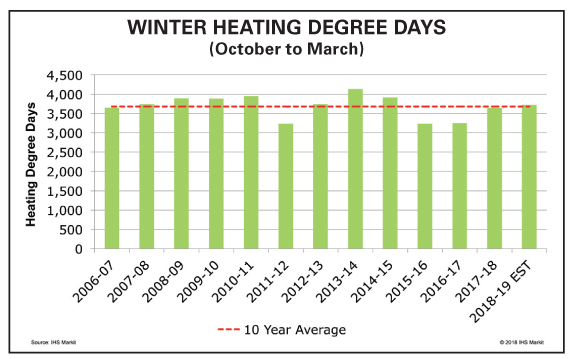

Debnil Chowdhury, executive director of IHS Markit oil, midstream, downstream, and chemicals research, observed that winter 2018-2019 is expected to be above average and cooler than last winter, with U.S. residential and commercial demand projected to be higher. “The risk of low days of disposition exists if inter-PADD tranfers and production do not keep up with new contracted exports,” he cautioned.

He outlined that East Coast propane stocks should be closely monitored as new export capacity comes online, but that concern has been kicked down the road owing to another pipeline construction delay. The second phase of Sunoco Pipeline’s Mariner East initiative, the Mariner East 2 pipeline across Pennsylvania, West Virginia, and Ohio, now under construction, will expand total NGL takeaway capacity from the Marcellus and Utica shales to 345,000 bbld. Marcellus and Utica propane production from gas processing continues at high levels as natural gas output ramps up.

However, Sunoco Pipeline said Oct. 18 that the project, as planned, would again be postponed, this time until the end of 2020. Mariner East 2 has been beset by delays due to regulatory issues, technical challenges, and local opposition. As an interim measure, the Energy Transfer Partners company will now use completed new pipeline sections, repurpose a 12-inch product pipeline in Pennsylvania’s Chester and Delaware counties, and incorporate Mariner East 1 as a temporary stand-in while Mariner East 2 mainline construction proceeds.

Mariner East 2, like its sister pipeline, Mariner East 1, terminates at the Marcus Hook, Pa. Industrial Complex on the Delaware River, site of Sunoco’s export terminal. Mariner East 2’s 20-in. line segment was scheduled to be in service by the end of this year, while the 16-inch segment, Mariner East 2X, was to commence operations in 2019.

Mariner East 1, which provides propane and ethane service, began operating in the fourth quarter of 2014 and the first quarter of 2016, respectively. The Mariner East projects are designed to play a major role in establishing Marcus Hook as a major Northeast hub for distribution of NGLs to commercial markets domestically and globally.

Chowdhury added that Midcontinent propane inventories are expected to remain in the middle of the normal range this winter rather than lifting owing to colder U.S. temperatures and transfers to the Northeast and Gulf Coast for exports. Noted was that crop drying demand was relatively average last winter and it is expected that demand this season will be similar.

Gulf Coast stocks, meanwhile, are expected to increase next year as production rises and outpaces exports, but “days of disposition are expected to remain low for the remainder of the winter of 2018-2019 in PADD 3.” Further, Rocky Mountain region supplies are projected to remain high due to new storage capacity, while on the West Coast they should remain near the average range. The IHS executive director surveyed that about 80% of PADD 5 propane supply is from refining and there are no propane-based crackers in the region, which makes cracking economics and chemical demand irrelevant.

He underscored that although U.S. propane stocks look average when viewed on an inventory basis alone, days of disposition are low. “Propane inventory must remain high or we run the risk of reaching dangerously low days of demand in the future,” he said. NPGA audited U.S. propane supply in its September Trend Report, prepared in conjunction with IHS Markit: U.S. exports remain high to Asia, therefore the risk of low days of disposition for the U.S. as a whole remains high. “The primary reason behind the high exports are tepid Middle East exports to Asia and high naphtha-to-propane spreads incentivizing PDH [propane dehydrogenation] economics in China,” NPGA said. “The high exports have stalled the required growth in PADD 3 inventory necessary to replenish inventory to the U.S. to safe days of disposition.

“Because of record summer exports of propane, the Trend Report forecast shows that inventory, on a days of disposition basis, is not growing at an adequate rate to replenish stocks in PADD 3 in time for the winter months. It should be noted that this is primarily a PADD 3 phenomenon and that PADD 1 and PADD 2 inventories appear to be well stocked at the end of September.”

Chowdhury recounted that U.S. propane exports were much higher this summer than expected. Northeast Asia and Northwest Europe have highly price-sensitive demand, and both regions cracked large amounts of propane in the first half of 2018. While Northeast Asia PDH demand growth slowed down this year, most of the U.S. export growth was to supply existing PDH plants running at higher utilization rates.

He explained that a relatively large fraction of China’s waterborne propane imports come from the U.S., but they are a small portion of overall seaborne shipments to the country. South Korea and Japan would benefit from a drop in U.S. propane prices, but the two nations already garner the majority of their waterborne propane supply from the U.S. And as the impact of Chinese tariffs on U.S. LPG will result in regional trade rebalancing for the market to adapt, China will import more from the Middle East, and Japan, South Korea, and Taiwan will import additional volumes from the U.S. But as the U.S.-to-Asia LPG trade pattern changes, it is also causing China’s prices to move above the Argus Far East Index. Chinese importers are paying more.

Prices

U.S. propane prices remain weaker compared to crude than last winter—so far, Chowdhury said. “We expect propane prices to strengthen versus crude over the next several months as we draw down already low—on a days of disposition basis—inventory.” He summarized that the propane-to-crude ratio was “extremely weak” in 2015. But due to flatter production, higher exports, and length in terminal and shipping capacity, U.S. propane prices have been able to recover versus crude as inventory retreated to low levels. Mont Belvieu prices are expected to rise over the next several months and the price ratio of propane to crude is expected to increase as winter progresses.

At the same time, associated gas plant propane production is growing quickly in conjunction with strong growth in crude oil output. “Much of this growth is in Texas in the Permian,” he said. IHS expects propane production growth rates similar to those seen before the crude oil price crash of 2014, but some takeaway and fractionation constraints may hinder growth. As U.S. crude supply growth nears 11 MMbbld, with 12 MMbbld targeted for 2019, onshore production proceeds apace.

“U.S. crude oil production in 2018 has been surprisingly strong despite concerns about the new-found capital discipline of operators and looming pipeline constraints in the Permian,” the IHS Markit consultant observed. “Oil prices have remained high enough for operators to maintain activity while living within cash flow, although we expect growth will slow into 2019 as drilled but uncompleted wells, DUCs, accelerate in the Permian in response to a lack of incremental pipeline capacity.”

By the second half of 2019, however, the DUC backlog is expected to liquidate, causing a surge in output. The U.S. crude oil system is now expected to reach 11.2 MMbbld by December, representing 1.2 MMbbld entry-to-exit growth and 1.3 MMbbld of annual average growth over that of 2017. Annual average growth in 2019 is expected to be similar to 2018, although it is back-loaded to the end of the year.

Accompanying higher oil production will be the need for additional gas processing capacity, Chowdhury said. Permian gas supply is forecast to more than double from 2017 to 2023. Therefore, Y-grade pipeline and NGL fractionation capacity additions are under way as Mont Belvieu fractionation capacity has fallen short to meet demand growth. This in turn has caused ethane prices to rise.

Meantime, and again, propane production from gas plants is expected to continue growing despite some infrastructure constraints, and whereas propane production from refineries was depressed in 2015 despite strong runs, output recovered in 2016 and 2017 because of stronger propane prices and less internal refinery burning for power generation.

On the petrochemical side, Chowdhury overviewed that high propane costs have led to ethane becoming the favored NGL feed. However, the recent spike in ethane prices has narrowed the favorability gap between the two feedstocks. Nonetheless, ethane’s cash-cost favorability puts a cap on chemical propane demand until summer 2019. —John Needham

Debnil Chowdhury, executive director of IHS Markit oil, midstream, downstream, and chemicals research, observed that winter 2018-2019 is expected to be above average and cooler than last winter, with U.S. residential and commercial demand projected to be higher. “The risk of low days of disposition exists if inter-PADD tranfers and production do not keep up with new contracted exports,” he cautioned.

He outlined that East Coast propane stocks should be closely monitored as new export capacity comes online, but that concern has been kicked down the road owing to another pipeline construction delay. The second phase of Sunoco Pipeline’s Mariner East initiative, the Mariner East 2 pipeline across Pennsylvania, West Virginia, and Ohio, now under construction, will expand total NGL takeaway capacity from the Marcellus and Utica shales to 345,000 bbld. Marcellus and Utica propane production from gas processing continues at high levels as natural gas output ramps up.

However, Sunoco Pipeline said Oct. 18 that the project, as planned, would again be postponed, this time until the end of 2020. Mariner East 2 has been beset by delays due to regulatory issues, technical challenges, and local opposition. As an interim measure, the Energy Transfer Partners company will now use completed new pipeline sections, repurpose a 12-inch product pipeline in Pennsylvania’s Chester and Delaware counties, and incorporate Mariner East 1 as a temporary stand-in while Mariner East 2 mainline construction proceeds.

Mariner East 2, like its sister pipeline, Mariner East 1, terminates at the Marcus Hook, Pa. Industrial Complex on the Delaware River, site of Sunoco’s export terminal. Mariner East 2’s 20-in. line segment was scheduled to be in service by the end of this year, while the 16-inch segment, Mariner East 2X, was to commence operations in 2019.

Mariner East 1, which provides propane and ethane service, began operating in the fourth quarter of 2014 and the first quarter of 2016, respectively. The Mariner East projects are designed to play a major role in establishing Marcus Hook as a major Northeast hub for distribution of NGLs to commercial markets domestically and globally.

Chowdhury added that Midcontinent propane inventories are expected to remain in the middle of the normal range this winter rather than lifting owing to colder U.S. temperatures and transfers to the Northeast and Gulf Coast for exports. Noted was that crop drying demand was relatively average last winter and it is expected that demand this season will be similar.

Gulf Coast stocks, meanwhile, are expected to increase next year as production rises and outpaces exports, but “days of disposition are expected to remain low for the remainder of the winter of 2018-2019 in PADD 3.” Further, Rocky Mountain region supplies are projected to remain high due to new storage capacity, while on the West Coast they should remain near the average range. The IHS executive director surveyed that about 80% of PADD 5 propane supply is from refining and there are no propane-based crackers in the region, which makes cracking economics and chemical demand irrelevant.

He underscored that although U.S. propane stocks look average when viewed on an inventory basis alone, days of disposition are low. “Propane inventory must remain high or we run the risk of reaching dangerously low days of demand in the future,” he said. NPGA audited U.S. propane supply in its September Trend Report, prepared in conjunction with IHS Markit: U.S. exports remain high to Asia, therefore the risk of low days of disposition for the U.S. as a whole remains high. “The primary reason behind the high exports are tepid Middle East exports to Asia and high naphtha-to-propane spreads incentivizing PDH [propane dehydrogenation] economics in China,” NPGA said. “The high exports have stalled the required growth in PADD 3 inventory necessary to replenish inventory to the U.S. to safe days of disposition.

“Because of record summer exports of propane, the Trend Report forecast shows that inventory, on a days of disposition basis, is not growing at an adequate rate to replenish stocks in PADD 3 in time for the winter months. It should be noted that this is primarily a PADD 3 phenomenon and that PADD 1 and PADD 2 inventories appear to be well stocked at the end of September.”

Chowdhury recounted that U.S. propane exports were much higher this summer than expected. Northeast Asia and Northwest Europe have highly price-sensitive demand, and both regions cracked large amounts of propane in the first half of 2018. While Northeast Asia PDH demand growth slowed down this year, most of the U.S. export growth was to supply existing PDH plants running at higher utilization rates.

He explained that a relatively large fraction of China’s waterborne propane imports come from the U.S., but they are a small portion of overall seaborne shipments to the country. South Korea and Japan would benefit from a drop in U.S. propane prices, but the two nations already garner the majority of their waterborne propane supply from the U.S. And as the impact of Chinese tariffs on U.S. LPG will result in regional trade rebalancing for the market to adapt, China will import more from the Middle East, and Japan, South Korea, and Taiwan will import additional volumes from the U.S. But as the U.S.-to-Asia LPG trade pattern changes, it is also causing China’s prices to move above the Argus Far East Index. Chinese importers are paying more.

Prices

U.S. propane prices remain weaker compared to crude than last winter—so far, Chowdhury said. “We expect propane prices to strengthen versus crude over the next several months as we draw down already low—on a days of disposition basis—inventory.” He summarized that the propane-to-crude ratio was “extremely weak” in 2015. But due to flatter production, higher exports, and length in terminal and shipping capacity, U.S. propane prices have been able to recover versus crude as inventory retreated to low levels. Mont Belvieu prices are expected to rise over the next several months and the price ratio of propane to crude is expected to increase as winter progresses.

At the same time, associated gas plant propane production is growing quickly in conjunction with strong growth in crude oil output. “Much of this growth is in Texas in the Permian,” he said. IHS expects propane production growth rates similar to those seen before the crude oil price crash of 2014, but some takeaway and fractionation constraints may hinder growth. As U.S. crude supply growth nears 11 MMbbld, with 12 MMbbld targeted for 2019, onshore production proceeds apace.

“U.S. crude oil production in 2018 has been surprisingly strong despite concerns about the new-found capital discipline of operators and looming pipeline constraints in the Permian,” the IHS Markit consultant observed. “Oil prices have remained high enough for operators to maintain activity while living within cash flow, although we expect growth will slow into 2019 as drilled but uncompleted wells, DUCs, accelerate in the Permian in response to a lack of incremental pipeline capacity.”

By the second half of 2019, however, the DUC backlog is expected to liquidate, causing a surge in output. The U.S. crude oil system is now expected to reach 11.2 MMbbld by December, representing 1.2 MMbbld entry-to-exit growth and 1.3 MMbbld of annual average growth over that of 2017. Annual average growth in 2019 is expected to be similar to 2018, although it is back-loaded to the end of the year.

Accompanying higher oil production will be the need for additional gas processing capacity, Chowdhury said. Permian gas supply is forecast to more than double from 2017 to 2023. Therefore, Y-grade pipeline and NGL fractionation capacity additions are under way as Mont Belvieu fractionation capacity has fallen short to meet demand growth. This in turn has caused ethane prices to rise.

Meantime, and again, propane production from gas plants is expected to continue growing despite some infrastructure constraints, and whereas propane production from refineries was depressed in 2015 despite strong runs, output recovered in 2016 and 2017 because of stronger propane prices and less internal refinery burning for power generation.

On the petrochemical side, Chowdhury overviewed that high propane costs have led to ethane becoming the favored NGL feed. However, the recent spike in ethane prices has narrowed the favorability gap between the two feedstocks. Nonetheless, ethane’s cash-cost favorability puts a cap on chemical propane demand until summer 2019. —John Needham