Tuesday, December 11, 2018

Tank monitors are going to continue to gain ground in the next few years, suppliers of tank monitoring systems and services told BPN. They said that while no more than 5% of tanks in the U.S. are monitored currently, 35% or more of tanks could provide a suitable return on investment on a tank monitor today and more will be able to do so in the next few years. At least two suppliers said all tanks will have monitors in the future. They explained that tank monitors have been getting more affordable, consumers have come to expect to have information available on demand, and propane marketers have been gaining experience with the technology and the benefits it provides.

The suppliers shared several tips that will make it easier for propane marketers to expand their use of monitors. They offered suggestions on how to compare tank monitors and suppliers, shared their estimates of how many tanks are already being monitored, and explained the return on investment (ROI) monitoring provides in the form of improved delivery efficiency and customer service.

Hardware and Battery

To provide maximum return on investment, a tank monitor must be reliable for many years; the ROI will drop rapidly if the unit has to be regularly serviced or replaced. The suppliers suggested looking at the design of the hardware, the failure rate, and the battery life. One also suggested looking at the UL rating, because that can determine how easy it is to install the unit.

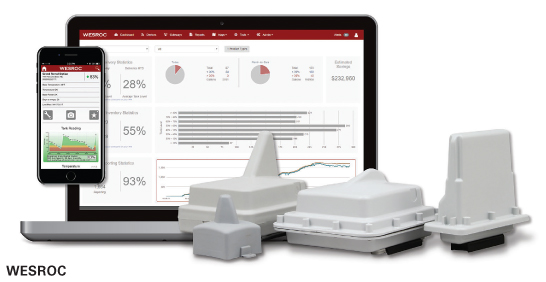

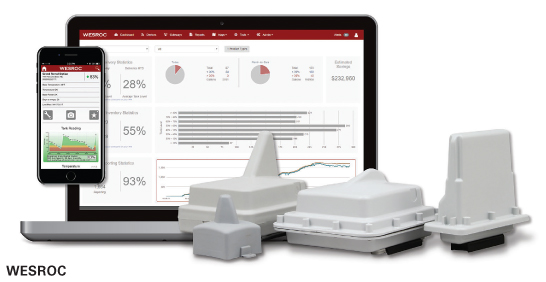

“Hardware can be a differentiator,” said Boyd McGathey, COO at WESROC Monitoring Solutions (Blair, Neb.). “These units will be exposed to extreme weather including sun, water, and temperatures as much as 40 degrees below zero. You want them to be rock solid and perform when you need them most.”

“Durability is critical,” said Robert Battye, vice president North America at Silicon Controls (Philadelphia), supplier of the Gaslog remote monitoring system. “This is a battery-operated device living the toughest possible life outdoors for, in the case of Gaslog, up to 15 years; poor design or materials may prove fatal. Understanding the reliability of the monitor, its battery life, warranty, and, if possible, historical failure rates should be part of a customer’s selection process, being critical to the protection of their investment.”

“You need the installer not to have to worry about where to physically place the unit,” said Mike Vigliotti, tank monitor sales specialist at Bergquist (Toledo, Ohio). Bergquist is the sole distributor in North America of Silicon Controls’ Gaslog remote tank monitor. “Gaslog units are UL certified Class 1, Division 1. That means a driver can mount it anywhere on the tank, including in the turret.”

“Battery life is something everybody needs to compare,” said David Montgomery, customer relationship manager at Gremlin Tank Monitors (Fort Lauderdale, Fla.). “Marketers should be looking for long-term heavy-duty batteries that will not only last, but will also stand extreme temps in not only the coldest areas of the country, but also the warmest.”

“Battery life is a big one,” said André Boulay, president of Otodata (Montreal). “Sending someone to a tank to change a battery is very costly. The cost of that could be more than the cost of communications.”

Networks

Tank monitors can communicate in a number of ways, including through cellular networks, satellite, and low-power wide-area networks (LPWAN) for Internet-of-Things (IoT) devices. The supplier of a tank monitor may also use one or more network providers which can provide marketers needed options for any particular geography.

“Fuel marketers should ask suppliers what cellular network it works on, what carrier or carriers they have relationships with, and why,” said Boulay. “Customers should ask how long these units are going to last. We as manufacturers—all of us—are responsible to sell hardware that will last 20 years. We must move to new cellular technologies as they come along.”

“We have the products that fit the bill, whether it’s WiFi, cellular, or RF,” said Montgomery. “Some areas have good cellular service, others don’t; for those that don’t, RF provides a great alternative. We fit the product to the location.”

“We believe the dominant technology today is cellular,” said Battye. “In selecting a tank monitor, marketers will want to understand the cellular service being used as well as the network providers and how long the communications service will be available. These choices will often determine the usable life of the unit, the coverage (which is of particular importance to rural deployments), and the quality of service.”

“Cellular can be a differentiator, too,” said McGathey. “Many suppliers out there have only one network solution. WESROC has LTE—both Verizon and AT&T—satellite, and LPWAN. We have a network for every potential need.”

Software

All tank monitors will report tank levels, but some may also do much more. The suppliers suggested comparing call frequency and alarm settings, the analysis they can help provide, and the back-office software they can integrate with.

“Not all software platforms are created equally; some have a broader range of capabilities than others,” said McGathey. “For example, with software-based hardware reporting once a day, if you have set a threshold—like a draw alert or a fill alert—you will only find out if there is an alarm at the time it is scheduled to report. Ours is hardware-based; every 60 seconds, it looks at the dial and reports if any set alert threshold has been violated; the monitor immediately reports it along with the current inventory level. Otherwise, you’re blind until the next scheduled report.”

“Compatibility with back-office forecasting, ticketing, and CRM [customer relationship management] software is very important,” said Vigliotti. “Seamless integration of tank levels with the forecasting system supports the achievement of targeted efficiency gains and reduces operations workload. Integration becomes even more critical as more monitors are deployed over time.”

“Back-office integration and compatibility is very important,” Montgomery explained. “That compatibility and full back-office integration means there’s one less step in the process of creating routes. Back-office integration will also support the use of internal data that will help a marketer’s management team make solid business decisions.”

Charging Customers

Some propane marketers charge their customers a monthly fee for tank monitoring, some charge only some of their customers, and some provide it as a service at no charge or strictly for their own operating efficiency benefit. The suppliers have seen a variety of strategies used.

“There is no standard in the industry; it is up to each fuel marketer.” Boulay pointed out, “Some of our customers never charge; they put monitors where it makes sense for their ROI. Other customers systematically charge; if you want a tank monitored, you pay a fee. Others charge only if the customer does not consume enough. It varies a lot.”

“Some marketers charge monthly fees, some charge annual fees, and some just charge a deposit on the device,” said Montgomery. “We have seen the most successful deployments happen when marketers offer monitors free for the ‘peace of mind’ of their customers. This is an opportunity for the marketer to present themselves as the technology leader in their markets. Monitors are most successfully marketed as a value-added piece of a larger marketing and strategic plan… all of which should make their customers’ lives easier.”

“Many marketers would like to charge their customers for the tank monitor,” said Battye. “However, unless it provides a value to the consumer beyond delivery efficiency or avoided run outs, marketers have struggled to make a compelling case. Presumably, if you have already told a customer you will be a reliable propane supplier and not run them out, they may object if you later suggest they should pay a fee to have a monitor deployed to their tank, especially as it will primarily benefit the marketer. Where it provides a value, such as on will-call or unpredictable generators, pool heaters, and holiday homes, the case will be more readily appreciated.”

“I’ve seen that too,” said Vigliotti. “It has worked in some instances with customers wanting the added insurance policy of knowing their pool heaters or holiday home tanks are being monitored, but, overall, it’s a low number.”

Current State of the Industry

Together with these suggestions for comparing hardware, software, and business plans, these suppliers of tank monitors also offered a look at the current state of the industry, the percentage of marketers who have deployed tank monitors, and the reasons why they are likely to deploy more. Among the reasons for the growing number of monitors out there, they said, are the payback and return on investment, improvement of service quality, customer retention, safety, capital avoidance or recovery, and end users’ expectations that they will have information on demand. Customer experience and engagement is becoming a more critical component in sales differentiation and customer retention.

Improvements in Profitability, Safety

Most marketers have tried monitors on some tanks, and some are now using them on all their tanks, said McGathey. WESROC provides residential and Industrial Internet of Things (IIoT) solutions to the propane market. On Aug. 1, it became part of DataOnline, the global leader of IIoT solutions. Market research firm Berg Insight (Gothenburg, Sweden) reports that these are the two firms with the largest global installed bases of remote tank monitoring solutions in propane, refined products, and industrial gases. The company promotes its tank monitors as being full-featured and providing a total solution. It provides delivery route optimization all the way to back-office integration, while offering an improved customer experience through a mobile app designed specifically for end users.

“We demonstrate payback and ROI,” McGathey said. “That’s measurable; it’s the investment in equipment, fees, and maintenance versus the savings realized by the reduction of unnecessary deliveries and increased delivery, customer, and business profitability.

“A marketer’s largest controllable expenses related to delivery are vehicle and labor,” he added. “They can’t control their product cost or the weather, but they can improve their delivery efficiency. A customer is going to buy a certain amount of propane in a year; the question is, is the marketer going to deliver it in three, four, or five deliveries? The least amount of trips to the tank means more delivery, customer, and business profitability.

“The customers who should be equipped with monitors, you’re going to find in the data. We look at a couple years of delivery history and determine where the marketer can get one-year, two-year, or five-year payback. Those would be the most inefficient locations you are over-servicing or under-servicing.

“Tank monitors also improve safety; a marketer’s number one liability expense is related to out of gas, and monitors help prevent that. There’s also the cost of bobtails; if you can get enough deployment of monitors, you may be able to get rid of the extra truck that most marketers have. It’s usually the oldest truck in the fleet, highest cost per mile to operate, and the first one they’ll spend $170,000-plus to replace.

“I think most marketers have used or at least tried a few tank monitors,” McGathey said. “When I give presentations at trade shows, I always start by asking for a show of hands: ‘Who is using tank monitors?’ This past April at NPGA, pretty much everyone raised their hand. Three or four years ago, only about one-third of them would have raised their hand.”

Gains in Distribution Efficiency

Most marketers are currently using tank monitors for less than 5% of their customers, primarily those that are difficult to forecast, high value, or off-route, said Battye. But, he added, the ROI on cellular monitors will typically support up to 35% of tanks through distribution savings. Silicon Controls is a global player that has been selling monitors for more than 20 years to the propane industry. Market research firm Berg Insight reports Silicon Controls has the third-largest installed base of remote tank monitoring solutions worldwide.

“We believe most of the 4500 marketers in the U.S. are using at least some tank monitors, either as a test or for their most difficult accounts,” said Vigliotti.

“After deploying monitors to improve service quality to a limited number of customers, the marketers move on to distribution efficiency gains,” said Battye. “This is often a journey, expanding the number of monitored tanks to 10%, 20%, and often 30% of their customers over a three- to four-year period.” He explained that with an average fill rate of 37% of a tank’s water volume, and at the current total cost of ownership of tank monitoring (capital, monthly fees, and deployment costs), the opportunity to achieve a three-year or better ROI after fees on up to 35% of tanks is achievable. Silicon Controls bases its assessment on work done analyzing over 4.5 million delivery records across U.S. and European marketers and working with a number of marketers on monitor-based forecasting change management programs.

Battye said, “As the price of monitoring continues to come down, it will make sense to deploy monitors on more and more tanks.”

Piece of a Larger Strategy

The percentage of tanks currently being monitored is low, but the word is getting out, said Montgomery. Monitoring is a hot topic in the industry because the market is demanding greater efficiency and better service. Gremlin Tank Monitors promotes its products and services as a way to optimize business operations, business intelligence, and the bottom line.

“There is a cost to monitoring, but there is a larger cost to sending out trucks and drivers,” Montgomery said. “That’s especially true in the current climate of the apparent driver shortages in all markets. If you have the data at your fingertips, monitors will provide data to reduce inefficient deliveries and driving needless miles, and your drivers and equipment will certainly become more efficient while reducing personnel and equipment costs.

“Monitoring is one piece of a retailer’s larger strategy,” he added. “Do you want to be the technology leader in your area? Do you want to be thought of as forward-thinking and providing peace of mind? Customers have become much more savvy over recent years, and the next generation of homeowners are no different—they have grown up with technology. They will expect marketers to have a solution for their own peace of mind; they don’t want to be bothered with worrying about the fuel level in the tank.

“When you evaluate partners, you should make sure they understand the business, have your best interests in mind, and are interested in your long-term success. The Angus Gremlin monitoring solution coupled with our SAS-based business intelligence and logistics-based platform, all work seamlessly to bring our partners the data they need to create major changes in their companies. These are important items to consider prior to budgeting Cap X funds to an overall solution.”

Security for Customers

Price has been the main barrier to greater adoption of tank monitors by marketers, said Boulay. Otodata has been selling tank monitors in Canada for five years and in the U.S. for one year. The company has focused on providing a lower-than-traditional price structure, in part by selling direct to marketers. As the price comes down, he added, it will make sense for marketers to monitor more tanks.

“Tank monitors have mainly been used for problematic customers,” Boulay said. “If they have had a run-out, you want to retain them as a customer. If they are an important customer, you don’t want them to run out at all. If they are at the end of the line, you don’t want to travel that far if you don’t have to. Fuel marketers were using tank monitors to solve these problems.

“Today, fuel marketers are thinking about whether they can be more efficient by deploying more monitors—not to 100% of their customers, but to 10%, 20%, or 30%,” he added. “The way to make money with monitors is by increasing efficiency. To do that, you need a decent percentage of customers with monitors so you can get rid of trucks and get rid of overtime. The ideal percentage would differ; when a customer consumes a certain amount of fuel, it’s simple, but the one who doesn’t use much, it’s a lot harder to ROI that to make sense to monitor.

“In five years, it will be close to 100%. Our customers want the security of seeing their level. Both homes and businesses want to know how much they have used and when they used it. It’s a little ridiculous that in 2018 we have $500 sitting in a tank and we have no clue how much is left.” —Steve Relyea

The suppliers shared several tips that will make it easier for propane marketers to expand their use of monitors. They offered suggestions on how to compare tank monitors and suppliers, shared their estimates of how many tanks are already being monitored, and explained the return on investment (ROI) monitoring provides in the form of improved delivery efficiency and customer service.

Hardware and Battery

To provide maximum return on investment, a tank monitor must be reliable for many years; the ROI will drop rapidly if the unit has to be regularly serviced or replaced. The suppliers suggested looking at the design of the hardware, the failure rate, and the battery life. One also suggested looking at the UL rating, because that can determine how easy it is to install the unit.

“Hardware can be a differentiator,” said Boyd McGathey, COO at WESROC Monitoring Solutions (Blair, Neb.). “These units will be exposed to extreme weather including sun, water, and temperatures as much as 40 degrees below zero. You want them to be rock solid and perform when you need them most.”

“Durability is critical,” said Robert Battye, vice president North America at Silicon Controls (Philadelphia), supplier of the Gaslog remote monitoring system. “This is a battery-operated device living the toughest possible life outdoors for, in the case of Gaslog, up to 15 years; poor design or materials may prove fatal. Understanding the reliability of the monitor, its battery life, warranty, and, if possible, historical failure rates should be part of a customer’s selection process, being critical to the protection of their investment.”

“You need the installer not to have to worry about where to physically place the unit,” said Mike Vigliotti, tank monitor sales specialist at Bergquist (Toledo, Ohio). Bergquist is the sole distributor in North America of Silicon Controls’ Gaslog remote tank monitor. “Gaslog units are UL certified Class 1, Division 1. That means a driver can mount it anywhere on the tank, including in the turret.”

“Battery life is something everybody needs to compare,” said David Montgomery, customer relationship manager at Gremlin Tank Monitors (Fort Lauderdale, Fla.). “Marketers should be looking for long-term heavy-duty batteries that will not only last, but will also stand extreme temps in not only the coldest areas of the country, but also the warmest.”

“Battery life is a big one,” said André Boulay, president of Otodata (Montreal). “Sending someone to a tank to change a battery is very costly. The cost of that could be more than the cost of communications.”

Networks

Tank monitors can communicate in a number of ways, including through cellular networks, satellite, and low-power wide-area networks (LPWAN) for Internet-of-Things (IoT) devices. The supplier of a tank monitor may also use one or more network providers which can provide marketers needed options for any particular geography.

“Fuel marketers should ask suppliers what cellular network it works on, what carrier or carriers they have relationships with, and why,” said Boulay. “Customers should ask how long these units are going to last. We as manufacturers—all of us—are responsible to sell hardware that will last 20 years. We must move to new cellular technologies as they come along.”

“We have the products that fit the bill, whether it’s WiFi, cellular, or RF,” said Montgomery. “Some areas have good cellular service, others don’t; for those that don’t, RF provides a great alternative. We fit the product to the location.”

“We believe the dominant technology today is cellular,” said Battye. “In selecting a tank monitor, marketers will want to understand the cellular service being used as well as the network providers and how long the communications service will be available. These choices will often determine the usable life of the unit, the coverage (which is of particular importance to rural deployments), and the quality of service.”

“Cellular can be a differentiator, too,” said McGathey. “Many suppliers out there have only one network solution. WESROC has LTE—both Verizon and AT&T—satellite, and LPWAN. We have a network for every potential need.”

Software

All tank monitors will report tank levels, but some may also do much more. The suppliers suggested comparing call frequency and alarm settings, the analysis they can help provide, and the back-office software they can integrate with.

“Not all software platforms are created equally; some have a broader range of capabilities than others,” said McGathey. “For example, with software-based hardware reporting once a day, if you have set a threshold—like a draw alert or a fill alert—you will only find out if there is an alarm at the time it is scheduled to report. Ours is hardware-based; every 60 seconds, it looks at the dial and reports if any set alert threshold has been violated; the monitor immediately reports it along with the current inventory level. Otherwise, you’re blind until the next scheduled report.”

“Compatibility with back-office forecasting, ticketing, and CRM [customer relationship management] software is very important,” said Vigliotti. “Seamless integration of tank levels with the forecasting system supports the achievement of targeted efficiency gains and reduces operations workload. Integration becomes even more critical as more monitors are deployed over time.”

“Back-office integration and compatibility is very important,” Montgomery explained. “That compatibility and full back-office integration means there’s one less step in the process of creating routes. Back-office integration will also support the use of internal data that will help a marketer’s management team make solid business decisions.”

Charging Customers

Some propane marketers charge their customers a monthly fee for tank monitoring, some charge only some of their customers, and some provide it as a service at no charge or strictly for their own operating efficiency benefit. The suppliers have seen a variety of strategies used.

“There is no standard in the industry; it is up to each fuel marketer.” Boulay pointed out, “Some of our customers never charge; they put monitors where it makes sense for their ROI. Other customers systematically charge; if you want a tank monitored, you pay a fee. Others charge only if the customer does not consume enough. It varies a lot.”

“Some marketers charge monthly fees, some charge annual fees, and some just charge a deposit on the device,” said Montgomery. “We have seen the most successful deployments happen when marketers offer monitors free for the ‘peace of mind’ of their customers. This is an opportunity for the marketer to present themselves as the technology leader in their markets. Monitors are most successfully marketed as a value-added piece of a larger marketing and strategic plan… all of which should make their customers’ lives easier.”

“Many marketers would like to charge their customers for the tank monitor,” said Battye. “However, unless it provides a value to the consumer beyond delivery efficiency or avoided run outs, marketers have struggled to make a compelling case. Presumably, if you have already told a customer you will be a reliable propane supplier and not run them out, they may object if you later suggest they should pay a fee to have a monitor deployed to their tank, especially as it will primarily benefit the marketer. Where it provides a value, such as on will-call or unpredictable generators, pool heaters, and holiday homes, the case will be more readily appreciated.”

“I’ve seen that too,” said Vigliotti. “It has worked in some instances with customers wanting the added insurance policy of knowing their pool heaters or holiday home tanks are being monitored, but, overall, it’s a low number.”

Current State of the Industry

Together with these suggestions for comparing hardware, software, and business plans, these suppliers of tank monitors also offered a look at the current state of the industry, the percentage of marketers who have deployed tank monitors, and the reasons why they are likely to deploy more. Among the reasons for the growing number of monitors out there, they said, are the payback and return on investment, improvement of service quality, customer retention, safety, capital avoidance or recovery, and end users’ expectations that they will have information on demand. Customer experience and engagement is becoming a more critical component in sales differentiation and customer retention.

Improvements in Profitability, Safety

Most marketers have tried monitors on some tanks, and some are now using them on all their tanks, said McGathey. WESROC provides residential and Industrial Internet of Things (IIoT) solutions to the propane market. On Aug. 1, it became part of DataOnline, the global leader of IIoT solutions. Market research firm Berg Insight (Gothenburg, Sweden) reports that these are the two firms with the largest global installed bases of remote tank monitoring solutions in propane, refined products, and industrial gases. The company promotes its tank monitors as being full-featured and providing a total solution. It provides delivery route optimization all the way to back-office integration, while offering an improved customer experience through a mobile app designed specifically for end users.

“We demonstrate payback and ROI,” McGathey said. “That’s measurable; it’s the investment in equipment, fees, and maintenance versus the savings realized by the reduction of unnecessary deliveries and increased delivery, customer, and business profitability.

“A marketer’s largest controllable expenses related to delivery are vehicle and labor,” he added. “They can’t control their product cost or the weather, but they can improve their delivery efficiency. A customer is going to buy a certain amount of propane in a year; the question is, is the marketer going to deliver it in three, four, or five deliveries? The least amount of trips to the tank means more delivery, customer, and business profitability.

“The customers who should be equipped with monitors, you’re going to find in the data. We look at a couple years of delivery history and determine where the marketer can get one-year, two-year, or five-year payback. Those would be the most inefficient locations you are over-servicing or under-servicing.

“Tank monitors also improve safety; a marketer’s number one liability expense is related to out of gas, and monitors help prevent that. There’s also the cost of bobtails; if you can get enough deployment of monitors, you may be able to get rid of the extra truck that most marketers have. It’s usually the oldest truck in the fleet, highest cost per mile to operate, and the first one they’ll spend $170,000-plus to replace.

“I think most marketers have used or at least tried a few tank monitors,” McGathey said. “When I give presentations at trade shows, I always start by asking for a show of hands: ‘Who is using tank monitors?’ This past April at NPGA, pretty much everyone raised their hand. Three or four years ago, only about one-third of them would have raised their hand.”

Gains in Distribution Efficiency

Most marketers are currently using tank monitors for less than 5% of their customers, primarily those that are difficult to forecast, high value, or off-route, said Battye. But, he added, the ROI on cellular monitors will typically support up to 35% of tanks through distribution savings. Silicon Controls is a global player that has been selling monitors for more than 20 years to the propane industry. Market research firm Berg Insight reports Silicon Controls has the third-largest installed base of remote tank monitoring solutions worldwide.

“We believe most of the 4500 marketers in the U.S. are using at least some tank monitors, either as a test or for their most difficult accounts,” said Vigliotti.

“After deploying monitors to improve service quality to a limited number of customers, the marketers move on to distribution efficiency gains,” said Battye. “This is often a journey, expanding the number of monitored tanks to 10%, 20%, and often 30% of their customers over a three- to four-year period.” He explained that with an average fill rate of 37% of a tank’s water volume, and at the current total cost of ownership of tank monitoring (capital, monthly fees, and deployment costs), the opportunity to achieve a three-year or better ROI after fees on up to 35% of tanks is achievable. Silicon Controls bases its assessment on work done analyzing over 4.5 million delivery records across U.S. and European marketers and working with a number of marketers on monitor-based forecasting change management programs.

Battye said, “As the price of monitoring continues to come down, it will make sense to deploy monitors on more and more tanks.”

Piece of a Larger Strategy

The percentage of tanks currently being monitored is low, but the word is getting out, said Montgomery. Monitoring is a hot topic in the industry because the market is demanding greater efficiency and better service. Gremlin Tank Monitors promotes its products and services as a way to optimize business operations, business intelligence, and the bottom line.

“There is a cost to monitoring, but there is a larger cost to sending out trucks and drivers,” Montgomery said. “That’s especially true in the current climate of the apparent driver shortages in all markets. If you have the data at your fingertips, monitors will provide data to reduce inefficient deliveries and driving needless miles, and your drivers and equipment will certainly become more efficient while reducing personnel and equipment costs.

“Monitoring is one piece of a retailer’s larger strategy,” he added. “Do you want to be the technology leader in your area? Do you want to be thought of as forward-thinking and providing peace of mind? Customers have become much more savvy over recent years, and the next generation of homeowners are no different—they have grown up with technology. They will expect marketers to have a solution for their own peace of mind; they don’t want to be bothered with worrying about the fuel level in the tank.

“When you evaluate partners, you should make sure they understand the business, have your best interests in mind, and are interested in your long-term success. The Angus Gremlin monitoring solution coupled with our SAS-based business intelligence and logistics-based platform, all work seamlessly to bring our partners the data they need to create major changes in their companies. These are important items to consider prior to budgeting Cap X funds to an overall solution.”

Security for Customers

Price has been the main barrier to greater adoption of tank monitors by marketers, said Boulay. Otodata has been selling tank monitors in Canada for five years and in the U.S. for one year. The company has focused on providing a lower-than-traditional price structure, in part by selling direct to marketers. As the price comes down, he added, it will make sense for marketers to monitor more tanks.

“Tank monitors have mainly been used for problematic customers,” Boulay said. “If they have had a run-out, you want to retain them as a customer. If they are an important customer, you don’t want them to run out at all. If they are at the end of the line, you don’t want to travel that far if you don’t have to. Fuel marketers were using tank monitors to solve these problems.

“Today, fuel marketers are thinking about whether they can be more efficient by deploying more monitors—not to 100% of their customers, but to 10%, 20%, or 30%,” he added. “The way to make money with monitors is by increasing efficiency. To do that, you need a decent percentage of customers with monitors so you can get rid of trucks and get rid of overtime. The ideal percentage would differ; when a customer consumes a certain amount of fuel, it’s simple, but the one who doesn’t use much, it’s a lot harder to ROI that to make sense to monitor.

“In five years, it will be close to 100%. Our customers want the security of seeing their level. Both homes and businesses want to know how much they have used and when they used it. It’s a little ridiculous that in 2018 we have $500 sitting in a tank and we have no clue how much is left.” —Steve Relyea