We live in a society where we broadcast loads of information about ourselves to the public via Facebook, LinkedIn, etc. But our compensation is one of the last pieces of personal information that is still closely guarded. As a result, it is not uncommon for the owners of a company to be uncomfortable sharing information regarding their compensation with potential acquirers of their business. Many business owners, however, may not realize that adjustments related to owners’ compensation often play a significant role in determining an appropriate value for their business, particularly in the context of an acquisition transaction.

If a potential acquirer is probing about a business owner’s compensation and how much they would pay an unrelated third party to perform that job, it is because this information can have a direct — and significant — impact on value. Once owner compensation is known, a potential buyer can determine whether an adjustment is necessary for valuation purposes based on industry compensation data for similar positions, as well as the amount the selling owner is willing to accept to occupy that same position post-transaction.

Imagine a scenario in which you run a company that is structured as an S corporation and own 100% of its stock. Because of this business structure, your tax advisor has suggested you minimize the amount of compensation you pay yourself from the company in order to maximize your flow-through income and minimize your self-employment taxes. Therefore, you have historically paid yourself 50% of what it would cost to hire an equally competent replacement.

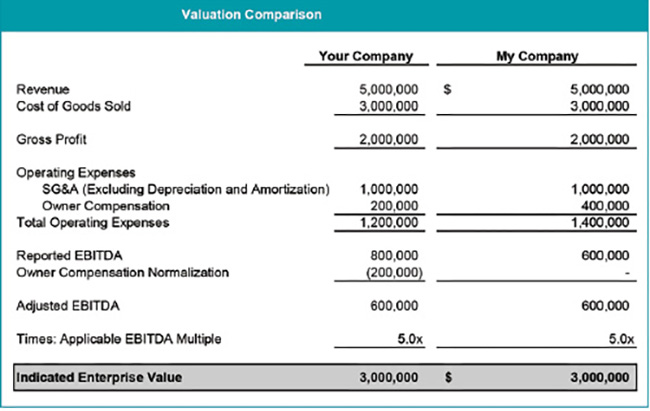

Assume another company is identical to yours, but the owner has paid themselves fair market value compensation for their position. Which company is worth more? The answer is the both have the same value after fair market value compensation has been taken into account. See Figure 1 for proof.

In valuing your business, buyers will likely make normalizing adjustments for certain income statement items to better reflect economic reality. One of these typical adjustments relates to owners’ compensation. A higher owner payroll does not make your business any more or less valuable than the other company; it simply means that owner is paying themselves more in compensation rather than directing those same funds to themselves through distributions from the company.

Strategic Normalization & Value

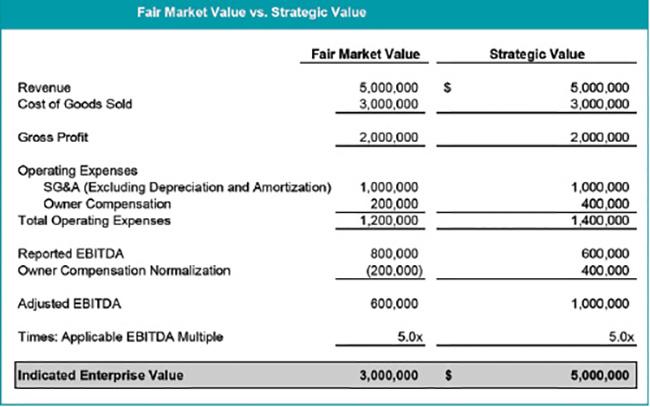

The normalization of owner compensation can be even more significant in a strategic acquisition in which the buyer is already a participant in the industry and can eliminate the owner’s position altogether because of management resources previously in place with the buyer. This is known as a synergistic or strategic normalization, since not all buyers would be able to realize this potential benefit.

While the owner’s role may be necessary for the target company to operate as a standalone entity, the position may not be necessary if the business is folded into another company. The question becomes how much of this additional value the potential buyer is willing to pay for.

If there aren’t multiple potential buyers at the table, they may not be incentivized to pay for any of these synergistic benefits. If multiple buyers are jockeying to buy the company, however, one or more may be willing to pay a synergistic premium above the business’s standalone fair market value due to additional cash flow that can be realized from cost savings derived from the elimination of duplicative positions.

Considering the prior scenario, assume your company is being courted by a few potential buyers who could eliminate your position without negatively impacting the business. The strategic value of your company after eliminating owner compensation would be in excess of fair market value, as shown in Figure 2.

Owner compensation may not always be reflective of fair market value for the services provided. Further, a synergistic/strategic buyer may take an aggressive position regarding owner compensation if they believe the expense could be eliminated altogether due to the management resources already in place with the acquirer.

Therefore, even if an owner may feel uncomfortable sharing compensation information with a potential buyer, it can be a critical piece of the puzzle in determining an accurate value of the business.