The global LPG industry is in motion. Supplies are rising, demand is shifting, trade is changing and new opportunities are emerging. These dynamics matter for every player in the industry. The “2025 Statistical Review of Global LPG,” from the World Liquid Gas Association (WLGA) and Argus Media, captures the dynamics that are reshaping the industry and driving continued growth and success.

Global LPG Supply: Abundance, Shale, Resilience

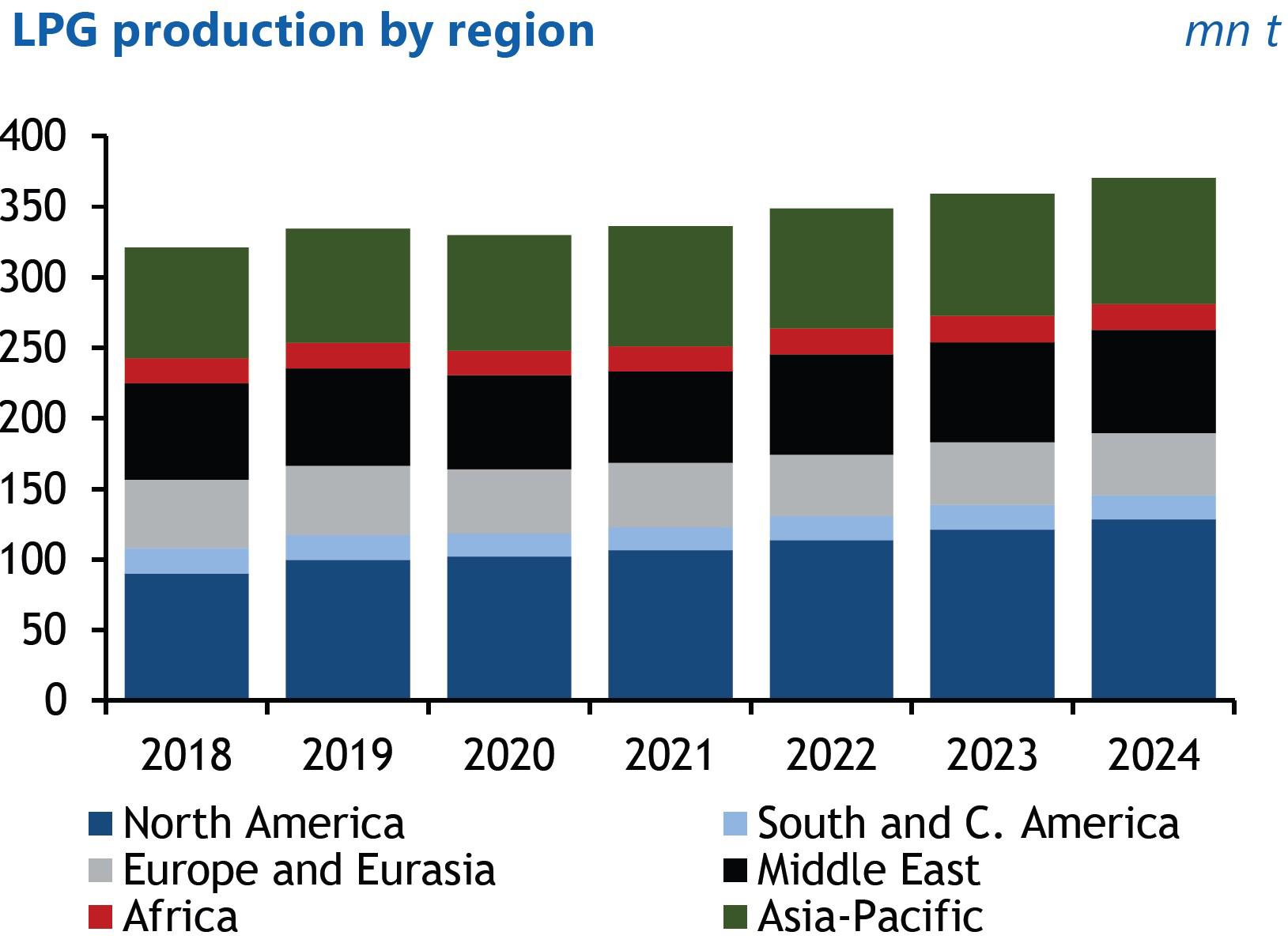

In 2024, global liquefied petroleum gas (LPG) supply increased by 11 million tonnes to exceed 370 million tonnes in total, continuing the trend of increasing global supply and demand. North America accounted for two-thirds of the supply growth. The United States LPG output rose by 6 million tonnes to 111 million, underscoring the country’s role as the world’s largest producer and accounting for 43% of all LPG exports. The Middle East also experienced supply growth, and similar to the U.S., it was largely driven by additional gas processing supply. The Asia-Pacific region also showed significant growth, mostly from the expansion of refining capacity in China.

For the U.S., the Permian Basin remained the key driver of production growth, providing steady propane and butane output that outpaced overall oil and gas growth. Going forward, LPG supply can grow independently of oil market cycles, providing resilience in an uncertain energy landscape.

Global LPG Market Demand: Petrochemicals Today, New Markets Tomorrow

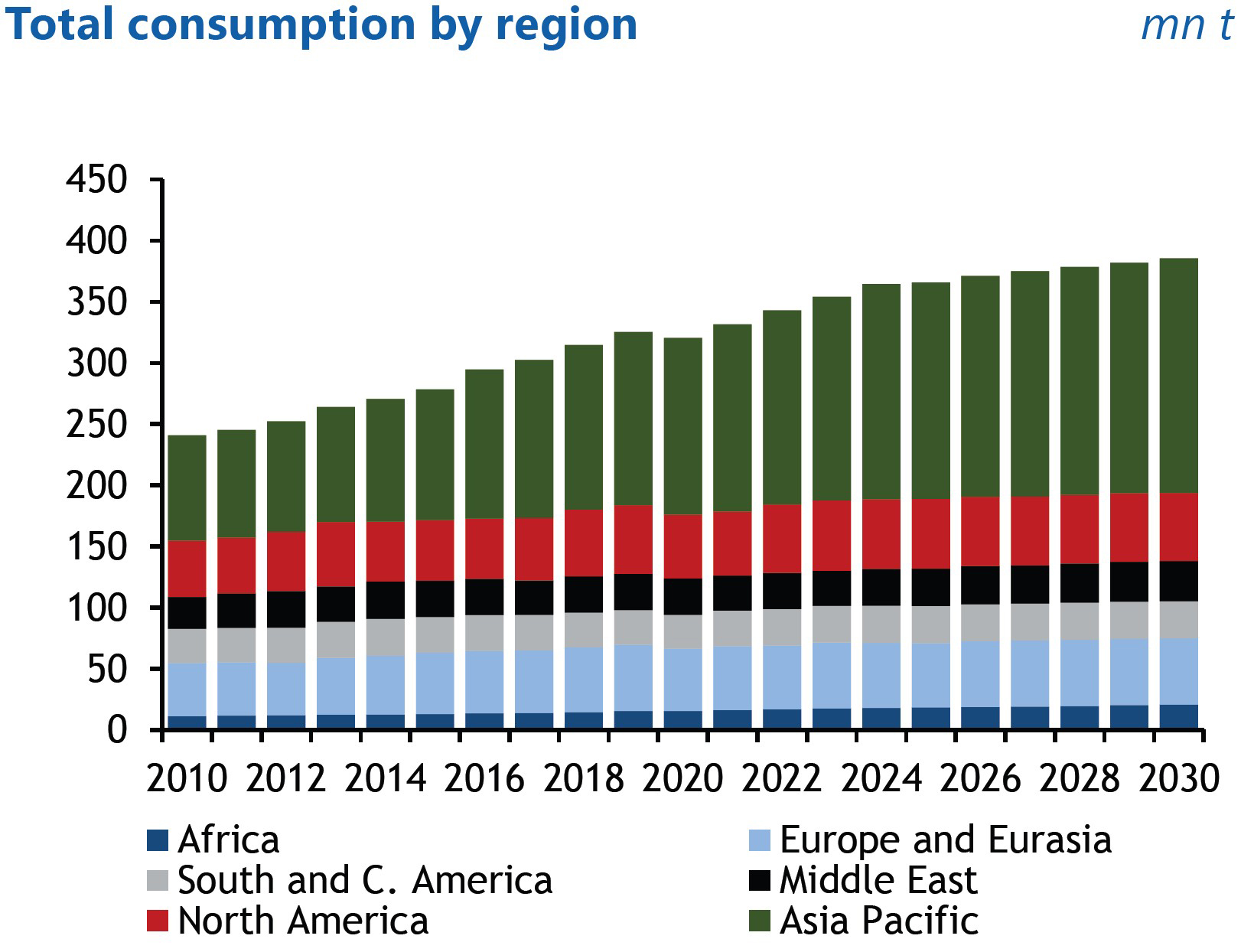

Globally, the petrochemical sector continues to be the main driver of new demand. China added 4.1 million tonnes per year of propane dehydrogenation (PDH) capacity in 2024, reinforcing the role of propane as a feedstock for plastics and other industrial products. Since 2019, PDH capacity in China has increased from 5.2 million tonnes per year to 18 million tonnes per year, which is nearly a 250% increase. Utilization rates have softened since 2019, but PDH capacity expansion remains a defining factor for global propane demand.

At the same time, the residential market, which is the largest demand sector for LPG, held steady in 2024. Peeling this onion back, though, shows that residential demand in high-income markets, including China, fell by 3.4 million tonnes while demand in developing markets rose by 3 million tonnes. This trend is important.

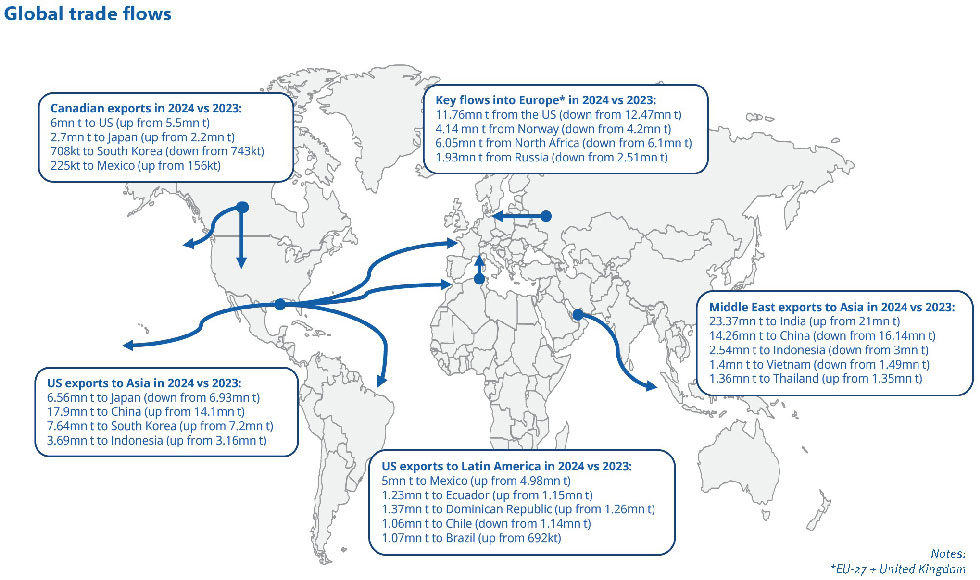

In 2024, India overtook China to become the world’s largest residential LPG market at 27.8 million tonnes, larger than Africa, the Middle East, Europe and Eurasia combined. Subsidy policies are politically sensitive, but relevant, and LPG continues to provide a reliable household energy source for hundreds of millions. India has also recently shown increased interest in U.S. exports, partly because China is pursuing LPG from countries other than the U.S. and because India projects continued growth in its domestic market. For U.S. suppliers and marketers, this is an important market development.

Africa continues to show potential as the next major growth market, potentially becoming one of the largest residential markets globally. North Africa markets have some of the highest residential consumption per capita; countries such as Nigeria, Kenya and Tanzania are advancing clean cooking programs, and others are at earlier stages of a transition to LPG. International organizations, including the International Energy Agency through its Universal Access to Clean Cooking in Africa program, are making large investments to support this shift.

This highlights both the challenges and the significant opportunity for LPG in the region.

Market Friction

Rapid growth can run up against infrastructure constraints. The excess production in the U.S. has outstripped export capacity. In the Gulf Coast, export terminals fees that averaged $30 per tonne in recent years increased to more than $110 per tonne in the second half of 2024 and peaked near $190. Of course, the industry is responding as expansions and new terminals have been announced.

Shipping has also been volatile. The addition of 36 new very large gas carriers, or VLGCs, in 2023-2024 put downward pressure on freight rates in early 2024 that rebounded late in the year. Conditions along trade routes, including weather and transit times — as well as trade tensions — will continue to lend unpredictability to the freight markets.

Geopolitical dynamics also impacted on LPG trade flows. Poland, once reliant on Russian LPG, secured LPG from U.S. suppliers via Sweden. China, meanwhile, sourced just over half of its propane imports from the U.S., even amid political tensions between the two countries that may impact future demand.

Future Bets: Petrochemicals, Renewable LPG, Africa’s Rise

The “2025 Statistical Review of Global LPG” also highlights emerging shifts in the global markets. Petrochemical demand will remain a key driver of LPG growth, though the rate will slow, and competition from ethane as a feedstock could impact demand.

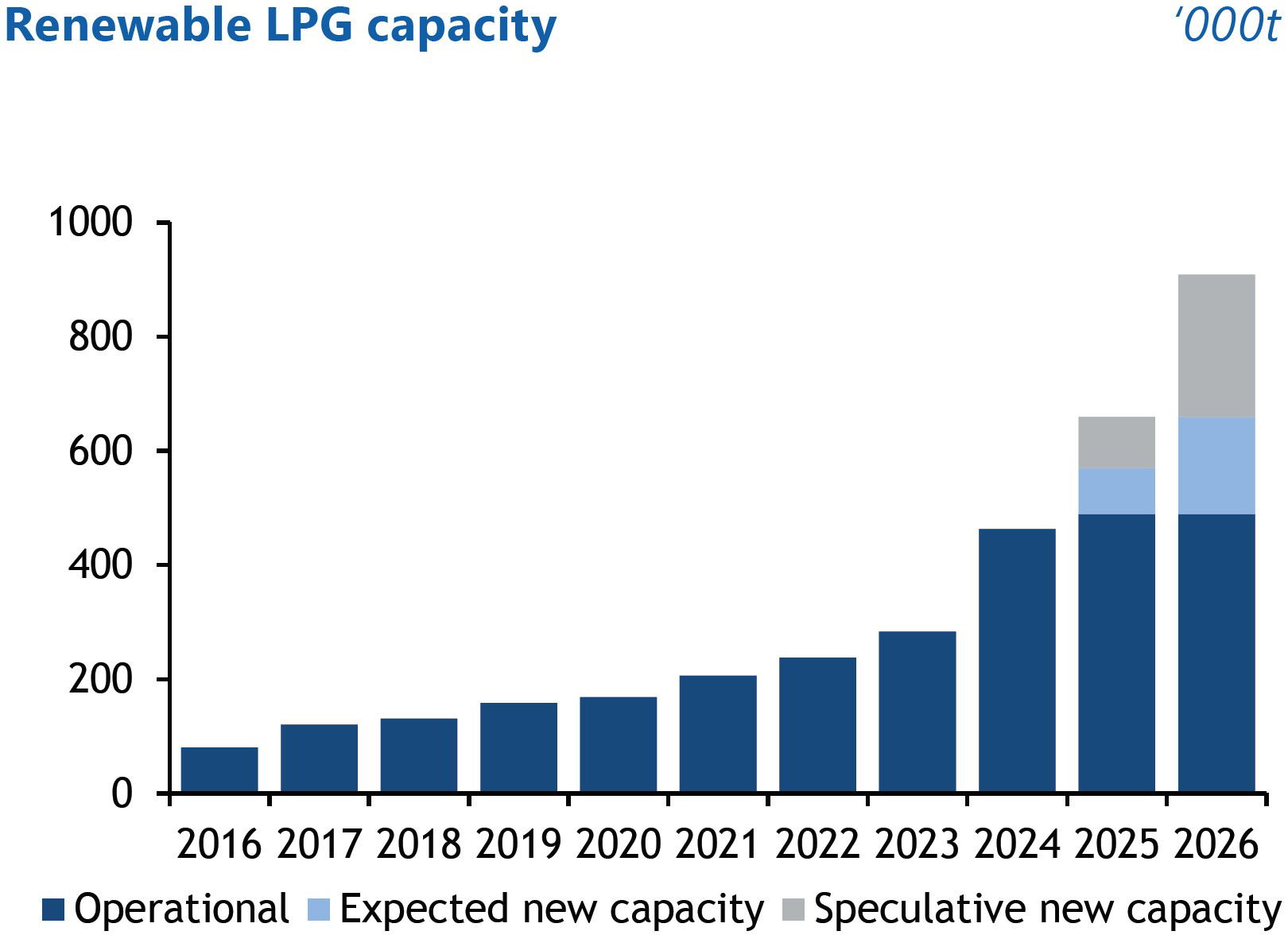

Renewable LPG production capacity reached 480,000 tonnes in 2024, a 60% increase year-over-year. Brazil recorded its first sale of renewable LPG and produced renewable LPG from eucalyptus biomass, while Ireland more than doubled demand under EU mandates.

Though still modest in scale, renewable LPG is establishing itself as part of the energy transition in the markets where it is in demand, and demand for renewable fuels in other industries brings opportunities and competition to the LPG industry.

Africa remains the long-term growth story. With nearly 1 billion lacking access to clean cooking, demand growing at double-digit rates and governments prioritizing clean cooking initiatives, the region is set to be a major driver of global LPG consumption over the next decade.

Global LPG Markets, Local Opportunities

The message from the statistical review is clear: The global LPG industry is strong. It is expanding in scale, in geographic reach and in relevance.

From U.S. shale abundance and Asia’s chemical capacity to Africa’s clean cooking needs and the emergence of renewable LPG, the industry is on track for continued growth.