This year has the potential to be a significant turning point in the banking and equipment financing sectors. The Republican Party will hold a unified control over the U.S. government and will have majorities in both the Senate and the House of Representatives, with Donald Trump as president. This represents a shift in the political landscape and provides Republicans with an opportunity to implement their legislative goals. Additionally, the U.S. economy has continued to perform well in comparison to other major economies, and U.S. businesses report optimism regarding growth in 2025.

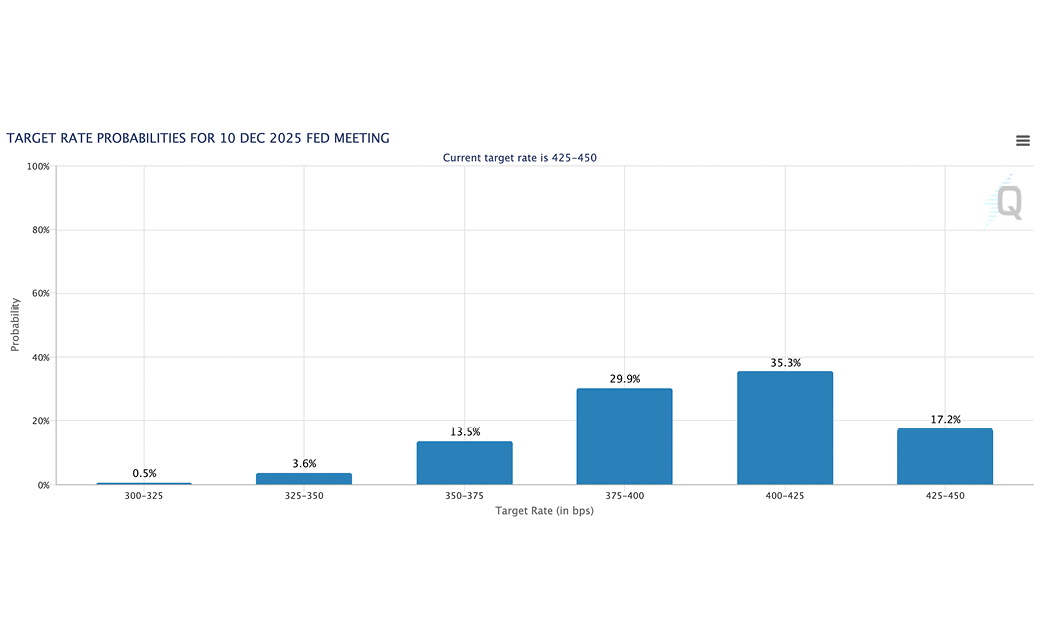

The Equipment Leasing & Finance Foundation’s 2025 U.S. Economic Outlook projects 2.7% GDP growth, 4.7% equipment and software growth, and an additional 50 basis point federal funds rate reduction in 2025. These factors and forecasts are likely to positively influence the economic landscape, including industries in the energy sector that rely on equipment financing.

Political Shift & Its Impact

The new administration has shared a reform agenda that includes the realignment of regulations governing banking and equipment financing, with a focus on simplifying compliance requirements and increasing transparency in lending. For energy retailers, these regulatory changes could mean easier access to capital equipment loans and leases. The government’s intent to support infrastructure and energy also directly benefits the propane industry, which is essential for residential, commercial and agricultural heating and as a fuel with various industrial applications.

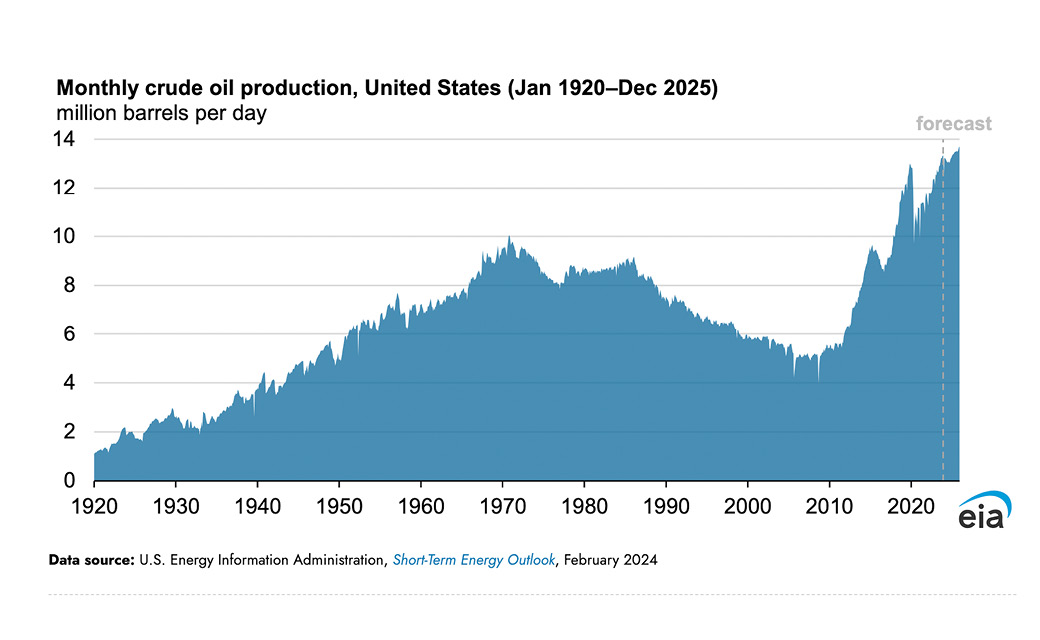

With a focus on domestic energy production, the oil and gas industry should benefit not only from streamlining the permit and regulatory process, but also by advancements in drilling technology, which has increased output while at the same time lessening the number of active oil rigs. Supporting energy, infrastructure and the modernization of equipment will not only strengthen the economy but will also likely improve supply efficiency, which includes propane distribution and retailing systems.

The propane industry’s push toward promoting propane as a cleaner alternative to other fossil fuels can also be leveraged as a competitive advantage by aligning business operations with broader environmental goals and government incentives.

Projected Interest Rates & Financing Costs

The economic trajectory for 2025 is promising, with a forecasted growth in the GDP and a stable interest rate environment. The stability in financial markets should encourage investment in capital equipment. Propane marketers should consider that it may be an advantageous time to invest in new technologies and expand their operational capacities.

Federal Open Market Committee members will be evaluating upside and downside risks, including tariffs, employment, deportations, geopolitical conflict and climate-related incidents. Tariffs would likely increase prices for U.S. consumers, and geopolitical conflicts and climate-related issues could result in commodity price increases.

It is important to note that while economic forecasting can be a valuable tool, there are many unknowns which make prediction difficult. In this writer’s opinion, meteorologists are now more accurate than economists. For instance, the conversations surrounding tariffs could simply be a strategy to gain access for U.S. goods to foreign markets, and aggressive tariffs may not actually be implemented. Modest tariffs would have less of an impact on the economy. Dialogue surrounding deportation is mixed, as well. The bottom line is there is still uncertainty about what campaign promises will be implemented, the effect of unforeseen events and unpredictable human behavior. These factors should be monitored as part of an overall adaptable business strategy.

Although it is difficult to predict government behavior, forecasting tools can be a worthwhile complement to your business decision-making.

Continued Business Growth & Optimism Projected

The equipment lease finance industry showed growth in the fourth quarter of 2024, with new business growth up 3.7% from January. Equipment Leasing and Finance Association members reported strong portfolio performance and reduced charge-offs, which signifies the strength of U.S. businesses financing essential equipment.

The Equipment Leasing & Finance Foundation historically tracks 12 vertical markets, including agricultural machinery, construction machinery, materials handling equipment, other industrial equipment, medical equipment, mining and oilfield machinery, aircraft, ships and boats, railroad equipment, trucks, computers and software. While some verticals show weakened momentum relative to historical performance, half of the verticals showed momentum that is stronger, including computers, software, and mining and oilfield machinery, which are positives for the retail energy sector’s growth and stability.

Additionally, the National Federation of Independent Businesses surveys revealed an increase in small business optimism, which is anticipated to continue as an upward trend in 2025.

The Role of AI & Automation in Lending

Artificial intelligence (AI) and automation are transforming most industries, including banking and finance, making it faster, more accurate and more accessible. In the context of equipment financing, these technologies are streamlining the application and approval processes and can reduce both the time and cost associated with securing financing.

For propane retailers, AI-enhanced lending platforms can offer customized financing solutions that are tailored to the specific needs of the energy sector. These platforms can propose optimal loan structures and manage the life cycle of the lease or loan more efficiently. Automation in loan servicing can also reduce the administrative burden on borrowers, allowing them to focus more on their core business activities.

Best Practices for Propane Retailers

To navigate the evolving landscape of 2025, propane retailers must stay up to date on policy changes, economic developments and technological advancements in lending. Here are some tips to bear in mind:

- Stay informed about regulatory changes: Engage with trade associations and financial consultants to understand how these changes could benefit your financing needs.

- Use sustainability as a competitive advantage: Align your business operations with the government’s sustainability goals. By promoting propane as a cleaner alternative, you can enhance your market position and possibly benefit from available government incentives.

- Capitalize on a stable economy: Stable interest rates and government support for energy and infrastructure can be a good formula for making long-term investments.

- Adopt technology in financing: Explore AI-driven financing options that can offer better terms and more personalized service. Automation tools can help manage your finances more effectively, from the initial loan applications to repayment.

This year is likely to be positive for the propane and retail fuel industries in terms of financing and economic opportunity. The shifts brought about by the new unified government and presidential administration provide both challenges and opportunities. By understanding these dynamics and how they affect your business practices, propane marketers can continue to thrive in this new economic environment.