Monday, June 12, 2017

(June 12, 2017) — Multiple whirling masses of frigid air — polar vortexes — brought bone-chilling cold to large swaths of the nation the winter of 2013-2014, driving heating degree days, or HDDs, to unaccustomed heights. According to National Oceanic and Atmospheric Administration (NOAA) data, the U.S. experienced 1045 gas home customer-weighted HDDs in January 2014, 55 more than the long-term average. There were 1258 HDDs in New England, 1283 in the Mid-Atlantic, and 1489 in the east-north-central region. Of the nine regions monitored by NOAA, only the Mountain and Pacific areas recorded fewer HDDs in January than they did a year earlier or as measured by the long-term average. But over the past two heating seasons, polar vortexes, even sustained cold temperatures, faded from recollection.

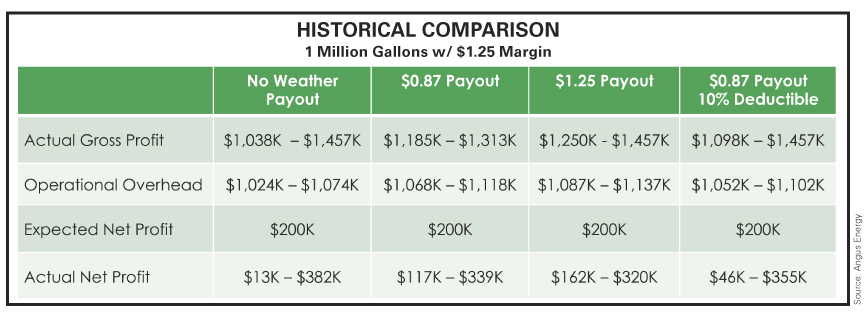

After laboring under two clement winters in a row, propane retailers are understandably eyeing strategies to hedge against weather risk, moves separate and distinct from those aimed at supply reliability. And weather is a major risk for companies, observes Danny Silverman of Fort Lauderdale, Fla.-based Angus Energy, which operates consultancy, analytics, hedging, and finance divisions.

Silverman underscored during a breakout session at the recent Southeastern Convention in Nashville that weather volatility has become a threat to companies’ long-term financial condition. Deliveries lost to lack of demand can quickly and materially impact a dealer’s profit-and-loss statement and lead to deterioration of its balance sheet. And weather risk applies to all enterprises, from agricultural producers to sandal makers.

“Extreme cold will certainly hurt the farmer but help the fuel dealer,” he says, “but both are exposed to weather risk, only for opposite reasons.” He adds that underwriters that provide hedging programs depend on both sides of the weather equation, because some of their clients reap benefits from one set of climatic conditions and others suffer. “Policy writers know there are two sides of the table, and they are only going to pay one,” Silverman explains.

He comments that unseasonable warmth and cold aren’t the only pervasive weather risks. Rain doesn’t just ruin well-planned outdoor weddings, it heavily impacts virtually every sale. As an example, while heavy precipitation can drive customers into indoor shopping malls, bowling alleys, and movie theaters, it works to the detriment of car dealers and sidewalk shopping traffic. It follows that nice weather has the opposite effect.

He draws a comparison between the efficacy of weather hedging and the price-protection programs propane retailers offer their customers. Such fixed-, or locked-in, pricing programs provide a guarantee against them paying higher prices in the future should they rise. “Most homeowners don’t take advantage of the programs, but when the price goes up they lose money and pay more,” says Silverman. “Every bill gets paid monthly, but when it comes to heating fuel, customers pay the most in the winter. The money they did not pay in the summer is spent elsewhere, rather than working to level and manage fuel costs throughout the year.”

He comments that banks, lenders, and investors are increasingly growing weary of warm-weather excuses from borrowers when weather risk tools are available and the vagaries of warm and cold can be managed. “A consistent 9% annual profit year after year will make your bank happier than a 19% profit one year, no profit the next, and an 11% profit in year three for an average profit of 10%,” he maintains. Silverman drew a parallel between the effect the two latest warm winters have had on propane marketers to the drought conditions in 1998 and 2012 that hit Midwest soybean and corn growers. He cited a comment by then-agriculture secretary Thomas Vilsack while on a visit to drought-stricken farmers in 2012: “Last time only 25% of farmers had crop insurance, but this time 85% are covered.” In other words, despite reduced crop production and projected financial losses, farmers were nonetheless in much better shape than during the previous major drought.

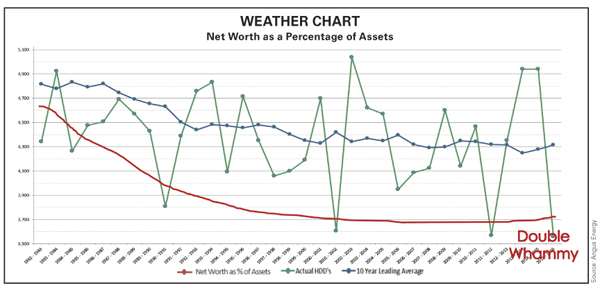

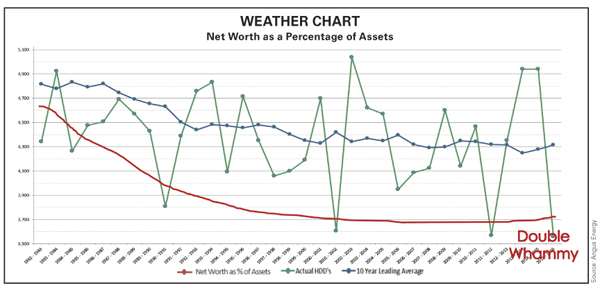

As a provider of weather hedging plans, Silverman predictably advocates such protection for fuel providers. “When you overlay the propane distribution industry net worth trend on the weather trend, the need for protection is more evident,” he says. “The decision to hedge should be viewed in the context of the relative balance-sheet strength of your company. What is your ability to recover from another lost winter? Fuel dealers needing the protection the most are also the most likely to dismiss the hedge as too expensive in an effort to preserve cash, leaving them exposed to the knockout blow.”

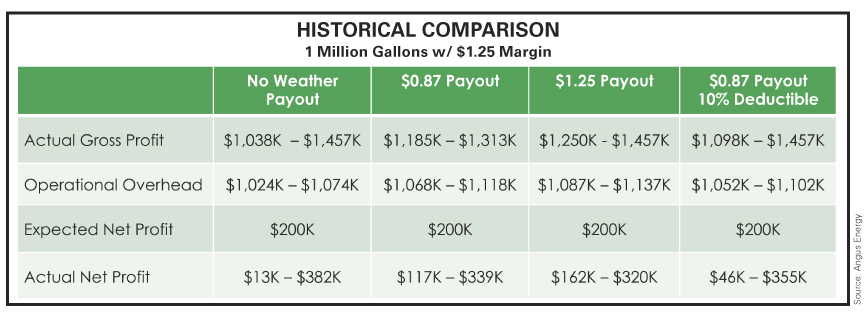

He points to frequent justifications for not purchasing weather protection, among them, “I can manage warm weather myself by reducing delivery costs and increasing margins;” “I can handle a 10% loss in volume;” “If it’s warmer, prices will fall so I’m okay;” “It’s not going to be warm next year. This was an anomaly;” “I didn’t know it was available and I’m not sure how it works;” and “It costs too much.” However, Silverman asserts that, absent weather hedging protection, a 16.9% loss in gross profit can equal a 93.3% loss in net profit.

He expounds that no one would ever cancel their general liability insurance, their fleet insurance, their property insurance, or their life insurance, although they also cost too much. Why are these insurance policies never canceled? Although a safeguard against liability and, in the main, a requirement for responsible business operations, overall they provide peace of mind and stability.

Further, hedging, Silverman insists, “insulates companies from the irrationality of competitors in a warm winter, and in a severely warm winter you simply cannot raise the margin high enough to be made whole.” He observes that implementing a weather hedging plan also demonstrates to lenders a business is taking steps to create an earnings floor by largely eliminating “the last great risk.” Such programs also show financial partners an understanding of the financial tools available while avoiding the lingering multiyear impact on balance sheets from a weather event.

Heating Degree Days

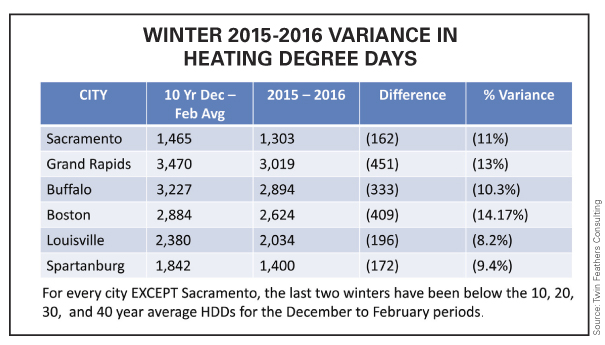

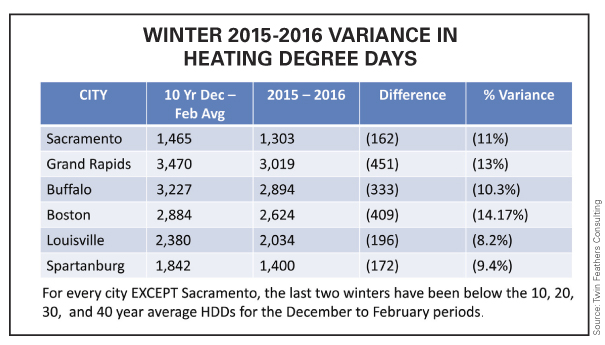

In a review of winter 2015-2016, Twin Feathers Consulting of Overland Park, Kan. hosted a session at the 2017 Southeastern Expo that highlighted the wide variance between expected and long-term average weather patterns over the past two winters. Used as examples were Grand Rapids, Mich.; Buffalo, N.Y.; Boston, Mass.; Louisville, Ky.; Spartanburg, S.C.; and Sacramento, Calif. For every city except Sacramento, of all places, the last two winters have been below the 10-, 20-, 30-, and even 40-year average for HDDs for the December through February period.

Highlighting the extensive departure from the norm, and up-side-down weather volatility, Twin Feathers pointed out in a West Coast/East Coast comparison that Sacramento has had more winters over the last 30 years skewed to the warm side, while Boston has had more winters on the cold side. That volatility extends to the Great Lakes Region and the Southeast, which has had stronger cold weather occurrences in the last 30 years. The presentation concluded that it doesn’t matter where the business is located, volatility can be skewed to both warm and cold, both of which present weather risk. However, weather risk management tools are available.

And while a traditional propane hedge mitigates propane price and supply risk, it doesn’t protect against weather, which is a volumetric and margin risk. Weather risk-management tools include selling an HDD swap, buying an HDD call, or doing both. Charles Robertson, president of Twin Feathers, and JD Buss, trading manager, said one of their clients was able to garner protection from warmer temperatures — lower HDDs — and at the same time remain protected from paying out if temperatures turned cold. In addition, marketers might consider employing the services of a weather forecast provider.

Gary Lezak of Weather2020.com and senior KSHB-TV weather anchor participated in the Twin Feathers session. His company provides short- and long-term forecasts out to 30, 60, even 250 days to businesses within individual ZIP Codes using a proprietary model. Lezak holds that weather patterns cycle regularly, therefore they can be forecast. He says this year’s cycle is about 58 or 59 days. In addition, he advances the view that by using the formula, high-impact weather events can accurately be predicted with 15 to as many as 200 days of lead time. He posited that “existing technology is unable to accurately forecast weather beyond 10 days. We time out the cold outbreaks, long warm spells, and when storm systems strike. Adverse weather conditions have significant impacts on the global economy.”

This Winter?

Meanwhile, the U.S. Energy Information Administration’s (EIA) Winter Fuels Outlook released May 9 calls for winter 2017-2018 to be much colder than last winter east of the Rocky Mountains, with the Northeast and Midwest 17% colder and the South 18% colder. EIA based its prediction on the most recent forecast of HDDs from NOAA. However, despite the expectation of colder temperatures compared to last winter, temperatures in the eastern U.S. are expected to be about 3% warmer than the average of the five winters preceding last winter, since temperatures last winter were much warmer than normal in those areas.

In the West, temperatures are forecast to be about 2% warmer than last winter. But EIA underscores that recent winters provide a reminder that weather can be unpredictable. In addition to the agency’s base case, the Winter Fuels Outlook includes forecasts for scenarios where heating degree days in all regions may be 10% colder or 10% warmer than forecast. For the purposes of the outlook, EIA considers the winter season to run from October through March.

EIA, the statistics and analysis arm of the Department of Energy and a principal agency of the U.S. Federal Statistical System, calculates that nearly 5% of U.S. households heat primarily with propane. The agency expects those households to spend less on heating this winter than in eight out of the past 10 winters, but more than last winter when both heating demand and propane prices were low. The projected increase in expenditures from last winter varies by region.

EIA expects that households heating with propane in the Midwest will spend an average of $290, or 30%, more this winter than last winter, reflecting prices that are about 14% higher and consumption that is up 13% compared to last winter. Households in the Northeast are expected to spend an average of $346, or 21%, more, with average prices that are about 7% higher and consumption that is 13% above last winter. However, average propane expenditures across the two regions are 18% below average expenditures from the five winters prior to last winter.

The agency notes primary U.S. propane inventories were at record-high levels throughout last winter, reaching 104 MMbbl as of Sept. 30, 2016, nearly 4 MMbbl, or 4%, higher than a year earlier. Last winter, stocks were drawn down by 33.8 MMbbl during the heating season — October-March. An inventory draw of 40.6 MMbbl is expected this winter. The projected draw would leave volumes 32% above the previous five-year average at the conclusion of EIA’s heating season in March.

“Current inventory levels should be sufficient to allow for even stronger-than-projected inventory draws given colder weather, higher crop-drying use, or stronger exports,” asserts EIA. If that outlook holds, and the agency’s forecast for inventories entering the upcoming heating season stands at even higher levels than last year, despite heavy export demand, it would go far to assuage concerns in the retail propane segment that as of early May stocks remained stubbornly below storage levels compared to 2016.

The agency highlights that with the addition of new export facilities over the past several years, and a new Gulf Coast terminal expected to begin operations, the U.S. has the capacity to support higher-than-forecast levels of propane exports when spot shipments are economically viable. Inventories on the Gulf Coast have been the main contributor to the record-high storage levels, with propane stocks in that region 55% above the previous five-year average for the week ended Sept. 30, 2016.

EIA comments that much of this storage is at facilities connected to industrial users and export terminals, and transportation of propane out of the region to the Midwest and Northeast is often costly. However, propane inventories in the Midwest and Northeast were 9% and 42% above the five-year average, respectively, as of Sept. 30. Higher stock levels and improved rail delivery networks for propane should contribute to more robust supply chains than three years ago, when the Midwest saw prices spike during extremely cold weather. Nonetheless, local markets could still see tight supply conditions, particularly in cases of severely cold temperatures. —John Needham

After laboring under two clement winters in a row, propane retailers are understandably eyeing strategies to hedge against weather risk, moves separate and distinct from those aimed at supply reliability. And weather is a major risk for companies, observes Danny Silverman of Fort Lauderdale, Fla.-based Angus Energy, which operates consultancy, analytics, hedging, and finance divisions.

Silverman underscored during a breakout session at the recent Southeastern Convention in Nashville that weather volatility has become a threat to companies’ long-term financial condition. Deliveries lost to lack of demand can quickly and materially impact a dealer’s profit-and-loss statement and lead to deterioration of its balance sheet. And weather risk applies to all enterprises, from agricultural producers to sandal makers.

“Extreme cold will certainly hurt the farmer but help the fuel dealer,” he says, “but both are exposed to weather risk, only for opposite reasons.” He adds that underwriters that provide hedging programs depend on both sides of the weather equation, because some of their clients reap benefits from one set of climatic conditions and others suffer. “Policy writers know there are two sides of the table, and they are only going to pay one,” Silverman explains.

He comments that unseasonable warmth and cold aren’t the only pervasive weather risks. Rain doesn’t just ruin well-planned outdoor weddings, it heavily impacts virtually every sale. As an example, while heavy precipitation can drive customers into indoor shopping malls, bowling alleys, and movie theaters, it works to the detriment of car dealers and sidewalk shopping traffic. It follows that nice weather has the opposite effect.

He draws a comparison between the efficacy of weather hedging and the price-protection programs propane retailers offer their customers. Such fixed-, or locked-in, pricing programs provide a guarantee against them paying higher prices in the future should they rise. “Most homeowners don’t take advantage of the programs, but when the price goes up they lose money and pay more,” says Silverman. “Every bill gets paid monthly, but when it comes to heating fuel, customers pay the most in the winter. The money they did not pay in the summer is spent elsewhere, rather than working to level and manage fuel costs throughout the year.”

He comments that banks, lenders, and investors are increasingly growing weary of warm-weather excuses from borrowers when weather risk tools are available and the vagaries of warm and cold can be managed. “A consistent 9% annual profit year after year will make your bank happier than a 19% profit one year, no profit the next, and an 11% profit in year three for an average profit of 10%,” he maintains. Silverman drew a parallel between the effect the two latest warm winters have had on propane marketers to the drought conditions in 1998 and 2012 that hit Midwest soybean and corn growers. He cited a comment by then-agriculture secretary Thomas Vilsack while on a visit to drought-stricken farmers in 2012: “Last time only 25% of farmers had crop insurance, but this time 85% are covered.” In other words, despite reduced crop production and projected financial losses, farmers were nonetheless in much better shape than during the previous major drought.

As a provider of weather hedging plans, Silverman predictably advocates such protection for fuel providers. “When you overlay the propane distribution industry net worth trend on the weather trend, the need for protection is more evident,” he says. “The decision to hedge should be viewed in the context of the relative balance-sheet strength of your company. What is your ability to recover from another lost winter? Fuel dealers needing the protection the most are also the most likely to dismiss the hedge as too expensive in an effort to preserve cash, leaving them exposed to the knockout blow.”

He points to frequent justifications for not purchasing weather protection, among them, “I can manage warm weather myself by reducing delivery costs and increasing margins;” “I can handle a 10% loss in volume;” “If it’s warmer, prices will fall so I’m okay;” “It’s not going to be warm next year. This was an anomaly;” “I didn’t know it was available and I’m not sure how it works;” and “It costs too much.” However, Silverman asserts that, absent weather hedging protection, a 16.9% loss in gross profit can equal a 93.3% loss in net profit.

He expounds that no one would ever cancel their general liability insurance, their fleet insurance, their property insurance, or their life insurance, although they also cost too much. Why are these insurance policies never canceled? Although a safeguard against liability and, in the main, a requirement for responsible business operations, overall they provide peace of mind and stability.

Further, hedging, Silverman insists, “insulates companies from the irrationality of competitors in a warm winter, and in a severely warm winter you simply cannot raise the margin high enough to be made whole.” He observes that implementing a weather hedging plan also demonstrates to lenders a business is taking steps to create an earnings floor by largely eliminating “the last great risk.” Such programs also show financial partners an understanding of the financial tools available while avoiding the lingering multiyear impact on balance sheets from a weather event.

Heating Degree Days

In a review of winter 2015-2016, Twin Feathers Consulting of Overland Park, Kan. hosted a session at the 2017 Southeastern Expo that highlighted the wide variance between expected and long-term average weather patterns over the past two winters. Used as examples were Grand Rapids, Mich.; Buffalo, N.Y.; Boston, Mass.; Louisville, Ky.; Spartanburg, S.C.; and Sacramento, Calif. For every city except Sacramento, of all places, the last two winters have been below the 10-, 20-, 30-, and even 40-year average for HDDs for the December through February period.

Highlighting the extensive departure from the norm, and up-side-down weather volatility, Twin Feathers pointed out in a West Coast/East Coast comparison that Sacramento has had more winters over the last 30 years skewed to the warm side, while Boston has had more winters on the cold side. That volatility extends to the Great Lakes Region and the Southeast, which has had stronger cold weather occurrences in the last 30 years. The presentation concluded that it doesn’t matter where the business is located, volatility can be skewed to both warm and cold, both of which present weather risk. However, weather risk management tools are available.

And while a traditional propane hedge mitigates propane price and supply risk, it doesn’t protect against weather, which is a volumetric and margin risk. Weather risk-management tools include selling an HDD swap, buying an HDD call, or doing both. Charles Robertson, president of Twin Feathers, and JD Buss, trading manager, said one of their clients was able to garner protection from warmer temperatures — lower HDDs — and at the same time remain protected from paying out if temperatures turned cold. In addition, marketers might consider employing the services of a weather forecast provider.

Gary Lezak of Weather2020.com and senior KSHB-TV weather anchor participated in the Twin Feathers session. His company provides short- and long-term forecasts out to 30, 60, even 250 days to businesses within individual ZIP Codes using a proprietary model. Lezak holds that weather patterns cycle regularly, therefore they can be forecast. He says this year’s cycle is about 58 or 59 days. In addition, he advances the view that by using the formula, high-impact weather events can accurately be predicted with 15 to as many as 200 days of lead time. He posited that “existing technology is unable to accurately forecast weather beyond 10 days. We time out the cold outbreaks, long warm spells, and when storm systems strike. Adverse weather conditions have significant impacts on the global economy.”

This Winter?

Meanwhile, the U.S. Energy Information Administration’s (EIA) Winter Fuels Outlook released May 9 calls for winter 2017-2018 to be much colder than last winter east of the Rocky Mountains, with the Northeast and Midwest 17% colder and the South 18% colder. EIA based its prediction on the most recent forecast of HDDs from NOAA. However, despite the expectation of colder temperatures compared to last winter, temperatures in the eastern U.S. are expected to be about 3% warmer than the average of the five winters preceding last winter, since temperatures last winter were much warmer than normal in those areas.

In the West, temperatures are forecast to be about 2% warmer than last winter. But EIA underscores that recent winters provide a reminder that weather can be unpredictable. In addition to the agency’s base case, the Winter Fuels Outlook includes forecasts for scenarios where heating degree days in all regions may be 10% colder or 10% warmer than forecast. For the purposes of the outlook, EIA considers the winter season to run from October through March.

EIA, the statistics and analysis arm of the Department of Energy and a principal agency of the U.S. Federal Statistical System, calculates that nearly 5% of U.S. households heat primarily with propane. The agency expects those households to spend less on heating this winter than in eight out of the past 10 winters, but more than last winter when both heating demand and propane prices were low. The projected increase in expenditures from last winter varies by region.

EIA expects that households heating with propane in the Midwest will spend an average of $290, or 30%, more this winter than last winter, reflecting prices that are about 14% higher and consumption that is up 13% compared to last winter. Households in the Northeast are expected to spend an average of $346, or 21%, more, with average prices that are about 7% higher and consumption that is 13% above last winter. However, average propane expenditures across the two regions are 18% below average expenditures from the five winters prior to last winter.

The agency notes primary U.S. propane inventories were at record-high levels throughout last winter, reaching 104 MMbbl as of Sept. 30, 2016, nearly 4 MMbbl, or 4%, higher than a year earlier. Last winter, stocks were drawn down by 33.8 MMbbl during the heating season — October-March. An inventory draw of 40.6 MMbbl is expected this winter. The projected draw would leave volumes 32% above the previous five-year average at the conclusion of EIA’s heating season in March.

“Current inventory levels should be sufficient to allow for even stronger-than-projected inventory draws given colder weather, higher crop-drying use, or stronger exports,” asserts EIA. If that outlook holds, and the agency’s forecast for inventories entering the upcoming heating season stands at even higher levels than last year, despite heavy export demand, it would go far to assuage concerns in the retail propane segment that as of early May stocks remained stubbornly below storage levels compared to 2016.

The agency highlights that with the addition of new export facilities over the past several years, and a new Gulf Coast terminal expected to begin operations, the U.S. has the capacity to support higher-than-forecast levels of propane exports when spot shipments are economically viable. Inventories on the Gulf Coast have been the main contributor to the record-high storage levels, with propane stocks in that region 55% above the previous five-year average for the week ended Sept. 30, 2016.

EIA comments that much of this storage is at facilities connected to industrial users and export terminals, and transportation of propane out of the region to the Midwest and Northeast is often costly. However, propane inventories in the Midwest and Northeast were 9% and 42% above the five-year average, respectively, as of Sept. 30. Higher stock levels and improved rail delivery networks for propane should contribute to more robust supply chains than three years ago, when the Midwest saw prices spike during extremely cold weather. Nonetheless, local markets could still see tight supply conditions, particularly in cases of severely cold temperatures. —John Needham