Wednesday, May 17, 2017

The U.S. shale revolution has driven a need for increased infrastructure in areas where there was neither extensive crude oil nor natural gas production previously, observes Ajey Chandra, vice president of the global energy consulting firm Muse, Stancil & Co. (Dallas). The Northeast, namely, was historically a region that imported natural gas from producing regions — the Gulf of Mexico, Texas, and Louisiana. But exponential increases in Marcellus and Utica natural gas and natural gas liquids production drove a need for large infrastructure projects.

And even with the downturn in crude oil prices since 2014, U.S. natural gas production has continued to increase. Forecasts call for output to rise above 30 Tcf in 2020 and reach 40 Tcf in 2035. At the same time, Marcellus gas production has proven to be extremely resilient and has not been significantly affected by the downturn in crude oil prices. Production has now grown to more than 18 MMcfd.

“In 2008, pipelines were focused on taking gas from the Texas/Louisiana producing region to the consumption centers in the Northeast U.S.,” says Chandra, speaking at the 2017 Argus Americas LPG Summit in Houston. “Pipeline capacity has now become focused on taking natural gas away from the Northeast and moving it in the reverse direction. LNG export capacity is being built on the Gulf Coast.” He adds that from the 1950s to 2016 gas could flow in only one direction — south to north. However, beginning this year most trunk lines will also flow in the opposite direction — north to south.

Natural gas takeaway capacity continues to grow, supporting production of both dry gas and NGLs. Chandra outlines that Energy Transfer Partners’ (Dallas) Rover Pipeline is scheduled to be in service this year, as is the Leach Xpress line, now a project of TransCanada Corp. (Calgary) since its acquisition of Columbia Pipeline Group in July 2016. Also scheduled to come online in 2017 is the Nexus Gas Transmission project, initially an initiative of DTE Energy (Detroit) and Spectra Energy (Houston), it now headed by Calgary-based Enbridge Inc., which acquired Spectra earlier this year. On tap for 2018 are Williams Cos.’ Atlantic Sunrise project, the PennEast Pipeline joint venture, and the Valley Mountain Pipeline, another joint venture. The Atlantic Coast Pipeline, yet one more joint venture initiative, is scheduled to be operational in 2019. However, activist opposition to new pipeline construction is growing and becoming more of an issue. As a result, Chandra observes, delays can be expected, adding that “NIMBY is alive and well.”

The Rover Pipeline will transport 3.25 Bcfd to markets in the Midwest, Northeast, East Coast, Gulf Coast, and Canada. The line will have direct deliveries in Ohio, West Virginia, Michigan, and into the Dawn Hub in Ontario, Canada. The $4.2-billion pipeline will gather gas from processing plants in West Virginia, eastern Ohio, and western Pennsylvania for delivery to the Midwest Hub near Defiance, Ohio, where about 68% of the gas will be delivered via interconnects with existing pipelines in Ohio and West Virginia for distribution to markets across the U.S. The remaining 32% will be delivered to markets in Michigan through a connection in Livingston County, Mich. with the existing Vector Pipeline.

The Leach Xpress project involves construction of about 160 miles of natural gas pipeline and compression facilities in southeastern Ohio and West Virginia’s northern panhandle. The $1.4-billion investment will transport 1.5 Bcfd of natural gas from the heart of the Appalachian supply basin to consumers served by the Columbia Gas and Columbia Gulf pipeline systems. The line will originate in Marshall County, W.Va. and travel through southwestern Pennsylvania and southeastern Ohio and end in Wayne County, W.Va.

The Nexus Gas Transmission project will construct about 255 miles of interstate pipeline to deliver 1.5 Bcfd to recipient points in eastern Ohio to existing pipeline system interconnects in southeastern Michigan. The developers have secured significant market interest in new natural gas supplies in Ohio, Michigan, Chicago, and Ontario to provide increased energy diversity, security, and reliability in those regions. The project will transport emerging Appalachian shale gas supplies directly to consumers in northern Ohio, southeastern Michigan, the Chicago Hub, and the Dawn Hub.

The Atlantic Sunrise project is designed to supply gas to meet the daily needs of more than seven million homes by connecting producing regions in northeastern Pennsylvania to markets in the Mid-Atlantic and southeastern states. The expansion will add 1.7 million dekatherms per day of pipeline capacity to Williams’ Transco system. The project will include compression and looping of the Transco Leidy Line in Pennsylvania along with the construction of a new pipeline segment, referred to as the Central Penn Line, which will connect to the northeastern Marcellus producing region and to the Transco mainline in southeastern Pennsylvania. Additional existing Transco facilities are being modified to allow gas to flow bi-directionally.

The PennEast Pipeline will bring natural gas to customers in Pennsylvania and New Jersey. The $1-billion investment will construct a 118-mile, primarily 26-in.-dia. pipeline designed to deliver about 1 Bcfd, enough to serve more than 4.7 million homes. PennEast will originate in Luzerne County in northeastern Pennsylvania and terminate at Transco’s pipeline interconnection near Pennington in Mercer County, N.J. The line will supply natural gas to local businesses and households, as well as to electric generation companies.

The project got a boost in March when a federal court judge dismissed as baseless a lawsuit brought by the environmental group Delaware Riverkeeper Network, which sought to derail PennEast by suing the Federal Energy Regulatory Commission (FERC). “The Delaware Riverkeeper Network is an organization that stops at nothing to spread misinformation, scare the public, and file ridiculous lawsuits, as validated by a federal court judge who dismissed the lawsuit that was filed last year,” said Pat Kornick, PennEast spokesman. “This is the latest example of opposition groups wasting time, tax dollars, and government resources with baseless claims and ridiculous lawsuits.” The lawsuit alleged that permit fees paid to FERC by applicants for energy infrastructure created an institutional bias.

Last year a separate lawsuit filed by opposition groups alleging trespassing also was dismissed by a New Jersey Superior Court judge after she found no evidence of their claims. In September, the Eastern Environmental Law Center, the New Jersey Conservation Foundation, and the Stony Brook-Millstone Watershed Association filed another frivolous complaint, requesting an “evidentiary hearing” of market need, which is duplicative and covered by FERC’s multiyear review. Even the New Jersey Sierra Club objected to their actions and said the “suit could easily be dismissed.”

“Despite scare tactics from opposition groups, the reality is that two government agencies under Democratic administrations have determined that the PennEast Pipeline can be constructed with minimal impact on the environment,” said Kornick. “PennEast looks forward to a favorable environmental ruling…and delivering lower electric and gas bills, creating thousands of American jobs and powering the region’s economy with clean-burning, American energy for decades to come.”

The project received its final environmental impact statement from FERC in early April. With mitigation measures in place, the agency gave the go-ahead, noting that based on its analysis, “we conclude that the project would not significantly impact groundwater, surface water, or wetland quality or quantity during construction or operation….”

The Mountain Valley Pipeline project, as proposed, would run about 300 miles from northwestern West Virginia to southern Virginia. The joint venture initiative would be constructed and owned by Mountain Valley Pipeline LLC. EQT Midstream Partners, which owns a significant stake in the joint venture, will operate the line. Sourcing natural gas from Marcellus and Utica production, the pipeline is expected to provide up to two million dekatherms per day of firm transmission capacity to markets in the mid-Atlantic and south-Atlantic regions.

Mountain Valley will extend the Equitrans transmission system in Wetzel County, W.Va. to Transcontinental Gas Pipeline Co.’s Zone 5 compressor station 165 in Pittsylvania County, Va. As currently planned, the pipeline will be up to 42 inches in diameter. The project will require three compressor stations, with locations identified in Wetzel, Braxton, and Fayette counties in West Virginia.

The Atlantic Coast Pipeline would serve multiple public utilities and their growing energy needs in Virginia and North Carolina. Atlantic, a company formed by four major reginal energy companies, Dominion, Duke Energy, Piedmont Natural Gas, and South Company Gas, would develop, construct, and operate the pipeline. The route through West Virginia will begin in Harrison County and travel southeast about 100 miles through five counties before crossing into Virginia. The route through Virginia will begin in Highland County and move southeast, including lateral lines to Brunswick County, Greensville County, and Hampton Roads. The line will travel about 300 miles through 14 counties and then cross into North Carolina.

The route through North Carolina will begin in Northampton County and move southwest about 200 miles through eight counties before ending in Robeson County in the southern end of the state. Construction is expected to create thousands of jobs and significant new, long-term revenue for state and local governments throughout West Virginia, Virginia, and North Carolina.

NGLs

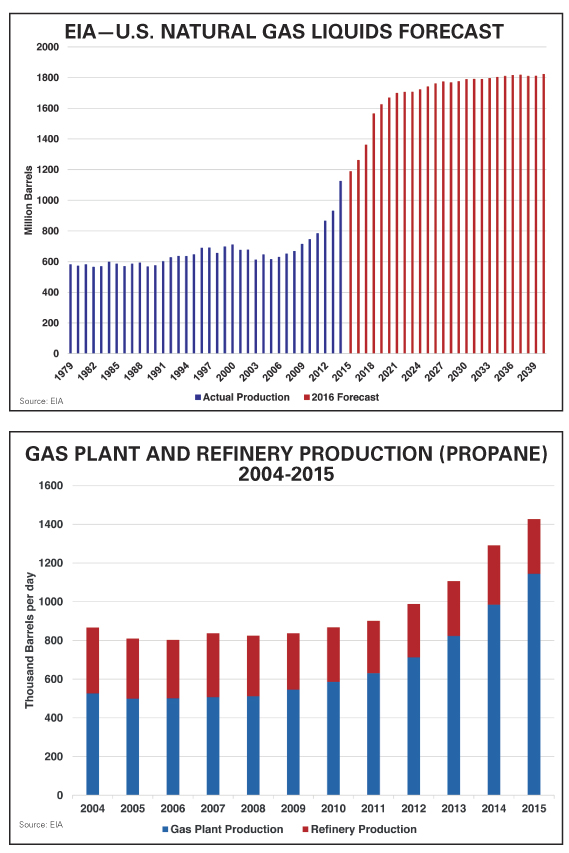

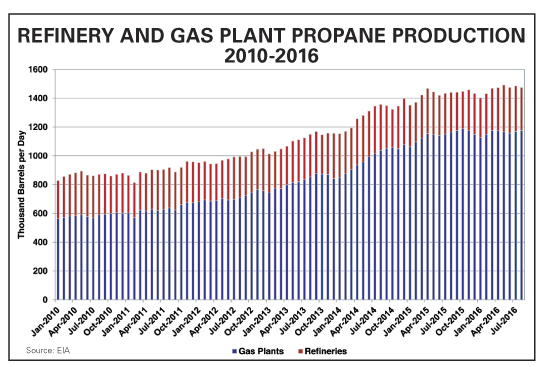

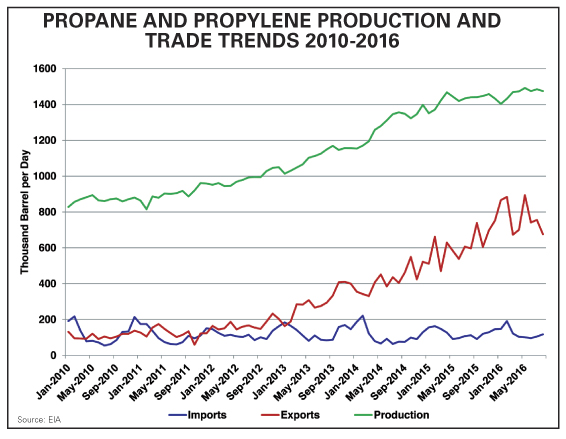

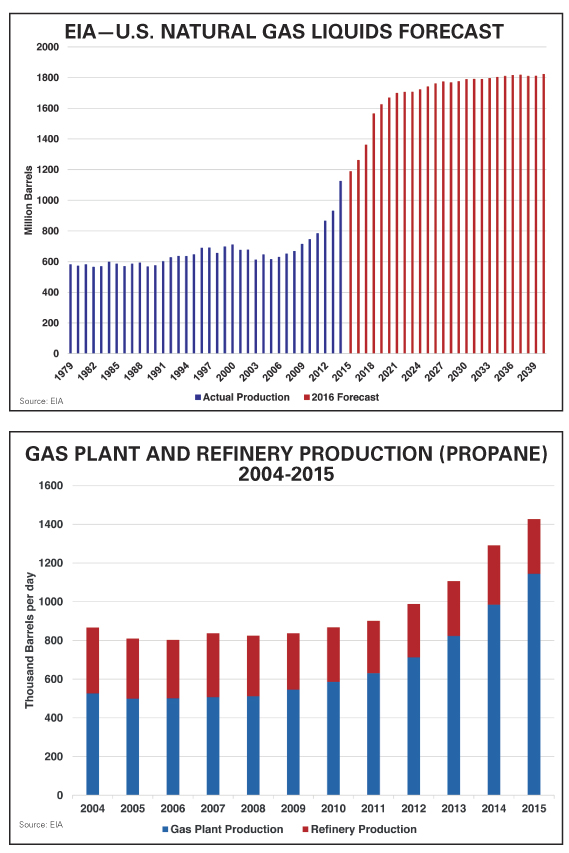

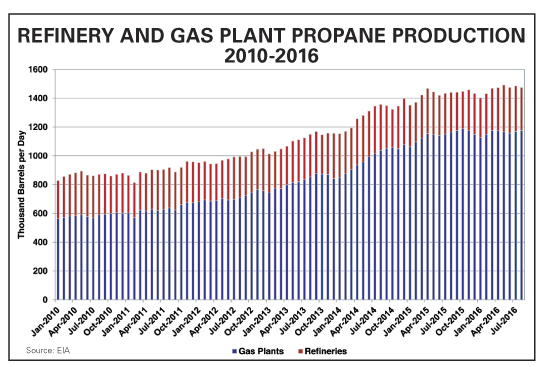

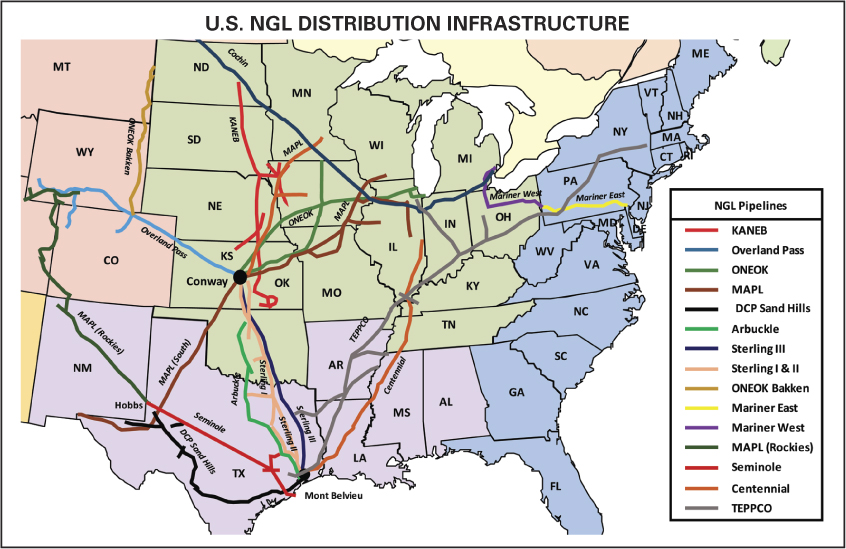

Chandra emphasized that increases in natural gas production, and the resulting infrastructure buildout, have in turn driven a steep rise in NGL production. In other words, more natural gas equals additional natural gas liquids. “U.S. propane production has increased, most notably from gas processing plants,” he said. “Refinery production has increased slightly as lighter shale crude is processed.” Meanwhile, domestic propane production continues to grow, and even the price downturn has not forced propane output to drop. “Decreased drilling has slowed the overall production increases, but recent support of crude oil prices will likely result in some additional drilling and production.” At the same time, U.S. butane production has also risen.

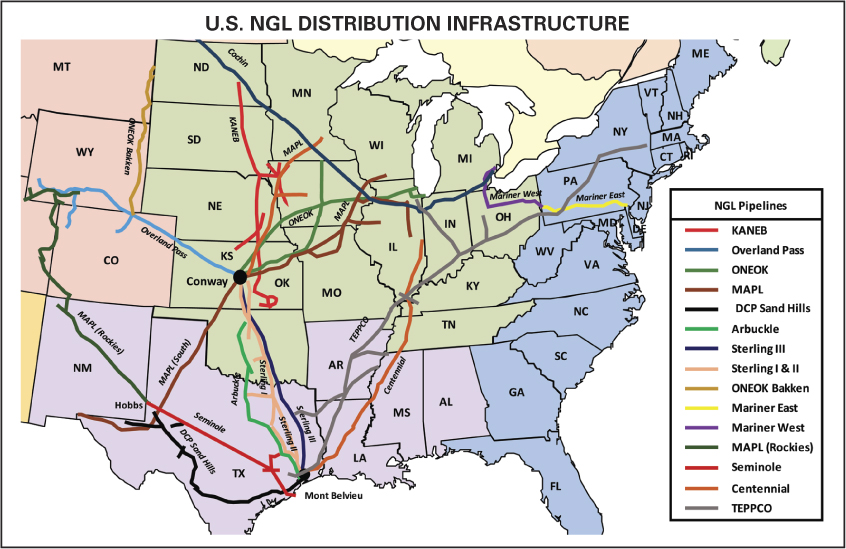

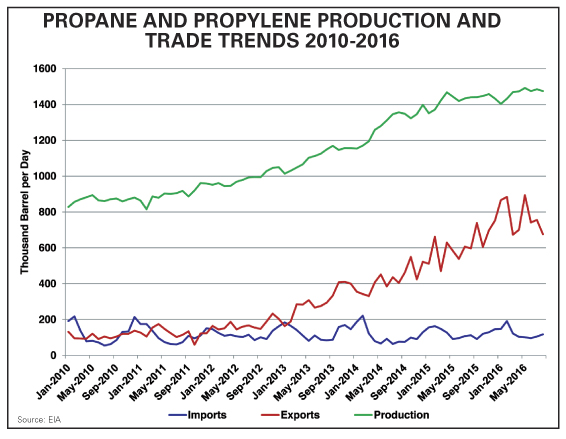

To support booming energy production in the U.S. Northeast, processing infrastructure has grown rapidly. “In 2016, total processing capacity in the region was over 11 Bcfd,” the Muse Stancil & Co. vice president says. “NGL pipeline takeaway capacity was needed to match growing processing capacity.” And overall NGL distribution infrastructure continues to expand. Chandra outlines that the Mariner West pipeline was built to move ethane from the Marcellus to Sarnia for petrochemical consumption, while Mariner East was built to move ethane and propane to the East Coast for export to Europe.

Hand in hand with ramped up NGL production, U.S. exports from the Northeast are growing substantially as U.S. producers seek new markets in order to clear the output overhang. Simultaneously, expansion of the Mariner NGL pipeline system proceeds apace, ethane exports have commenced from the East Coast, and propane exports from the region will continue to grow over time since it is more economical than transporting product to the U.S. Gulf Coast.

Chandra recounts that the first ethane shipment from Marcus Hook, Pa. was in the first quarter of 2016, and that Sunoco Logistics’ Marcus Hook Industrial Complex includes terminalling and storage assets, with a capacity of about 3 MMbbl of NGL storage capacity. The facility can receive waterborne NGLs, as well as product by pipeline, truck, and rail, and can deliver via marine vessel, pipeline, and truck. In addition to providing NGL storage and terminalling services to both affiliates and third-party customers, the Marcus Hook Industrial Complex serves as an offtake outlet for Sunoco Logistics’ Mariner East 1 system. In addition, Mariner East 2 is expected to start up this year, opening the door to the potential to transport 675,000 bbld through Mariner East 1 and 2. More expansions to the systems are expected.

Another transportation project, Enterprise Products’ ATEX Express pipeline, began service in 2014 to transport ethane from the Marcellus/Utica to Mont Belvieu. Another takeaway initiative is Kinder Morgan’s Utopia Pipeline, planned to take ethane and propane to Sarnia for the petrochemical industry there. Finally, the Bluegrass Pipeline, proposed to take NGLs to the U.S. Gulf Coast, not only faces strong headwinds but may be dead. Kentucky opponents won court victories following their pushback. Project developers Williams and Boardwalk Pipeline Partners lost court battles against landowners opposed to eminent domain. The project also faces sustained and vocal protests from environmental activists and student groups inside and outside the state. Even nuns and priests weighed in against the project.

Nonetheless, and despite vociferous opposition nationwide to energy development of any kind, Chandra concludes that U.S. production of NGLs is expected to grow, even in a low-price environment. “Gas processing capacity in the Northeast has grown to be able to handle gas production, and NGL exports from the East Coast have helped balance the need to transport ethane and propane.” Finally, NGL transport capacity still needs to grow further over the next several years. —John Needham

And even with the downturn in crude oil prices since 2014, U.S. natural gas production has continued to increase. Forecasts call for output to rise above 30 Tcf in 2020 and reach 40 Tcf in 2035. At the same time, Marcellus gas production has proven to be extremely resilient and has not been significantly affected by the downturn in crude oil prices. Production has now grown to more than 18 MMcfd.

“In 2008, pipelines were focused on taking gas from the Texas/Louisiana producing region to the consumption centers in the Northeast U.S.,” says Chandra, speaking at the 2017 Argus Americas LPG Summit in Houston. “Pipeline capacity has now become focused on taking natural gas away from the Northeast and moving it in the reverse direction. LNG export capacity is being built on the Gulf Coast.” He adds that from the 1950s to 2016 gas could flow in only one direction — south to north. However, beginning this year most trunk lines will also flow in the opposite direction — north to south.

Natural gas takeaway capacity continues to grow, supporting production of both dry gas and NGLs. Chandra outlines that Energy Transfer Partners’ (Dallas) Rover Pipeline is scheduled to be in service this year, as is the Leach Xpress line, now a project of TransCanada Corp. (Calgary) since its acquisition of Columbia Pipeline Group in July 2016. Also scheduled to come online in 2017 is the Nexus Gas Transmission project, initially an initiative of DTE Energy (Detroit) and Spectra Energy (Houston), it now headed by Calgary-based Enbridge Inc., which acquired Spectra earlier this year. On tap for 2018 are Williams Cos.’ Atlantic Sunrise project, the PennEast Pipeline joint venture, and the Valley Mountain Pipeline, another joint venture. The Atlantic Coast Pipeline, yet one more joint venture initiative, is scheduled to be operational in 2019. However, activist opposition to new pipeline construction is growing and becoming more of an issue. As a result, Chandra observes, delays can be expected, adding that “NIMBY is alive and well.”

The Rover Pipeline will transport 3.25 Bcfd to markets in the Midwest, Northeast, East Coast, Gulf Coast, and Canada. The line will have direct deliveries in Ohio, West Virginia, Michigan, and into the Dawn Hub in Ontario, Canada. The $4.2-billion pipeline will gather gas from processing plants in West Virginia, eastern Ohio, and western Pennsylvania for delivery to the Midwest Hub near Defiance, Ohio, where about 68% of the gas will be delivered via interconnects with existing pipelines in Ohio and West Virginia for distribution to markets across the U.S. The remaining 32% will be delivered to markets in Michigan through a connection in Livingston County, Mich. with the existing Vector Pipeline.

The Leach Xpress project involves construction of about 160 miles of natural gas pipeline and compression facilities in southeastern Ohio and West Virginia’s northern panhandle. The $1.4-billion investment will transport 1.5 Bcfd of natural gas from the heart of the Appalachian supply basin to consumers served by the Columbia Gas and Columbia Gulf pipeline systems. The line will originate in Marshall County, W.Va. and travel through southwestern Pennsylvania and southeastern Ohio and end in Wayne County, W.Va.

The Nexus Gas Transmission project will construct about 255 miles of interstate pipeline to deliver 1.5 Bcfd to recipient points in eastern Ohio to existing pipeline system interconnects in southeastern Michigan. The developers have secured significant market interest in new natural gas supplies in Ohio, Michigan, Chicago, and Ontario to provide increased energy diversity, security, and reliability in those regions. The project will transport emerging Appalachian shale gas supplies directly to consumers in northern Ohio, southeastern Michigan, the Chicago Hub, and the Dawn Hub.

The Atlantic Sunrise project is designed to supply gas to meet the daily needs of more than seven million homes by connecting producing regions in northeastern Pennsylvania to markets in the Mid-Atlantic and southeastern states. The expansion will add 1.7 million dekatherms per day of pipeline capacity to Williams’ Transco system. The project will include compression and looping of the Transco Leidy Line in Pennsylvania along with the construction of a new pipeline segment, referred to as the Central Penn Line, which will connect to the northeastern Marcellus producing region and to the Transco mainline in southeastern Pennsylvania. Additional existing Transco facilities are being modified to allow gas to flow bi-directionally.

The PennEast Pipeline will bring natural gas to customers in Pennsylvania and New Jersey. The $1-billion investment will construct a 118-mile, primarily 26-in.-dia. pipeline designed to deliver about 1 Bcfd, enough to serve more than 4.7 million homes. PennEast will originate in Luzerne County in northeastern Pennsylvania and terminate at Transco’s pipeline interconnection near Pennington in Mercer County, N.J. The line will supply natural gas to local businesses and households, as well as to electric generation companies.

The project got a boost in March when a federal court judge dismissed as baseless a lawsuit brought by the environmental group Delaware Riverkeeper Network, which sought to derail PennEast by suing the Federal Energy Regulatory Commission (FERC). “The Delaware Riverkeeper Network is an organization that stops at nothing to spread misinformation, scare the public, and file ridiculous lawsuits, as validated by a federal court judge who dismissed the lawsuit that was filed last year,” said Pat Kornick, PennEast spokesman. “This is the latest example of opposition groups wasting time, tax dollars, and government resources with baseless claims and ridiculous lawsuits.” The lawsuit alleged that permit fees paid to FERC by applicants for energy infrastructure created an institutional bias.

Last year a separate lawsuit filed by opposition groups alleging trespassing also was dismissed by a New Jersey Superior Court judge after she found no evidence of their claims. In September, the Eastern Environmental Law Center, the New Jersey Conservation Foundation, and the Stony Brook-Millstone Watershed Association filed another frivolous complaint, requesting an “evidentiary hearing” of market need, which is duplicative and covered by FERC’s multiyear review. Even the New Jersey Sierra Club objected to their actions and said the “suit could easily be dismissed.”

“Despite scare tactics from opposition groups, the reality is that two government agencies under Democratic administrations have determined that the PennEast Pipeline can be constructed with minimal impact on the environment,” said Kornick. “PennEast looks forward to a favorable environmental ruling…and delivering lower electric and gas bills, creating thousands of American jobs and powering the region’s economy with clean-burning, American energy for decades to come.”

The project received its final environmental impact statement from FERC in early April. With mitigation measures in place, the agency gave the go-ahead, noting that based on its analysis, “we conclude that the project would not significantly impact groundwater, surface water, or wetland quality or quantity during construction or operation….”

The Mountain Valley Pipeline project, as proposed, would run about 300 miles from northwestern West Virginia to southern Virginia. The joint venture initiative would be constructed and owned by Mountain Valley Pipeline LLC. EQT Midstream Partners, which owns a significant stake in the joint venture, will operate the line. Sourcing natural gas from Marcellus and Utica production, the pipeline is expected to provide up to two million dekatherms per day of firm transmission capacity to markets in the mid-Atlantic and south-Atlantic regions.

Mountain Valley will extend the Equitrans transmission system in Wetzel County, W.Va. to Transcontinental Gas Pipeline Co.’s Zone 5 compressor station 165 in Pittsylvania County, Va. As currently planned, the pipeline will be up to 42 inches in diameter. The project will require three compressor stations, with locations identified in Wetzel, Braxton, and Fayette counties in West Virginia.

The Atlantic Coast Pipeline would serve multiple public utilities and their growing energy needs in Virginia and North Carolina. Atlantic, a company formed by four major reginal energy companies, Dominion, Duke Energy, Piedmont Natural Gas, and South Company Gas, would develop, construct, and operate the pipeline. The route through West Virginia will begin in Harrison County and travel southeast about 100 miles through five counties before crossing into Virginia. The route through Virginia will begin in Highland County and move southeast, including lateral lines to Brunswick County, Greensville County, and Hampton Roads. The line will travel about 300 miles through 14 counties and then cross into North Carolina.

The route through North Carolina will begin in Northampton County and move southwest about 200 miles through eight counties before ending in Robeson County in the southern end of the state. Construction is expected to create thousands of jobs and significant new, long-term revenue for state and local governments throughout West Virginia, Virginia, and North Carolina.

NGLs

Chandra emphasized that increases in natural gas production, and the resulting infrastructure buildout, have in turn driven a steep rise in NGL production. In other words, more natural gas equals additional natural gas liquids. “U.S. propane production has increased, most notably from gas processing plants,” he said. “Refinery production has increased slightly as lighter shale crude is processed.” Meanwhile, domestic propane production continues to grow, and even the price downturn has not forced propane output to drop. “Decreased drilling has slowed the overall production increases, but recent support of crude oil prices will likely result in some additional drilling and production.” At the same time, U.S. butane production has also risen.

To support booming energy production in the U.S. Northeast, processing infrastructure has grown rapidly. “In 2016, total processing capacity in the region was over 11 Bcfd,” the Muse Stancil & Co. vice president says. “NGL pipeline takeaway capacity was needed to match growing processing capacity.” And overall NGL distribution infrastructure continues to expand. Chandra outlines that the Mariner West pipeline was built to move ethane from the Marcellus to Sarnia for petrochemical consumption, while Mariner East was built to move ethane and propane to the East Coast for export to Europe.

Hand in hand with ramped up NGL production, U.S. exports from the Northeast are growing substantially as U.S. producers seek new markets in order to clear the output overhang. Simultaneously, expansion of the Mariner NGL pipeline system proceeds apace, ethane exports have commenced from the East Coast, and propane exports from the region will continue to grow over time since it is more economical than transporting product to the U.S. Gulf Coast.

Chandra recounts that the first ethane shipment from Marcus Hook, Pa. was in the first quarter of 2016, and that Sunoco Logistics’ Marcus Hook Industrial Complex includes terminalling and storage assets, with a capacity of about 3 MMbbl of NGL storage capacity. The facility can receive waterborne NGLs, as well as product by pipeline, truck, and rail, and can deliver via marine vessel, pipeline, and truck. In addition to providing NGL storage and terminalling services to both affiliates and third-party customers, the Marcus Hook Industrial Complex serves as an offtake outlet for Sunoco Logistics’ Mariner East 1 system. In addition, Mariner East 2 is expected to start up this year, opening the door to the potential to transport 675,000 bbld through Mariner East 1 and 2. More expansions to the systems are expected.

Another transportation project, Enterprise Products’ ATEX Express pipeline, began service in 2014 to transport ethane from the Marcellus/Utica to Mont Belvieu. Another takeaway initiative is Kinder Morgan’s Utopia Pipeline, planned to take ethane and propane to Sarnia for the petrochemical industry there. Finally, the Bluegrass Pipeline, proposed to take NGLs to the U.S. Gulf Coast, not only faces strong headwinds but may be dead. Kentucky opponents won court victories following their pushback. Project developers Williams and Boardwalk Pipeline Partners lost court battles against landowners opposed to eminent domain. The project also faces sustained and vocal protests from environmental activists and student groups inside and outside the state. Even nuns and priests weighed in against the project.

Nonetheless, and despite vociferous opposition nationwide to energy development of any kind, Chandra concludes that U.S. production of NGLs is expected to grow, even in a low-price environment. “Gas processing capacity in the Northeast has grown to be able to handle gas production, and NGL exports from the East Coast have helped balance the need to transport ethane and propane.” Finally, NGL transport capacity still needs to grow further over the next several years. —John Needham