Wednesday, February 15, 2017

By early December 2016, primary U.S. propane stocks were just sliding below the 100-MMbbl mark. Mid-December, when the Energy Information Administration (EIA) released data for the week ended Dec. 9, the inventory level was at 95.6 MMbbl. In mid-January, after several weeks of sizable declines, EIA reported a 7.4-MMbbl draw that took inventory down to 72.2 MMbbl for the week ended Jan. 13. By the week ended Jan. 20, with another 4-MMbbl draw, the market stood at 68.2 MMbbl, a full 15.5 MMbbl below the same time last year. Several weeks of cold temperatures across much of the U.S.— combined with export levels around a million barrels per week — had taken their toll.

While propane inventories were moving lower, traders were expecting world crude oil inventories to start moving lower as well as OPEC members had agreed to lower output to around 32.5 MMbbld beginning in January 2017. The Nov. 30 decision by OPEC members to make cuts was greeted with skepticism by traders from the beginning since OPEC members have cheated on such agreements in the past. However, at least for now it appears OPEC, as well as the non-OPEC members that also agreed to cuts, are serious. The agreement is holding.

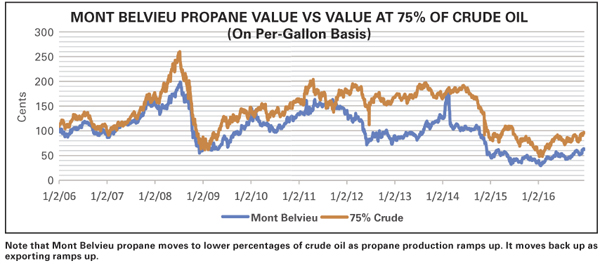

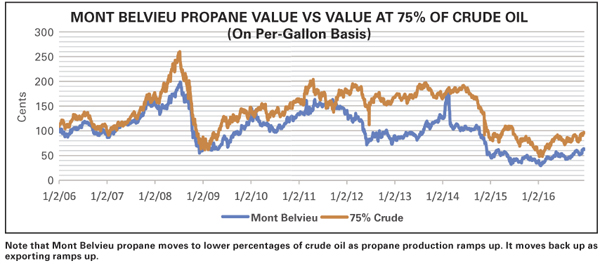

With factors driving both propane and crude oil into a more balanced world supply and demand situation, it is likely prices for both will steadily move higher. As of late January, it was apparent that propane was poised to move up at a stronger pace than crude oil. For many years before the shale revolution came about, propane usually traded in the 75% of crude area. The crude oil price per barrel divided by 42 puts crude into a per-gallon calculation, and the propane price is a percentage of this value. For quite a while over the past few years, propane moved to a much lower percentage of crude as more and more propane was produced and flooded the U.S. Export capacity until only recently was only at 4 MMbbl a month. As the production levels soared and more export capacity was being built, propane moved to a much lower percentage to crude oil, as low as the 35% to crude area for most of the past several years. The brief exception was during the supply shortage in January and February of 2014 when propane’s price and percentage to crude soared. Now, as capacity to export exceeds 30 MMbbl a month and exports have been flowing at approximately 1 MMbbld, we have seen propane’s value to crude steadily rise back to just above the 60% mark following several weeks of strong domestic demand as well.

In 2016, we saw propane surpass motor gasoline to become the second-largest U.S. petroleum product export, after distillate. The U.S. has doubled its exports since 2013 and now meets 31% of world demand. In addition to more investment in export terminals, with Phillips 66’s 150,000-bbld Freeport, Texas facility just the latest to come online, several other factors have come into play to expand waterborne shipping. The widening of the Panana Canal in June 2016 dramatically cut routes from the U.S. Gulf Coast for VLGC’s (very large gas carriers). They can now pass through the canal en route to high demand countries in East Asia. This also ended the need for transfers from smaller ships to larger ships after propane was moved through the Panama Canal, and it helped bring about a boom in VLGC production. As a result, freight rates dropped as more ships began competing for cargos. Further, newer ships were 17% more fuel efficient.

Propane demand remains strong for petrochemical plants in Asia, but there has been a strong movement toward propane in many Asian countries as they seek a cleaner fuel for cooking. Nations such as Indonesia, India, and others are subsidizing a switch from other fuel sources that produce unhealthy smoke and fumes. This is adding to propane demand from Asia, which continues to set new records for propane demand from the U.S. South Korea doubled its imports of U.S. propane in 2016. With steam cracker capacity increasing over the next couple of years in many regions, export capacity continuing to increase, and more interest in propane as an alternative to unhealthy fuels for cooking, it is expected that demand for U.S. propane will continue to increase. Keep in mind that while the U.S. experienced a boom in exports over the past few months and back in the first quarter of 2016, exports were only running at 50% of capacity during mid-2016 when the international market demand was not as strong and arbitrage opportunities narrowed or closed.

And the stronger demand for propane comes at a time when ethane is also highly sought. That hydrocarbon picked up some of the domestic feedstock demand slack at U.S. petrochemical plants in recent years. As ethane too gets more export capacity online, it may not offset U.S. propane petrochemical usage as much. Add to the mix slowing natural gas production in the U.S. and it is fair to say less natural gas means less propane and ethane. For the first time in 10 years there was a decline in natural gas production in 2016. It can certainly pick up as drilling increases once again, with 2017 forecast to usher in elevated demand and therefore the likelihood of higher prices.

Looking forward, as January wrapped up, weather forecasts were calling for colder temperatures in February across the U.S. It is likely far enough along in the season to avoid a supply emergency, but nonetheless the U.S. will probably see a more rapid depletion of winter propane volumes, perhaps to as low as 45 MMbbl by the end of the demand season. For the most part, world demand for propane is likely to continue to boost U.S. prices as U.S. players will have to bid higher against world offers for shipments. We will likely see propane’s percentage to crude move up at a time when crude oil is also finding more support.

For crude oil, leadership by Saudi Arabia has historically been key to OPEC agreements to cut production, and the November output curtailment agreement was another example where Saudi leadership was important. OPEC members were also able to convince several non-OPEC members to curb production as well. It was clear to all that world crude oil output was continuing to outpace demand and action had to be taken if prices were going to be pushed higher.

As a group, OPEC had only earned $341 billion from oil exports in 2016 when it prepared for the Nov. 30 meeting. This figure was way down from $753 billion in 2014 and a record $920 billion in 2012. Saudi Arabia, which had been working hard to boost market share after several failed OPEC negotiations in recent years, was now ready to take the biggest hit by lowering its output by 486,000 bbld to 10.058 MMbbld. Iraq, the second largest OPEC producer, agreed to a 210,000 bbld cut after earlier seeking an exemption due to its ongoing war with Islamic State. Even Russia, a non-OPEC member, agreed to cut output by 300,000 bbld after previously stating it was only willing to freeze production at its current level of 11.2 MMbbld.

With OPEC and non-OPEC members so willing to make cuts, traders became more convinced they were more serious than originally thought about trimming production. The skepticism continues to an extent, but OPEC has emphasized a stringent process is in place, complete with an oversight committee to make sure all members committed to cutting production are truly going to do so. A Jan. 21-22 weekend meeting of OPEC and non-OPEC members further stressed that all were adhering to their agreed-to cuts. At the meeting, producers stated that of the 1.8 MMbbld they agreed to remove from the market, 1.5 MMbbld had already been held back. A key purpose of this meeting was to draw as much attention as possible to the cooperation of the OPEC and non-OPEC countries, and to push traders to move prices higher.

As January progressed, traders began to become more convinced that OPEC and non-OPEC members were adhering to the cuts, but were less convinced that the cuts alone would bring supply and demand back into balance. Traders became focused on output from Libya, which was not required to make any cuts, as well as output from the U.S., where more and more production was coming online and rig counts stood at a 14-month high. U.S. oil production has risen more than 6% since mid-2016, although it remains 7% below its 2015 peak. Goldman Sachs estimated an additional 265,000 bbld of output from the U.S. could be expected throughout 2017.

But there are signs of progress in the balancing of world crude oil supply and demand. Bernstein Energy said global inventories declined by 24 MMbbl to 5.7 Bbbl in the fourth quarter of 2016 compared to the previous quarter. Bernstein noted this is the biggest quarterly decline since the fourth quarter of 2013, confirming that inventory builds are now reversing as the market shifts from oversupply to undersupply. Concerns about additional output from the U.S. and Libya, as well as the continually strengthening U.S. dollar, helped to keep crude oil in the low-$50/bbl area through January despite OPEC and non-OPEC cuts appearing to be taking hold and world supply dropping. But, as crude stayed steady and even backtracked some, propane continued to move up and trade at a higher percentage to crude oil.

Going forward, the combination of tightening world supply for both crude oil and propane will likely mean higher prices for both. Converting $60/bbl crude to its gallon equivalent equals $1.42 per gallon. A slight move up for propane to 65% of crude’s value would put propane at 92 cents/gal. If crude were to rise to $65/bbl, $1.55 per gallon, and holding at 65%, propane would be at 100.01 cents/gal. And at a 70% valuation to crude, propane would be at 100.09 cents/gal. Keeping in mind that propane was for years considered to be in balance at 75% of crude oil, we could be in for significantly higher prices if this returns as a norm. World demand is the key to this, and as we saw in 2016 world demand can fluctuate dramatically. A big difference is we are now positioned to meet world demand when it materializes, and that leaves domestic buyers bidding against the rest of the world when demand is strong.

For the retail propane marketer, as always, the decision is when to buy and how much. Given the potential for both crude oil and propane volumes to come back into a supply/demand balance, and now that there is firsthand experience regarding the rapid rate at which propane exports can ramp up, it does make sense to cover positions for next season as well as the year after. This is despite the fact prices have already moved up quite a bit. Remember, export capacity is at a record high and exports only went at 50% of that capacity for a big part of 2016. Large commercial users especially should welcome current prices as an opportunity to keep their cost of goods much lower than they were in previous years when propane and crude prices were much higher. Covering at least a portion makes sense with the strong possibility for a return to higher prices. — Pat Thornton

While propane inventories were moving lower, traders were expecting world crude oil inventories to start moving lower as well as OPEC members had agreed to lower output to around 32.5 MMbbld beginning in January 2017. The Nov. 30 decision by OPEC members to make cuts was greeted with skepticism by traders from the beginning since OPEC members have cheated on such agreements in the past. However, at least for now it appears OPEC, as well as the non-OPEC members that also agreed to cuts, are serious. The agreement is holding.

With factors driving both propane and crude oil into a more balanced world supply and demand situation, it is likely prices for both will steadily move higher. As of late January, it was apparent that propane was poised to move up at a stronger pace than crude oil. For many years before the shale revolution came about, propane usually traded in the 75% of crude area. The crude oil price per barrel divided by 42 puts crude into a per-gallon calculation, and the propane price is a percentage of this value. For quite a while over the past few years, propane moved to a much lower percentage of crude as more and more propane was produced and flooded the U.S. Export capacity until only recently was only at 4 MMbbl a month. As the production levels soared and more export capacity was being built, propane moved to a much lower percentage to crude oil, as low as the 35% to crude area for most of the past several years. The brief exception was during the supply shortage in January and February of 2014 when propane’s price and percentage to crude soared. Now, as capacity to export exceeds 30 MMbbl a month and exports have been flowing at approximately 1 MMbbld, we have seen propane’s value to crude steadily rise back to just above the 60% mark following several weeks of strong domestic demand as well.

In 2016, we saw propane surpass motor gasoline to become the second-largest U.S. petroleum product export, after distillate. The U.S. has doubled its exports since 2013 and now meets 31% of world demand. In addition to more investment in export terminals, with Phillips 66’s 150,000-bbld Freeport, Texas facility just the latest to come online, several other factors have come into play to expand waterborne shipping. The widening of the Panana Canal in June 2016 dramatically cut routes from the U.S. Gulf Coast for VLGC’s (very large gas carriers). They can now pass through the canal en route to high demand countries in East Asia. This also ended the need for transfers from smaller ships to larger ships after propane was moved through the Panama Canal, and it helped bring about a boom in VLGC production. As a result, freight rates dropped as more ships began competing for cargos. Further, newer ships were 17% more fuel efficient.

Propane demand remains strong for petrochemical plants in Asia, but there has been a strong movement toward propane in many Asian countries as they seek a cleaner fuel for cooking. Nations such as Indonesia, India, and others are subsidizing a switch from other fuel sources that produce unhealthy smoke and fumes. This is adding to propane demand from Asia, which continues to set new records for propane demand from the U.S. South Korea doubled its imports of U.S. propane in 2016. With steam cracker capacity increasing over the next couple of years in many regions, export capacity continuing to increase, and more interest in propane as an alternative to unhealthy fuels for cooking, it is expected that demand for U.S. propane will continue to increase. Keep in mind that while the U.S. experienced a boom in exports over the past few months and back in the first quarter of 2016, exports were only running at 50% of capacity during mid-2016 when the international market demand was not as strong and arbitrage opportunities narrowed or closed.

And the stronger demand for propane comes at a time when ethane is also highly sought. That hydrocarbon picked up some of the domestic feedstock demand slack at U.S. petrochemical plants in recent years. As ethane too gets more export capacity online, it may not offset U.S. propane petrochemical usage as much. Add to the mix slowing natural gas production in the U.S. and it is fair to say less natural gas means less propane and ethane. For the first time in 10 years there was a decline in natural gas production in 2016. It can certainly pick up as drilling increases once again, with 2017 forecast to usher in elevated demand and therefore the likelihood of higher prices.

Looking forward, as January wrapped up, weather forecasts were calling for colder temperatures in February across the U.S. It is likely far enough along in the season to avoid a supply emergency, but nonetheless the U.S. will probably see a more rapid depletion of winter propane volumes, perhaps to as low as 45 MMbbl by the end of the demand season. For the most part, world demand for propane is likely to continue to boost U.S. prices as U.S. players will have to bid higher against world offers for shipments. We will likely see propane’s percentage to crude move up at a time when crude oil is also finding more support.

For crude oil, leadership by Saudi Arabia has historically been key to OPEC agreements to cut production, and the November output curtailment agreement was another example where Saudi leadership was important. OPEC members were also able to convince several non-OPEC members to curb production as well. It was clear to all that world crude oil output was continuing to outpace demand and action had to be taken if prices were going to be pushed higher.

As a group, OPEC had only earned $341 billion from oil exports in 2016 when it prepared for the Nov. 30 meeting. This figure was way down from $753 billion in 2014 and a record $920 billion in 2012. Saudi Arabia, which had been working hard to boost market share after several failed OPEC negotiations in recent years, was now ready to take the biggest hit by lowering its output by 486,000 bbld to 10.058 MMbbld. Iraq, the second largest OPEC producer, agreed to a 210,000 bbld cut after earlier seeking an exemption due to its ongoing war with Islamic State. Even Russia, a non-OPEC member, agreed to cut output by 300,000 bbld after previously stating it was only willing to freeze production at its current level of 11.2 MMbbld.

With OPEC and non-OPEC members so willing to make cuts, traders became more convinced they were more serious than originally thought about trimming production. The skepticism continues to an extent, but OPEC has emphasized a stringent process is in place, complete with an oversight committee to make sure all members committed to cutting production are truly going to do so. A Jan. 21-22 weekend meeting of OPEC and non-OPEC members further stressed that all were adhering to their agreed-to cuts. At the meeting, producers stated that of the 1.8 MMbbld they agreed to remove from the market, 1.5 MMbbld had already been held back. A key purpose of this meeting was to draw as much attention as possible to the cooperation of the OPEC and non-OPEC countries, and to push traders to move prices higher.

As January progressed, traders began to become more convinced that OPEC and non-OPEC members were adhering to the cuts, but were less convinced that the cuts alone would bring supply and demand back into balance. Traders became focused on output from Libya, which was not required to make any cuts, as well as output from the U.S., where more and more production was coming online and rig counts stood at a 14-month high. U.S. oil production has risen more than 6% since mid-2016, although it remains 7% below its 2015 peak. Goldman Sachs estimated an additional 265,000 bbld of output from the U.S. could be expected throughout 2017.

But there are signs of progress in the balancing of world crude oil supply and demand. Bernstein Energy said global inventories declined by 24 MMbbl to 5.7 Bbbl in the fourth quarter of 2016 compared to the previous quarter. Bernstein noted this is the biggest quarterly decline since the fourth quarter of 2013, confirming that inventory builds are now reversing as the market shifts from oversupply to undersupply. Concerns about additional output from the U.S. and Libya, as well as the continually strengthening U.S. dollar, helped to keep crude oil in the low-$50/bbl area through January despite OPEC and non-OPEC cuts appearing to be taking hold and world supply dropping. But, as crude stayed steady and even backtracked some, propane continued to move up and trade at a higher percentage to crude oil.

Going forward, the combination of tightening world supply for both crude oil and propane will likely mean higher prices for both. Converting $60/bbl crude to its gallon equivalent equals $1.42 per gallon. A slight move up for propane to 65% of crude’s value would put propane at 92 cents/gal. If crude were to rise to $65/bbl, $1.55 per gallon, and holding at 65%, propane would be at 100.01 cents/gal. And at a 70% valuation to crude, propane would be at 100.09 cents/gal. Keeping in mind that propane was for years considered to be in balance at 75% of crude oil, we could be in for significantly higher prices if this returns as a norm. World demand is the key to this, and as we saw in 2016 world demand can fluctuate dramatically. A big difference is we are now positioned to meet world demand when it materializes, and that leaves domestic buyers bidding against the rest of the world when demand is strong.

For the retail propane marketer, as always, the decision is when to buy and how much. Given the potential for both crude oil and propane volumes to come back into a supply/demand balance, and now that there is firsthand experience regarding the rapid rate at which propane exports can ramp up, it does make sense to cover positions for next season as well as the year after. This is despite the fact prices have already moved up quite a bit. Remember, export capacity is at a record high and exports only went at 50% of that capacity for a big part of 2016. Large commercial users especially should welcome current prices as an opportunity to keep their cost of goods much lower than they were in previous years when propane and crude prices were much higher. Covering at least a portion makes sense with the strong possibility for a return to higher prices. — Pat Thornton