Tuesday, May 16, 2017

By mid-April 2017, many retail propane marketers were scratching their heads about why prices were steadily increasing. After all, a mild winter had wrapped up weeks earlier, crude oil had backed off during March 2017 when U.S. oil production continued to exceed expectations, and propane pulled back with it. As always, many waited and waited for further downside only to see prices take a turn back to the upside.

The major players who put record-level investment dollars into crude oil after the OPEC cuts were agreed to in late November were not budging much as prices declined in March. The basic belief among major investors such as Goldman Sachs, Bank of America, Morgan Stanley, and Citibank was that the OPEC cuts were real. Asian demand is, and will continue to be, strong, and the market is ultimately tightening. Large builds of crude oil during March, including an 8.2-MMbbl build during a gathering of world oil representatives for CERA Week in Houston, did cause some short positions to enter the market. Despite all the talk of compliance to the OPEC cuts in Houston, crude oil moved below $50/bbl that week. Many thought it was only a matter of time before the bottom fell out and pushed prices even lower. By mid-April, however, prices were moving back up amid U.S. military action in Syria, interruptions to Libyan output, and optimism that OPEC would extend production cuts for another six months.

Meanwhile, on the propane side, it was hoped that with the winter heating season over, demand and prices would back off as the build season got under way. There was concern, though. Despite a mild winter the strong 59-MMbbl draw that occurred far surpassed a projected 40.6-MMbbl draw, and that had everyone’s attention. The week ended April 7, Energy Information Administration (EIA) data showed primary propane inventories at 40.4 MMbbl, a full 27.3M barrels below year-ago levels. With build season supposed to be getting started, we were still seeing draws. That week showed a draw of 1.2 MMbbl. There was a draw of 1.3 MMbbl in the Gulf Coast and small draws in the Midwest and on the East Coast, but these were offset by a 400,000-bbl build in the West. Exports were still pegged at 900,000 bbld, just shy of the 1 MMbbld that had been commonplace during the winter of 2016-2017.

For propane, the inventory decline during the latest mild winter showed the impact of dramatically increased exports. The draw took propane from an inventory 29 MMbbl above the five-year average for the beginning of heating season to a level 6.7 MMbbl below the end-of-season five-year average. The draw was 25 MMbbl larger than during the winter of 2015-2016 and 19 MMbbl higher than in 2013-2014—the winter when crop drying, cold weather, and infrastructure challenges created the perfect storm and caused extreme shortages and price spikes during January and February 2014.

As we now enter the build season, a similar scenario to last year will take us to just shy of 80 MMbbl rather than the 100 MMbbl we still had in late November 2016. Considering the ever-improving infrastructure for exports, more very large gas carriers, and more efficient routes to Asia with its stronger demand and the newly widened Panama Canal, exports will likely only increase. Demand for propane is expected to rise during 2017 in countries like China, India, and South Korea. Seaborne LPG exports were up 5% from 2015 to 2016 and demand from China is expected to grow 10%.

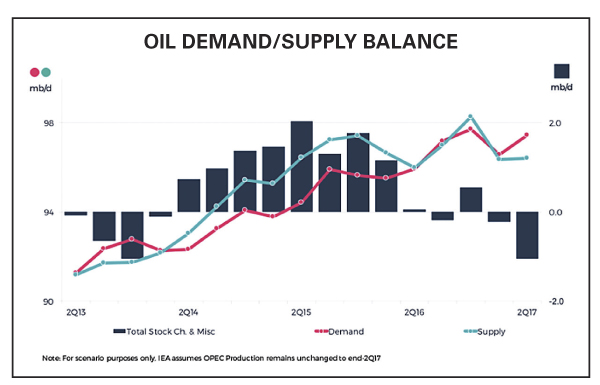

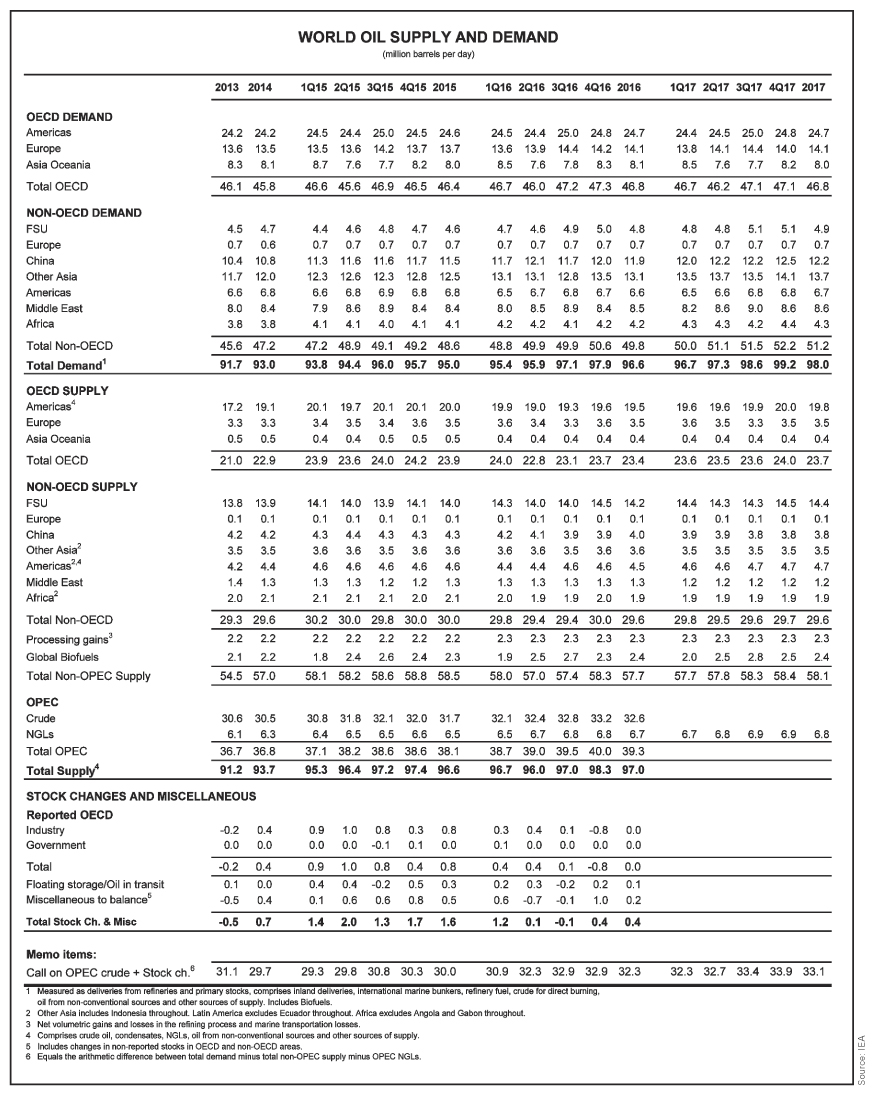

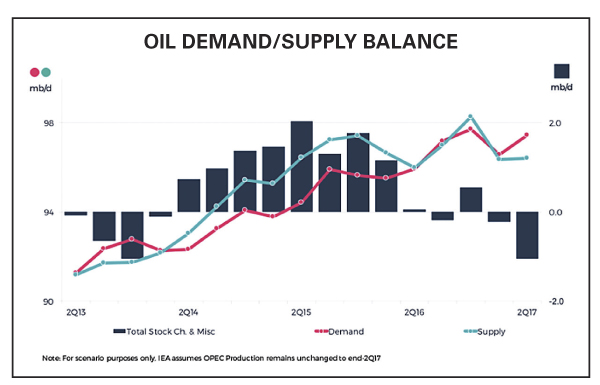

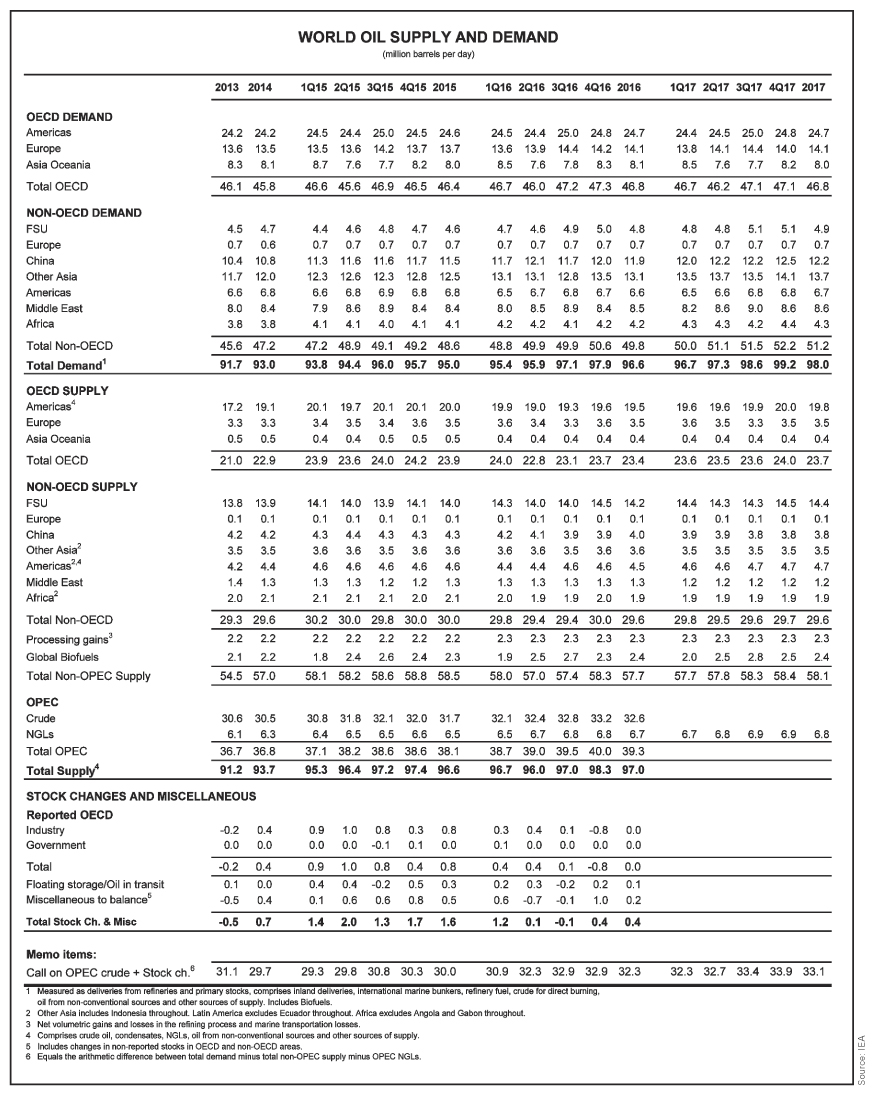

Some may look to the global crude oil supply surplus and hope that oil prices will ultimately collapse and bring propane prices down with them. As of late April, though, with OPEC members signaling they would be extending production cuts another six months and with continued compliance with existing cuts, traders are becoming more confident that prices will continue to steadily rise. In its monthly crude oil report for April, the International Energy Agency (IEA) made the case that supply and demand are coming more and more into balance once again.

Furthermore, IEA revised its five-year oil market forecast and said the crude market risks sharp increases in prices around 2020. The agency is concerned supply will struggle to keep up with demand. While IEA expects the global situation to remain comfortable for the next three years, it says supply growth slows down significantly after that. Forecast is a tight oil market with spare capacity at a 14-year low in 2022.

While crude oil supply is expected to grow in the U.S., Canada, Brazil, and other countries, the growth is expected to slow down by 2020—if the record slump in investment seen over 2015 and 2016 continues. In the U.S. investment in shale plays is growing, but global spending does not appear to be rising. Worldwide, we saw a decline of one quarter of global spending in 2015 and another one quarter decline in 2016. A few marginal increases are expected in 2017, however.

Meanwhile, oil demand is on track to rise in the next five years, passing 100 MMbbld in 2019 and reaching 104 MMbbld by 2022. All of the growth is expected in developing countries, with nations in Asia representing 70% of the growth. China and India alone would represent 46%. The expected global demand increase represents a net 7.3 MMbbld gain between 2016 and 2022. The transport sector, whether by road, water, or air, is expected to account for half of the global growth.

IEA suggests that the U.S. likely represents the largest potential contribution to additional supply. Fatih Birol, IEA’s executive director, said that investments globally must rebound sharply to avoid major price volatility after 2020. Production in the U.S. is expected to grow by 1.4 MMbbld by 2022 if prices remain around the $60/bbl area. On the other hand, an increase to $80/bbl might cause production to ramp up 3 MMbbld. Conversely, a drop to $50/bbl would likely cause production to be lower after 2020. Overall, worldwide oil production growth of 5.6 MMbbld is expected, with non-OPEC countries contributing 60%. This makes the case for a tightening of the market since demand is expected to post a 7.3-MMbbld net gain. While the effects of this may not be felt strongly until 2020, it is good to be aware of the potential.

New supplies will most likely come from major low-cost producers such as Iraq, Iran, and the United Arab Emirates. Production from Nigeria, Algeria, and Venezuela will likely decline. Russian output is expected to remain stable for the next five years.

For the retail propane marketer, many of the factors affecting prices for propane and crude oil could very likely trigger increases over the upcoming few years. As always, it is important to monitor prices and know what factors are on the horizon that could drive them higher or lower. It continues to be a concern that, as supply and demand for both propane and crude oil come closer together, the result will be prices that are higher than they are today. —Pat Thornton

The major players who put record-level investment dollars into crude oil after the OPEC cuts were agreed to in late November were not budging much as prices declined in March. The basic belief among major investors such as Goldman Sachs, Bank of America, Morgan Stanley, and Citibank was that the OPEC cuts were real. Asian demand is, and will continue to be, strong, and the market is ultimately tightening. Large builds of crude oil during March, including an 8.2-MMbbl build during a gathering of world oil representatives for CERA Week in Houston, did cause some short positions to enter the market. Despite all the talk of compliance to the OPEC cuts in Houston, crude oil moved below $50/bbl that week. Many thought it was only a matter of time before the bottom fell out and pushed prices even lower. By mid-April, however, prices were moving back up amid U.S. military action in Syria, interruptions to Libyan output, and optimism that OPEC would extend production cuts for another six months.

Meanwhile, on the propane side, it was hoped that with the winter heating season over, demand and prices would back off as the build season got under way. There was concern, though. Despite a mild winter the strong 59-MMbbl draw that occurred far surpassed a projected 40.6-MMbbl draw, and that had everyone’s attention. The week ended April 7, Energy Information Administration (EIA) data showed primary propane inventories at 40.4 MMbbl, a full 27.3M barrels below year-ago levels. With build season supposed to be getting started, we were still seeing draws. That week showed a draw of 1.2 MMbbl. There was a draw of 1.3 MMbbl in the Gulf Coast and small draws in the Midwest and on the East Coast, but these were offset by a 400,000-bbl build in the West. Exports were still pegged at 900,000 bbld, just shy of the 1 MMbbld that had been commonplace during the winter of 2016-2017.

For propane, the inventory decline during the latest mild winter showed the impact of dramatically increased exports. The draw took propane from an inventory 29 MMbbl above the five-year average for the beginning of heating season to a level 6.7 MMbbl below the end-of-season five-year average. The draw was 25 MMbbl larger than during the winter of 2015-2016 and 19 MMbbl higher than in 2013-2014—the winter when crop drying, cold weather, and infrastructure challenges created the perfect storm and caused extreme shortages and price spikes during January and February 2014.

As we now enter the build season, a similar scenario to last year will take us to just shy of 80 MMbbl rather than the 100 MMbbl we still had in late November 2016. Considering the ever-improving infrastructure for exports, more very large gas carriers, and more efficient routes to Asia with its stronger demand and the newly widened Panama Canal, exports will likely only increase. Demand for propane is expected to rise during 2017 in countries like China, India, and South Korea. Seaborne LPG exports were up 5% from 2015 to 2016 and demand from China is expected to grow 10%.

Some may look to the global crude oil supply surplus and hope that oil prices will ultimately collapse and bring propane prices down with them. As of late April, though, with OPEC members signaling they would be extending production cuts another six months and with continued compliance with existing cuts, traders are becoming more confident that prices will continue to steadily rise. In its monthly crude oil report for April, the International Energy Agency (IEA) made the case that supply and demand are coming more and more into balance once again.

Furthermore, IEA revised its five-year oil market forecast and said the crude market risks sharp increases in prices around 2020. The agency is concerned supply will struggle to keep up with demand. While IEA expects the global situation to remain comfortable for the next three years, it says supply growth slows down significantly after that. Forecast is a tight oil market with spare capacity at a 14-year low in 2022.

While crude oil supply is expected to grow in the U.S., Canada, Brazil, and other countries, the growth is expected to slow down by 2020—if the record slump in investment seen over 2015 and 2016 continues. In the U.S. investment in shale plays is growing, but global spending does not appear to be rising. Worldwide, we saw a decline of one quarter of global spending in 2015 and another one quarter decline in 2016. A few marginal increases are expected in 2017, however.

Meanwhile, oil demand is on track to rise in the next five years, passing 100 MMbbld in 2019 and reaching 104 MMbbld by 2022. All of the growth is expected in developing countries, with nations in Asia representing 70% of the growth. China and India alone would represent 46%. The expected global demand increase represents a net 7.3 MMbbld gain between 2016 and 2022. The transport sector, whether by road, water, or air, is expected to account for half of the global growth.

IEA suggests that the U.S. likely represents the largest potential contribution to additional supply. Fatih Birol, IEA’s executive director, said that investments globally must rebound sharply to avoid major price volatility after 2020. Production in the U.S. is expected to grow by 1.4 MMbbld by 2022 if prices remain around the $60/bbl area. On the other hand, an increase to $80/bbl might cause production to ramp up 3 MMbbld. Conversely, a drop to $50/bbl would likely cause production to be lower after 2020. Overall, worldwide oil production growth of 5.6 MMbbld is expected, with non-OPEC countries contributing 60%. This makes the case for a tightening of the market since demand is expected to post a 7.3-MMbbld net gain. While the effects of this may not be felt strongly until 2020, it is good to be aware of the potential.

New supplies will most likely come from major low-cost producers such as Iraq, Iran, and the United Arab Emirates. Production from Nigeria, Algeria, and Venezuela will likely decline. Russian output is expected to remain stable for the next five years.

For the retail propane marketer, many of the factors affecting prices for propane and crude oil could very likely trigger increases over the upcoming few years. As always, it is important to monitor prices and know what factors are on the horizon that could drive them higher or lower. It continues to be a concern that, as supply and demand for both propane and crude oil come closer together, the result will be prices that are higher than they are today. —Pat Thornton