Wednesday, April 12, 2017

Groundbreaking private initiatives by energy exploration and production innovators have returned to America the gift of energy abundance and security — virtually overnight and in robust measure. Nevertheless, a focused and vocal cadre of environmental activists, climate disciples, elected officials, and political operatives reject the contribution, demonize it, and seek to nullify its rewards.

That’s not only lamentable, observes A.J. (Jim) Teague, CEO of Enterprise Products Partners LP’s general partner, it’s “naïve and hypocritical” in light of the lifestyle benefits enjoyed as a result of oil and gas production, benefits most Americans would not willingly give up. Speaking at January’s Argus Americas LPG Summit in Houston, Teague said such anti-energy attitudes must be confronted. “Otherwise activists will press on. They will prevent pipelines from being built and cause delays for infrastructure.”

The former naval officer recalled memorable past assertions that “the world is running out of energy,” notably President Jimmy Carter’s 1977 televised address from the White House Oval Office. The nation’s then-chief executive, famously attired in a cardigan sweater and seated before a low wood fire, intoned oil shortages were permanent and accelerating and called for sacrifice, energy conservation, and ramped up coal production. He termed the energy crisis the “moral equivalent of war.” Wags soon termed the address the Jimmy Cardigan MEOW speech.

“Speed limits were reduced and Christmas lights were discouraged,” said Teague, “but shale pioneers had a different idea and their story proves the opposite of what was said then is true. We’re now a nation with the ability to export everything we touch and the U.S. is again a great hydrocarbon country. We have moved from a massive short to excess in less than 10 years.”

He observed that among the toughest hydrocarbons to handle is natural gas, but it nonetheless “is the easiest molecule to get from shale.” Further, ethane is also difficult to handle, but it can be exported raw or in finished products. “We still reject 500,000 bbld, and Enterprise will soon ship ethane to Asia,” he said. “The global petrochemical industry is increasingly looking to the U.S. for natural gas-derived feedstocks.” In pursuit of export markets, Enterprise in September 2016 loaded its first waterborne ethane cargo from its Morgan’s Point, Texas terminal. The destination — INEOS’ cracker in Rafnes, Norway.

The previous July, Enterprise loaded its first two vessels with polymer-grade propylene (PGP) for export at its hydrocarbons terminal on the Houston Ship Channel, adding a new service at the facility. The company expects growing international demand, and it has the ability to load 5000 metric tons a day of refrigerated PGP. Supply comes directly from fractionators and storage wells at Enterprise’s Mont Belvieu complex. In December 2015 the company loaded its first crude oil export cargo at the terminal, said to be the first U.S.-sourced shipment from the Gulf Coast in nearly 40 years. Finally, in late 2015 Enterprise completed an expansion at its Houston Ship Channel LPG export terminal from 16,500 bbl an hour to about 27,500 bbl of capacity. A new refrigeration train increased loading from 9 MMbbl a month to 16 MMbbl a month, which equates to about 29 vessels monthly.

The LPG terminal expansion was among $7.8 billion in capital growth projects Enterprise expects to bring into service by the end of 2017. Among them is construction of a propane dehydrogenation (PDH) facility at Mont Belvieu, which will produce 1.65 billion pounds of polymer-grade propylene a year, or 25,000 bbld. It will consume 35,000 bbld of propane. The plant is expected to be commissioned this year.

“We need the export market, given the magnitude of the [production] numbers,” said Teague. “We can’t leave LPG in crude or natural gas, and without exports we would have hurt the oil and natural gas industry. Oil exports are now averaging 2 MMbbld, and in December 2015, when the export ban was lifted, we wanted to be the first so we did the deal.” He added that Enterprise continues to build supply to feed its docks, and that “the U.S. is the only competitively priced barrel with the reliability to meet global demand.” Further, flat demand growth domestically has led to the need for energy product exports to clear supply, although at times the arbitrage won’t work.

He commented that as some politicians talk about U.S. energy independence, “we think the better term is energy security. What we have witnessed in the past 10 years is truly a historic event, and it’s not where we’re headed, but where we already are. We’re sitting here with a gift in our own backyard. It’s amazing some people don’t want that gift.”

More Players

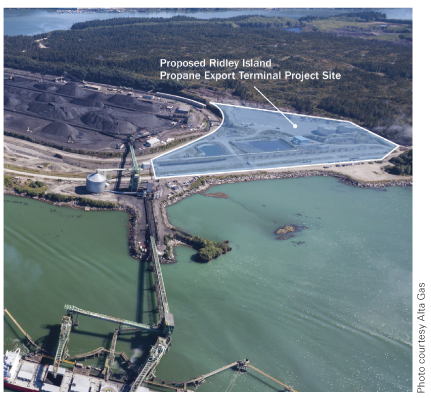

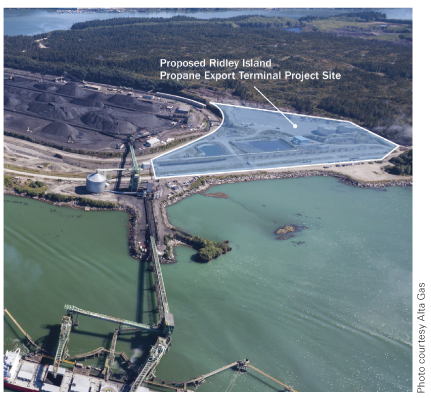

As reported by Knut Scharning, president of Houston-based Gulf Stream Tanker Chartering LLC at the Argus Summit, the U.S. isn’t alone in seeking overseas markets for its product overhang. AltaGas (Calgary) has committed to building the first LPG export terminal on Canada’s west coast. The facility, planned for Ridley Island near Prince Rupert in northwest British Columbia, is estimated to cost $475 million and has a completion target of early 2019. It is intended to supply markets in Asia, and already has an agreement from Japan’s Astomos Energy Corp. to buy half the export capacity. Construction of the facility is aimed at seriously undercutting delivery times of rivals shipping from the U.S. Gulf Coast.

The Ridley Island terminal is designed to ship 1.2 million tons of LPG annually. Product will be transported by rail from Western Canada’s prolific producing regions. Having gained federal approval for the project, AltaGas has been in consultation with First Nations groups on whose traditional lands the terminal will be built. In February 2016 AltaGas canceled a similar proposal for an export terminal at Kitimat in northern British Columbia.

Meanwhile, south of the U.S.-Mexico border MexPort, headquartered in Sonora, Mexico, is pursuing business opportunities within the logistics and port sectors at Guaymas-Empalme on the west coast, Scharning said. “This is to take advantage of a large property, privately owned, on the coast with direct access to the Pacific Ocean. MexPort is in the process of developing import and export projects to serve refined products terminals, LPG, LNG, and NGLs, a petrochemical industrial park, and renewable energy.” The site is adjacent to Interstate Highway 15 and a Pacific Coast railway line operated by Ferromex, whose extensive service provides connections throughout Mexico, as well as to the U.S. and Canada.

Connected to major U.S. energy basins through the Mexican Class 1 railroad, the rail line runs up to Nogales and interconnects with two Class 1 lines on the U.S. side operated by Union Pacific and BNSF. The 1265-acre property is registered with the Sonora state government. Zoning and permitting is in place for port and industrial development.

With the development of more export facilities, logistics and shipping are having an increased impact on the LPG industry. Scharning said the opening of the Panama Canal expansion, touted as shortening voyages and facilitating worldwide trade, has nevertheless had a negative impact on very large gas carrier (VLGC) earnings. Less ton miles have resulted in more availability of tonnage, and more cargo tons in the market have resulted in lower cost, insurance, freight (CIF) prices in Asia, putting rates under pressure. “In August and September 2016, some owners sailed via the cape in order to delay delivery…due to CIF on the cargo and availability of tonnage,” he said.

He added it can be expected that LNG will move via Panama, with about 12 voyages a month southbound, which could lead to a high cost for the transit. “Expect more congestion in the channel due to more containers and LNG vessels that want to transit. If auction principle starts, the transit fee/cost for LPG vessels will increase as containers and LNG vessels are expected to have a higher margin, meaning they can absorb a higher transit cost.”

Scharning outlined that some owners of Panamax LPG carriers no longer receive a premium for their capacity since the expansion’s opening, and large gas carrier operators have lost out on trade since they now have to compete with VLGCs, which are able to transit the expanded canal. In addition, buyers are looking at shorter delivery times as cargos arrive more quickly to Asia. “This has resulted in a change of attitude, where receivers hold longer before buying tons, and this creates more competition and length in the market,” he said. “The new Panama Canal has resulted in less ton miles. Combined with a major fleet increase—more than 50% in the past few years—these have not helped rate levels from a ship owner’s point of view.”

Seaborne Trade

Eyeing seaborne LPG trade, Craig Whitley, president and CEO of World Energy Consultants LLC (Houston), observed, “In a nutshell, we’ve experienced a prolonged period where we’ve had too many molecules and too many ships.” But, he added, the picture is slowly improving. Further, the LPG market is operating without constraint, “which explains why we don’t have the margins we had a few years ago.”

He explained Whitley’s Theory on Contraints and Margins, subtitled, In a constrained market even a blind squirrel can find a nut and make a buck. The theory holds that “the greater the bottleneck or constraint, the greater the margin, and in a world of bottlenecks and constraints, every trader is a market genius. As constraints and bottlenecks are removed, production and sales increase, while margins decrease. First movers — constraint removers — enjoy the longest period of high margins. In an unconstrained world the most creative and innovative are the most successful.”

The former NGL analytics leader at BP reviewed the U.S. shale revolution’s impact on NGL production, noting that in the unconstrained world of U.S. LPG, infrastructure—gas plants, pipelines, fractionators, export terminals, international shipping, and the Panama Canal—are all operating at full throttle. Total gas plant production has been running in the 3.3 to 3.5 MMbbld range, and with higher crude oil prices and increased drilling it can be expected U.S. NGL production will increase. Any rise in domestic production will result in higher LPG export levels. Last, infrastructure has been built to handle far greater production levels than witnessed in 2016. The only question remaining is if more storage is needed.

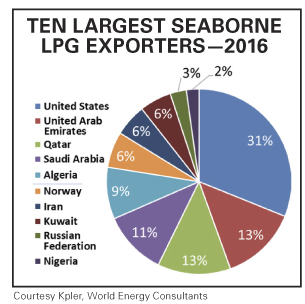

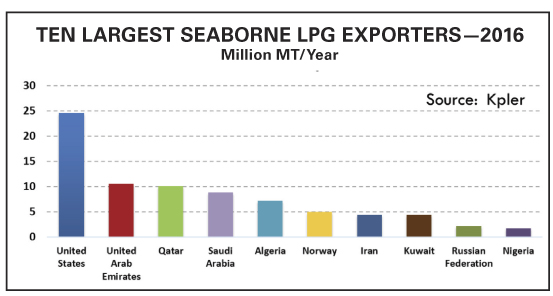

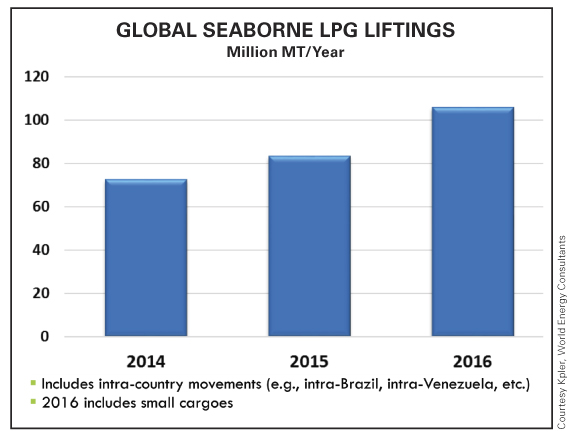

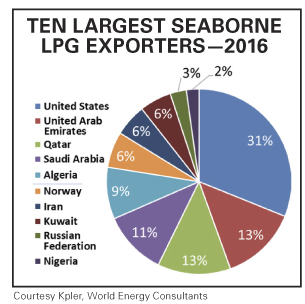

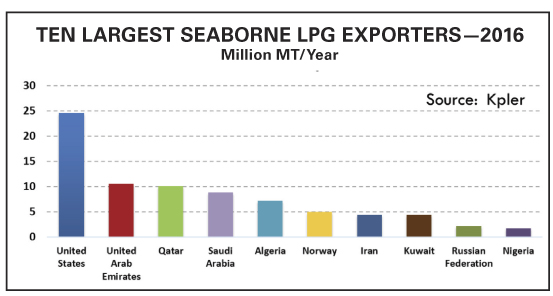

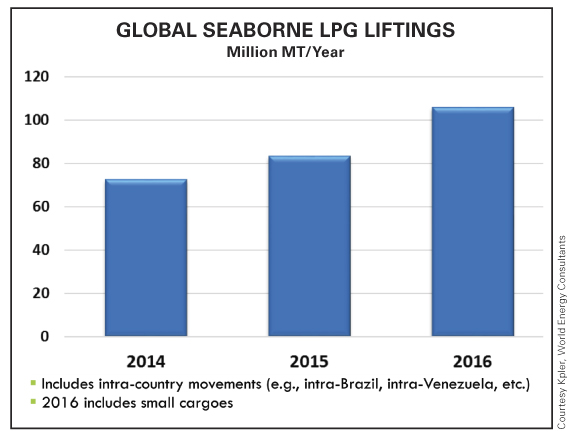

Meanwhile, global waterborne liftings, as reported by the Paris-based energy markets intelligence consultancy Kpler, while approaching 80 million tons a year in 2014, surpassed that mark in 2016 and leapt over 100 million tons in 2016. The list of top 10 seaborne LPG exporters is led by the U.S., with nearly 25 million tons shipped every year and a 31% share of the market. Following at a distant second are the United Arab Emirates and Qatar, which export about 10 million tons/year each with both holding 13% market shares. Saudi Arabia, with 11% of the market, exports in the area of 9 million tons/year, while Algeria, 9%, ships about 7 million tons. Norway, Iran, and Kuwait place next, each with 6% market shares. Norway is reported to export 5 million tons/year, whereas Iran and Kuwait ship nearly that volume. The Russian Federation and Nigeria round out the total, with 3% and 2% market shares, respectively, and about 3 and 2 million tons/year exported.

Roughly 60% of total seaborne deliveries are made to markets east of the Suez Canal. East-to-West trade runs around 1.7 million tons/year, while West-to-East is growing rapidly and has risen 8 million tons/year since 2014. For U.S.-sourced LPG, Asia has overtaken Latin America as the largest importer, while total exports have demonstrated linear growth and are nearing 25 million tons/year. Forty two percent of U.S. exports are destined for Asia, 35% go to Latin America, 16% to Europe, 4% to Africa, and 3% to other regions.

Whitley noted that while the U.S. is the biggest LPG exporting country, the Middle East remains the largest exporting region. Despite predictions of a drop in Middle East exports they continue to grow. The United Arab Emirates has overtaken Qatar as the leading regional exporter, and the Emirates, Qatar, and Saudi Arabia account for 76% of all Middle East exports.

Regarding export destinations, he said waterborne shipments to Latin America did not grow between 2015 and 2016 and remained in the area of 9 million tons/year, with the U.S. supplying most import demand. However, imports have risen from just under 8 million tons/year in 2014. European seaborne LPG imports, at 20 million tons/year in 2016, grew from 14 million tons in 2015 and 13 million tons in 2014. North Sea-sourced product continues to lead imports, followed by Africa, the U.S., other regions, and the Russian Federation. U.S. exports to Europe, at about 2.4 million tons/year in 2014, have now risen to 4 million tons.

In the Far East, China, which became the largest LPG importer in 2015, now imports 15 million tons/year, which is up from about 7 million tons in 2014. Whitley said China relied mostly on the Middle East in 2016, with the region capturing almost 11 million tons of the market. U.S.-sourced LPG represented about 3 million tons, with Africa, Australia, and other regions trailing.

Japan, which imported about 11 million tons in 2015 and 2016, is a market where the Middle East is losing share while the U.S. is capturing volume. Middle East imports dropped from 8 million tons/year in 2014 to just over 6 million tons in 2016, whereas imports from the U.S. grew from just under 2 million tons to nearly 3 million tons over the same period. Japan also sources LPG from Africa, Australia and other regions in smaller, but not insignificant, volumes in order to diversify supply.

Whitley said propane dehydrogenation (PDH) activities are driving rising imports in South Korea. That sector bumped volumes from 5 million tons/year in 2015 to almost 7 million tons in 2016. At the same time, the U.S. has overtaken the Middle East in the South Korean market. Middle East imports approached 4 million tons in 2014, only to fall to just over 2 million tons in 2016. Over the same period, U.S. imports grew from a half million tons to about 3.5 million tons. Africa and Australia, meanwhile, lost market share, while imports from other regions grew.

Taiwan’s LPG imports, at just over 1.5 million tons/year in 2014, slipped just under that total in 2015 but rose to 1.5 million tons in 2016. The U.S. is growing market share and has closed on the Middle East. Whereas the Middle East supplied 1 million tons in 2014, that number shrank to 0.7 million tons in 2016. U.S. imports grew from slightly under 0.1 million tons to nearly 0.7 million tons over the same period. Africa lost market share, declining from just over 0.4 million tons in 2014 to a bit more than 0.1 million tons in 2016. Volumes from Australia and other regions have also faded.

Finally, with 63% of world LPG supply now coming from gas plants and 37% from refineries, the residential/commercial sector continues to hold the largest market share at 46%, Whitley said. Following are chemical, 22%; autogas, 9%; price sensitive demand and stock builds, 8%; industrial, 7%; refining, 5%; other, 2%; and town gas, 1%.

Whitley concluded that underlying base demand for LPG will continue to grow modestly and remove any additional length in the market within two years. New PDH demand and a rise in Middle East petrochemical demand could remove marketplace length faster. “Better times are ahead and will come sooner than expected, but fundamentals don’t appear strong enough to classify the turnaround as being just around the corner,” he said. “This is particularly true with the LPG shipping industry. There are no bottlenecks in the U.S. NGL marketplace. There are no bottlenecks in seaborne LPG shipping infrastructure.”

In a follow-up assessment of his Argus Summit presentation, the World Energy Consultants CEO told BPN in March that the global LPG supply surplus, or overhang, of the past few years is gone after being consumed this past winter. “The global propane market will be very tight this coming winter if OPEC continues to curb production of crude oil, because that negatively impacts the production of Middle East LPG and Middle East LPG exports.”

He now sees the U.S. going into the 2017-2018 winter “with far less volume to export than we did in 2016 because domestic production in the U.S. will not grow fast enough to build back inventories to 2016 levels. Latin America, Europe, and Asia will be vying for the same U.S. barrels this winter.” In addition, “If the Trump administration implements sanctions on Iran, which in turn would reduce Iran’s LPG export levels, I fully expect the global LPG market to become even tighter this coming winter.”

Canadian Energy

While U.S. LPG production and exports lead world growth, it shouldn’t be forgotten that by region North America is the tip of the spear. The recovery has started for the Canadian energy business, asserted Gerry Goobie, a principal at the Calgary-based consultancy Gas Processing Management Inc., at the Argus Summit. He reminded those in attendance that Canada’s economy is resource based and its petroleum and mineral reserves are among the largest in the world. Further, the Canadian economy is driven by oil and gas. And while the Canada/U.S. trading relationship is critical to both countries, and energy exports to the U.S. are a substantial component of the economy, Canada is making significant investments in value-added industrial development to diversify its economy. Simultaneously, it is actively developing new markets for its resources.

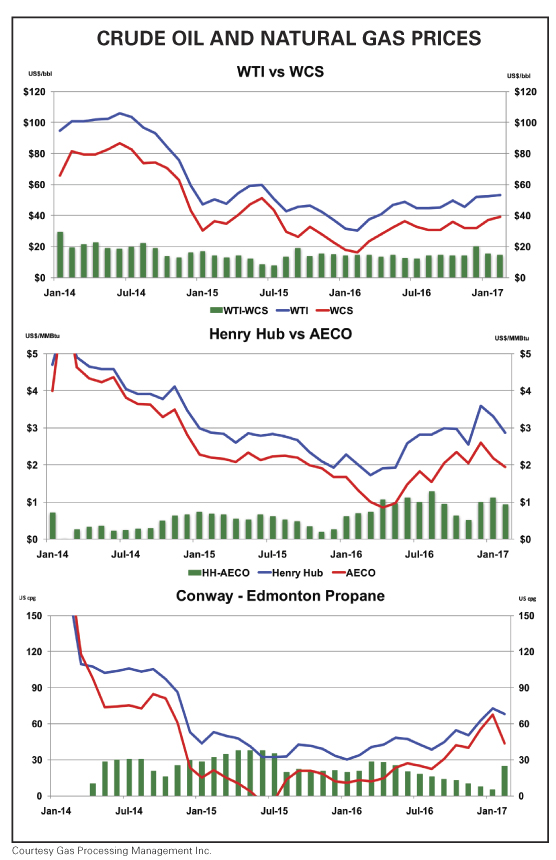

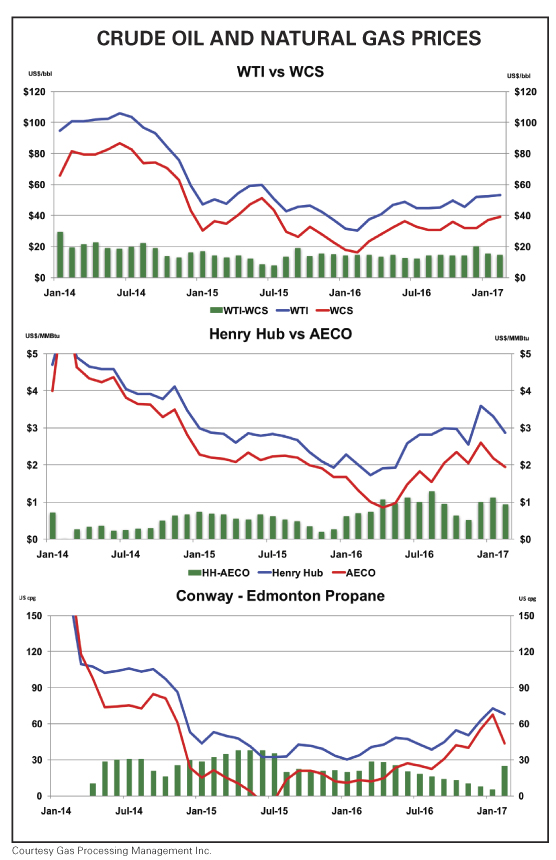

“There are tremendous efforts to turn our raw resources into finished products,” he said, adding that Canadian energy product prices, including Western Canadian Select (WCS) crude oil, are discounted to U.S. products. “We need to exploit that advantage for export options. We have to get rid of our excess propane. In summer 2015 we had to pay to have it taken away when it went negative. The U.S. doesn’t need our products. Business 101 says we need to export.”

Again, Canadian crude oil, natural gas, and propane remain significantly discounted to U.S. prices. Canada is currently a price taker because its primary market is the U.S. However, the nation’s low cost of production is one of its strongest competitive advantages and exploiting that advantage will strengthen Canada’s economy. “Crude oil export volumes to the U.S. continue to grow, but revenues have fallen sharply in the last two years,” Goobie said. “Canadian crude is cheap.” Natural gas export volumes also grew in 2016, but revenues continue to fall. Canadian gas is also cheap. Moreover, “propane export volumes to the U.S. remain strong and revenues have started to recover. Canadian propane is really cheap.”

The Gas Processing Management principal underscored that the push to diversify Canada’s exports is finally gaining momentum, with its lower resource costs and proximity to Asia seen as advantages. Natural gas, crude oil, and propane export project approvals include Pacific NorthWest LNG, the Kinder Morgan Trans Mountain Expansion, the Enbridge Line 3 Replacement, the AltaGas Ridley Island propane export terminal, Petrogas’ propane export license, and Pembina’s and Inter Pipeline’s PDH projects. In addition, the Keystone XL and Energy East projects are still alive.

Goobie reviewed that the Pacific NorthWest LNG project received a positive environmental assessment decision from the Canadian government. It is a proposed natural gas liquefaction and export facility on Lelu Island within the District of Port Edward on land administered by the Prince Rupert Port Authority. The facility would liquefy and export natural gas produced by Progress Energy Canada Ltd. in northeast British Columbia. Both Pacific NorthWest LNG and Progress Energy are majority owned by Petronas. Sinopec, JAPEX, Indian Oil Corp., and PetroleumBRUNEI are minority shareholders in Pacific NorthWest LNG.

The Trans Mountain Expansion project has received federal and provincial approvals. The $6.8-billion initiative will parallel the 1150-kilometer route of the existing Trans Mountain Pipeline, the only West Coast link for Western Canadian oil. Pipeline capacity will increase from 300,000 bbld to 890,000 bbld. The project came about in response to requests from shippers to help them reach new markets by expanding the capacity of North America’s only pipeline with access to the West Coast. Observed is that with oil sands production expanding in Alberta, new markets and opportunities are emerging as countries in the Asia Pacific region develop.

The Enbridge Line 3 Replacement project has also received federal approval. The $7.5-billion project includes replacing the existing pipe with modern pipe materials. Involved is replacing existing 34-in.-dia. pipe with 36-in.-dia. pipe from Hardisty to Gretna, Manitoba, and Neche, N.D. to Superior, Wis. Segments of Line 3 from the U.S.-Canada international border to Neche and near the Minnesota-Wisconsin border to Enbridge’s Superior Terminal will be replaced with 34-in.-dia. pipe.

Again, AltaGas has reached a positive final investment decision for its Ridley Island propane export terminal. Finally, Petrogas has received approval for LPG exports up to 107,000 bbld from its recently acquired Ferndale, Wash. deep-water wharf. The wharf is adjacent to the company’s terminal, which provides storage and distribution of propane and butane to domestic and international markets. “Expect more to come,” Goobie advised.

In other developments, he outlined that the Alberta government has awarded C$500 million in royalty credits to support the development of two PDH projects — Pembina PDH/PP and Inter Pipeline PDH. Keystone XL and Energy East are additional large crude oil export projects. Keystone XL, killed off by the Obama administration, has been resuscitated by President Trump. Energy East, also a TransCanada initiative, would carry 1.1 MMbbld from Alberta and Saskatchewan to refineries in Eastern Canada. The project involves converting an existing natural gas pipeline and constructing new pipelines, infrastructure, and marine facilities to enable access to markets by ship.

Goobie cautioned that environmental opposition to energy projects has not gone away. “Canada will continue to develop its resources in the most environmentally responsible manner,” he said. “Governments have imposed tough but fair environmental conditions on all projects. Canada is second to none at environmentally responsible resource development.” —John Needham

That’s not only lamentable, observes A.J. (Jim) Teague, CEO of Enterprise Products Partners LP’s general partner, it’s “naïve and hypocritical” in light of the lifestyle benefits enjoyed as a result of oil and gas production, benefits most Americans would not willingly give up. Speaking at January’s Argus Americas LPG Summit in Houston, Teague said such anti-energy attitudes must be confronted. “Otherwise activists will press on. They will prevent pipelines from being built and cause delays for infrastructure.”

The former naval officer recalled memorable past assertions that “the world is running out of energy,” notably President Jimmy Carter’s 1977 televised address from the White House Oval Office. The nation’s then-chief executive, famously attired in a cardigan sweater and seated before a low wood fire, intoned oil shortages were permanent and accelerating and called for sacrifice, energy conservation, and ramped up coal production. He termed the energy crisis the “moral equivalent of war.” Wags soon termed the address the Jimmy Cardigan MEOW speech.

“Speed limits were reduced and Christmas lights were discouraged,” said Teague, “but shale pioneers had a different idea and their story proves the opposite of what was said then is true. We’re now a nation with the ability to export everything we touch and the U.S. is again a great hydrocarbon country. We have moved from a massive short to excess in less than 10 years.”

He observed that among the toughest hydrocarbons to handle is natural gas, but it nonetheless “is the easiest molecule to get from shale.” Further, ethane is also difficult to handle, but it can be exported raw or in finished products. “We still reject 500,000 bbld, and Enterprise will soon ship ethane to Asia,” he said. “The global petrochemical industry is increasingly looking to the U.S. for natural gas-derived feedstocks.” In pursuit of export markets, Enterprise in September 2016 loaded its first waterborne ethane cargo from its Morgan’s Point, Texas terminal. The destination — INEOS’ cracker in Rafnes, Norway.

The previous July, Enterprise loaded its first two vessels with polymer-grade propylene (PGP) for export at its hydrocarbons terminal on the Houston Ship Channel, adding a new service at the facility. The company expects growing international demand, and it has the ability to load 5000 metric tons a day of refrigerated PGP. Supply comes directly from fractionators and storage wells at Enterprise’s Mont Belvieu complex. In December 2015 the company loaded its first crude oil export cargo at the terminal, said to be the first U.S.-sourced shipment from the Gulf Coast in nearly 40 years. Finally, in late 2015 Enterprise completed an expansion at its Houston Ship Channel LPG export terminal from 16,500 bbl an hour to about 27,500 bbl of capacity. A new refrigeration train increased loading from 9 MMbbl a month to 16 MMbbl a month, which equates to about 29 vessels monthly.

The LPG terminal expansion was among $7.8 billion in capital growth projects Enterprise expects to bring into service by the end of 2017. Among them is construction of a propane dehydrogenation (PDH) facility at Mont Belvieu, which will produce 1.65 billion pounds of polymer-grade propylene a year, or 25,000 bbld. It will consume 35,000 bbld of propane. The plant is expected to be commissioned this year.

“We need the export market, given the magnitude of the [production] numbers,” said Teague. “We can’t leave LPG in crude or natural gas, and without exports we would have hurt the oil and natural gas industry. Oil exports are now averaging 2 MMbbld, and in December 2015, when the export ban was lifted, we wanted to be the first so we did the deal.” He added that Enterprise continues to build supply to feed its docks, and that “the U.S. is the only competitively priced barrel with the reliability to meet global demand.” Further, flat demand growth domestically has led to the need for energy product exports to clear supply, although at times the arbitrage won’t work.

He commented that as some politicians talk about U.S. energy independence, “we think the better term is energy security. What we have witnessed in the past 10 years is truly a historic event, and it’s not where we’re headed, but where we already are. We’re sitting here with a gift in our own backyard. It’s amazing some people don’t want that gift.”

More Players

As reported by Knut Scharning, president of Houston-based Gulf Stream Tanker Chartering LLC at the Argus Summit, the U.S. isn’t alone in seeking overseas markets for its product overhang. AltaGas (Calgary) has committed to building the first LPG export terminal on Canada’s west coast. The facility, planned for Ridley Island near Prince Rupert in northwest British Columbia, is estimated to cost $475 million and has a completion target of early 2019. It is intended to supply markets in Asia, and already has an agreement from Japan’s Astomos Energy Corp. to buy half the export capacity. Construction of the facility is aimed at seriously undercutting delivery times of rivals shipping from the U.S. Gulf Coast.

The Ridley Island terminal is designed to ship 1.2 million tons of LPG annually. Product will be transported by rail from Western Canada’s prolific producing regions. Having gained federal approval for the project, AltaGas has been in consultation with First Nations groups on whose traditional lands the terminal will be built. In February 2016 AltaGas canceled a similar proposal for an export terminal at Kitimat in northern British Columbia.

Meanwhile, south of the U.S.-Mexico border MexPort, headquartered in Sonora, Mexico, is pursuing business opportunities within the logistics and port sectors at Guaymas-Empalme on the west coast, Scharning said. “This is to take advantage of a large property, privately owned, on the coast with direct access to the Pacific Ocean. MexPort is in the process of developing import and export projects to serve refined products terminals, LPG, LNG, and NGLs, a petrochemical industrial park, and renewable energy.” The site is adjacent to Interstate Highway 15 and a Pacific Coast railway line operated by Ferromex, whose extensive service provides connections throughout Mexico, as well as to the U.S. and Canada.

Connected to major U.S. energy basins through the Mexican Class 1 railroad, the rail line runs up to Nogales and interconnects with two Class 1 lines on the U.S. side operated by Union Pacific and BNSF. The 1265-acre property is registered with the Sonora state government. Zoning and permitting is in place for port and industrial development.

With the development of more export facilities, logistics and shipping are having an increased impact on the LPG industry. Scharning said the opening of the Panama Canal expansion, touted as shortening voyages and facilitating worldwide trade, has nevertheless had a negative impact on very large gas carrier (VLGC) earnings. Less ton miles have resulted in more availability of tonnage, and more cargo tons in the market have resulted in lower cost, insurance, freight (CIF) prices in Asia, putting rates under pressure. “In August and September 2016, some owners sailed via the cape in order to delay delivery…due to CIF on the cargo and availability of tonnage,” he said.

He added it can be expected that LNG will move via Panama, with about 12 voyages a month southbound, which could lead to a high cost for the transit. “Expect more congestion in the channel due to more containers and LNG vessels that want to transit. If auction principle starts, the transit fee/cost for LPG vessels will increase as containers and LNG vessels are expected to have a higher margin, meaning they can absorb a higher transit cost.”

Scharning outlined that some owners of Panamax LPG carriers no longer receive a premium for their capacity since the expansion’s opening, and large gas carrier operators have lost out on trade since they now have to compete with VLGCs, which are able to transit the expanded canal. In addition, buyers are looking at shorter delivery times as cargos arrive more quickly to Asia. “This has resulted in a change of attitude, where receivers hold longer before buying tons, and this creates more competition and length in the market,” he said. “The new Panama Canal has resulted in less ton miles. Combined with a major fleet increase—more than 50% in the past few years—these have not helped rate levels from a ship owner’s point of view.”

Seaborne Trade

Eyeing seaborne LPG trade, Craig Whitley, president and CEO of World Energy Consultants LLC (Houston), observed, “In a nutshell, we’ve experienced a prolonged period where we’ve had too many molecules and too many ships.” But, he added, the picture is slowly improving. Further, the LPG market is operating without constraint, “which explains why we don’t have the margins we had a few years ago.”

He explained Whitley’s Theory on Contraints and Margins, subtitled, In a constrained market even a blind squirrel can find a nut and make a buck. The theory holds that “the greater the bottleneck or constraint, the greater the margin, and in a world of bottlenecks and constraints, every trader is a market genius. As constraints and bottlenecks are removed, production and sales increase, while margins decrease. First movers — constraint removers — enjoy the longest period of high margins. In an unconstrained world the most creative and innovative are the most successful.”

The former NGL analytics leader at BP reviewed the U.S. shale revolution’s impact on NGL production, noting that in the unconstrained world of U.S. LPG, infrastructure—gas plants, pipelines, fractionators, export terminals, international shipping, and the Panama Canal—are all operating at full throttle. Total gas plant production has been running in the 3.3 to 3.5 MMbbld range, and with higher crude oil prices and increased drilling it can be expected U.S. NGL production will increase. Any rise in domestic production will result in higher LPG export levels. Last, infrastructure has been built to handle far greater production levels than witnessed in 2016. The only question remaining is if more storage is needed.

Meanwhile, global waterborne liftings, as reported by the Paris-based energy markets intelligence consultancy Kpler, while approaching 80 million tons a year in 2014, surpassed that mark in 2016 and leapt over 100 million tons in 2016. The list of top 10 seaborne LPG exporters is led by the U.S., with nearly 25 million tons shipped every year and a 31% share of the market. Following at a distant second are the United Arab Emirates and Qatar, which export about 10 million tons/year each with both holding 13% market shares. Saudi Arabia, with 11% of the market, exports in the area of 9 million tons/year, while Algeria, 9%, ships about 7 million tons. Norway, Iran, and Kuwait place next, each with 6% market shares. Norway is reported to export 5 million tons/year, whereas Iran and Kuwait ship nearly that volume. The Russian Federation and Nigeria round out the total, with 3% and 2% market shares, respectively, and about 3 and 2 million tons/year exported.

Roughly 60% of total seaborne deliveries are made to markets east of the Suez Canal. East-to-West trade runs around 1.7 million tons/year, while West-to-East is growing rapidly and has risen 8 million tons/year since 2014. For U.S.-sourced LPG, Asia has overtaken Latin America as the largest importer, while total exports have demonstrated linear growth and are nearing 25 million tons/year. Forty two percent of U.S. exports are destined for Asia, 35% go to Latin America, 16% to Europe, 4% to Africa, and 3% to other regions.

Whitley noted that while the U.S. is the biggest LPG exporting country, the Middle East remains the largest exporting region. Despite predictions of a drop in Middle East exports they continue to grow. The United Arab Emirates has overtaken Qatar as the leading regional exporter, and the Emirates, Qatar, and Saudi Arabia account for 76% of all Middle East exports.

Regarding export destinations, he said waterborne shipments to Latin America did not grow between 2015 and 2016 and remained in the area of 9 million tons/year, with the U.S. supplying most import demand. However, imports have risen from just under 8 million tons/year in 2014. European seaborne LPG imports, at 20 million tons/year in 2016, grew from 14 million tons in 2015 and 13 million tons in 2014. North Sea-sourced product continues to lead imports, followed by Africa, the U.S., other regions, and the Russian Federation. U.S. exports to Europe, at about 2.4 million tons/year in 2014, have now risen to 4 million tons.

In the Far East, China, which became the largest LPG importer in 2015, now imports 15 million tons/year, which is up from about 7 million tons in 2014. Whitley said China relied mostly on the Middle East in 2016, with the region capturing almost 11 million tons of the market. U.S.-sourced LPG represented about 3 million tons, with Africa, Australia, and other regions trailing.

Japan, which imported about 11 million tons in 2015 and 2016, is a market where the Middle East is losing share while the U.S. is capturing volume. Middle East imports dropped from 8 million tons/year in 2014 to just over 6 million tons in 2016, whereas imports from the U.S. grew from just under 2 million tons to nearly 3 million tons over the same period. Japan also sources LPG from Africa, Australia and other regions in smaller, but not insignificant, volumes in order to diversify supply.

Whitley said propane dehydrogenation (PDH) activities are driving rising imports in South Korea. That sector bumped volumes from 5 million tons/year in 2015 to almost 7 million tons in 2016. At the same time, the U.S. has overtaken the Middle East in the South Korean market. Middle East imports approached 4 million tons in 2014, only to fall to just over 2 million tons in 2016. Over the same period, U.S. imports grew from a half million tons to about 3.5 million tons. Africa and Australia, meanwhile, lost market share, while imports from other regions grew.

Taiwan’s LPG imports, at just over 1.5 million tons/year in 2014, slipped just under that total in 2015 but rose to 1.5 million tons in 2016. The U.S. is growing market share and has closed on the Middle East. Whereas the Middle East supplied 1 million tons in 2014, that number shrank to 0.7 million tons in 2016. U.S. imports grew from slightly under 0.1 million tons to nearly 0.7 million tons over the same period. Africa lost market share, declining from just over 0.4 million tons in 2014 to a bit more than 0.1 million tons in 2016. Volumes from Australia and other regions have also faded.

Finally, with 63% of world LPG supply now coming from gas plants and 37% from refineries, the residential/commercial sector continues to hold the largest market share at 46%, Whitley said. Following are chemical, 22%; autogas, 9%; price sensitive demand and stock builds, 8%; industrial, 7%; refining, 5%; other, 2%; and town gas, 1%.

Whitley concluded that underlying base demand for LPG will continue to grow modestly and remove any additional length in the market within two years. New PDH demand and a rise in Middle East petrochemical demand could remove marketplace length faster. “Better times are ahead and will come sooner than expected, but fundamentals don’t appear strong enough to classify the turnaround as being just around the corner,” he said. “This is particularly true with the LPG shipping industry. There are no bottlenecks in the U.S. NGL marketplace. There are no bottlenecks in seaborne LPG shipping infrastructure.”

In a follow-up assessment of his Argus Summit presentation, the World Energy Consultants CEO told BPN in March that the global LPG supply surplus, or overhang, of the past few years is gone after being consumed this past winter. “The global propane market will be very tight this coming winter if OPEC continues to curb production of crude oil, because that negatively impacts the production of Middle East LPG and Middle East LPG exports.”

He now sees the U.S. going into the 2017-2018 winter “with far less volume to export than we did in 2016 because domestic production in the U.S. will not grow fast enough to build back inventories to 2016 levels. Latin America, Europe, and Asia will be vying for the same U.S. barrels this winter.” In addition, “If the Trump administration implements sanctions on Iran, which in turn would reduce Iran’s LPG export levels, I fully expect the global LPG market to become even tighter this coming winter.”

Canadian Energy

While U.S. LPG production and exports lead world growth, it shouldn’t be forgotten that by region North America is the tip of the spear. The recovery has started for the Canadian energy business, asserted Gerry Goobie, a principal at the Calgary-based consultancy Gas Processing Management Inc., at the Argus Summit. He reminded those in attendance that Canada’s economy is resource based and its petroleum and mineral reserves are among the largest in the world. Further, the Canadian economy is driven by oil and gas. And while the Canada/U.S. trading relationship is critical to both countries, and energy exports to the U.S. are a substantial component of the economy, Canada is making significant investments in value-added industrial development to diversify its economy. Simultaneously, it is actively developing new markets for its resources.

“There are tremendous efforts to turn our raw resources into finished products,” he said, adding that Canadian energy product prices, including Western Canadian Select (WCS) crude oil, are discounted to U.S. products. “We need to exploit that advantage for export options. We have to get rid of our excess propane. In summer 2015 we had to pay to have it taken away when it went negative. The U.S. doesn’t need our products. Business 101 says we need to export.”

Again, Canadian crude oil, natural gas, and propane remain significantly discounted to U.S. prices. Canada is currently a price taker because its primary market is the U.S. However, the nation’s low cost of production is one of its strongest competitive advantages and exploiting that advantage will strengthen Canada’s economy. “Crude oil export volumes to the U.S. continue to grow, but revenues have fallen sharply in the last two years,” Goobie said. “Canadian crude is cheap.” Natural gas export volumes also grew in 2016, but revenues continue to fall. Canadian gas is also cheap. Moreover, “propane export volumes to the U.S. remain strong and revenues have started to recover. Canadian propane is really cheap.”

The Gas Processing Management principal underscored that the push to diversify Canada’s exports is finally gaining momentum, with its lower resource costs and proximity to Asia seen as advantages. Natural gas, crude oil, and propane export project approvals include Pacific NorthWest LNG, the Kinder Morgan Trans Mountain Expansion, the Enbridge Line 3 Replacement, the AltaGas Ridley Island propane export terminal, Petrogas’ propane export license, and Pembina’s and Inter Pipeline’s PDH projects. In addition, the Keystone XL and Energy East projects are still alive.

Goobie reviewed that the Pacific NorthWest LNG project received a positive environmental assessment decision from the Canadian government. It is a proposed natural gas liquefaction and export facility on Lelu Island within the District of Port Edward on land administered by the Prince Rupert Port Authority. The facility would liquefy and export natural gas produced by Progress Energy Canada Ltd. in northeast British Columbia. Both Pacific NorthWest LNG and Progress Energy are majority owned by Petronas. Sinopec, JAPEX, Indian Oil Corp., and PetroleumBRUNEI are minority shareholders in Pacific NorthWest LNG.

The Trans Mountain Expansion project has received federal and provincial approvals. The $6.8-billion initiative will parallel the 1150-kilometer route of the existing Trans Mountain Pipeline, the only West Coast link for Western Canadian oil. Pipeline capacity will increase from 300,000 bbld to 890,000 bbld. The project came about in response to requests from shippers to help them reach new markets by expanding the capacity of North America’s only pipeline with access to the West Coast. Observed is that with oil sands production expanding in Alberta, new markets and opportunities are emerging as countries in the Asia Pacific region develop.

The Enbridge Line 3 Replacement project has also received federal approval. The $7.5-billion project includes replacing the existing pipe with modern pipe materials. Involved is replacing existing 34-in.-dia. pipe with 36-in.-dia. pipe from Hardisty to Gretna, Manitoba, and Neche, N.D. to Superior, Wis. Segments of Line 3 from the U.S.-Canada international border to Neche and near the Minnesota-Wisconsin border to Enbridge’s Superior Terminal will be replaced with 34-in.-dia. pipe.

Again, AltaGas has reached a positive final investment decision for its Ridley Island propane export terminal. Finally, Petrogas has received approval for LPG exports up to 107,000 bbld from its recently acquired Ferndale, Wash. deep-water wharf. The wharf is adjacent to the company’s terminal, which provides storage and distribution of propane and butane to domestic and international markets. “Expect more to come,” Goobie advised.

In other developments, he outlined that the Alberta government has awarded C$500 million in royalty credits to support the development of two PDH projects — Pembina PDH/PP and Inter Pipeline PDH. Keystone XL and Energy East are additional large crude oil export projects. Keystone XL, killed off by the Obama administration, has been resuscitated by President Trump. Energy East, also a TransCanada initiative, would carry 1.1 MMbbld from Alberta and Saskatchewan to refineries in Eastern Canada. The project involves converting an existing natural gas pipeline and constructing new pipelines, infrastructure, and marine facilities to enable access to markets by ship.

Goobie cautioned that environmental opposition to energy projects has not gone away. “Canada will continue to develop its resources in the most environmentally responsible manner,” he said. “Governments have imposed tough but fair environmental conditions on all projects. Canada is second to none at environmentally responsible resource development.” —John Needham