Tuesday, July 19, 2016

Seeing the big picture, maximizing the value of your business, developing banking relationships, and deciphering and understanding the “numbers” are four challenges that propane marketers must conquer to successfully grow their business in 2016. Mike Shilts, vice president of marketing and business development for energy management software company K&K Management Solutions (Indianapolis), notes that propane companies must know their “key business indicators,” also known as KBIs or “dashboards.” The first of the four challenges — “seeing the big picture” —means knowing exactly what those indicators are for your specific business.

Shilts discussed the importance of key business indicators during a session titled “Growing Your Propane Business in 2016 and Beyond: Conquering Four Challenges” at the National Propane Gas Association Southeastern Convention in Nashville.

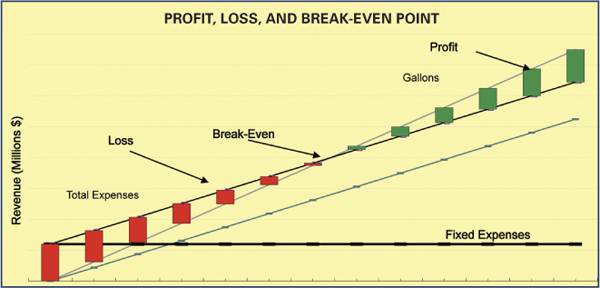

The number of deliveries and gallons per delivery are among the key business indicators. “If you don’t know what those key indicators are for your company, you’re lost,” said Shilts, a CPA with bachelor’s and master’s degrees in finance/accounting and psychology. When he asks propane marketers how many gallons they deliver each week and the location, many say they think they know the answer. “You have to know,” Shilts stressed.

At the Southeastern event, Shilts showed slides displaying key business indicators, explained why propane marketers must follow them, and most important, discussed what the variance is between an indicator number and what the marketer should expect it to be.

“If there’s a variance, then you need to take those key indicators and drill down and say, ‘What caused the variance?’” He has implemented key business indicators for about 60 companies, including propane businesses and companies in other industries.

Shilts is presenting on this topic because the current times are challenging for businesses. “Small business owners often do not understand some of the key areas to make their companies successful,” he noted.

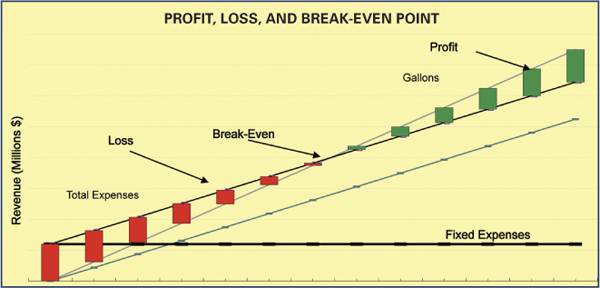

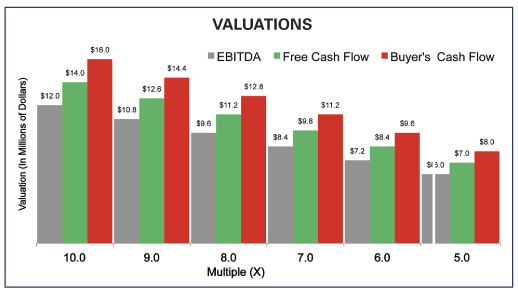

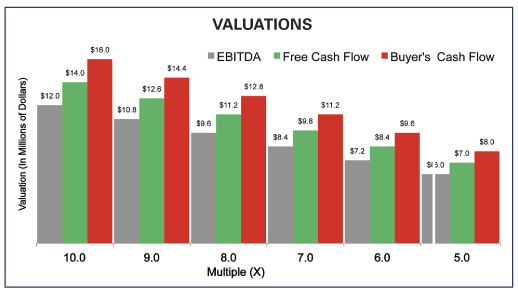

Maximizing the value (and earnings before interest, taxes, depreciation, and amortization, or EBITDA) of your company, or getting the most money when selling the company, is the second of those key areas or challenges Shilts describes in the presentation, and he discussed cash flow and how to avoid a “haircut.” He explains that with a haircut, a seller of a business starts out thinking his company is worth a high amount, but after going through due diligence he discovers the value is nowhere near the initial offer.

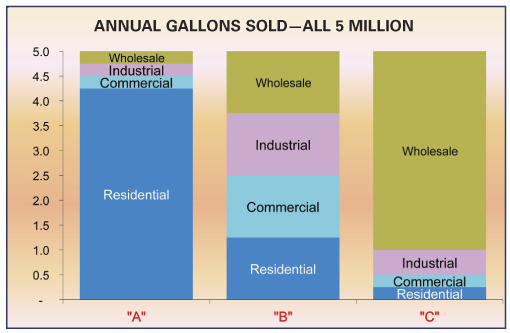

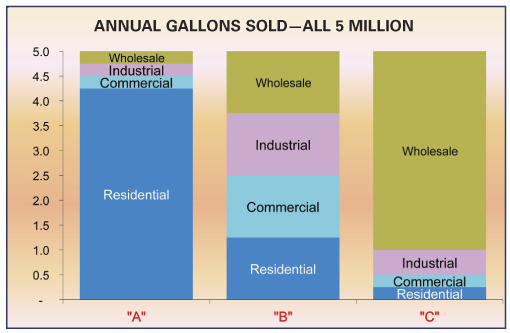

“When I say ‘maximize value,’ it’s how you get the most money for your company, and I also touch on how to not get ‘taken’ either.” He explained how to look at your company from the view of the person or company buying it. Marketers selling a company can avoid a haircut by managing their business effectively, watching their costs, and understanding that the gallons they sell are not all equal. For example, a high-margin residential gallon is nowhere near the same as an industrial gallon or a transport gallon, according to Shilts.

“Many people look at the number of gallons they sell and say, ‘That’s my company’s potential value,’ but what counts is the margin [cash flow] you receive from those gallons.” At his presentation, he provided examples of three companies that each sell about the same amount of gallons, but the margin they receive is completely different.

The third challenge, developing banking relationships, involves creating business plans, figuring out how to get funding, and securing letters of credit. Shilts explained what banks look for, or don’t look for, when deciding whether to lend money.

“There is a four-letter word with bankers, and that word is ‘risk.’ All bankers are concerned about avoiding risk,” he said. They want to know if your company will create enough cash flow to pay back the loan while also paying your employees and meeting all of the other business obligations.

Bankers will see your company as low risk if you strive to do well in meeting the four challenges.

Deciphering and understanding the numbers — the financial statements — is the fourth challenge. Using simple terms, he explained the four financial statements: the balance sheet, income statement, cash-flow statement, and retained earnings.

The balance sheet, he explains, never states, “for the period ending.” Balance sheets are a snapshot at a certain point in time.

On Dec. 31 of any year, the balance sheet’s accounts receivable balance might show a very high or very low number, partially depending on the business’s number of pre-buy or budget customers. “It depends on when you’re looking at it, and what you’re looking at, but the balance sheet is extremely critical to grow your company, because if you don’t have the equity, you’re not going to be able to grow. Why? Because the bank is not going to lend you money because you are not going to meet [its] covenants.”

Shilts, who also spoke in March at M-PACT in Indianapolis about the four challenges, tells attendees of his sessions, “Don’t pay outside accountants to regurgitate your numbers.” Marketers often pay good money for accountants to give you back exactly what you gave them, only in a nicer form.

“You don’t want to pay for that,” he stated. “You want to pay for tax advice, for analysis of the numbers. Don’t pay a CPA or other outside firm $40,000 per year to enter your data into Excel or other format. Get Quickbooks or another inexpensive accounting program. Don’t spend money on things that don’t give you any real value. Put your own numbers in and only pay outside accountants for value-added analysis that increases your bottom line.” —Daryl Lubinsky

Shilts discussed the importance of key business indicators during a session titled “Growing Your Propane Business in 2016 and Beyond: Conquering Four Challenges” at the National Propane Gas Association Southeastern Convention in Nashville.

The number of deliveries and gallons per delivery are among the key business indicators. “If you don’t know what those key indicators are for your company, you’re lost,” said Shilts, a CPA with bachelor’s and master’s degrees in finance/accounting and psychology. When he asks propane marketers how many gallons they deliver each week and the location, many say they think they know the answer. “You have to know,” Shilts stressed.

At the Southeastern event, Shilts showed slides displaying key business indicators, explained why propane marketers must follow them, and most important, discussed what the variance is between an indicator number and what the marketer should expect it to be.

“If there’s a variance, then you need to take those key indicators and drill down and say, ‘What caused the variance?’” He has implemented key business indicators for about 60 companies, including propane businesses and companies in other industries.

Shilts is presenting on this topic because the current times are challenging for businesses. “Small business owners often do not understand some of the key areas to make their companies successful,” he noted.

Maximizing the value (and earnings before interest, taxes, depreciation, and amortization, or EBITDA) of your company, or getting the most money when selling the company, is the second of those key areas or challenges Shilts describes in the presentation, and he discussed cash flow and how to avoid a “haircut.” He explains that with a haircut, a seller of a business starts out thinking his company is worth a high amount, but after going through due diligence he discovers the value is nowhere near the initial offer.

“When I say ‘maximize value,’ it’s how you get the most money for your company, and I also touch on how to not get ‘taken’ either.” He explained how to look at your company from the view of the person or company buying it. Marketers selling a company can avoid a haircut by managing their business effectively, watching their costs, and understanding that the gallons they sell are not all equal. For example, a high-margin residential gallon is nowhere near the same as an industrial gallon or a transport gallon, according to Shilts.

“Many people look at the number of gallons they sell and say, ‘That’s my company’s potential value,’ but what counts is the margin [cash flow] you receive from those gallons.” At his presentation, he provided examples of three companies that each sell about the same amount of gallons, but the margin they receive is completely different.

The third challenge, developing banking relationships, involves creating business plans, figuring out how to get funding, and securing letters of credit. Shilts explained what banks look for, or don’t look for, when deciding whether to lend money.

“There is a four-letter word with bankers, and that word is ‘risk.’ All bankers are concerned about avoiding risk,” he said. They want to know if your company will create enough cash flow to pay back the loan while also paying your employees and meeting all of the other business obligations.

Bankers will see your company as low risk if you strive to do well in meeting the four challenges.

Deciphering and understanding the numbers — the financial statements — is the fourth challenge. Using simple terms, he explained the four financial statements: the balance sheet, income statement, cash-flow statement, and retained earnings.

The balance sheet, he explains, never states, “for the period ending.” Balance sheets are a snapshot at a certain point in time.

On Dec. 31 of any year, the balance sheet’s accounts receivable balance might show a very high or very low number, partially depending on the business’s number of pre-buy or budget customers. “It depends on when you’re looking at it, and what you’re looking at, but the balance sheet is extremely critical to grow your company, because if you don’t have the equity, you’re not going to be able to grow. Why? Because the bank is not going to lend you money because you are not going to meet [its] covenants.”

Shilts, who also spoke in March at M-PACT in Indianapolis about the four challenges, tells attendees of his sessions, “Don’t pay outside accountants to regurgitate your numbers.” Marketers often pay good money for accountants to give you back exactly what you gave them, only in a nicer form.

“You don’t want to pay for that,” he stated. “You want to pay for tax advice, for analysis of the numbers. Don’t pay a CPA or other outside firm $40,000 per year to enter your data into Excel or other format. Get Quickbooks or another inexpensive accounting program. Don’t spend money on things that don’t give you any real value. Put your own numbers in and only pay outside accountants for value-added analysis that increases your bottom line.” —Daryl Lubinsky