Tuesday, June 30, 2020

By Tamera Kovacs and Cooper Wilburn… There are many factors that go into a retail propane marketer’s decision to sell their business but typically there is one key factor that propels them to act. That one deciding factor is unique to each marketer as to when the time is right. Today, retailers have another factor to consider, COVID-19. Should they proceed with their plans to sell or should they wait? That answer is not as straightforward as one might hope—the COVID-19 impact is just another factor that must be weighed into the decision-making process.

When considering the impact COVID-19 will have on the sale of propane businesses, most buyers will look at how it has impacted their business specifically. They will look at how it has impacted the factors that drive the exit multiple as well as the earnings of the company.

When considering the impact COVID-19 will have on the sale of propane businesses, most buyers will look at how it has impacted their business specifically. They will look at how it has impacted the factors that drive the exit multiple as well as the earnings of the company.

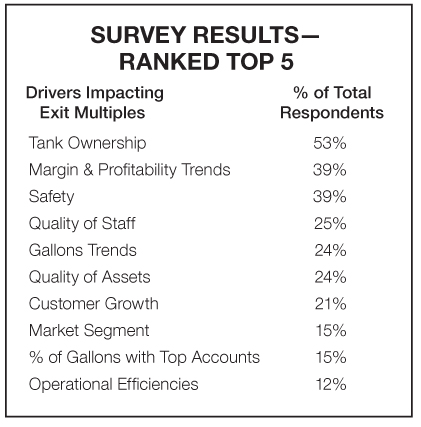

We recently surveyed retail propane marketers asking them to rank, in order of importance, 10 drivers that impact exit multiples. The survey results show the percentage of respondents who ranked each of the items within the top five. How do the retailers’ rankings compare to what we consider to be the most important? Read on.

Tank Ownership—At fifty-three percent (53%), tank ownership received the majority of votes as being one of the top factors impacting exit multiples. Let’s face it, it’s about control. You want to control the gallons delivered to the customer and the profitability gained. It’s also about controlling the safety of the tank and installation. Part two of tank ownership is having proper documentation to prove you own the tank. Make sure you have signed tank leases on file and in a system for easy access. Remember, buyers don’t buy what they can’t see. For customer-owned tanks, try to get a longer-term contract to maintain control of the tank.

Margin & Profitability Trends—Thirty-nine percent (39%) of responding retailers ranked margin and profitability trends as one of the top five factors. It is important to break down the gross margin by customer class so you and a potential buyer understand the margin trends by category. What do the trends look like? Have they trended up, down, or fluctuated year to year? Why? Understand the story behind the trends. Look at not only the total dollar amount but also the trends on a cents-per-gallon basis. The big question: Is it sustainable? Buyers buy sustainability over time, not on one great year. Margin and profitability trends are key to building value in your business.

Safety—Thirty-nine percent (39%) also ranked safety within the top five. Again, it’s about control, consistency, and documentation. It is very important to regularly schedule (monthly) meetings to review and reinforce safety, policies for performing GAS Checks, and the proper documentation and filing of each. For underground tanks, documentation on cathodic protection is also important. In the event of an accident, if a GAS Check isn’t documented and signed, the eyes of the courts will say it didn’t happen. Again, buyers don’t buy what they can’t see; we have seen buyers walk on deals because of a lack of safety documentation.

Quality of Staff—Twenty-five percent (25%) of the survey respondents felt quality of staff was one of the top five. A key differentiator from one business to another is people! Is the staff micromanaged or can they take on leadership roles? Can they help build a strong business? For a typical retail propane marketer, personnel expenses range between 40% and 60%. The staff’s efficiency, customer compassion and relatability, and ability to make decisions are all critical. Employees can make or break your business.

Gallons Trends—Twenty-four percent (24%) ranked gallons trends in the top five. When looking at your gallons trends it is important to break out gallons-by-customer classification. What’s happening and why? Gallons trends are a driver of gross margins, profitability, and an indicator of growth or decline. It is important to understand what is driving the trends.

Quality of Assets—Twenty-four percent (24%) ranked quality of assets in the top five. Quality of assets can be broken into three categories: rolling stock, bulk storage, and consumer tanks. The rolling stock is the category of assets that has a high churn rate in a company. The age of the fleet becomes important if the majority of the fleet is over 10 years old and will need to be replaced in short order. It’s also a question of expense dollars-versus-capital dollars plus opportunity costs. Companies with an older fleet tend to have higher repair and maintenance costs. This can lead to a risk of a truck being out of service during peak season, resulting in the loss of an opportunity. Companies with a newer fleet have higher capital expense outlay but often see lower repair and maintenance costs. What is the timing for investing in new rolling stock? A continuous update of rolling stock is suggested to avoid becoming over-burdened within a short amount of time (one or two years). Currently there are tax incentives available for capital purchases. These incentives won’t last forever, so take advantage of them while they are still available.

All tanks, whether bulk storage or consumer tanks, must have a legible data plate to be in service. For bulk storage tanks, it is also important to have the U1A Certificate. Buyers will look at your tanks; they do not want to buy a bunch of pitted tanks or tanks in violation of codes. Consumer tanks generally are the most valuable asset a retailer has. It is important to continuously keep them cleaned, painted, and within code.

Customer Growth—Twenty-one percent (21%) ranked customer growth within the top five. Customer growth can be thought of in two ways: net customer growth and burner tip growth. Track gain and loss numbers for both company-owned and customer-owned tanks. While customer-owned tank growth is good, the value placed on customer-owned growth isn’t as high as company-owned growth. An increase in burner tips within existing customers’ homes will help increase gallons growth trends and can lead to increased profitability.

Market Segment—Fifteen percent (15%) ranked market segment in the top five. Understanding the market segments you serve as in number of customers, percentage of gallons sold to each segment, and impact of the gross margin trends, are all key components to impacting the exit multiple and earnings of the company. We tend to see buyers pay higher multiples for bulk residential businesses versus large agricultural or commercial businesses.

Percent of Gallons with Top Accounts—Fifteen percent (15%) ranked percentage of gallons with top accounts in the top five. This driver of exit multiples typically doesn’t get much attention unless a company sells a large percentage of their gallons to a few accounts. If the majority of your gallons are sold to residential accounts, losing one or two won’t be a material impact to your business. However, losing one or two accounts that contribute to a significant number of gallons sold by your business could be very detrimental.

Operational Efficiencies—Twelve percent (12%) ranked operational efficiencies in the top five. Operational efficiencies are one of the most difficult to track and see direct impact, yet, is very important. Most changes to operational efficiencies take time to see the financial benefit to the business. While operational efficiencies are important, they fall more to the earnings side of the business versus the multiples side. If you have better operational efficiencies, you will have increased earnings and will get paid for these efficiencies, as your earnings are higher.

The above factors (among others) play a key role when assessing the value of your business. Adding to this is COVID-19’s impace on your business. The shutdown this spring could pose a significant impact on a company’s value and marketability through lost volumes and lost customers. The shutdown can also possibly affect the ability of customers to pay. As industrial, commercial, and residential customers come back online and return to work post-COVID-19, it will be critical to understand the long-term economic impact to the propane business serving those accounts.

The big question: If you were considering selling, is now a good time? Buyers are continuing to acquire companies. And in the past several years multiples have trended up. In the last few years, buyers have been more aggressive with multiples on good quality companies and weaker companies benefitted from those stronger multiples. For strong companies, multiples will likely remain high. Where we may see a decline in multiples is with companies that have problem areas—they may not benefit from the stronger multiples as they have in the past.

COVID-19 caused a shock to markets and many experts say this will send us into a recession. The retail propane industry is a fairly recession-resistant industry; people still need to heat their homes, cook their food, and heat their water. This should cause new buyers to continue to come into the market and help keep multiples elevated.

Depending on your situation, now is definitely a good time to sell. Buyers continue to have access to cheap money and look to continue growing. Historically, factors causing multiples to weaken have been an increase in interest rates, inflation, and availability of investment dollars. We don’t know the timing of this impact but at some point, we will have to pay back the money that is being printed. The kind of debt that is being added will generally cause an inflationary period that is stopped or slowed with rising interest rates. We have helped numerous companies buy and sell businesses over the years; each company has their own unique situation and reasons for buying or selling. Most people only get one shot at selling their business; make sure you get the deal that makes the most sense for your specific situation.

Tamera Kovacs and Cooper Wilburn of Propane Resources assist retail propane marketers with valuations, business reviews focusing on increasing value and helping companies buy and/or sell businesses. PropaneResources,com