- China’s decision to temporarily remove the 25% import tariff they had imposed on imports of U.S. propane, to feed the growth of their propylene production facilities.

- The continued expansion of LPG connections in India to extend access to LPG to most of the population.

- The removal of constraints on access to LPG export capacity that allows U.S. producers to market their seasonal surplus production year around.

PROPANE SUPPLY 2020 — NO PANDEMIC PANIC

PROPANE SUPPLY 2020 — NO PANDEMIC PANIC

The big surprise in terms of supply last year turned out to be how well gas plant propane volumes recovered relative to the declines in oil and gas supply that occurred after the initial U.S. pandemic lockdowns last March. While both oil and natural gas production fell in March and have not yet recovered to those levels as of the last reported numbers, gas plant propane production actually rose and recovered to a level that exceeded December 2019 production.

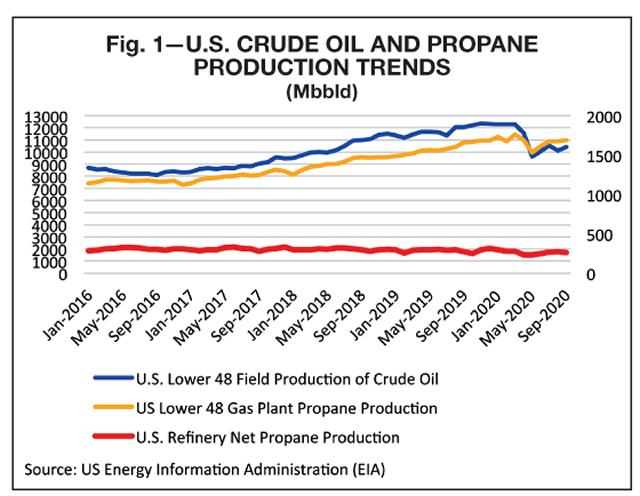

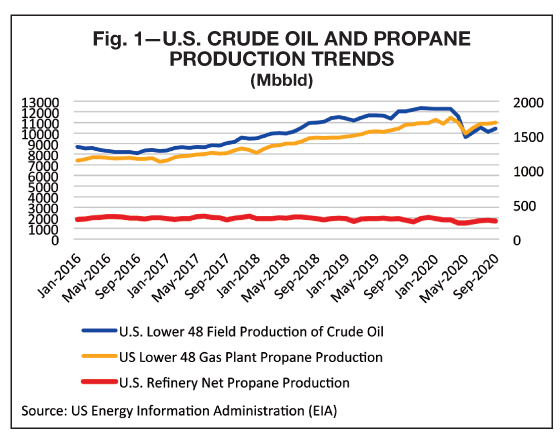

Fig. 1 shows the drop in crude production that occurred in March to accommodate the dramatic drops in demand due to COVID restrictions on travel outside the home. While crude production fell by 2.7 MMbbld (21%) between when lockdowns were imposed in March and the low point in May, gas plant propane supply dropped by 230 Mbbld, or only 13%, during the same time period.

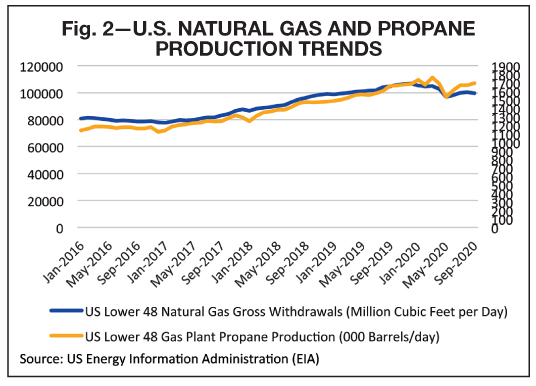

Fig. 2 shows the relationship between the change in natural gas wellhead production (known as “gross withdrawals” in EIA statistics) and gas plant propane supply.

Natural gas production fell by about 8 Bcfd (7.5%) between March and May 2020, recovering somewhat but still showing a 5.4-Bcfd deficit

between March and September. Although gas plant propane supply fell further on a percentage basis, propane production recovered faster than gas supply grew.

In our May 2020 “pandemic” supply forecast, we estimated crude production would fall by a maximum of about 2 MMbbld during 2020 vs the actual initial dip of 2.7 million, and that natural gas production would fall by a maximum of 9.1 Bcfd vs the actual of 8 Bcfd. Since much of the gas supply reduction was in areas associated with crude oil and would have had a relatively high NGL content, we would have expected to see a propane supply cut of about 290 Mbbld in May. In reality, supply only fell by 230 Mbbld, and recovered, whereas both crude oil and natural gas production remained below early 2020 levels.

The rapid rebound in propane production was concentrated largely in the Permian region in southeast New Mexico and West Texas, and in the Rocky Mountain states, primarily Colorado, where oil wells were shut-in.

Propane production in the Permian region got a boost from higher NGL recoveries by plants using high-efficiency cryogenic technology as well as from higher ethane prices. Older plants that increase ethane recoveries also boost propane production.

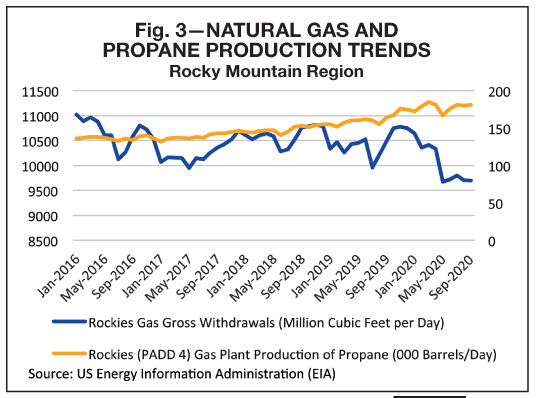

In the Rockies, primarily Colorado where oil drilling in Weld County (northeast of Denver) has increased the NGL content of the gas stream over the past few years, propane production was definitely resilient. Fig. 3 shows propane supply rebounding to nearly March levels over the summer, while gas production fell by 7% from March to September. This indicates that the ongoing gas shortfall was mostly “dry” gas with lower NGL content, while “rich” gas was brought back online as crude production recovered. Supply also rebounded to early 2020 levels in North Dakota, where 45% of crude production was taken offline between March and May. Although at this writing production in the region is still down by 200 Mbbld compared to January 2020 levels, propane volumes have recovered as additional gas processing and NGL takeaway capacity have been added to reduce the volume of gas that has been flared.

Meanwhile, in the Northeast U.S., Marcellus gas and propane production have been steadily growing in spite of a number of mergers and bankruptcies that have seen a wave of E&P consolidation in 2020. Shell and Chevron exited the region, and Exxon has written down the value of its reserves there, indicating a divestiture may be in the works this year. This leaves the region in the hands of larger, stronger companies such as EQT and Southwestern.

SUPPLY OUTLOOK 2021— STILL MOVING UP

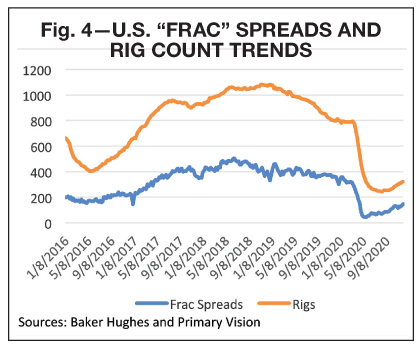

After the E&P industry essentially stopped drilling and fracturing in the Q2 2020, the rig count began to rise even before crude prices began to move up in November as producers tried to keep production from falling even farther by year end 2020. More important, the “frac spread” count, Fig. 4, is rising as the pressure pumping gear is brought in to fracture the reservoirs for completion. We are currently expecting Lower 48 U.S. crude production to grow by 0.5-0.8 MMbbld by year end 2021 to as much as 11.6 MMbbld, and that Lower 48 natural gas production will return to December 2019 levels of around 106 Bcfd by December 2021. Part of this will be “drier” gas seeking export markets at LNG facilities, but associated gas production should add at least 50 Mbbld of propane supply in the Bakken and Gulf Coast regions, bringing December 2021 gas plant production to around 1.750 MMbbld. This means production should not be a concern this year, but with more distribution options available to marketers and traders, availability may be.

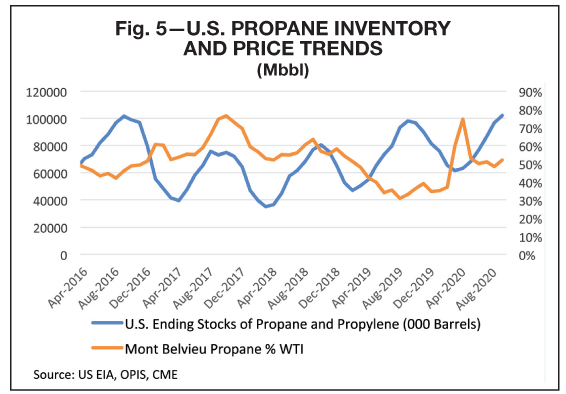

The U.S. passed Saudi Arabia to become the world’s largest exporter of LPG in 2017. At the time, in a move similar to what we saw in 2020, crude prices had recovered from a $26/bbl low in early 2016 to over $50. Rising production and the record setting 100+ MMbbl inventory levels that occurred in the fall of 2016 had forecasters expecting price collapses and a long market adjustment period as overseas markets developed to absorb the rise in shale gas NGLs. The reality was that U.S. Gulf Coast propane prices measured as a percentage of WTI bottomed out in mid 2015 at 27%, and proceeded to rise as high as 76% (to $0.94/gallon at Mont Belvieu) by the fall of 2017. Fig. 5 compares U.S. propane inventory levels to the U.S. Gulf Coast price at Mont Belvieu as a percentage of WTI crude.

The “spike” in prices relative to crude oil occurred when crude oil prices collapsed during the initial pandemic lockdowns. Although prices for the heavier NGLs such as butane and natural gasoline fell to historic lows, a world event occurred that kept propane prices from following suit.

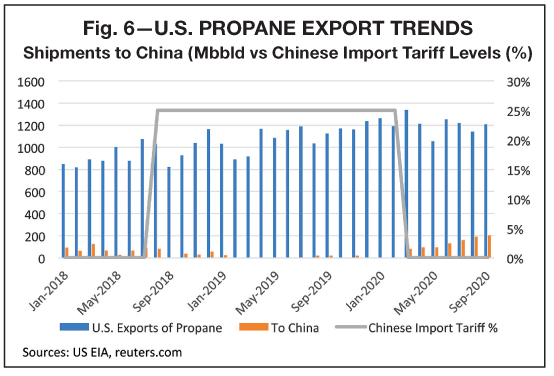

The event that literally moved the market was the Chinese government’s decision in March 2020 to “temporarily” remove the 25% tariff it had imposed on imported U.S. propane, not co-incidentally when crude prices started sliding. While the tariffs were in place, China had to go to other sources such as Iran for supply, which reduced freight costs but put them in the same market as other buyers and allowed countries such as Japan to benefit from being able to buy from the U.S. China’s demand growth is in the petrochemical sector, since they produce a significant amount of the world’s personal protective equipment (PPE) such as masks and gowns that have been in enormous demand during the pandemic. These and other consumer goods that people have been snapping up to support working from home require propylene. Although U.S. producers have also expanded their propylene production capacity, the number of on purpose propylene production (PDH) units on the ground in China dwarfs that of any other country. Demand for imported LPG in the residential/commercial sector there actually fell in 2020, with supply from local refineries pushing imports for that sector down by 22%. The volume was made up by petrochemical manufacturers. Argus forecaster Celia Chen estimates Chinese demand for propane feedstock will grow by about 220 Mbbld in 2020. With supply from other sources constrained by production cuts, the ability to import feedstock from the U.S. has proven to be a big help to China. Chen’s outlook for additional feedstock demand in 2021 if there are no tariff issues, and the current and new units run at high rates, is as much as 98 Mbbld. This would be enough to absorb the forecast increase in U.S. production and then some.

Fig. 6 shows how U.S. exports going directly to China during the years the import tariff has been in effect have changed. The tariff was initially imposed in August 2018, starting at 25%. An additional 5% tariff was initially set to take effect in December 2018, but not imposed. The tariff was removed in March 2020.

Year over year, U.S. monthly average propane exports jumped from 892 Mbbld to a record-high 1.337 MMbbld in March 2020, with China going from 0 to 82 Mbbld. Between March and September 2020, a total of 29.4 MMbbl have been exported to China, compared to 2.6 million total for all of 2019. These volumes have helped keep U.S. stocks from causing a strain on U.S. storage capacity and have definitely helped support U.S. prices.

This year, U.S. propane marketers should be alert to changes in Chinese trade policy that could affect their propane purchases, as well as following the status of the PDH units that are operating there. Chinese buyers act in concert to take advantage of surpluses, and price declines in the U.S. could lead to large increases in exports, limiting the opportunity to buy distressed inventory for seasonal sales.

Another major challenge for U.S. supply managers comes from the growing residential/commercial market in India. The Indian government set up a program beginning in 2016 to extend the reach of LPG fuel to all Indian households to eliminate the use of dung and other solid fuels which was resulting in health issues and pollution. By Q1 of 2020, the program had targeted installing about 80 million more household LPG connections. As a result, an estimated 90% of the population has the ability to connect an LPG cylinder to a home burner. Since many of the rural poor can’t afford to pay the deposit for a cylinder, much less buy the LPG, the Indian government provided a subsidy that enabled them to buy two cylinders’ worth of fuel per year. This program has helped boost India’s LPG consumption by 50% between 2014 and 2019 to about 22.5 million tonnes (765 Mbbld) in 2019. This is almost exactly the volume reported (760 Mbbld) sold as “Consumer Grade” propane in the U.S. in 2019 per the EIA. Over half of India’s supply is imported, and they are the second largest importer after China. India buys very little of its LPG from the U.S., since they are very close to the Middle East supply points, but their demand serves as part of the balancing mechanism in the global market. In an effort to reduce the amount paid for subsidies, the Indian national oil companies are now offering to sell LPG to a wider range of private bottlers beyond the handful of large companies who currently control the market to increase competition and drive cylinder prices lower. This may have the effect of increasing demand further, which would boost imports. Through November 2020, Indian imports rose by 4.5% vs 2019, a strong showing during a year where the pandemic has slowed its economy. We would expect 2021 demand to be at least as strong as 2020, at the 800-Mbbld level or higher, with imports above 400 Mbbld.

The final domestic propane marketer’s challenge for 2021 results from a combination of the midstream industry’s efforts to expand its fee based asset business to control the “last mile” of pipe to the export market, and the strategic goal of keeping the barrels inside their owned assets from the field to their docks. Export projects continued to move forward, on both the East and Gulf Coasts.

There are two potential and one operating export facilities in the U.S. Northeast that can offer international market access to producers in addition to the main port at Marcus Hook, Pa. The two potential locations are the SEA-3 facilities at Newington, N.H., and Providence, R.I. Both these facilities are currently used for imports but have refrigerated storage and chiller capacity that would enable them to expand fairly easily to buy and load propane for export. In addition to these, a company called Delaware River Partners, owned by New Fortress, has converted an old ammonia storage cavern near Repuano, N.J., into LPG storage. One new dock has been built there already that can handle so-called “handy size” vessels that hold a little less than half the cargo of a VLGC, about 220,000 to 240,000 bbl. A second dock has been approved, with plans to use it to load LNG cargoes railed in from a project near Wyalusing, Pa., that is currently under construction.

The largest LPG export facility in the U.S. is the Enterprise Products Partners Enterprise Hydrocarbons Terminal (EHT) on the Houston Ship Channel. Its next expansion adds another 265 Mbbld of loading capacity, which will allow loading of up to 1.1 MMbbld when construction is completed in the second half of this year. In addition to this terminal, the Targa Resources facility in nearby Galena Park was expanded to handle up to 490 Mbbld in the Q3 2020. Down the coast, the P66 terminal at Freeport adds another 200 Mbbld of capacity, and the Energy Transfer export terminal in Nederland, Texas, near the Louisiana border, can load up to 500 Mbbld. In Corpus Christi, terminals operated by Moda Midstream and Buckeye Partners can load ships bound for Latin America and the Caribbean, with a rail hub currently under development to aggregate and load up to 30 Mbbld for export to Mexico.

Taken together, these terminals provide enough capacity to export all the propane and normal butane produced in the U.S. today. Removing logistics constraints on export sales provides U.S. producers with maximum optionality to market their production but also reduces opportunities for marketers to secure “stranded” supply unable to find a sales outlet. The three largest facility operators, Energy Transfer (Marcus Hook, Nederland), Targa (Galena Park), and Enterprise (Houston) also own and operate networks of gas processing plants, NGL pipelines, and storage facilities that generate fee revenues throughout the entire supply chain from the field to the dock. The challenge for marketers without production facilities and/or term supply agreements is summed up by Enterprise’s description of the customer base for its export terminal:

“The primary customer of EHT is our NGL marketing group, which uses EHT to meet the needs of export customers. NGL marketing transacts with these customers using long-term sales contracts with take-or-pay provisions and/or exchange agreements. In recent years, the U.S. has become the largest exporter of LPG in the world, with shipments originating from EHT playing a key role.” (https://www.enterpriseproducts.com/operations/ngl-pipelines-services/ngl-export-import-facilities, accessed Dec. 11, 2020.)

Companies who prefer longer-term export sales contracts with guaranteed offtake may commit more barrels to these buyers, leaving less room for spot sales in the domestic market. In addition, the large volumes involved in export transactions reduces the administrative cost per gallon, making it more efficient to deal with a smaller number of larger customers. When inventories are high, and supply seems ample, these issues don’t seem as important. But as the big miss in the 2017 forecast shows, the market can tighten quickly, and staying on top of supplier relationships is key to continued success.