Wednesday, December 9, 2015

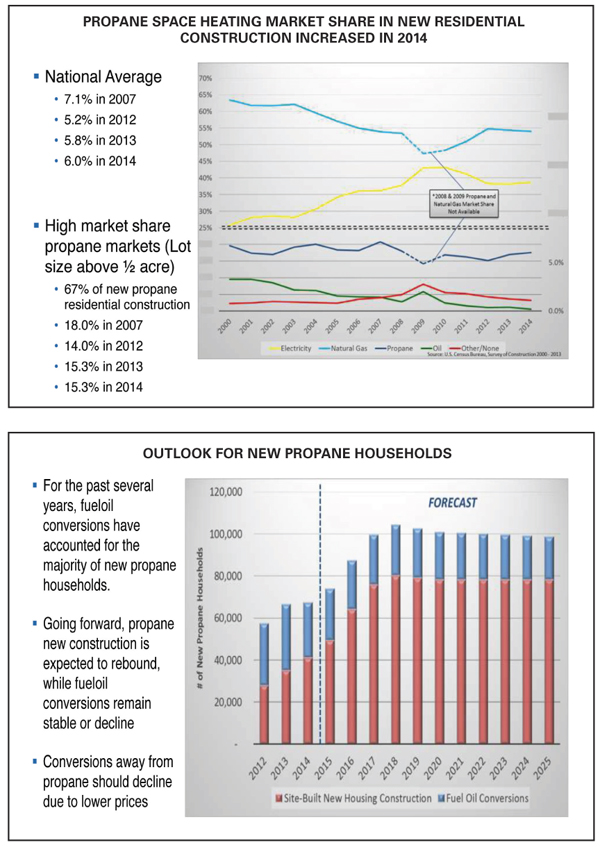

As the residential housing market continues to improve, the overall number of propane customers is expected to increase from now to 2025. However, total residential sales are expected to continue a slow decline as improvements in efficiency offset customer growth. Residential and commercial markets also will continue to face significant threats from electricity and natural gas, said Mike Sloan, principal for ICF International (Fairfax, Va.).

Sloan, making his comments at a meeting of the Propane Education & Research Council (PERC) meeting Nov. 6, provided some highlights of ICF’s 2016 Propane Market Outlook, which was scheduled to be released soon after the meeting. He added that long-term efficiency trends will continue to reduce the amount of propane used per customer. Commercial markets are expected to remain relatively stable.

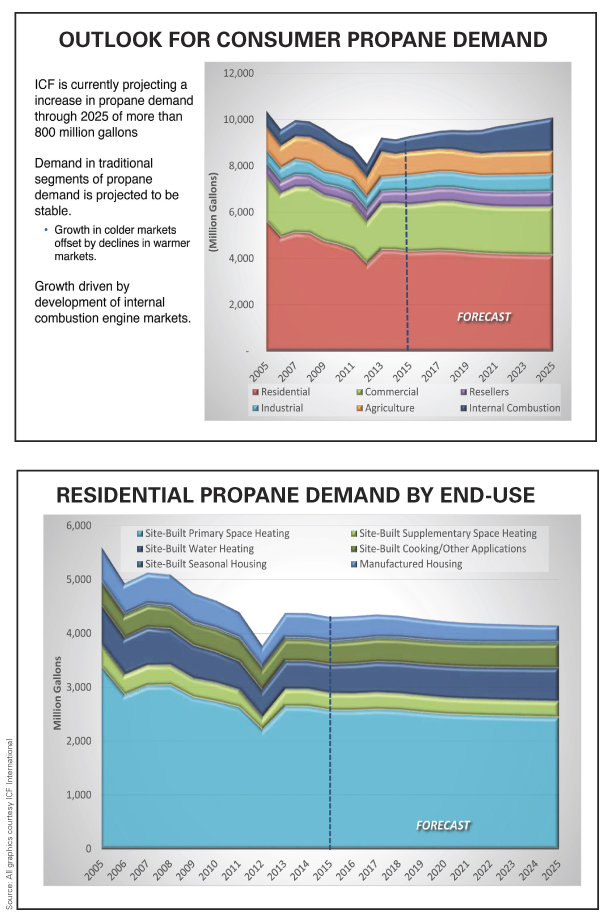

Discussing what he referred to as a “sea change” or a shift in the trend of declining consumer propane demand from about 12 billion gallons per year 10 to 12 years ago to below 9 billion gallons per year over the past several years, ICF International expects the propane industry to recapture a fairly significant share of those losses, with an estimated growth of more than 800 million gallons by 2025.

“Most of that is driven by growth in engine fuel demand,” Sloan stated. “There are fairly significant opportunities in off-road irrigation and mowers. In addition, ICF expects propane consumption in the propane autogas sectors to rise steadily to more than 1 billion gallons by 2020 and 1.6 billion gallons by 2025.”

A good portion of Sloan’s PERC presentation focused on the engine fuel sector, noting that slightly fewer than 13,000 new propane vehicles sold in 2014. “But we expect that number to grow to more than 50,000 units per year by 2025,” he noted.

Outlook for the forklift market is not quite as favorable, he stated. Competition from electric forklifts is expected to remain a challenge in the market. ICF is seeing a rebound in sales of conventional forklifts, but various factors are driving the forklift market toward smaller and tighter forklifts that favor the electric forklifts, he said. But propane will continue to be competitive and see growth relative to gasoline forklifts.

Agricultural markets such as irrigation should see modest growth supported by agricultural engine applications. The grain drying load is likely to decline because of continuing improvements in efficiency.

Continuing a positive outlook for the residential sector, he noted that propane site-built space-heated households increased from 5.54 million in 2012 to 5.57 million in 2014 and are expected to increase to 5.90 million by 2025, with growth primarily in the New England and Mid-Atlantic regions. Manufactured housing is expected to continue to decline, from 958,000 in 2014 to 706,000 by 2025.

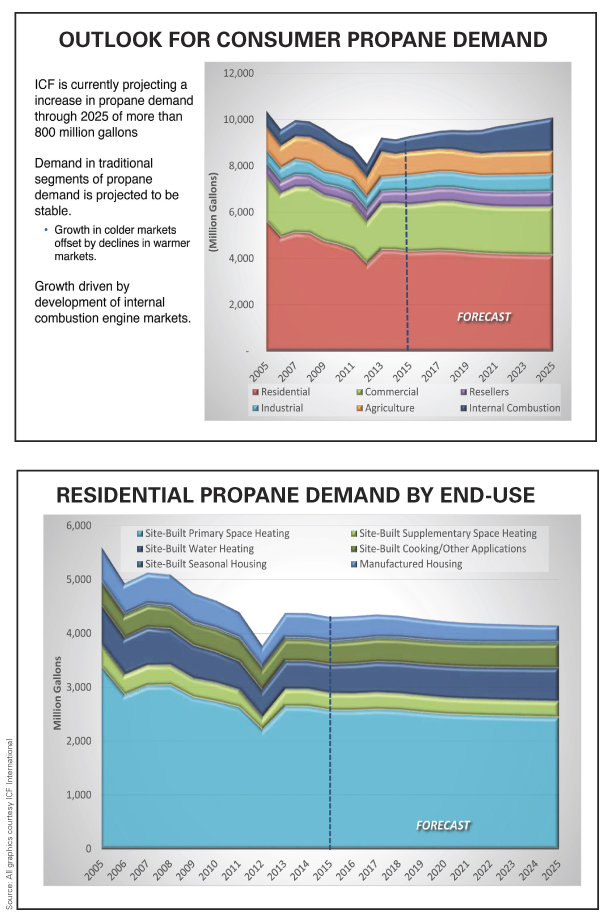

The recent decline in propane prices relative to electricity and natural gas is expected to lead to growth in propane market share. The propane new construction market is expected to increase substantially through 2017.

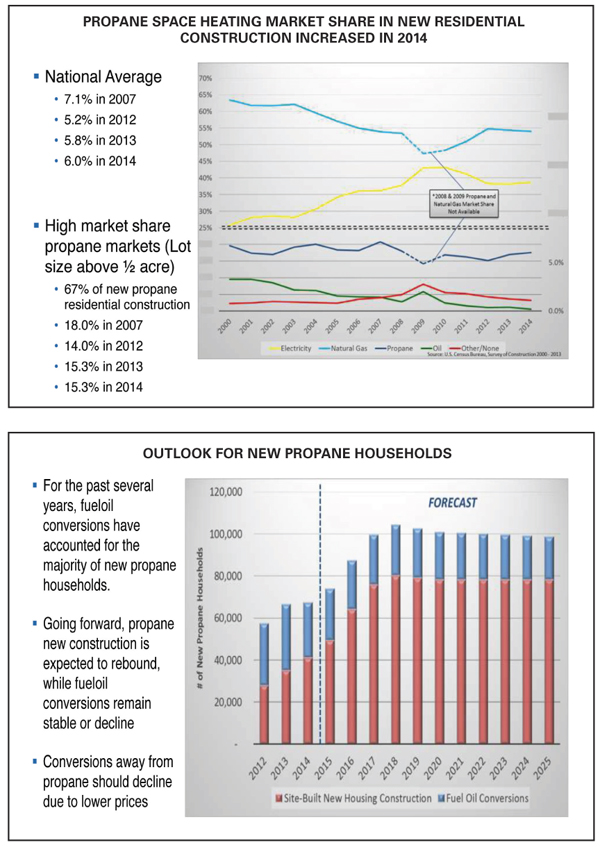

ICF forecasts that propane new construction is expected to rebound, while fueloil conversions remain stable or decline. Conversions away from propane should decline due to lower prices.

Sloan, making his comments at a meeting of the Propane Education & Research Council (PERC) meeting Nov. 6, provided some highlights of ICF’s 2016 Propane Market Outlook, which was scheduled to be released soon after the meeting. He added that long-term efficiency trends will continue to reduce the amount of propane used per customer. Commercial markets are expected to remain relatively stable.

Discussing what he referred to as a “sea change” or a shift in the trend of declining consumer propane demand from about 12 billion gallons per year 10 to 12 years ago to below 9 billion gallons per year over the past several years, ICF International expects the propane industry to recapture a fairly significant share of those losses, with an estimated growth of more than 800 million gallons by 2025.

“Most of that is driven by growth in engine fuel demand,” Sloan stated. “There are fairly significant opportunities in off-road irrigation and mowers. In addition, ICF expects propane consumption in the propane autogas sectors to rise steadily to more than 1 billion gallons by 2020 and 1.6 billion gallons by 2025.”

A good portion of Sloan’s PERC presentation focused on the engine fuel sector, noting that slightly fewer than 13,000 new propane vehicles sold in 2014. “But we expect that number to grow to more than 50,000 units per year by 2025,” he noted.

Outlook for the forklift market is not quite as favorable, he stated. Competition from electric forklifts is expected to remain a challenge in the market. ICF is seeing a rebound in sales of conventional forklifts, but various factors are driving the forklift market toward smaller and tighter forklifts that favor the electric forklifts, he said. But propane will continue to be competitive and see growth relative to gasoline forklifts.

Agricultural markets such as irrigation should see modest growth supported by agricultural engine applications. The grain drying load is likely to decline because of continuing improvements in efficiency.

Continuing a positive outlook for the residential sector, he noted that propane site-built space-heated households increased from 5.54 million in 2012 to 5.57 million in 2014 and are expected to increase to 5.90 million by 2025, with growth primarily in the New England and Mid-Atlantic regions. Manufactured housing is expected to continue to decline, from 958,000 in 2014 to 706,000 by 2025.

The recent decline in propane prices relative to electricity and natural gas is expected to lead to growth in propane market share. The propane new construction market is expected to increase substantially through 2017.

ICF forecasts that propane new construction is expected to rebound, while fueloil conversions remain stable or decline. Conversions away from propane should decline due to lower prices.