Tuesday, September 18, 2018

(September 2018) — As students head back to school this fall, a growing number will be transported on school buses that are powered by alternative fuels including propane autogas. School bus manufacturer Blue Bird Corp. (Macon, Ga.) reports that the use of alternative fuels has tripled in the last five years. According to Blue Bird, 12% of the buses in operation in the United States and Canada used alternative fuels in 2017, up from 4% in 2012. Alternative fuels include propane, gasoline, and compressed natural gas; the remainder of the buses were powered by diesel.

As a growing share of the school bus population is powered by alternative fuels, an increasing percentage of the fuel consumed by school buses will be propane autogas. In the most recent figures released by the American School Bus Council (ASBC), there were 480,000 school buses in the United States. Assuming large-capacity buses with diesel engines, ASBC estimated the average fuel use per school bus per year to be 1714 gallons and the total fuel used by all school buses per year to be 822.9 million gallons of diesel.

But the growing number of gallons of autogas being consumed by school buses is only one reason to work to build this business, propane marketers say. Another reason is that autogas is needed year-round by school buses and other fleet vehicles. Five propane marketers recently shared with BPN what they have learned about this market and some of the ways they are working to build the business and their share of it.

Pursuing This Market

“It’s worth pursuing and being open-minded about,” says Mark Denton, vice president of business development with Blossman Gas (Ocean Springs, Miss.). “Anything marketers can do to get year-round business is worth considering. It’s difficult to make it on supplemental heating alone; we need to create year-round business, whether it’s water heaters, forklifts, or on-the-road vehicles.”

Blossman Gas, a founding member of Alliance AutoGas, currently services about a dozen school districts in the Southeast. The company has a long history with autogas.

“Once customers have made the switch to propane autogas, they tend to stick with it,” Denton says, adding that when customers have seen that the cost savings and other benefits are real, they are likely to keep adding autogas-fueled buses to their fleet.

Suburban Propane (Whippany, N.J.), too, has seen growth in the school bus market. The company services a wide scope of school districts located all around the country. The districts range from those with a fleet of five buses to those with several hundred.

“While autogas conversions have been part of our history for many years, we have been actively involved in providing solutions to school districts for the last five years and, more recently, our growth in this area has accelerated,” says Christina Roberts, national autogas representative with Suburban Propane.

“According to PERC, more than 15,000 propane-fueled school buses are on the road today, transporting more than 1 million students in 48 states,” she adds. “This is a high-growth area for Suburban Propane and the industry in general and we expect it to continue.”

Ferrellgas (Liberty, Mo.) promotes to potential customers that it has the experience, resources, and strategic partnerships to make a fleet’s transition to propane autogas a success.

“Autogas is the fastest-growing segment in our industry and we’ve seen double-digit growth even in years where the spread between propane and traditional fuels has compressed,” says Nathan Ediger, director of autogas sales at Ferrellgas. “With gasoline demand at record levels, we are again seeing the spread widen, which should support continued growth.”

“Propane is still primarily a heating fuel and we remain very active with our residential and industrial heating customers, but we can’t always depend on colder weather,” Ediger adds. “Autogas, like our forklift and Blue Rhino business, is non-weather-related and school buses today are used nearly year-round to support summer school and community events. These gallons level our winter/summer buys and build allocation for when demand increases. Growth of non-weather-related segments will remain a priority in the foreseeable future at Ferrellgas.”

ARRO Autogas (Paso Robles, Calif.) services approximately two dozen school districts. ARRO Autogas has been an established brand since 2008; its parent company, Delta Liquid Energy, has been providing service for school buses since the late 1990s. Each of the districts ARRO Autogas services today runs anywhere from two to 200 school buses.

“Many of our districts operate in rural areas of the state where the range and horsepower a propane school bus provides is important,” says Allison Platz, marketing manager with Delta Liquid Energy. “Others are in more urban areas of the state.”

“Propane school buses are being used across the country,” she adds. “Currently, over 800 school districts in the U.S. are transporting students every day in propane-powered buses, according to the Propane Education & Research Council. We hope to see these figures continue to grow. Each of the major school bus manufacturers are producing a propane-powered model, so this gives school districts options when they are ready to upgrade their current fleet.”

Wilson Oil and Propane (Wallingford, Pa.) entered the autogas market four years ago. The company has a dedicated sales rep for the autogas market.

“Autogas in general is an untapped market,” says David O’Connell, president of Wilson Oil and Propane. “Pretty much all the other markets for propane are well established–not tapped out, but mature. Autogas is untapped. There’s lots of potential to talk to school districts about how they can green up their fleets and save money.”

From their experience talking to school districts, promoting the benefits of propane autogas, and helping customers convert their fleets to this fuel, these five propane marketers have learned what it takes to succeed in this market.

Getting to Know the Players

When Wilson Oil and Propane entered the autogas market four years ago, the first thing its staff did was travel to Detroit to meet the manufacturers of the alternative-fuel systems and get to know the technology.

“We traveled to Detroit and met with Todd Mouw at ROUSH and Albert Venezio at Icom,” O’Connell says. “We wanted to get an understanding of the technology, the applications, and what to look for. We have a dedicated sales rep for the autogas market and we sent her to Detroit, too, to get to know the players.”

As Wilson Oil and Propane works to earn business in the school bus market, they get to know the local players in that market too.

“We have joined some organizations in regard to schools; we are a member of Clean Cities in Philadelphia as well as a local organization for school district transportation managers,” O’Connell says. “We attend their trade shows and meetings, advertise in their newsletter, and contribute to their fundraising. It’s a close-knit community, so we try to meet the people. As in any other market, the more people you know, the better.”

Promoting the Benefits

The most compelling factor that leads school districts to propane autogas is the cost savings, says Ediger of Ferrellgas. “Most districts lock in prices for 12- to 24-month periods and remove fuel volatility from their budgets,” he explains. “This allows those emergency funds to go directly into the classroom where they belong.”

Still, Ediger adds, there are other benefits that keep the propane school bus market growing even when the spread between propane and traditional fuels has compressed. Beyond the lower cost of the fuel, there’s lower cost of maintenance, faster warm-up, quieter operation, and cleaner running.

“Remember, propane is used inside buildings in forklift applications every day, that’s how clean it is,” Ediger notes. “Every time a bus door opens, it creates a vacuum and exposes passengers to the elements outside; this includes emissions produced by gasoline or diesel.”

“Education is the key when working with dealers and transportation managers,” he adds, “so when the Ferrellgas team isn’t installing new systems, we’re working to answer questions and provide facts about the benefits of propane. Nineteen out of the 25 largest school districts across the country use propane buses as their primary transportation fuel, so those who do their homework are quick to see the value.”

Utilizing Third-Party Resources

When contacting school districts, Suburban Propane makes use of material available from the Propane Education & Research Council (PERC). Marketing resources available from PERC for the autogas market include a mailer, a print ad, case studies, videos, fact sheets, and brochures.

“PERC provides excellent material that includes all of the benefits of converting from diesel to propane,” says Roberts of Suburban Propane. “We utilize these materials with school districts, which helps to reiterate the benefits and comes from a third-party source.

“We can also supply referrals from existing districts that we have converted who are now reaping the benefits of conversion to propane autogas,” she adds.

There are many benefits to the fleet customer, but the most compelling is the lower cost of ownership. “The primary factor is the lower total cost of ownership of propane buses versus those operating on diesel. Propane buses require less oil by volume versus diesel, with no need for additional filters or diesel emission fluid,” she explains. “The savings by switching to propane enable school districts to reallocate budget dollars toward teachers, supplies, and programs.”

Other benefits of propane buses include quieter operation, faster startup and warmup in cold weather, reduced emissions, and the fact that propane is a domestic fuel.

Building Coalitions

Denton of Blossman Gas has been working to build support for school bus conversion to autogas. He has been contacting state associations and propane marketers in the mid-Atlantic and Southeast regions and encouraging them to work together and lobby state officials to use VW Settlement funds for the conversion to autogas.

“The state associations have been very responsive,” Denton says. “When there is interest, I accompany them to meetings with local officials as an information resource.”

“I’ve been making the case for propane marketers to reach out to their school districts,” he adds. “The results have been mixed; some marketers are excited and ready to start an autogas program with their local school districts. Others aren’t interested in autogas because they tried it in the 1970s and ’80s, had a bad experience with old technology, and are closed to it now; or they are solely focused on the residential and commercial markets.”

Offering Refueling Options

With public and private refueling stations throughout California and southern Nevada, and the ability to construct a private station at a customer’s location, ARRO Autogas offers fleet managers options when it comes to refueling infrastructure.

“Many school districts like the convenience and ease of having the refueling site directly on their property and we will scale it to a size that will best fit with their needs,” says Platz of Delta Liquid Energy. “If a district is refueling two buses, their infrastructure will be less complex than a district refueling 10 buses. We will help direct schools into the size infrastructure that works best for their fleet.

“Our public network offers a unique opportunity for school districts–they can use one or all of our 24-hour/seven-day-a-week refueling sites to fill up while the drivers are on their route or before they go back to the bus yard,” she adds. “These refueling sites are located near one another and are on the properties of our service station partners. This gives the bus drivers the flexibility to refuel at a location that is most convenient for them when they need fuel. Some school districts prefer this route because they enjoy being able to fill up where they want, when they want.”

Competing with Electric

In California especially, one of the challenges in the school bus market is the trend to electrify everything. As with many other applications, propane buses must compete with electric ones.

“One concern in California is the lack of funding,” says Platz. “Most school districts do not have the ability to pay for these buses and equipment out of pocket — they rely on grants and incentives. The governmental entities that disperse these funding opportunities have chosen to allot most funding to electric school bus opportunities in our state. This gives a huge barrier to entry for many districts who would prefer to purchase propane-powered buses.”

At the same time, the benefits of propane-powered school buses keep them competitive with all the other alternatives. Key benefits include lower emissions, quieter operation, easy refueling and maintenance, and affordable fuel.

“In comparison to all the other alternative fuel options currently available, propane will show school districts the quickest return on their investment — factoring in both the price of our fuel and the cost to implement refueling infrastructure,” Platz says.

“Many districts see a return on their investment within the first few years of running propane buses; this allows them to put those savings to use in the classroom,” she adds.

Knowing the Customer

“To build demand for autogas in the school bus market, propane marketers need to talk to the right people — people responsible for a school district’s expenses — and deliver the right information,” says Denton of Blossman Gas.

“We communicate that autogas is a cleaner, more affordable, domestic product.”

The most common questions and concerns he hears from school district officials have to do with cost, safety, ease of use, and maintenance. They ask what it will cost to make the conversion, what the fuel will cost, how safe the vehicles will be, whether drivers will need to be trained to refuel their buses, and whether the school district’s shop will have to be modified for servicing the buses.

“If you think about it, to school district officials, propane is a new product. They have been fueling buses with diesel or gasoline for 20 years,” Denton says. “Their experience is with those fuels. Their mechanics are trained to work on vehicles that use those fuels. People often feel uncomfortable with change.”

“It’s can be a huge hill to climb to convert those who have been running diesel or gasoline for their buses,” he adds. “I talked with someone who thought propane was more expensive than diesel because he called a local cylinder provider and got the price of a grill cylinder refill. So, there’s misinformation out there and there’s a lack of information out there.”

In addition to the cost of the fuel, there’s the cost of the refueling infrastructure. Denton explains to school district officials that, typically, school districts only pay for the parts of the infrastructure that can’t be removed; anything that is portable, is leased.

“Early on, they think they have to buy all this equipment; when they learn they can lease some of it, it’s a different conversation,” he says. “They don’t know this until you go in and talk to them.”

Providing Options

When school districts are considering converting a school bus fleet to propane autogas, their questions typically center around on-site fueling, explains Roberts of Suburban Propane. With its 90 years of experience in the propane industry and its significant relationships with a wide scope of equipment vendors, Suburban Propane can meet with school districts, determine their needs, and suggest a variety of options.

“Most school bus fleets already have onsite fueling for conventional fuels and they want to be able to maintain this convenience with propane. There are also a lot of questions about the dispensing equipment, fuel management systems, and training.

“Suburban Propane has relationships with a wide scope of equipment vendors, which enables us to provide the customer with a variety of equipment options,” she adds. “They can choose the system that best meets their needs and budget, from very sophisticated, to very simple.

“As part of our analysis in determining what they need, we will visit their site, analyze their fleet, determine the best location for fueling that meets all of the local codes and regulations, and assist them with permitting and installation. Once the system is installed, we will train them on every aspect of refueling. We can also help them incorporate any fuel management data into their existing system.”

Providing Full Service

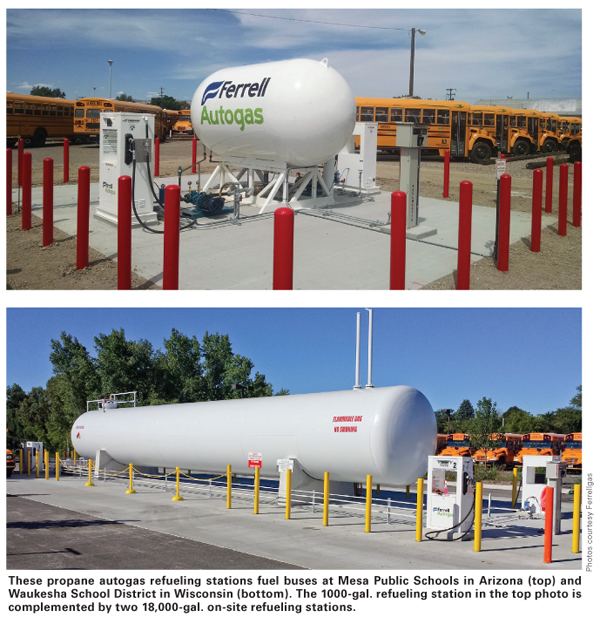

When promoting autogas for school buses, the sorts of questions propane marketers hear from school districts are different from the ones they heard just a few years ago, says Ediger of Ferrellgas.

“The major school bus manufacturers are seeing tremendous growth in the propane bus market and have experienced and dedicated staff to support this segment,” he notes. “For that reason, we are seeing fewer questions about the safety and performance of the bus and more focus on fueling equipment and pricing options.”

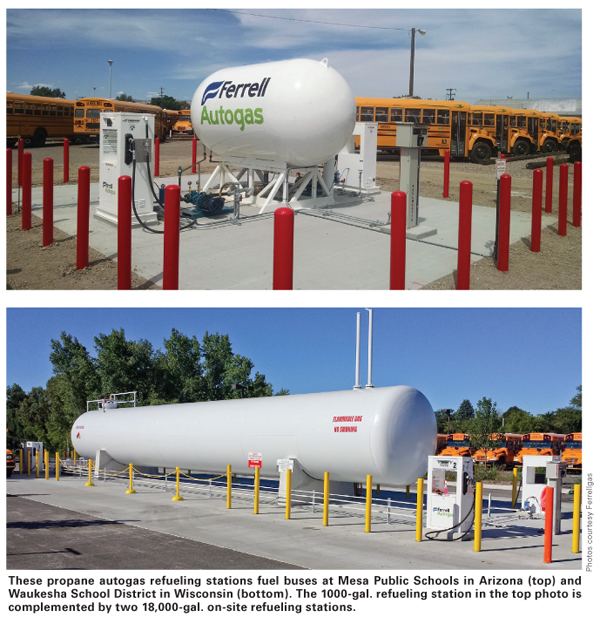

“Equipment questions are related to the size of the fleet, future plans for expansion, and what capacity is needed on site to support that volume,” Ediger adds. “Most installations are a couple 1000-gallon tanks with a single dispenser, but the more elaborate systems include multiple fuel dispensers, fuel management, and large-capacity tanks of 18,000 to 30,000 gallons. We’ve installed hundreds of stations over the years and knowing how to size according to the fleet is important for pricing and the overall customer experience.”

Ferrellgas, he notes, is a full-service propane provider. The company not only supplies the fuel, but also manages all parts of the installation, training, and maintenance.

Understanding Customer Needs

School districts may have needs that are different from other customers. When buying fuel, for example, they may have a long approval process and require a fixed price.

“A lot of school districts look for fixed pricing on propane,” says O’Connell of Wilson Oil and Propane. “One year or two years is the most common bid request I see. Some want three years, which is challenging. Some school districts want us to hold a price for 30 days to 60 days while they go through their approval process. That is difficult to accommodate in a volatile commodity market.”

In addition, different school districts may have different needs when it comes to refueling infrastructure. Wilson Oil and Propane can offer them setups with fuel capacity ranging from 1000 gallons to 30,000 gallons.

“Pennsylvania has a great grant program and that has provided funding to school districts to offset the cost of not only the buses, but also the infrastructure,” O’Connell says.

“Some school districts start off small, so they fuel off a bobtail first and then grow into the infrastructure,” he adds. “Other school districts start off with 10 or 20 buses and need infrastructure right off the bat. There’s no real rhyme or reason; it could be that they just want to try it out first and crawl before they walk.”

Questions on these topics — pricing and infrastructure — are the ones Wilson Oil and Propane hears most often from school districts.

“Most school districts have already been approached by the bus representatives, so questions about the technology and the benefits of the buses have already been answered by Blue Bird reps,” O’Connell says. “It’s not that we can’t answer those questions, but the Blue Bird reps have those covered. For us, the questions center around pricing and infrastructure.”

Explaining Rebates, Incentives

Suburban Propane is offering an Environmental Improvement Rebate that gives qualified districts up to a $5000 rebate towards every school bus fueled by propane autogas when they become a Suburban Propane customer. Terms and conditions apply. For details, see www.suburbanpropane.com/offer120/.

In addition, various states around the country have their own incentives and rebates. Suburban Propane representatives help customers understand what they may be eligible for.

“Generally, the benefit of converting and operating a fleet on propane is more economically viable based on the lower total cost of ownership alone, without consideration of any incentives or rebates that might be available,” says Roberts. “Suburban Propane announced an Environmental Improvement Rebate at the beginning of the year. School districts that convert and sign a new fueling contract with Suburban Propane are eligible to apply.” —Steve Relyea

As a growing share of the school bus population is powered by alternative fuels, an increasing percentage of the fuel consumed by school buses will be propane autogas. In the most recent figures released by the American School Bus Council (ASBC), there were 480,000 school buses in the United States. Assuming large-capacity buses with diesel engines, ASBC estimated the average fuel use per school bus per year to be 1714 gallons and the total fuel used by all school buses per year to be 822.9 million gallons of diesel.

But the growing number of gallons of autogas being consumed by school buses is only one reason to work to build this business, propane marketers say. Another reason is that autogas is needed year-round by school buses and other fleet vehicles. Five propane marketers recently shared with BPN what they have learned about this market and some of the ways they are working to build the business and their share of it.

Pursuing This Market

“It’s worth pursuing and being open-minded about,” says Mark Denton, vice president of business development with Blossman Gas (Ocean Springs, Miss.). “Anything marketers can do to get year-round business is worth considering. It’s difficult to make it on supplemental heating alone; we need to create year-round business, whether it’s water heaters, forklifts, or on-the-road vehicles.”

Blossman Gas, a founding member of Alliance AutoGas, currently services about a dozen school districts in the Southeast. The company has a long history with autogas.

“Once customers have made the switch to propane autogas, they tend to stick with it,” Denton says, adding that when customers have seen that the cost savings and other benefits are real, they are likely to keep adding autogas-fueled buses to their fleet.

Suburban Propane (Whippany, N.J.), too, has seen growth in the school bus market. The company services a wide scope of school districts located all around the country. The districts range from those with a fleet of five buses to those with several hundred.

“While autogas conversions have been part of our history for many years, we have been actively involved in providing solutions to school districts for the last five years and, more recently, our growth in this area has accelerated,” says Christina Roberts, national autogas representative with Suburban Propane.

“According to PERC, more than 15,000 propane-fueled school buses are on the road today, transporting more than 1 million students in 48 states,” she adds. “This is a high-growth area for Suburban Propane and the industry in general and we expect it to continue.”

Ferrellgas (Liberty, Mo.) promotes to potential customers that it has the experience, resources, and strategic partnerships to make a fleet’s transition to propane autogas a success.

“Autogas is the fastest-growing segment in our industry and we’ve seen double-digit growth even in years where the spread between propane and traditional fuels has compressed,” says Nathan Ediger, director of autogas sales at Ferrellgas. “With gasoline demand at record levels, we are again seeing the spread widen, which should support continued growth.”

“Propane is still primarily a heating fuel and we remain very active with our residential and industrial heating customers, but we can’t always depend on colder weather,” Ediger adds. “Autogas, like our forklift and Blue Rhino business, is non-weather-related and school buses today are used nearly year-round to support summer school and community events. These gallons level our winter/summer buys and build allocation for when demand increases. Growth of non-weather-related segments will remain a priority in the foreseeable future at Ferrellgas.”

ARRO Autogas (Paso Robles, Calif.) services approximately two dozen school districts. ARRO Autogas has been an established brand since 2008; its parent company, Delta Liquid Energy, has been providing service for school buses since the late 1990s. Each of the districts ARRO Autogas services today runs anywhere from two to 200 school buses.

“Many of our districts operate in rural areas of the state where the range and horsepower a propane school bus provides is important,” says Allison Platz, marketing manager with Delta Liquid Energy. “Others are in more urban areas of the state.”

“Propane school buses are being used across the country,” she adds. “Currently, over 800 school districts in the U.S. are transporting students every day in propane-powered buses, according to the Propane Education & Research Council. We hope to see these figures continue to grow. Each of the major school bus manufacturers are producing a propane-powered model, so this gives school districts options when they are ready to upgrade their current fleet.”

Wilson Oil and Propane (Wallingford, Pa.) entered the autogas market four years ago. The company has a dedicated sales rep for the autogas market.

“Autogas in general is an untapped market,” says David O’Connell, president of Wilson Oil and Propane. “Pretty much all the other markets for propane are well established–not tapped out, but mature. Autogas is untapped. There’s lots of potential to talk to school districts about how they can green up their fleets and save money.”

From their experience talking to school districts, promoting the benefits of propane autogas, and helping customers convert their fleets to this fuel, these five propane marketers have learned what it takes to succeed in this market.

Getting to Know the Players

When Wilson Oil and Propane entered the autogas market four years ago, the first thing its staff did was travel to Detroit to meet the manufacturers of the alternative-fuel systems and get to know the technology.

“We traveled to Detroit and met with Todd Mouw at ROUSH and Albert Venezio at Icom,” O’Connell says. “We wanted to get an understanding of the technology, the applications, and what to look for. We have a dedicated sales rep for the autogas market and we sent her to Detroit, too, to get to know the players.”

As Wilson Oil and Propane works to earn business in the school bus market, they get to know the local players in that market too.

“We have joined some organizations in regard to schools; we are a member of Clean Cities in Philadelphia as well as a local organization for school district transportation managers,” O’Connell says. “We attend their trade shows and meetings, advertise in their newsletter, and contribute to their fundraising. It’s a close-knit community, so we try to meet the people. As in any other market, the more people you know, the better.”

Promoting the Benefits

The most compelling factor that leads school districts to propane autogas is the cost savings, says Ediger of Ferrellgas. “Most districts lock in prices for 12- to 24-month periods and remove fuel volatility from their budgets,” he explains. “This allows those emergency funds to go directly into the classroom where they belong.”

Still, Ediger adds, there are other benefits that keep the propane school bus market growing even when the spread between propane and traditional fuels has compressed. Beyond the lower cost of the fuel, there’s lower cost of maintenance, faster warm-up, quieter operation, and cleaner running.

“Remember, propane is used inside buildings in forklift applications every day, that’s how clean it is,” Ediger notes. “Every time a bus door opens, it creates a vacuum and exposes passengers to the elements outside; this includes emissions produced by gasoline or diesel.”

“Education is the key when working with dealers and transportation managers,” he adds, “so when the Ferrellgas team isn’t installing new systems, we’re working to answer questions and provide facts about the benefits of propane. Nineteen out of the 25 largest school districts across the country use propane buses as their primary transportation fuel, so those who do their homework are quick to see the value.”

Utilizing Third-Party Resources

When contacting school districts, Suburban Propane makes use of material available from the Propane Education & Research Council (PERC). Marketing resources available from PERC for the autogas market include a mailer, a print ad, case studies, videos, fact sheets, and brochures.

“PERC provides excellent material that includes all of the benefits of converting from diesel to propane,” says Roberts of Suburban Propane. “We utilize these materials with school districts, which helps to reiterate the benefits and comes from a third-party source.

“We can also supply referrals from existing districts that we have converted who are now reaping the benefits of conversion to propane autogas,” she adds.

There are many benefits to the fleet customer, but the most compelling is the lower cost of ownership. “The primary factor is the lower total cost of ownership of propane buses versus those operating on diesel. Propane buses require less oil by volume versus diesel, with no need for additional filters or diesel emission fluid,” she explains. “The savings by switching to propane enable school districts to reallocate budget dollars toward teachers, supplies, and programs.”

Other benefits of propane buses include quieter operation, faster startup and warmup in cold weather, reduced emissions, and the fact that propane is a domestic fuel.

Building Coalitions

Denton of Blossman Gas has been working to build support for school bus conversion to autogas. He has been contacting state associations and propane marketers in the mid-Atlantic and Southeast regions and encouraging them to work together and lobby state officials to use VW Settlement funds for the conversion to autogas.

“The state associations have been very responsive,” Denton says. “When there is interest, I accompany them to meetings with local officials as an information resource.”

“I’ve been making the case for propane marketers to reach out to their school districts,” he adds. “The results have been mixed; some marketers are excited and ready to start an autogas program with their local school districts. Others aren’t interested in autogas because they tried it in the 1970s and ’80s, had a bad experience with old technology, and are closed to it now; or they are solely focused on the residential and commercial markets.”

Offering Refueling Options

With public and private refueling stations throughout California and southern Nevada, and the ability to construct a private station at a customer’s location, ARRO Autogas offers fleet managers options when it comes to refueling infrastructure.

“Many school districts like the convenience and ease of having the refueling site directly on their property and we will scale it to a size that will best fit with their needs,” says Platz of Delta Liquid Energy. “If a district is refueling two buses, their infrastructure will be less complex than a district refueling 10 buses. We will help direct schools into the size infrastructure that works best for their fleet.

“Our public network offers a unique opportunity for school districts–they can use one or all of our 24-hour/seven-day-a-week refueling sites to fill up while the drivers are on their route or before they go back to the bus yard,” she adds. “These refueling sites are located near one another and are on the properties of our service station partners. This gives the bus drivers the flexibility to refuel at a location that is most convenient for them when they need fuel. Some school districts prefer this route because they enjoy being able to fill up where they want, when they want.”

Competing with Electric

In California especially, one of the challenges in the school bus market is the trend to electrify everything. As with many other applications, propane buses must compete with electric ones.

“One concern in California is the lack of funding,” says Platz. “Most school districts do not have the ability to pay for these buses and equipment out of pocket — they rely on grants and incentives. The governmental entities that disperse these funding opportunities have chosen to allot most funding to electric school bus opportunities in our state. This gives a huge barrier to entry for many districts who would prefer to purchase propane-powered buses.”

At the same time, the benefits of propane-powered school buses keep them competitive with all the other alternatives. Key benefits include lower emissions, quieter operation, easy refueling and maintenance, and affordable fuel.

“In comparison to all the other alternative fuel options currently available, propane will show school districts the quickest return on their investment — factoring in both the price of our fuel and the cost to implement refueling infrastructure,” Platz says.

“Many districts see a return on their investment within the first few years of running propane buses; this allows them to put those savings to use in the classroom,” she adds.

Knowing the Customer

“To build demand for autogas in the school bus market, propane marketers need to talk to the right people — people responsible for a school district’s expenses — and deliver the right information,” says Denton of Blossman Gas.

“We communicate that autogas is a cleaner, more affordable, domestic product.”

The most common questions and concerns he hears from school district officials have to do with cost, safety, ease of use, and maintenance. They ask what it will cost to make the conversion, what the fuel will cost, how safe the vehicles will be, whether drivers will need to be trained to refuel their buses, and whether the school district’s shop will have to be modified for servicing the buses.

“If you think about it, to school district officials, propane is a new product. They have been fueling buses with diesel or gasoline for 20 years,” Denton says. “Their experience is with those fuels. Their mechanics are trained to work on vehicles that use those fuels. People often feel uncomfortable with change.”

“It’s can be a huge hill to climb to convert those who have been running diesel or gasoline for their buses,” he adds. “I talked with someone who thought propane was more expensive than diesel because he called a local cylinder provider and got the price of a grill cylinder refill. So, there’s misinformation out there and there’s a lack of information out there.”

In addition to the cost of the fuel, there’s the cost of the refueling infrastructure. Denton explains to school district officials that, typically, school districts only pay for the parts of the infrastructure that can’t be removed; anything that is portable, is leased.

“Early on, they think they have to buy all this equipment; when they learn they can lease some of it, it’s a different conversation,” he says. “They don’t know this until you go in and talk to them.”

Providing Options

When school districts are considering converting a school bus fleet to propane autogas, their questions typically center around on-site fueling, explains Roberts of Suburban Propane. With its 90 years of experience in the propane industry and its significant relationships with a wide scope of equipment vendors, Suburban Propane can meet with school districts, determine their needs, and suggest a variety of options.

“Most school bus fleets already have onsite fueling for conventional fuels and they want to be able to maintain this convenience with propane. There are also a lot of questions about the dispensing equipment, fuel management systems, and training.

“Suburban Propane has relationships with a wide scope of equipment vendors, which enables us to provide the customer with a variety of equipment options,” she adds. “They can choose the system that best meets their needs and budget, from very sophisticated, to very simple.

“As part of our analysis in determining what they need, we will visit their site, analyze their fleet, determine the best location for fueling that meets all of the local codes and regulations, and assist them with permitting and installation. Once the system is installed, we will train them on every aspect of refueling. We can also help them incorporate any fuel management data into their existing system.”

Providing Full Service

When promoting autogas for school buses, the sorts of questions propane marketers hear from school districts are different from the ones they heard just a few years ago, says Ediger of Ferrellgas.

“The major school bus manufacturers are seeing tremendous growth in the propane bus market and have experienced and dedicated staff to support this segment,” he notes. “For that reason, we are seeing fewer questions about the safety and performance of the bus and more focus on fueling equipment and pricing options.”

“Equipment questions are related to the size of the fleet, future plans for expansion, and what capacity is needed on site to support that volume,” Ediger adds. “Most installations are a couple 1000-gallon tanks with a single dispenser, but the more elaborate systems include multiple fuel dispensers, fuel management, and large-capacity tanks of 18,000 to 30,000 gallons. We’ve installed hundreds of stations over the years and knowing how to size according to the fleet is important for pricing and the overall customer experience.”

Ferrellgas, he notes, is a full-service propane provider. The company not only supplies the fuel, but also manages all parts of the installation, training, and maintenance.

Understanding Customer Needs

School districts may have needs that are different from other customers. When buying fuel, for example, they may have a long approval process and require a fixed price.

“A lot of school districts look for fixed pricing on propane,” says O’Connell of Wilson Oil and Propane. “One year or two years is the most common bid request I see. Some want three years, which is challenging. Some school districts want us to hold a price for 30 days to 60 days while they go through their approval process. That is difficult to accommodate in a volatile commodity market.”

In addition, different school districts may have different needs when it comes to refueling infrastructure. Wilson Oil and Propane can offer them setups with fuel capacity ranging from 1000 gallons to 30,000 gallons.

“Pennsylvania has a great grant program and that has provided funding to school districts to offset the cost of not only the buses, but also the infrastructure,” O’Connell says.

“Some school districts start off small, so they fuel off a bobtail first and then grow into the infrastructure,” he adds. “Other school districts start off with 10 or 20 buses and need infrastructure right off the bat. There’s no real rhyme or reason; it could be that they just want to try it out first and crawl before they walk.”

Questions on these topics — pricing and infrastructure — are the ones Wilson Oil and Propane hears most often from school districts.

“Most school districts have already been approached by the bus representatives, so questions about the technology and the benefits of the buses have already been answered by Blue Bird reps,” O’Connell says. “It’s not that we can’t answer those questions, but the Blue Bird reps have those covered. For us, the questions center around pricing and infrastructure.”

Explaining Rebates, Incentives

Suburban Propane is offering an Environmental Improvement Rebate that gives qualified districts up to a $5000 rebate towards every school bus fueled by propane autogas when they become a Suburban Propane customer. Terms and conditions apply. For details, see www.suburbanpropane.com/offer120/.

In addition, various states around the country have their own incentives and rebates. Suburban Propane representatives help customers understand what they may be eligible for.

“Generally, the benefit of converting and operating a fleet on propane is more economically viable based on the lower total cost of ownership alone, without consideration of any incentives or rebates that might be available,” says Roberts. “Suburban Propane announced an Environmental Improvement Rebate at the beginning of the year. School districts that convert and sign a new fueling contract with Suburban Propane are eligible to apply.” —Steve Relyea