Selling your business is a major decision. You’ve spent years working hard to grow your business and increase its value. You’ve hired and trained the right people, taken good care of your customers and been an active supporter of your local community while building a great reputation along the way. And, hopefully, you’ve learned a few good lessons on your journey. When it comes time to make a transition, you want to do it the right way. And that starts with finding the right buyer. No matter what else, the right buyer is someone who should preserve your legacy.

Before you get to that point, there are several things to consider that will benefit you greatly when it comes time to sell. The Energy Distribution Partners (EDP) team collectively has been involved in more than 200 transactions. The following article lists the most important things we look for when considering an acquisition.

Ensure Your Records Are Accurate

Although we don’t expect every prospective seller to have audited financials, we do expect the books to be accurate, detailed and in good order.

A balance sheet and an income statement that has been prepared or reviewed by a knowledgeable CPA (especially someone who really understands the propane business) is far more well-received than a simple QuickBooks printout.

Some other important records you should ensure are in place ahead of time include:

- Tank agreements — It’s important to have a tank lease or equipment agreement signed by the customer for every company-owned tank. It proves you own the asset and creates “stickiness” with the customer. You should also have records showing precisely how many tanks you own versus how many tanks are customer-owned.

- Nonrecurring seller expenses — Do you keep comprehensive records as to your nonrecurring expenses that would likely not continue with a buyer post-closing? Some examples of these expenses could include club memberships, cellphones and cellular plans, automobile or travel expenses. Make sure you accurately capture those costs so a potential buyer can clearly see which expenses will likely carry forward after the sale and which ones will no longer exist.

- A detailed breakdown of customer segments — What percent of your company’s gallons are residential versus commercial versus agricultural? Knowing and tracking the metrics of these three categories (or more, if you have forklifts, autogas, etc.) is hugely important, given the difference in margin among the various groups.

- Capitalization policy — Document the types of costs you typically expense rather than capitalize. For instance, would you expense an engine on a bobtail, or would you capitalize it? Most costs that will be used or expire within a year are typically expensed, whereas larger expenditures that will provide the business value beyond a year are typically capitalized.

Maintain Your Margins

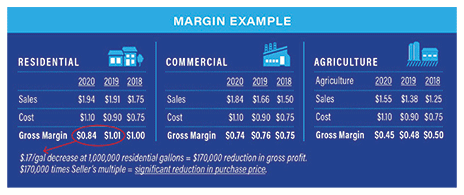

“Margin sustainability” is an extremely important metric to a potential buyer. Have you and your leadership team been able to maintain your margins when prices spiked? In the margin example to the right, you will see that the propane marketer didn’t track with the increasing product costs, and they gave up 17 cents per gallon in residential margin, it resulted in an overall decrease in gross profit of $170,000.

“Margin sustainability” is an extremely important metric to a potential buyer. Have you and your leadership team been able to maintain your margins when prices spiked? In the margin example to the right, you will see that the propane marketer didn’t track with the increasing product costs, and they gave up 17 cents per gallon in residential margin, it resulted in an overall decrease in gross profit of $170,000.

If they were able to sell that business for, say, a seven-times multiple, they would be shorting the company approximately $1.2 million. That’s a big impact on your retirement package!

Prove Your Commitment to Safety

Are you documenting your safety practices? Have all your employees gone through basic Certified Employee Training Program (CETP) training? Keep up-to-date records that show which of your employees have taken what CETP courses and when they took them.

Also, make sure to record any additional noncertified training that has taken place for your employees, such as your state association’s Propane Emergency Response Training (PERT).

And don’t overlook documenting each monthly safety meeting. Keep a record of the topic and materials discussed, along with a sign-in sheet for employees in attendance. Plus, keep your safety manuals updated with verification that each employee has received the latest revision. The safety manual should include a detailed script to use with customers who call to report a gas smell along with an approved form to capture the details of a possible gas leak.

In addition, make sure you have a GASCheck agreement (or equivalent form) in each customer’s file, signed by both the customer and the technician.

In summary, finding the right buyer for your business is of primary importance. You’ll want to sell to someone who shares your same values and will respect your legacy. Paying close attention to these important metrics will pay big dividends when it comes time for you to make the transition.