Thursday, November 2, 2017

With winter 2017-2018 promising supply tightness, Ferrellgas joining Suburban Propane in withholding dues payments to the National Propane Gas Association (NPGA), and a host of 90-day “criticals” requiring legislative outreach, the association board meeting had no shortage of issues to discuss as members gathered in Minneapolis Oct. 1-3.

The topic was primary U.S. inventory 25 MMbbl behind year-ago levels, and the number of people who wanted to discuss it was higher than normal. Extra chairs had to be brought in to accommodate all who wished to join the NPGA Supply and Infrastructure Task Force meeting Oct. 1. The two-hour gathering featured a detailed overview of the U.S. propane supply situation, titled “The Effects of Hurricane Harvey on the U.S. Winter Supply Outlook,” presented by Debnil Chowdhury, U.S. NGL research and consulting lead at IHS Markit (London).

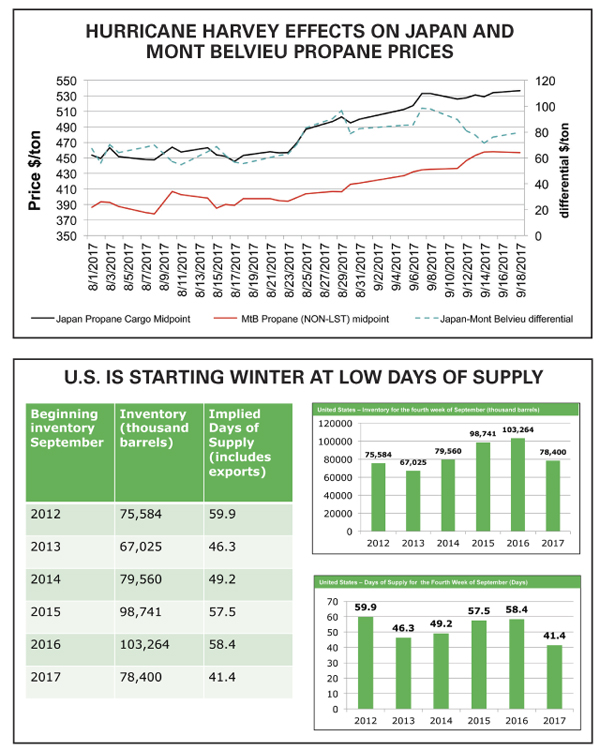

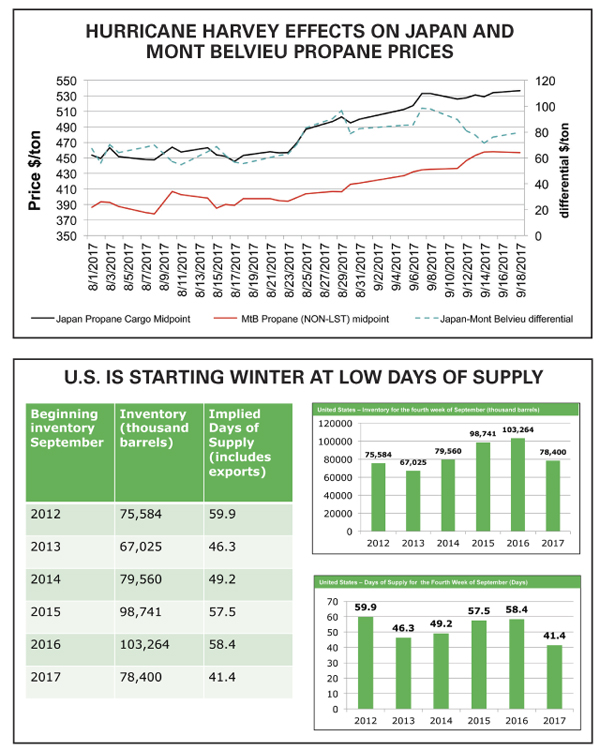

As a packed room of committee members, retail propane marketers, state association executives, and industry stakeholders looked on, Chowdhury detailed how Hurricane Harvey made history, not only with devastating damage in Texas but also as the first U.S. hurricane to impact NGL prices outside the U.S.

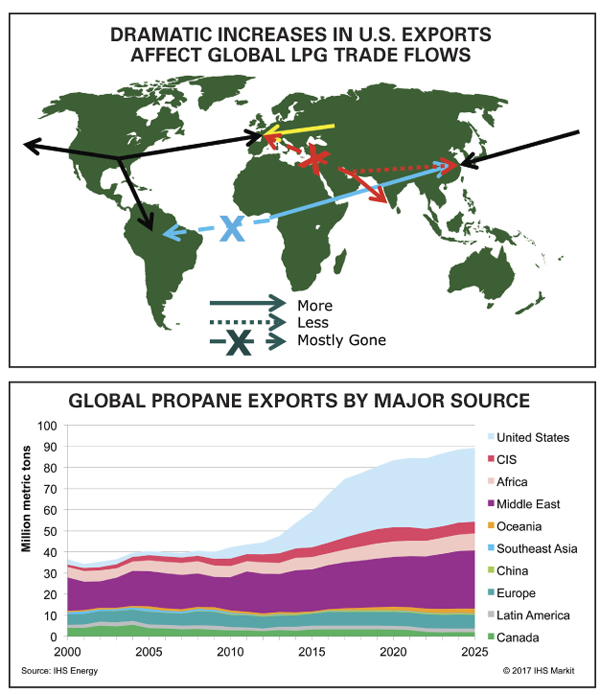

“For the first time, a hurricane caused propane prices to move up significantly around the world when propane was temporarily not accessible from the Gulf,” he said. “Japan was a major importer at a time when shipments from the Gulf were inaccessible.” He noted that despite higher prices from alternative sources in the Middle East, Japan is very strict about keeping 40 days of supply and continued to buy from other sources. During two weeks in September, less than 200,000 bbld were shipped from the Gulf. Energy Information Administration (EIA) inventory data showed U.S. stocks jumped to 82 MMbbl, but then after two weeks exports flew quickly back to 1 MMbbld. By the time of the Oct. 1 meeting, inventory shrank to 78 MMbbl, where it remained through the middle of the month.

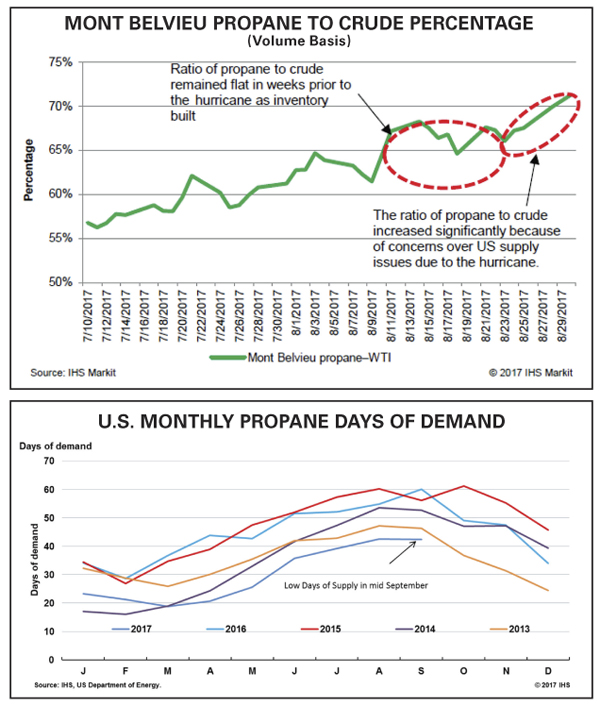

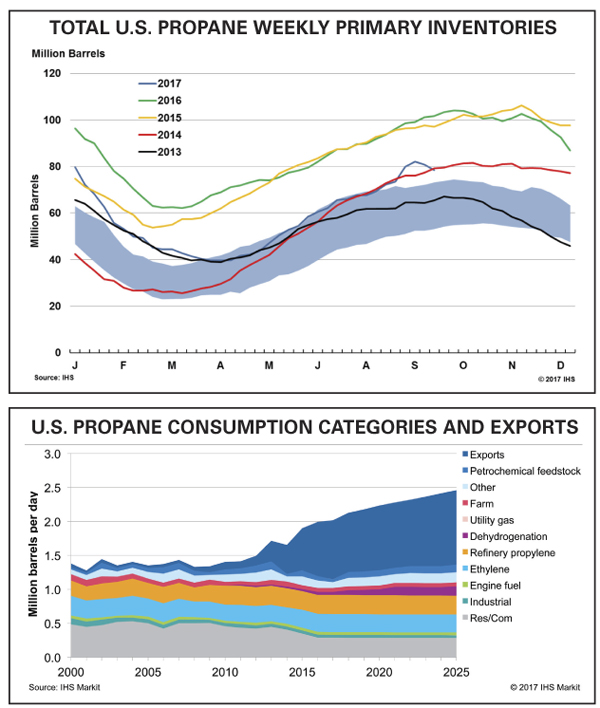

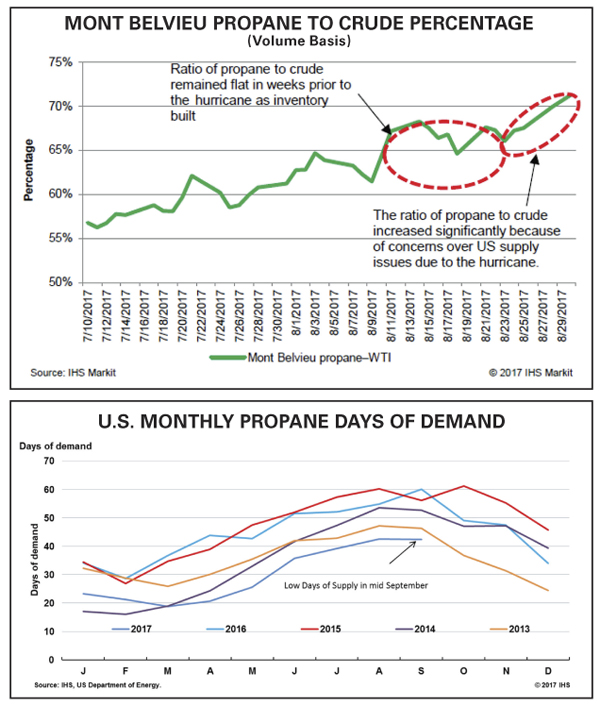

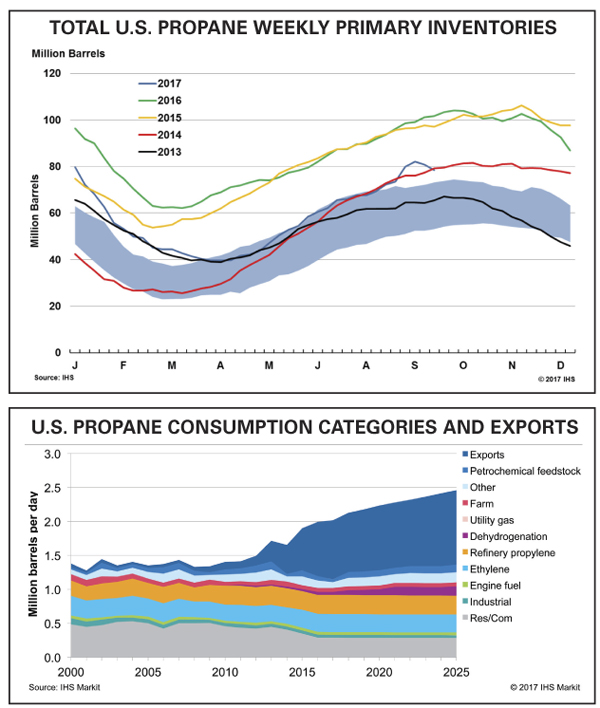

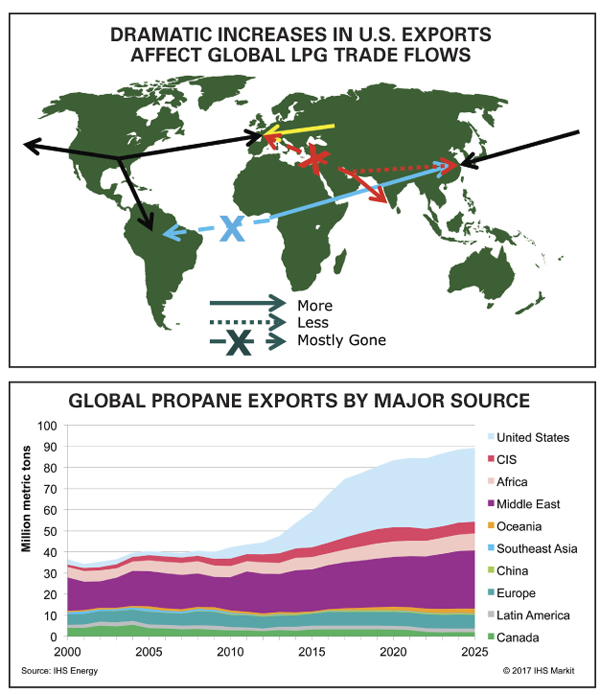

During the weeks after the hurricane, propane from gas plant production began to grow again as U.S. crude and gas production recovered. The impact of the hurricane lasted less than two weeks, but the price increase and rise to a higher percentage of crude oil’s value was more lasting. With Gulf Coast shipments curtailed, Asian LPG prices soared, restoring a marked premium to U.S. product. Higher prices in Asia boosted the incentive to export, which bumped cargos to high levels once again, even higher than expected. Meanwhile, for U.S. chemical demand, propane has been less favored recently due to the abundance and low price of ethane. The hurricane did a lot of damage to new ethane crackers under construction, which may cause ethane to be favored for a longer time than expected before Harvey struck. Ultimately, U.S. ethane demand is expected to increase as the new crackers are brought online and as the capacity to export ethane continues to expand.

Chowdhury then observed that the temporary effects of Hurricane Harvey weren’t enough to overcome the effects of higher exports. He shared data showing implied days of supply at 41.4, even though EIA, which does not yet take exports into account in its days of supply calculation, set it at 81. “The 41.4 level is even lower than 46.3, which was the level at the same time ahead of the Polar Vortex winter of 2013-2014 when major shortages affected the industry in January and February that season,” he said. “Overall, the build season started later than usual and draw season is starting earlier than usual due to exports.”

On the issue of crude oil prices, Chowdhury explained that crude oil prices continue to be a major factor affecting propane prices. “OPEC crude oil cuts also limited propane production in the Middle East, so barrels available for export to Asia were limited. Higher crude oil prices also affect propane because when crude oil prices are higher, naphtha prices are higher. Propane and naphtha are exchangeable in many petrochemical facilities. Higher-priced naphtha presents an opportunity for more sales to northern Asia when the benefit of running propane as a feedstock and demand in Asia increases.”

Chowdhury expects the upcoming U.S. winter to be an average one overall, with 3700 heating degree days, up from the 3200 during the past two warmer-than-normal heating seasons. Therefore, U.S. residential and commercial demand should be higher than last winter. While demand for crop drying was also weak last year, he expected it would be only moderately higher this year.

In the global picture and looking forward to 2025, Chowdhury expects the U.S. to continue to be a major exporter of propane and Asia to continue to be the region to absorb the excess supply. Latin America will also absorb more of the excess.

For this winter, strong exports and heavy demand in the U.S. may put the nation into critical inventory situations along the way. There may be some relief. The Mariner-2 Export Terminal on the East Coast, which will ship ethane, is being delayed until mid-2018. Ethane is a cheaper chemical feedstock. Low-cost ethane for chemical use combined with a warm winter slowed U.S. demand for propane dramatically during the 2014-2015 winter, but propane was more competitive again as prices dipped in 2015-2016.

With the prospects for more degree days and continuing strong export levels, the propane industry will need all the breaks it can get.

Membership Issues

Suburban Propane bailed first, followed by Ferrellgas hitting the offramp. Both national marketers bid adieu to NPGA in recent months, suspending their memberships and withholding dues. Naturally those departures were a major issue of discussion in Minneapolis. On the part of Ferrellgas, the company is withholding payment of its dues until changes it demands are made. A Sept. 14 letter from Jim Ferrell, president and CEO, said that while Ferrellgas has been involved at the highest levels and supportive of industry associations, recent events have caused him to question what it is associations should do. Earlier in the year, Suburban Propane left NPGA, and Ferrell said what he knows of that company’s efforts for the advancement of the industry seem to lead in the right direction, and he believes other propane companies share similar concerns.

Ferrell outlined what he believes should be done to move the industry forward:

Roldan added that the development will have a major adverse effect. Following the May agreement, NPGA reconciled dues with 37 state and regional associations—effectively paying them their portions of the Ferrellgas dues in full, even though the total amount had not yet been collected.

He said code of conduct and membership standards issues raised by Suburban were already being discussed at state association meetings, and with state association executives and NPGA leadership. He noted the affiliation agreement with state associations has been in effect for many years, but said all policies, no matter how longstanding, should always be subject to review. This process began at the Minneapolis board meeting and the policy will also be reviewed at the annual meeting of state executives in November.

While Roldan underscored there is no question that Suburban’s and Ferrellgas’s actions are going to present certain management challenges, he commented that those challenges are no greater than those faced by every marketer member who has had to deal with a polar vortex followed by back-to-back record-warm winters. Leaders of NPGA are to meet with Ferrellgas leaders to further discuss concerns.

90-Day Criticals

An array of policy issues were discussed at the Governmental Affairs Committee meeting, which ran overtime. NPGA maintains a list of “90-Day Criticals,” items that demand immediate focus due to their importance and the need for success to benefit the industry. The following items were discussed in detail at the committee meetings and then presented in summary the next morning at the board of directors meeting.

Tax Reform: With no comprehensive reform of the tax code since 1986, a United Framework from members of Congress and the Trump administration was released Sept. 27, just days before the NPGA board meeting, to outline what a new tax code would look like. “This is an issue where we may have a short window to take some action,” said Phil Squair, NPGA’s senior vice president of public and governmental affairs. “Politically, the House, Senate, and White House are positioned to make this happen. From a procedural standpoint, the Senate is already able to pass tax reform with just 50 votes.” The framework includes many goals that appeal to many in the propane industry: repealing the estate tax, simplifying and lowering corporate and individual tax rates, and enacting immediate expensing of business purchases for at least five years.

Winter Preparedness and Supply: Because of exports, it no longer makes sense to calculate days of supply without including those volumes. Absent their inclusion, a false sense of security is fostered. As discussed at the Supply and Infrastructure Task Force meeting, EIA’s 81 days of supply probably only meant 41.4 days. Agency personnel don’t disagree with including exports in the tally, but no one has stepped forward to take the lead in making the change. The Department of Energy (DOE) has received aggressive communication from both NPGA and the Propane Education & Research Council stressing the need to prepare. Five senators sent a letter to DOE Secretary Rick Perry urging the agency to “incorporate propane export volumes in EIA’s accounting of domestic propane stocks.” NPGA is also pursuing proactive hours-of-service waivers at the U.S. Department of Transportation, and co-hosting regular phone call updates with the Midwestern Governors Association and other regional groups. By continuing to build relationships with key stakeholders in various associations and agencies, it is hoped they will know the issues and operational constraints faced by the propane industry in advance. It was noted in Minneapolis that attention to the Jones Act and exemptions from the 97-year-old cabotage law following hurricanes Harvey, Irma, and Maria could help gain traction for further exemptions. The Jones Act requires American-flagged ships be used to transport products from one U.S. port to another. An exemption from the act would have been helpful in January 2014 when the Northeast was in desperate need of propane from the Gulf Coast, and there were no U.S. ships available to transport propane.

OSHA Crane Operators Compliance: The Occupational Safety and Health Administration (OSHA) had extended a deadline for compliance with third-party certification of crane operators for three years. That was to allow time for a requirement more suitable for small crane operators in the propane industry, but that three years is to expire this month. The industry has been successful in getting an extension for one more year, but the ultimate goal is a rule that doesn’t lump propane employees who simply deliver tanks to customers’ homes in with large crane operators. “OSHA still doesn’t have an administrator,” Squair said. “We will continue to work with congressmembers to put pressure on the Department of Labor to permanently exempt the propane industry from this expensive requirement.” The challenge is now to get OSHA, without an administrator, to accomplish in one year what it could not accomplish in three.

Natural Gas Expansion: The National Association of Regulatory Utility Commissioners (NARUC) established a natural gas access and expansion task force charged with developing best practices and recommendations regarding natural gas service for so called “underserved and unserved” areas of the country. The establishment of this task force, almost certainly pushed by natural gas utilities, may create a possible tilt by NARUC in favor of fuel switching to natural gas. NPGA’s vice president and general counsel, Jeff Petrash, is meeting with members of the task force one-on-one to oppose uneconomic natural gas expansion and to educate them of the role of propane. Meetings so far have been positive and will continue.

Expand Short Haul Exemption: NPGA is pursuing an expansion of the air-mile radius component of the Short Haul Operation exemption. Through the short haul exemption, drivers who operate under specific conditions are not required to maintain Record of Duty Status (RODS) reports. NPGA seeks an expansion of the radius from 100 to 300 air-miles based on improvements in highway accessibility and commercial vehicle technology. This could save the industry $11 million annually in paperwork costs and help marketers serve more customers and grow gallons.

State Engagement: Some state legislatures are moving toward carbon taxes or cap-and-trade programs that view electricity in a much more favorable light than propane. NPGA, state associations, and PERC are working to educate stakeholders at all levels about the importance of accounting for the full fuel cycle when determining efficiency.

Enbridge Line 5 Challenges: The Michigan Propane Gas Association has been working in partnership with NPGA and others to help resolve the challenges of Enbridge’s Line 5 Pipeline, which flows through the Great Lakes region. Many in Northern Michigan want to shut down Line 5 due to environmental concerns should there be a breach in the pipeline. A shutdown of Line 5 would cause major propane supply issues in Michigan and surrounding states. A study found a very small chance for a significant breach before 2050, but the concerns remain. A study of potential solutions such as trucks and railcars replacing the pipeline were found to not be either financially or logistically feasible. One promising potential solution is a $150-million project to encase the $6-billion pipeline to further ensure no leaks can occur. The Michigan attorney general, who is expected to be a candidate for governor in 2018, has spoken in favor of closing Line 5, but appears to want a resolution to the matter that satisfies environmental concerns and allows Line 5 to remain open. —Pat Thornton

The topic was primary U.S. inventory 25 MMbbl behind year-ago levels, and the number of people who wanted to discuss it was higher than normal. Extra chairs had to be brought in to accommodate all who wished to join the NPGA Supply and Infrastructure Task Force meeting Oct. 1. The two-hour gathering featured a detailed overview of the U.S. propane supply situation, titled “The Effects of Hurricane Harvey on the U.S. Winter Supply Outlook,” presented by Debnil Chowdhury, U.S. NGL research and consulting lead at IHS Markit (London).

As a packed room of committee members, retail propane marketers, state association executives, and industry stakeholders looked on, Chowdhury detailed how Hurricane Harvey made history, not only with devastating damage in Texas but also as the first U.S. hurricane to impact NGL prices outside the U.S.

“For the first time, a hurricane caused propane prices to move up significantly around the world when propane was temporarily not accessible from the Gulf,” he said. “Japan was a major importer at a time when shipments from the Gulf were inaccessible.” He noted that despite higher prices from alternative sources in the Middle East, Japan is very strict about keeping 40 days of supply and continued to buy from other sources. During two weeks in September, less than 200,000 bbld were shipped from the Gulf. Energy Information Administration (EIA) inventory data showed U.S. stocks jumped to 82 MMbbl, but then after two weeks exports flew quickly back to 1 MMbbld. By the time of the Oct. 1 meeting, inventory shrank to 78 MMbbl, where it remained through the middle of the month.

During the weeks after the hurricane, propane from gas plant production began to grow again as U.S. crude and gas production recovered. The impact of the hurricane lasted less than two weeks, but the price increase and rise to a higher percentage of crude oil’s value was more lasting. With Gulf Coast shipments curtailed, Asian LPG prices soared, restoring a marked premium to U.S. product. Higher prices in Asia boosted the incentive to export, which bumped cargos to high levels once again, even higher than expected. Meanwhile, for U.S. chemical demand, propane has been less favored recently due to the abundance and low price of ethane. The hurricane did a lot of damage to new ethane crackers under construction, which may cause ethane to be favored for a longer time than expected before Harvey struck. Ultimately, U.S. ethane demand is expected to increase as the new crackers are brought online and as the capacity to export ethane continues to expand.

Chowdhury then observed that the temporary effects of Hurricane Harvey weren’t enough to overcome the effects of higher exports. He shared data showing implied days of supply at 41.4, even though EIA, which does not yet take exports into account in its days of supply calculation, set it at 81. “The 41.4 level is even lower than 46.3, which was the level at the same time ahead of the Polar Vortex winter of 2013-2014 when major shortages affected the industry in January and February that season,” he said. “Overall, the build season started later than usual and draw season is starting earlier than usual due to exports.”

On the issue of crude oil prices, Chowdhury explained that crude oil prices continue to be a major factor affecting propane prices. “OPEC crude oil cuts also limited propane production in the Middle East, so barrels available for export to Asia were limited. Higher crude oil prices also affect propane because when crude oil prices are higher, naphtha prices are higher. Propane and naphtha are exchangeable in many petrochemical facilities. Higher-priced naphtha presents an opportunity for more sales to northern Asia when the benefit of running propane as a feedstock and demand in Asia increases.”

Chowdhury expects the upcoming U.S. winter to be an average one overall, with 3700 heating degree days, up from the 3200 during the past two warmer-than-normal heating seasons. Therefore, U.S. residential and commercial demand should be higher than last winter. While demand for crop drying was also weak last year, he expected it would be only moderately higher this year.

In the global picture and looking forward to 2025, Chowdhury expects the U.S. to continue to be a major exporter of propane and Asia to continue to be the region to absorb the excess supply. Latin America will also absorb more of the excess.

For this winter, strong exports and heavy demand in the U.S. may put the nation into critical inventory situations along the way. There may be some relief. The Mariner-2 Export Terminal on the East Coast, which will ship ethane, is being delayed until mid-2018. Ethane is a cheaper chemical feedstock. Low-cost ethane for chemical use combined with a warm winter slowed U.S. demand for propane dramatically during the 2014-2015 winter, but propane was more competitive again as prices dipped in 2015-2016.

With the prospects for more degree days and continuing strong export levels, the propane industry will need all the breaks it can get.

Membership Issues

Suburban Propane bailed first, followed by Ferrellgas hitting the offramp. Both national marketers bid adieu to NPGA in recent months, suspending their memberships and withholding dues. Naturally those departures were a major issue of discussion in Minneapolis. On the part of Ferrellgas, the company is withholding payment of its dues until changes it demands are made. A Sept. 14 letter from Jim Ferrell, president and CEO, said that while Ferrellgas has been involved at the highest levels and supportive of industry associations, recent events have caused him to question what it is associations should do. Earlier in the year, Suburban Propane left NPGA, and Ferrell said what he knows of that company’s efforts for the advancement of the industry seem to lead in the right direction, and he believes other propane companies share similar concerns.

Ferrell outlined what he believes should be done to move the industry forward:

- The requirement that we belong to every association in the country, regardless of merit, must be abolished. We would like to support the associations we believe serve the industry.

- NPGA must become a professional association of members who meet certain standards.

- We require a voice in directing the true lobbying efforts of NPGA as it meets the challenges of all its professional members.

- Our dues to NPGA must be reduced to a reasonable level, which means a total review and acceptance of the NPGA budget.

Roldan added that the development will have a major adverse effect. Following the May agreement, NPGA reconciled dues with 37 state and regional associations—effectively paying them their portions of the Ferrellgas dues in full, even though the total amount had not yet been collected.

He said code of conduct and membership standards issues raised by Suburban were already being discussed at state association meetings, and with state association executives and NPGA leadership. He noted the affiliation agreement with state associations has been in effect for many years, but said all policies, no matter how longstanding, should always be subject to review. This process began at the Minneapolis board meeting and the policy will also be reviewed at the annual meeting of state executives in November.

While Roldan underscored there is no question that Suburban’s and Ferrellgas’s actions are going to present certain management challenges, he commented that those challenges are no greater than those faced by every marketer member who has had to deal with a polar vortex followed by back-to-back record-warm winters. Leaders of NPGA are to meet with Ferrellgas leaders to further discuss concerns.

90-Day Criticals

An array of policy issues were discussed at the Governmental Affairs Committee meeting, which ran overtime. NPGA maintains a list of “90-Day Criticals,” items that demand immediate focus due to their importance and the need for success to benefit the industry. The following items were discussed in detail at the committee meetings and then presented in summary the next morning at the board of directors meeting.

Tax Reform: With no comprehensive reform of the tax code since 1986, a United Framework from members of Congress and the Trump administration was released Sept. 27, just days before the NPGA board meeting, to outline what a new tax code would look like. “This is an issue where we may have a short window to take some action,” said Phil Squair, NPGA’s senior vice president of public and governmental affairs. “Politically, the House, Senate, and White House are positioned to make this happen. From a procedural standpoint, the Senate is already able to pass tax reform with just 50 votes.” The framework includes many goals that appeal to many in the propane industry: repealing the estate tax, simplifying and lowering corporate and individual tax rates, and enacting immediate expensing of business purchases for at least five years.

Winter Preparedness and Supply: Because of exports, it no longer makes sense to calculate days of supply without including those volumes. Absent their inclusion, a false sense of security is fostered. As discussed at the Supply and Infrastructure Task Force meeting, EIA’s 81 days of supply probably only meant 41.4 days. Agency personnel don’t disagree with including exports in the tally, but no one has stepped forward to take the lead in making the change. The Department of Energy (DOE) has received aggressive communication from both NPGA and the Propane Education & Research Council stressing the need to prepare. Five senators sent a letter to DOE Secretary Rick Perry urging the agency to “incorporate propane export volumes in EIA’s accounting of domestic propane stocks.” NPGA is also pursuing proactive hours-of-service waivers at the U.S. Department of Transportation, and co-hosting regular phone call updates with the Midwestern Governors Association and other regional groups. By continuing to build relationships with key stakeholders in various associations and agencies, it is hoped they will know the issues and operational constraints faced by the propane industry in advance. It was noted in Minneapolis that attention to the Jones Act and exemptions from the 97-year-old cabotage law following hurricanes Harvey, Irma, and Maria could help gain traction for further exemptions. The Jones Act requires American-flagged ships be used to transport products from one U.S. port to another. An exemption from the act would have been helpful in January 2014 when the Northeast was in desperate need of propane from the Gulf Coast, and there were no U.S. ships available to transport propane.

OSHA Crane Operators Compliance: The Occupational Safety and Health Administration (OSHA) had extended a deadline for compliance with third-party certification of crane operators for three years. That was to allow time for a requirement more suitable for small crane operators in the propane industry, but that three years is to expire this month. The industry has been successful in getting an extension for one more year, but the ultimate goal is a rule that doesn’t lump propane employees who simply deliver tanks to customers’ homes in with large crane operators. “OSHA still doesn’t have an administrator,” Squair said. “We will continue to work with congressmembers to put pressure on the Department of Labor to permanently exempt the propane industry from this expensive requirement.” The challenge is now to get OSHA, without an administrator, to accomplish in one year what it could not accomplish in three.

Natural Gas Expansion: The National Association of Regulatory Utility Commissioners (NARUC) established a natural gas access and expansion task force charged with developing best practices and recommendations regarding natural gas service for so called “underserved and unserved” areas of the country. The establishment of this task force, almost certainly pushed by natural gas utilities, may create a possible tilt by NARUC in favor of fuel switching to natural gas. NPGA’s vice president and general counsel, Jeff Petrash, is meeting with members of the task force one-on-one to oppose uneconomic natural gas expansion and to educate them of the role of propane. Meetings so far have been positive and will continue.

Expand Short Haul Exemption: NPGA is pursuing an expansion of the air-mile radius component of the Short Haul Operation exemption. Through the short haul exemption, drivers who operate under specific conditions are not required to maintain Record of Duty Status (RODS) reports. NPGA seeks an expansion of the radius from 100 to 300 air-miles based on improvements in highway accessibility and commercial vehicle technology. This could save the industry $11 million annually in paperwork costs and help marketers serve more customers and grow gallons.

State Engagement: Some state legislatures are moving toward carbon taxes or cap-and-trade programs that view electricity in a much more favorable light than propane. NPGA, state associations, and PERC are working to educate stakeholders at all levels about the importance of accounting for the full fuel cycle when determining efficiency.

Enbridge Line 5 Challenges: The Michigan Propane Gas Association has been working in partnership with NPGA and others to help resolve the challenges of Enbridge’s Line 5 Pipeline, which flows through the Great Lakes region. Many in Northern Michigan want to shut down Line 5 due to environmental concerns should there be a breach in the pipeline. A shutdown of Line 5 would cause major propane supply issues in Michigan and surrounding states. A study found a very small chance for a significant breach before 2050, but the concerns remain. A study of potential solutions such as trucks and railcars replacing the pipeline were found to not be either financially or logistically feasible. One promising potential solution is a $150-million project to encase the $6-billion pipeline to further ensure no leaks can occur. The Michigan attorney general, who is expected to be a candidate for governor in 2018, has spoken in favor of closing Line 5, but appears to want a resolution to the matter that satisfies environmental concerns and allows Line 5 to remain open. —Pat Thornton