Monday, July 17, 2017

June 2017 data shows the U.S. propane inventory build is accelerating, reports the National Propane Gas Association (NPGA). May 2017 saw a sharp drop in export demand due to a closed arbitrage as Japanese inventories reached required levels. The fall in exports helped lift U.S. stocks from a critical inventory of 18.6 days of supply at the end of April to 27 days at the close of May.

The association’s latest Trend Report observes that inventory has started to outpace that of 2013. However, even with aggressive builds the U.S. was at extremely low days of supply historically at the beginning of June. NPGA cautions it will be extremely important to monitor propane inventory builds through the summer months to determine the upcoming winter situation.

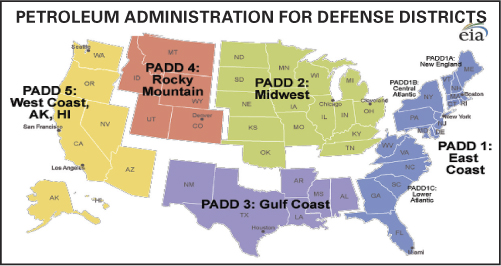

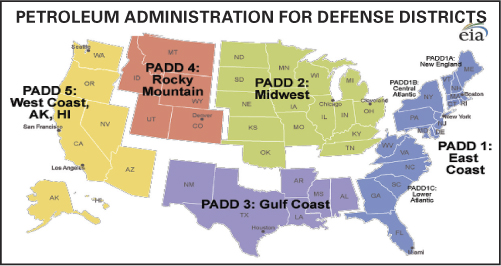

Although the forecast is early, IHS Markit sees the possibility of low days of supply in the autumn months prior to the start of the winter heating season. That low inventory situation is evidenced in PADD 3, the Gulf Coast, whereas PADD 1, the East Coast, and PADD 2, the Midwest, are both near average.

NPGA highlights that exports were the primary driver of the sharp draw on propane inventory this past winter. IHS expects exports will fall substantially over the next several months since the arbitrage has crashed. Noted is that 24 export cargos had been canceled or deferred in May and June. This, combined with seasonal declines in residential/commercial demand, should lead to an acceleration of inventory builds over the next few months.

IHS expects propane supply from gas plants to resume growth as higher crude prices lead to new rig deployments and a resumption of new associated production. For this summer, the consultancy expects propane exports will be much lower than records set during the past winter. However, due to terminal capacity and contracts, it is likely exports will be slightly higher this summer versus last.

In preparation for winter 2017-2018 it will be important to closely monitor inventory levels in August and September, NPGA emphasizes. Unlike the past several winters, winter 2016-2017 drew inventory down to critical levels. In addition, IHS propane supply forecasts are highly dependent on associated crude oil production growth over the next several quarters. If crude prices fall and propane production remains flat, inventory may not be replenished to levels necessary to meet expected export demand during the winter. This could pull stocks down to critical levels in the winter months.

The association’s latest Trend Report observes that inventory has started to outpace that of 2013. However, even with aggressive builds the U.S. was at extremely low days of supply historically at the beginning of June. NPGA cautions it will be extremely important to monitor propane inventory builds through the summer months to determine the upcoming winter situation.

Although the forecast is early, IHS Markit sees the possibility of low days of supply in the autumn months prior to the start of the winter heating season. That low inventory situation is evidenced in PADD 3, the Gulf Coast, whereas PADD 1, the East Coast, and PADD 2, the Midwest, are both near average.

NPGA highlights that exports were the primary driver of the sharp draw on propane inventory this past winter. IHS expects exports will fall substantially over the next several months since the arbitrage has crashed. Noted is that 24 export cargos had been canceled or deferred in May and June. This, combined with seasonal declines in residential/commercial demand, should lead to an acceleration of inventory builds over the next few months.

IHS expects propane supply from gas plants to resume growth as higher crude prices lead to new rig deployments and a resumption of new associated production. For this summer, the consultancy expects propane exports will be much lower than records set during the past winter. However, due to terminal capacity and contracts, it is likely exports will be slightly higher this summer versus last.

In preparation for winter 2017-2018 it will be important to closely monitor inventory levels in August and September, NPGA emphasizes. Unlike the past several winters, winter 2016-2017 drew inventory down to critical levels. In addition, IHS propane supply forecasts are highly dependent on associated crude oil production growth over the next several quarters. If crude prices fall and propane production remains flat, inventory may not be replenished to levels necessary to meet expected export demand during the winter. This could pull stocks down to critical levels in the winter months.