Thursday, March 9, 2017

Despite comparatively milder temperatures in most regions this winter, there is nonetheless a risk that the U.S. could reach critical days of propane supply over the heating season. That alert came from IHS Markit at the National Propane Gas Association’s Supply & Logistics Committee meeting in San Antonio, Texas Jan. 29. As February rolled up, Debnil Chowdhury, director of U.S. NGL research at IHS, advised that days of supply stood at 24.9 days, a total below the five-year average.

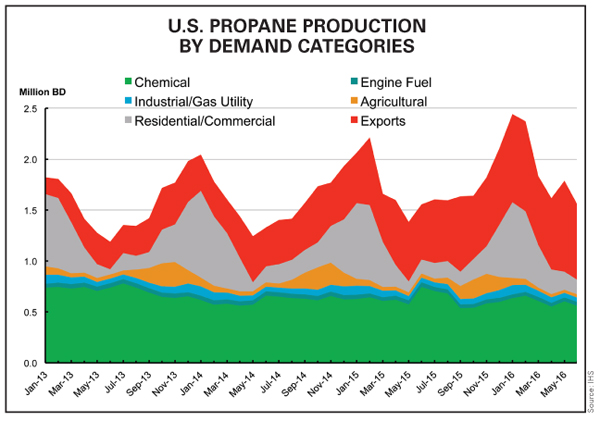

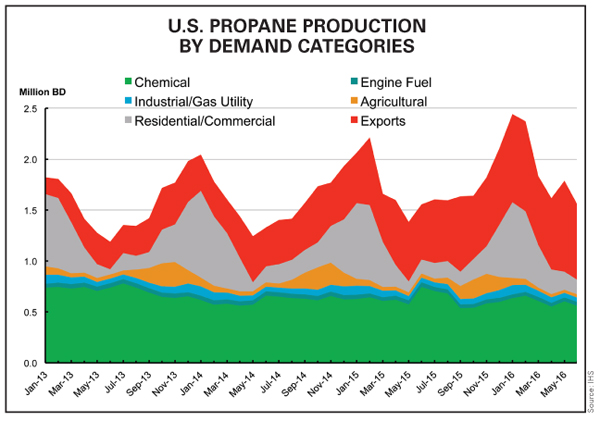

He added that even with primary stocks remaining higher than historical levels, it was no longer a good practice to compare current stocks to five-year averages or even the prior year to determine how long or short supply is. Rather, days of supply should be the key measurement, this with an eye on exports. Ramped up exports drew hard on stocks in December and January, and were continuing to run north of 1 MMbbld in February. As a result, IHS reissued its Trend Report to NPGA as new weekly export data showed the possibility of higher draws than previously forecast.

“We now have export capacity great enough to draw down inventory at a rate that can quickly lead to critical days of supply,” Chowdhury cautioned. “When you get to 42 MMbbl, you approach days of supply problems.” He added that while each region has a different level for triggering critical days of supply concerns, and although winter this year was turning out to be average, “exports can replicate a cold winter draw.”

Meanwhile, IHS is monitoring exports and heating degree days weekly. If major upward revisions are detected in weekly data, the consultancy modifies its Trend Report to determine if the probability of critical days of supply is increasing and notifies NPGA. Looking forward, however, IHS expects propane supply from gas plants to resume growth as higher crude prices lead to new rig deployment and a resumption of associated production. Higher supply and no substantial new export capacity should lead to a recovery of volumes into the summer months. While imports of propane came from Canada in 2015 and 2016, waterborne imports have not been necessary. Furthermore, this winter is expected to remain near average, although cooler than last winter.

Chowdhury called the committee’s attention to the disparity of days of propane supply reported by the Energy Information Administration (EIA) as opposed to what IHS calculates for NPGA. “Currently, EIA is calculating 43.6 days of supply while the NPGA model is calculating 24.9,” he said. He explained that EIA’s definition of days of supply for propane — and all the refined products it monitors — is a measure of inventory adequacy calculated by taking the current stock level and dividing by product supplied, which is used as an estimate of demand, and averaged over the most recent four-week period. The NGL director characterized the formula as “adequate when the U.S. was a net importer of propane,” but “we are now exporting more than 1 million barrels of propane a day. We must include exports as a demand category when calculating days of supply. The NPGA model does, while the EIA model does not.” Similar analysis needs to be performed at the PADD level since some PADDs have much lower days of supply normality than others.

He noted that primary propane inventories in January were lower than levels seen in 2016 due to cooler weather and higher exports resulting from stronger arbitrage differentials to Asia. Further, days of demand are much more in line with history than the overall inventory number would indicate, and the current Trend Report is indicating a historical draw-down rate by the end of this winter. While East Coast propane stocks as of the end of January were higher than average, Midwest volumes were below the normal range. Gulf Coast inventories had the greatest differential to last year. “This makes logical sense as the vast majority of exports are from PADD 3,” Chowdhury emphasized. Rocky Mountain and West Coast stocks were high because of new storage capacity in PADD 5. On the whole, U.S. propane inventories in primary storage were near the five-year average at the beginning of January.

Looking forward, IHS expects East Coast stocks to remain on the high side of the historical range in 2017. Propane production from gas processing is proceeding at high levels as Marcellus and Utica production continues to grow. The pace of growth is seen as remaining strong, leading to higher inventory this year. Mid-Continent propane inventories are expected to remain in the middle of the range owing to the cooler winter and transfers to the Gulf Coast for exports. U.S. Gulf Coast propane volumes for 2017 will depend on how quickly supply ramps up in lockstep with higher crude oil production. In addition, days of supply in PADD 3 may be higher than indicated in the current Trend Report later this year if exports turn out to be lower than forecast. Propane supplies in the Rocky Mountain region should remain high due to new storage capacity. Finally, stocks on the West Coast are expected to remain near the average.

Turning to global market influences, he outlined that core OPEC Gulf countries would continue to keep their crude output lower in line with their commitments under an agreement to curb production over the next few months, thereby stimulating higher world oil prices and concurrently pulling down global stockpiles. Elevated U.S. output is expected to accompany higher oil prices. “We continue to expect the pace of world liquids demand growth to quicken in 2017-2018. Despite the OPEC and non-OPEC agreements to cut output, our liquids balance implies that global oil inventory levels will remain relatively steady on an annual basis in 2017.”

Chowdhury noted that it is still too early to determine whether OPEC will roll over its six-month production agreement at its May 2017 meeting. “The real goal of OPEC production cuts is to support prices — and bolster government revenues. As such, the price level and broader market context at that time will be key. So too will the answer to the question: How might prices react to a continuation of, or an end to, the current output regime?”

Meanwhile, U.S. lower 48 propane production growth from natural gas sources will be strong, but slower in pace, he reiterated, and implications of higher crude prices relating to propane supply are favorable. In addition, propane’s value as a traded commodity compared to the crude price has hardened, recently touching above 60%. As well, Chowdhury observed that U.S. refineries are running at high rates due to strong margins, and although propane production from refineries was depressed in 2015 despite strong runs, output recovered in 2016 owing to stronger propane prices and less internal burning for onsite power generation. “The crude story will drive all energy forecasts,” he said.

Further noted was that U.S. propane exports will see strong growth as new terminal capacity is brought online — if production continues to grow — and that most global propane supply growth is from North America. However, export capacity is not expected to be fully utilized over the next few years due to flattening production. But as crude prices and production recovers, new export capability will eventually be required.

“Global propane demand is flat in North America, but growing in the Far East, Southeast Asia, the Indian Subcontinent, and the Middle East. This leads to more trade,” Chowdhury said. And the world is trading significantly more propane, with U.S. exports at more than 1 MMbbld currently. “East China, home to most PDH [propane dehydrogenation] plants, continues to be the demand driver of LPG. The region imported 6.32 million metric tonnes over January-October 2016, about 56% higher than the same period in 2015 on account of increased feedstock consumption and procurement by chemical companies.”

He said another emerging player is India, whose LPG consumption recently reached a new monthly record high of 1.88 million metric tonnes, up from the previous month’s record high of 1.866 million metric tonnes. Consumption is 16.5% higher year on year and is poised to remain strong. While India does not yet depend on the U.S. for imports, the U.S. has pushed Middle East exporters out of Japan’s market in the Far East. For now, however, India continues to rely on Middle Eastern suppliers. “To cater to the growing LPG demand and to address infrastructure issues around it, Indian Oil Corp. is planning to lay the country’s longest and biggest LPG pipeline from Kandla on the west coast to Gorakhpur in the north.”

Japan’s LPG consumption was reported by IHS to have risen 11.5% in November to 1 million metric tons over the previous month. Propane demand increased by 20% to 780,000 metric tonnes on the back of increased heating requirements as temperatures fell. Reduced output and increased heating demand led to a drawdown on inventories as domestic production fell by about 23% to 175,000 metric tons, but imports surged by 59% to 909,000 metric tons. “To take advantage of lower propane prices, Idemitsu Kosan and Mitsui have announced plans to increase propane cracking capacity at their 920,000-ton-year ethylene plant by investing 200 million yen,” Chowdhury said. “The work is expected to start in the second half of 2017.”

Back in the U.S., propane exports grew the most between 2005 and 2015, but are still expected to increase by another 14 million metric tons between 2015 and 2025. “As natural gas production in the U.S. flattens out in the later years, propane exports will then only increase by another 3 million tonnes from 2025 through 2040,” Chowdhury commented. “Growth in propane exports from the Middle East, Africa, and Oceania are also expected to increase from 2015 through 2025.”

IHS highlights that, prior to 2010, world propane exports rose slowly and averaged about 40 million tonnes annually over the 2005-2010 period. The Middle East was the major supplier and accounted for most of the growth historically. “However, as the shale oil and gas reserves began to be developed in the U.S. beginning in 2010, propane production expanded rapidly, reaching 60 million tonnes in 2015. The U.S. switched from being a net importer to becoming the largest exporting country. However, the Middle East is still the largest exporting region.”

Chowdhury underscored that dramatic increases in U.S. exports have resulted in major changes in global LPG trade flows. “U.S. exports increased from around 5 million tonnes in 2010 to over 18 million tonnes currently. The U.S. is the largest exporter of propane. Initially, most of the increase in exports went to Latin America as the U.S. was able to displace most of the imports to Latin America from Africa and the Middle East due to lower prices and proximity to the region. Once the Latin American market was saturated, exports were then directed to Asia, primarily China, Japan, and South Korea.”

Exports to Europe also increased as North Sea production declined and the U.S. was able to effectively compete with Africa and the Middle East for this market. The Middle East has been essentially displaced from Europe, whereas Africa exports have been reduced but not eliminated. U.S. propane exports are forecast by IHS to peak at about 35 million tonnes by 2030 and then level off. Most of the increase in propane exports will go to Asia, primarily to China, with only a modest increase in exports to Latin America.

IHS holds that the increase in availability of propane will stimulate demand growth in Asia, primarily, including the Indian Subcontinent where demand growth for all energy products is greatest. “Most of the increase in Asian demand will be in the residential and commercial sectors, but there will also be a sharp increase in demand in the chemical sector. Growing global supply will keep propane prices low relative to naphtha feedstock and will cause olefin producers to substitute as much propane for naphtha as possible.”

Also observed was that world propane imports began to increase in about 2010 and grew from about 40 million tonnes to nearly 60 million tonnes today. Asia accounts for about half of total world imports, with Europe, Latin America, and the U.S. and India making up most of the balance. China will become the largest importer.

Therefore, global propane exports will continue to increase. Expectations are they will approach 80 million tonnes by 2025. The U.S. will account for most of the increase, but the Middle East, Africa, and the Commonwealth of Independent States will also expand production and exports. Propane exports from Europe will decline modestly as production in the North Sea falls and recovery from refineries is reduced as crude runs fade.

Accompanying all this new worldwide trade has been the buildout of the global LPG carrier fleet. The very large gas carrier (VLGC) fleet alone is set to reach 253 vessels this year, according to IHS, up from 167 just three years ago. About 14 newbuildings occurred in 2014, 32 in 2015, and 45 in 2016, with another 10 or more joining those ranks this year.

Chowdhury concluded that U.S. propane inventories should reach much lower days of supply in February and March this year versus last, and that the nation will exit the winter heating season with much lower days of supply than in previous years. However, there is the potential for a resumption of stronger supply growth as new rigs come online. Further, there is stronger residential and commercial sector propane demand this year than last, and chemical demand for propane may increase as ethane loses the advantage it currently enjoys, probably later this year.

Last, the price ratio of propane to crude is expected to fall starting in March as the country leaves winter behind. Overall prices in the U.S. are forecast to be weaker compared to crude oil and other global propane prices as supply recovers, thereby spurring exports once again in order to balance the market. However, the unfolding of that supply recovery/export scenario is more likely to occur in 2018 rather than this year.

—John Needham

He added that even with primary stocks remaining higher than historical levels, it was no longer a good practice to compare current stocks to five-year averages or even the prior year to determine how long or short supply is. Rather, days of supply should be the key measurement, this with an eye on exports. Ramped up exports drew hard on stocks in December and January, and were continuing to run north of 1 MMbbld in February. As a result, IHS reissued its Trend Report to NPGA as new weekly export data showed the possibility of higher draws than previously forecast.

“We now have export capacity great enough to draw down inventory at a rate that can quickly lead to critical days of supply,” Chowdhury cautioned. “When you get to 42 MMbbl, you approach days of supply problems.” He added that while each region has a different level for triggering critical days of supply concerns, and although winter this year was turning out to be average, “exports can replicate a cold winter draw.”

Meanwhile, IHS is monitoring exports and heating degree days weekly. If major upward revisions are detected in weekly data, the consultancy modifies its Trend Report to determine if the probability of critical days of supply is increasing and notifies NPGA. Looking forward, however, IHS expects propane supply from gas plants to resume growth as higher crude prices lead to new rig deployment and a resumption of associated production. Higher supply and no substantial new export capacity should lead to a recovery of volumes into the summer months. While imports of propane came from Canada in 2015 and 2016, waterborne imports have not been necessary. Furthermore, this winter is expected to remain near average, although cooler than last winter.

Chowdhury called the committee’s attention to the disparity of days of propane supply reported by the Energy Information Administration (EIA) as opposed to what IHS calculates for NPGA. “Currently, EIA is calculating 43.6 days of supply while the NPGA model is calculating 24.9,” he said. He explained that EIA’s definition of days of supply for propane — and all the refined products it monitors — is a measure of inventory adequacy calculated by taking the current stock level and dividing by product supplied, which is used as an estimate of demand, and averaged over the most recent four-week period. The NGL director characterized the formula as “adequate when the U.S. was a net importer of propane,” but “we are now exporting more than 1 million barrels of propane a day. We must include exports as a demand category when calculating days of supply. The NPGA model does, while the EIA model does not.” Similar analysis needs to be performed at the PADD level since some PADDs have much lower days of supply normality than others.

He noted that primary propane inventories in January were lower than levels seen in 2016 due to cooler weather and higher exports resulting from stronger arbitrage differentials to Asia. Further, days of demand are much more in line with history than the overall inventory number would indicate, and the current Trend Report is indicating a historical draw-down rate by the end of this winter. While East Coast propane stocks as of the end of January were higher than average, Midwest volumes were below the normal range. Gulf Coast inventories had the greatest differential to last year. “This makes logical sense as the vast majority of exports are from PADD 3,” Chowdhury emphasized. Rocky Mountain and West Coast stocks were high because of new storage capacity in PADD 5. On the whole, U.S. propane inventories in primary storage were near the five-year average at the beginning of January.

Looking forward, IHS expects East Coast stocks to remain on the high side of the historical range in 2017. Propane production from gas processing is proceeding at high levels as Marcellus and Utica production continues to grow. The pace of growth is seen as remaining strong, leading to higher inventory this year. Mid-Continent propane inventories are expected to remain in the middle of the range owing to the cooler winter and transfers to the Gulf Coast for exports. U.S. Gulf Coast propane volumes for 2017 will depend on how quickly supply ramps up in lockstep with higher crude oil production. In addition, days of supply in PADD 3 may be higher than indicated in the current Trend Report later this year if exports turn out to be lower than forecast. Propane supplies in the Rocky Mountain region should remain high due to new storage capacity. Finally, stocks on the West Coast are expected to remain near the average.

Turning to global market influences, he outlined that core OPEC Gulf countries would continue to keep their crude output lower in line with their commitments under an agreement to curb production over the next few months, thereby stimulating higher world oil prices and concurrently pulling down global stockpiles. Elevated U.S. output is expected to accompany higher oil prices. “We continue to expect the pace of world liquids demand growth to quicken in 2017-2018. Despite the OPEC and non-OPEC agreements to cut output, our liquids balance implies that global oil inventory levels will remain relatively steady on an annual basis in 2017.”

Chowdhury noted that it is still too early to determine whether OPEC will roll over its six-month production agreement at its May 2017 meeting. “The real goal of OPEC production cuts is to support prices — and bolster government revenues. As such, the price level and broader market context at that time will be key. So too will the answer to the question: How might prices react to a continuation of, or an end to, the current output regime?”

Meanwhile, U.S. lower 48 propane production growth from natural gas sources will be strong, but slower in pace, he reiterated, and implications of higher crude prices relating to propane supply are favorable. In addition, propane’s value as a traded commodity compared to the crude price has hardened, recently touching above 60%. As well, Chowdhury observed that U.S. refineries are running at high rates due to strong margins, and although propane production from refineries was depressed in 2015 despite strong runs, output recovered in 2016 owing to stronger propane prices and less internal burning for onsite power generation. “The crude story will drive all energy forecasts,” he said.

Further noted was that U.S. propane exports will see strong growth as new terminal capacity is brought online — if production continues to grow — and that most global propane supply growth is from North America. However, export capacity is not expected to be fully utilized over the next few years due to flattening production. But as crude prices and production recovers, new export capability will eventually be required.

“Global propane demand is flat in North America, but growing in the Far East, Southeast Asia, the Indian Subcontinent, and the Middle East. This leads to more trade,” Chowdhury said. And the world is trading significantly more propane, with U.S. exports at more than 1 MMbbld currently. “East China, home to most PDH [propane dehydrogenation] plants, continues to be the demand driver of LPG. The region imported 6.32 million metric tonnes over January-October 2016, about 56% higher than the same period in 2015 on account of increased feedstock consumption and procurement by chemical companies.”

He said another emerging player is India, whose LPG consumption recently reached a new monthly record high of 1.88 million metric tonnes, up from the previous month’s record high of 1.866 million metric tonnes. Consumption is 16.5% higher year on year and is poised to remain strong. While India does not yet depend on the U.S. for imports, the U.S. has pushed Middle East exporters out of Japan’s market in the Far East. For now, however, India continues to rely on Middle Eastern suppliers. “To cater to the growing LPG demand and to address infrastructure issues around it, Indian Oil Corp. is planning to lay the country’s longest and biggest LPG pipeline from Kandla on the west coast to Gorakhpur in the north.”

Japan’s LPG consumption was reported by IHS to have risen 11.5% in November to 1 million metric tons over the previous month. Propane demand increased by 20% to 780,000 metric tonnes on the back of increased heating requirements as temperatures fell. Reduced output and increased heating demand led to a drawdown on inventories as domestic production fell by about 23% to 175,000 metric tons, but imports surged by 59% to 909,000 metric tons. “To take advantage of lower propane prices, Idemitsu Kosan and Mitsui have announced plans to increase propane cracking capacity at their 920,000-ton-year ethylene plant by investing 200 million yen,” Chowdhury said. “The work is expected to start in the second half of 2017.”

Back in the U.S., propane exports grew the most between 2005 and 2015, but are still expected to increase by another 14 million metric tons between 2015 and 2025. “As natural gas production in the U.S. flattens out in the later years, propane exports will then only increase by another 3 million tonnes from 2025 through 2040,” Chowdhury commented. “Growth in propane exports from the Middle East, Africa, and Oceania are also expected to increase from 2015 through 2025.”

IHS highlights that, prior to 2010, world propane exports rose slowly and averaged about 40 million tonnes annually over the 2005-2010 period. The Middle East was the major supplier and accounted for most of the growth historically. “However, as the shale oil and gas reserves began to be developed in the U.S. beginning in 2010, propane production expanded rapidly, reaching 60 million tonnes in 2015. The U.S. switched from being a net importer to becoming the largest exporting country. However, the Middle East is still the largest exporting region.”

Chowdhury underscored that dramatic increases in U.S. exports have resulted in major changes in global LPG trade flows. “U.S. exports increased from around 5 million tonnes in 2010 to over 18 million tonnes currently. The U.S. is the largest exporter of propane. Initially, most of the increase in exports went to Latin America as the U.S. was able to displace most of the imports to Latin America from Africa and the Middle East due to lower prices and proximity to the region. Once the Latin American market was saturated, exports were then directed to Asia, primarily China, Japan, and South Korea.”

Exports to Europe also increased as North Sea production declined and the U.S. was able to effectively compete with Africa and the Middle East for this market. The Middle East has been essentially displaced from Europe, whereas Africa exports have been reduced but not eliminated. U.S. propane exports are forecast by IHS to peak at about 35 million tonnes by 2030 and then level off. Most of the increase in propane exports will go to Asia, primarily to China, with only a modest increase in exports to Latin America.

IHS holds that the increase in availability of propane will stimulate demand growth in Asia, primarily, including the Indian Subcontinent where demand growth for all energy products is greatest. “Most of the increase in Asian demand will be in the residential and commercial sectors, but there will also be a sharp increase in demand in the chemical sector. Growing global supply will keep propane prices low relative to naphtha feedstock and will cause olefin producers to substitute as much propane for naphtha as possible.”

Also observed was that world propane imports began to increase in about 2010 and grew from about 40 million tonnes to nearly 60 million tonnes today. Asia accounts for about half of total world imports, with Europe, Latin America, and the U.S. and India making up most of the balance. China will become the largest importer.

Therefore, global propane exports will continue to increase. Expectations are they will approach 80 million tonnes by 2025. The U.S. will account for most of the increase, but the Middle East, Africa, and the Commonwealth of Independent States will also expand production and exports. Propane exports from Europe will decline modestly as production in the North Sea falls and recovery from refineries is reduced as crude runs fade.

Accompanying all this new worldwide trade has been the buildout of the global LPG carrier fleet. The very large gas carrier (VLGC) fleet alone is set to reach 253 vessels this year, according to IHS, up from 167 just three years ago. About 14 newbuildings occurred in 2014, 32 in 2015, and 45 in 2016, with another 10 or more joining those ranks this year.

Chowdhury concluded that U.S. propane inventories should reach much lower days of supply in February and March this year versus last, and that the nation will exit the winter heating season with much lower days of supply than in previous years. However, there is the potential for a resumption of stronger supply growth as new rigs come online. Further, there is stronger residential and commercial sector propane demand this year than last, and chemical demand for propane may increase as ethane loses the advantage it currently enjoys, probably later this year.

Last, the price ratio of propane to crude is expected to fall starting in March as the country leaves winter behind. Overall prices in the U.S. are forecast to be weaker compared to crude oil and other global propane prices as supply recovers, thereby spurring exports once again in order to balance the market. However, the unfolding of that supply recovery/export scenario is more likely to occur in 2018 rather than this year.

—John Needham