Tuesday, May 22, 2018

Analysis released in April of U.S.-China trade relations by IHS Markit — namely escalation of the two countries’ ongoing trade dispute — finds that both have responded with bids of punitive tariffs that could, if enacted, derail a global economic boom that has benefited the world petrochemical industry, a multinational enterprise that has enjoyed significant profitability across many sectors.

Noted is that the U.S. petchem industry, in particular, has experienced a renaissance in productivity and profitability due to its abundant supply of advantaged, domestically produced shale gas feedstocks thanks to the shale boom, enabling it to invest significantly in capacity and new production, much of which is aimed at exports to feed hungry Asian and Chinese markets.

“While the U.S. represents a country with many resources, including available investment capital, low-cost energy and feedstocks, as well as chemical technology, China represents the primary hub for future chemicals demand growth as it seeks to back-integrate within various value chains to maintain an acceptable level of self-sufficiency in base chemicals,” the consultancy writes.

“China requires these basic chemicals, which serve as the building blocks used in the manufacturing of durable and non-durable consumer goods. These consumer goods are manufactured in China and are sold all over the world, and increasingly are consumed domestically, as China’s urbanization levels continue to rise.”

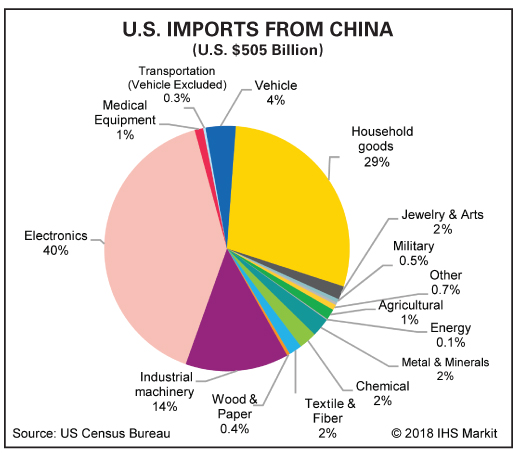

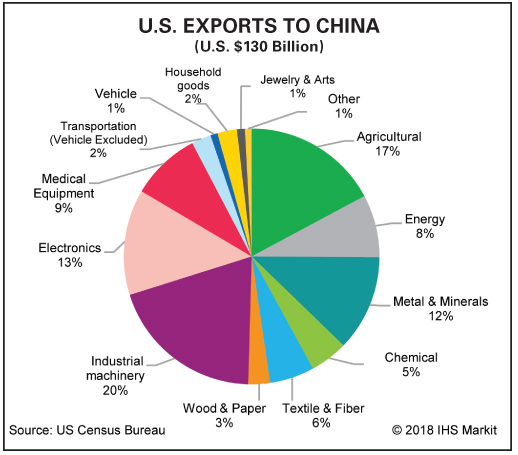

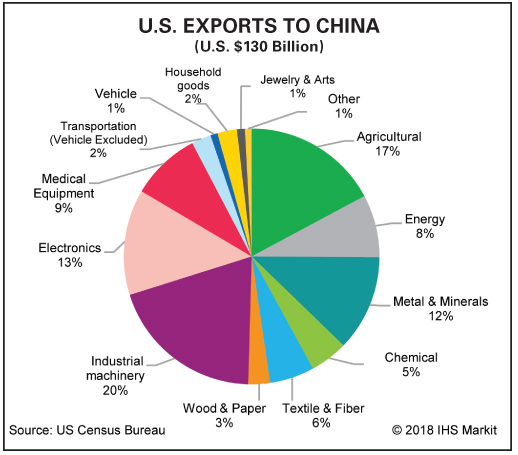

IHS adds that trade between the U.S. and China is a key and essential connection between the two countries. In 2017, the U.S. imported $505 billion in goods from China, and China imported $130 billion in goods from the U.S. The bilateral trade relationship’s disharmonious deficit of $375 billion was one of the key issues raised by the 2016 Trump presidential campaign, and now President Trump has made trade with China a major issue in 2018, with numerous tariffs imposed across many business sectors. The Chinese quickly responded in kind, with more tariffs on U.S. imports, many of which take aim at the petrochemical and plastics sectors.

The IHS Markit economics team observes that a potential trade war between the U.S. and China — which pits the world’s largest developed country and consumer against the world’s largest developing country and supplier — is one shock that could derail the global economic boom. On March 22, 2018, based on the findings of a Section 201 investigation by the U.S. Department of Commerce into China’s alleged intellectual property rights violations, the U.S. imposed a 25% tariff on $60 billion worth of imports from China. China responded within hours with a tariff plan of its own.

China outlined tariffs to be carried out in two phases covering 128 products worth about $3 billion. And on April 4, 2018, China announced additional retaliatory tariffs on U.S. products, including a proposal to impose a 25% tariff on U.S. exports of 106 products worth about $50 billion a year, including several key petrochemical and plastics products such as propane, a key chemical feedstock for the polyethylene and vinyl, generally known as plastics, value chains.

Further, as of April 6, 2018 the IHS Chemical Week team reported President Trump had requested tariffs on an additional $100 billion of Chinese exports, tensioning the ramp-up of the trade spat. IHS says one of the significant risks to its forecast for an extended upcycle of profitability in the global chemical industry is the threat of an all-out trade war between the U.S. and China that would also envelop key allies.

While the trade of energy and chemicals represents a small portion of the total trade between the two nations, the consultancy cautions that, within given petrochemical value chains, the impact of a trade war could be significant. Most notably, it expects impacts to be experienced in the propane and polyethylene (PE) value chains, the latter the world’s most widely used plastic, as well as for vinyl, widely referred to by its product abbreviations EDC and PVC.

Propane Production

But regardless of any Chinese tariffs in place, U.S. propane production will likely continue to jump since LPG is produced as a by-product of refining and natural gas processing, IHS asserts. That propane growth is forecast to reach or exceed 150,000 bbld this year versus 2017, that figure representing gas plant output alone, says Yanyu He, executive director of the consultancy’s Asia-Pacific and Middle East NGL service. Additional output is expected to be augmented by the crude oil refining sector, which is enjoying good refining margins and stronger propane-to-crude ratios, resulting in much less internal burning of the NGL to serve refinery operations.

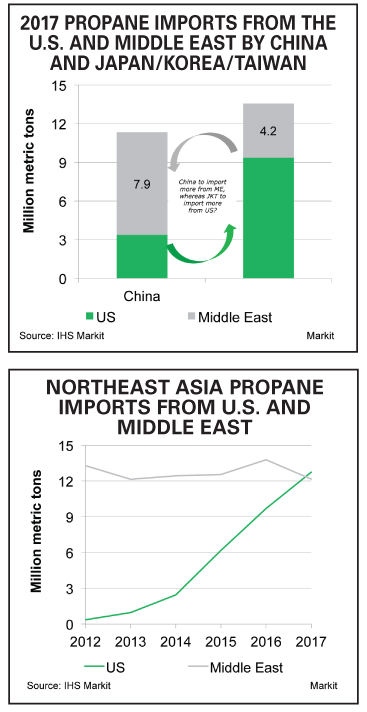

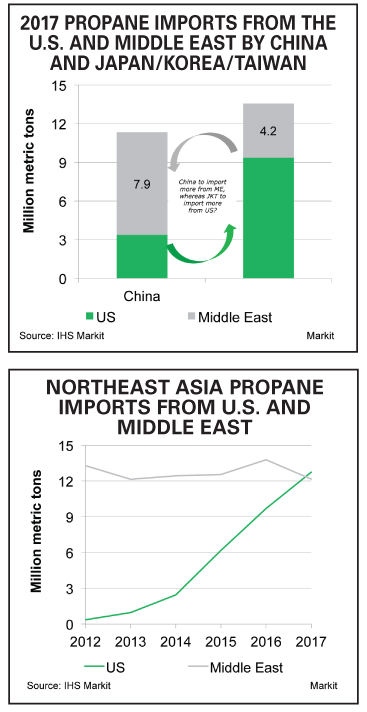

Nevertheless, in the near-term, Mont Belvieu propane prices could face downward pressure if China reduces import volumes from the U.S., IHS analysis shows. In 2017, the U.S. exported 3.4 million metric tons of propane to China, according to the consultancy, which adds that while the additional propane volumes produced in the U.S. could be diverted as an olefins cracker feedstock, this would not be enough to offset the lost volumes to China. Therefore, U.S. LPG volumes will need to be exported to an alternate market location.

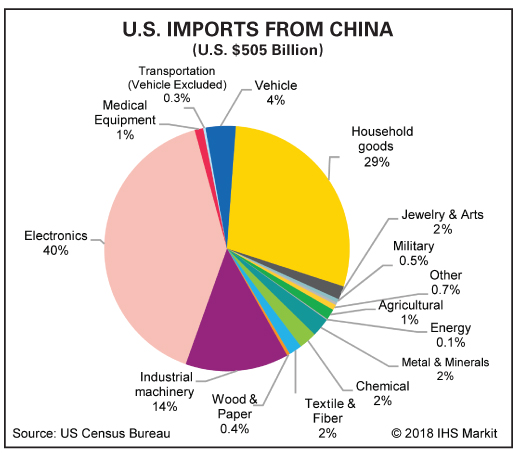

Noted is that, unlike ethane, propane abides in a much more liquid market, and is therefore fungible in world trade. The expectation is that the China tariff, if it comes to pass, will result in a propane trade rebalancing. For example, northeast Asia currently takes large volumes of LPG from both the U.S. and the Middle East. The market reshuffle is likely to result in Japan and South Korea taking more LPG from the U.S., while China will take more from the Middle East.

“Of course, there are likely some constraints in the near-term, due to term-contract obligations and other considerations,” IHS comments. “Further, we expect price signals to incentivize such a rebalancing act. For example, the U.S.-Asia arbitrage will likely increase for Japan and [South] Korea, whose traders will view U.S. propane as an attractive sourcing option. With that said, the arbitrage is not expected to increase the level of Japanese and Korean demand for U.S. propane that the 25% tariff increase would require to offset the lost demand from China.”

In a presentation before the Propane Education & Research Council at its April meeting in Atlanta, Debnil Chowdhury, executive director, natural gas liquids, at IHS Markit, underscored that China’s 25% import tariff on liquefied propane carries with it the goal to punish U.S. producers and exporters “and deprive them of access to the Chinese import market.”

However, he pointed out that the “actual punishment will be to Chinese PDH [propane dehydrogenation] plants. Although the propane world is fungible, future growth of the PDH industry is highly dependent on U.S. supply—20% today.” He added that regarding term contracts, on an fob (free on board) basis, the destination is irrelevant to the contract. Therefore, Chinese contractors might need to send U.S. propane elsewhere and switch to Middle East barrels.

“Some switch in trade flows may occur,” Chowdhury explains. “Companies with ample Middle East term supply contracts can offer to take a U.S. cargo and substitute it with one from the Middle East. The Middle East cargo would go to China instead of Japan or South Korea and the U.S. cargo will go to Japan or Korea instead of China.”

He concludes that IHS doesn’t see much of an effect on U.S. export volumes, although it does foresee the potential for some price weakness in the U.S. during the summer months as the economics required to clear the market are harder to achieve. Meanwhile, U.S. exports will not change.

His colleague, Yanyu He, maintains, “Along with U.S. natural gas and crude oil production growth, NGL output will grow as well. You can’t reject propane. Nothing about the tariff situation changes our export view.” The Asia-Pacific, Middle East IHS lead adds it will be at the end of May, at the earliest, before U.S.-China positions come to light regarding the closing rounds of trade tariff game plans.

“LPG is a by-product, and when you look at the impressive growth of [U.S.] crude oil and natural gas, propane exports remain just as strong. They can absolutely go anywhere, although there will be near-term constraints because of certain contracts. In the longer term, the market is fungible.” In other words, a propane cargo, once loaded on a waterborne gas carrier, whether on the U.S. Gulf Coast or the Middle East by a global trader, can be optioned — anywhere, anytime.

Questions remain, however, about how the Middle East will react if tariffs, as posed, are executed. Will the region, especially the Saudi contract price, harden in response? That contract price reacted strongly to another market game-changer — Hurricane Harvey hitting the Gulf Coast in August last year. The storm briefly shut in LPG, for only two weeks, ultimately, although refining operations were more severely hit. Nonetheless, merely upon concerns of extended shipping delays as the Category 4 storm approached, along with a tight Middle East spot market, the Saudi propane contract price for September rose to $460 a metric ton from forecasts of about $435, according to S&P Global Platts. However, the current tariff scenario, another game-changer, should it unfold as presented, cannot now be forecast.

What is known is that the Middle East produces significant LPG volumes currently, notes He of IHS, and the region can boost output significantly, especially once, and when, crude oil production curbs now in place among OPEC and non-OPEC producers to support and balance the global oil market expire at the end of this year.

And personalities are in play. China President Xi Jinping, leader of the ruling Communist Party, is oft described as the strongman of the party and is dubbed the new Mao. This owes to his successful concentration of power, assertiveness, and authoritarianism to cement China’s push to reach superpower status.

While he has sometimes signaled to western media willingness to consider market flexibility and trade concessions, his reaction to President Trump’s own decisiveness regarding the two nations’ trade gap has been met with tit-for-tat tariff responses and pointed jabs at the U.S., demonstrating to his own people a more equal balance of power that has emerged between the two countries. The Chinese and U.S. presidents, at least publicly and to date, have not softened their back-and-forth rhetoric.

Summarizing, IHS asserts that the global propane market is efficient enough to find a “new norm” if the proposed tariffs are implemented. There are likely to be short-term inefficiencies before achieving a “steady-state new norm” caused by short-term contractual obligations and the allowance of enough time for pricing signals to incentivize the global rebalancing of the market.

Plastic

Regarding additional retaliatory tariffs by China for U.S. products essential to its manufacture of plastics, IHS Markit observes there are still many unknowns that make estimating the impacts more challenging, although some products have been targeted, including certain grades of PE. Currently, China is about 60% self-sufficient in terms of overall PE consumption. In 2017, total U.S. exports were just under one million tons, with exports representing about 17% of total PE exports from the U.S. Propane is a major manufacturing feedstock.

If the tariffs are finalized as proposed, it is likely some producers will optimize their global footprint by exporting more products from the U.S. to Europe, while supplying China from their Middle East or Asia-based facilities. IHS forecasts minimal impact on U.S. prices unless the situation lasts into 2019 and beyond, when new LDPE (low-density polyethylene) comes online from Dow, Formosa, and Sasol. Most of the expanded production of LDPE has been aimed at the export market — China—and some may be redirected to the U.S. market. Meanwhile, other U.S. exports targeted by China serve the vinyl value chain, with some carrying the full 25% tariff.

Finally, as the trade rhetoric between the U.S. and China heats up, IHS advises, it is important for U.S. companies that rely heavily on exports to China to begin to identify alternative market scenarios if tariffs are imposed that would make U.S. products non-competitive. But, it is also critical to look at U.S.-China trade from a global trade-balance perspective, since the implementation of tariffs will cause a rebalancing over time, as contracts play out and new arbitrage opportunities open and close.

—John Needham

Noted is that the U.S. petchem industry, in particular, has experienced a renaissance in productivity and profitability due to its abundant supply of advantaged, domestically produced shale gas feedstocks thanks to the shale boom, enabling it to invest significantly in capacity and new production, much of which is aimed at exports to feed hungry Asian and Chinese markets.

“While the U.S. represents a country with many resources, including available investment capital, low-cost energy and feedstocks, as well as chemical technology, China represents the primary hub for future chemicals demand growth as it seeks to back-integrate within various value chains to maintain an acceptable level of self-sufficiency in base chemicals,” the consultancy writes.

“China requires these basic chemicals, which serve as the building blocks used in the manufacturing of durable and non-durable consumer goods. These consumer goods are manufactured in China and are sold all over the world, and increasingly are consumed domestically, as China’s urbanization levels continue to rise.”

IHS adds that trade between the U.S. and China is a key and essential connection between the two countries. In 2017, the U.S. imported $505 billion in goods from China, and China imported $130 billion in goods from the U.S. The bilateral trade relationship’s disharmonious deficit of $375 billion was one of the key issues raised by the 2016 Trump presidential campaign, and now President Trump has made trade with China a major issue in 2018, with numerous tariffs imposed across many business sectors. The Chinese quickly responded in kind, with more tariffs on U.S. imports, many of which take aim at the petrochemical and plastics sectors.

The IHS Markit economics team observes that a potential trade war between the U.S. and China — which pits the world’s largest developed country and consumer against the world’s largest developing country and supplier — is one shock that could derail the global economic boom. On March 22, 2018, based on the findings of a Section 201 investigation by the U.S. Department of Commerce into China’s alleged intellectual property rights violations, the U.S. imposed a 25% tariff on $60 billion worth of imports from China. China responded within hours with a tariff plan of its own.

China outlined tariffs to be carried out in two phases covering 128 products worth about $3 billion. And on April 4, 2018, China announced additional retaliatory tariffs on U.S. products, including a proposal to impose a 25% tariff on U.S. exports of 106 products worth about $50 billion a year, including several key petrochemical and plastics products such as propane, a key chemical feedstock for the polyethylene and vinyl, generally known as plastics, value chains.

Further, as of April 6, 2018 the IHS Chemical Week team reported President Trump had requested tariffs on an additional $100 billion of Chinese exports, tensioning the ramp-up of the trade spat. IHS says one of the significant risks to its forecast for an extended upcycle of profitability in the global chemical industry is the threat of an all-out trade war between the U.S. and China that would also envelop key allies.

While the trade of energy and chemicals represents a small portion of the total trade between the two nations, the consultancy cautions that, within given petrochemical value chains, the impact of a trade war could be significant. Most notably, it expects impacts to be experienced in the propane and polyethylene (PE) value chains, the latter the world’s most widely used plastic, as well as for vinyl, widely referred to by its product abbreviations EDC and PVC.

Propane Production

But regardless of any Chinese tariffs in place, U.S. propane production will likely continue to jump since LPG is produced as a by-product of refining and natural gas processing, IHS asserts. That propane growth is forecast to reach or exceed 150,000 bbld this year versus 2017, that figure representing gas plant output alone, says Yanyu He, executive director of the consultancy’s Asia-Pacific and Middle East NGL service. Additional output is expected to be augmented by the crude oil refining sector, which is enjoying good refining margins and stronger propane-to-crude ratios, resulting in much less internal burning of the NGL to serve refinery operations.

Nevertheless, in the near-term, Mont Belvieu propane prices could face downward pressure if China reduces import volumes from the U.S., IHS analysis shows. In 2017, the U.S. exported 3.4 million metric tons of propane to China, according to the consultancy, which adds that while the additional propane volumes produced in the U.S. could be diverted as an olefins cracker feedstock, this would not be enough to offset the lost volumes to China. Therefore, U.S. LPG volumes will need to be exported to an alternate market location.

Noted is that, unlike ethane, propane abides in a much more liquid market, and is therefore fungible in world trade. The expectation is that the China tariff, if it comes to pass, will result in a propane trade rebalancing. For example, northeast Asia currently takes large volumes of LPG from both the U.S. and the Middle East. The market reshuffle is likely to result in Japan and South Korea taking more LPG from the U.S., while China will take more from the Middle East.

“Of course, there are likely some constraints in the near-term, due to term-contract obligations and other considerations,” IHS comments. “Further, we expect price signals to incentivize such a rebalancing act. For example, the U.S.-Asia arbitrage will likely increase for Japan and [South] Korea, whose traders will view U.S. propane as an attractive sourcing option. With that said, the arbitrage is not expected to increase the level of Japanese and Korean demand for U.S. propane that the 25% tariff increase would require to offset the lost demand from China.”

In a presentation before the Propane Education & Research Council at its April meeting in Atlanta, Debnil Chowdhury, executive director, natural gas liquids, at IHS Markit, underscored that China’s 25% import tariff on liquefied propane carries with it the goal to punish U.S. producers and exporters “and deprive them of access to the Chinese import market.”

However, he pointed out that the “actual punishment will be to Chinese PDH [propane dehydrogenation] plants. Although the propane world is fungible, future growth of the PDH industry is highly dependent on U.S. supply—20% today.” He added that regarding term contracts, on an fob (free on board) basis, the destination is irrelevant to the contract. Therefore, Chinese contractors might need to send U.S. propane elsewhere and switch to Middle East barrels.

“Some switch in trade flows may occur,” Chowdhury explains. “Companies with ample Middle East term supply contracts can offer to take a U.S. cargo and substitute it with one from the Middle East. The Middle East cargo would go to China instead of Japan or South Korea and the U.S. cargo will go to Japan or Korea instead of China.”

He concludes that IHS doesn’t see much of an effect on U.S. export volumes, although it does foresee the potential for some price weakness in the U.S. during the summer months as the economics required to clear the market are harder to achieve. Meanwhile, U.S. exports will not change.

His colleague, Yanyu He, maintains, “Along with U.S. natural gas and crude oil production growth, NGL output will grow as well. You can’t reject propane. Nothing about the tariff situation changes our export view.” The Asia-Pacific, Middle East IHS lead adds it will be at the end of May, at the earliest, before U.S.-China positions come to light regarding the closing rounds of trade tariff game plans.

“LPG is a by-product, and when you look at the impressive growth of [U.S.] crude oil and natural gas, propane exports remain just as strong. They can absolutely go anywhere, although there will be near-term constraints because of certain contracts. In the longer term, the market is fungible.” In other words, a propane cargo, once loaded on a waterborne gas carrier, whether on the U.S. Gulf Coast or the Middle East by a global trader, can be optioned — anywhere, anytime.

Questions remain, however, about how the Middle East will react if tariffs, as posed, are executed. Will the region, especially the Saudi contract price, harden in response? That contract price reacted strongly to another market game-changer — Hurricane Harvey hitting the Gulf Coast in August last year. The storm briefly shut in LPG, for only two weeks, ultimately, although refining operations were more severely hit. Nonetheless, merely upon concerns of extended shipping delays as the Category 4 storm approached, along with a tight Middle East spot market, the Saudi propane contract price for September rose to $460 a metric ton from forecasts of about $435, according to S&P Global Platts. However, the current tariff scenario, another game-changer, should it unfold as presented, cannot now be forecast.

What is known is that the Middle East produces significant LPG volumes currently, notes He of IHS, and the region can boost output significantly, especially once, and when, crude oil production curbs now in place among OPEC and non-OPEC producers to support and balance the global oil market expire at the end of this year.

And personalities are in play. China President Xi Jinping, leader of the ruling Communist Party, is oft described as the strongman of the party and is dubbed the new Mao. This owes to his successful concentration of power, assertiveness, and authoritarianism to cement China’s push to reach superpower status.

While he has sometimes signaled to western media willingness to consider market flexibility and trade concessions, his reaction to President Trump’s own decisiveness regarding the two nations’ trade gap has been met with tit-for-tat tariff responses and pointed jabs at the U.S., demonstrating to his own people a more equal balance of power that has emerged between the two countries. The Chinese and U.S. presidents, at least publicly and to date, have not softened their back-and-forth rhetoric.

Summarizing, IHS asserts that the global propane market is efficient enough to find a “new norm” if the proposed tariffs are implemented. There are likely to be short-term inefficiencies before achieving a “steady-state new norm” caused by short-term contractual obligations and the allowance of enough time for pricing signals to incentivize the global rebalancing of the market.

Plastic

Regarding additional retaliatory tariffs by China for U.S. products essential to its manufacture of plastics, IHS Markit observes there are still many unknowns that make estimating the impacts more challenging, although some products have been targeted, including certain grades of PE. Currently, China is about 60% self-sufficient in terms of overall PE consumption. In 2017, total U.S. exports were just under one million tons, with exports representing about 17% of total PE exports from the U.S. Propane is a major manufacturing feedstock.

If the tariffs are finalized as proposed, it is likely some producers will optimize their global footprint by exporting more products from the U.S. to Europe, while supplying China from their Middle East or Asia-based facilities. IHS forecasts minimal impact on U.S. prices unless the situation lasts into 2019 and beyond, when new LDPE (low-density polyethylene) comes online from Dow, Formosa, and Sasol. Most of the expanded production of LDPE has been aimed at the export market — China—and some may be redirected to the U.S. market. Meanwhile, other U.S. exports targeted by China serve the vinyl value chain, with some carrying the full 25% tariff.

Finally, as the trade rhetoric between the U.S. and China heats up, IHS advises, it is important for U.S. companies that rely heavily on exports to China to begin to identify alternative market scenarios if tariffs are imposed that would make U.S. products non-competitive. But, it is also critical to look at U.S.-China trade from a global trade-balance perspective, since the implementation of tariffs will cause a rebalancing over time, as contracts play out and new arbitrage opportunities open and close.

—John Needham