Thursday, March 16, 2017

Wednesday, March 15, 2017

The National Propane Gas Association (NPGA) shared information in response to recent questions regarding the scope of the new electronic logging device (ELD) requirement by the Federal Motor Carrier Safety Administration (FMCSA). Around the time of the 2016 NPGA Southeastern Conference in Nashville, some questions on the requirement arose as to the applicability of ELDs to industry trucks that were transported to Nashville for exhibition on the show floor.

Wednesday, March 15, 2017

With tax reform high on the agenda of the 115th Congress, NPGA Government Affairs Committee members were recently advised of a Republican-sponsored tax policy paper introduced in the summer of 2016 that includes a provision to establish a border adjusted tax (BAT) designed to exempt exports while taxing all imported goods at the corporate tax rate. The paper, “A Better Way,” by House Speaker Paul Ryan (R-Wis.) and House Ways and Means Committee chairman Kevin Brady (R-Texas), has several key implications for propane marketers.

Tuesday, March 14, 2017

The following propane industry pioneers will be greatly missed.

Leslie Howard Armstrong, an employee of Universal Gas (Devine and Lufkin, Texas) from 1977 to 1986, and Ferrellgas until his retirement in 1991, passed away Dec. 13, 2016. He was 86.

Leslie Howard Armstrong, an employee of Universal Gas (Devine and Lufkin, Texas) from 1977 to 1986, and Ferrellgas until his retirement in 1991, passed away Dec. 13, 2016. He was 86.

Tuesday, March 14, 2017

Wayne Morgan, vice president of sales at Meeder Equipment Co. (Fresno, Calif.), retired Nov. 18. He started with Meeder in 1972 at its Fresno location before moving to Colorado to manage the Denver warehouse. Morgan returned to California in 2002 to manage sales from the corporate office in Fresno.

Thursday, March 9, 2017

(March 9, 2017) Superior Plus Corp. (Toronto) has entered into an agreement with Gibson Energy Inc. (Calgary) to acquire its retail propane business, Canwest Propane, in a transaction valued at $412 million. e acquisition is expected to be completed by the second half of this year. e acquisition is seen as significantly enhancing Superior Plus Corp.’s energy distribution business while positioning it for oil eld activity recovery and improved demand in Western Canada.

Monday, March 6, 2017

MPLX LP (Findlay, Ohio) subsidiary MarkWest Energy Partners LP and Antero Midstream Partners LP (Denver) have formed a joint venture to support the development of Antero Resources’ extensive Marcellus Shale acreage in the prolific rich-gas corridor of West Virginia. The joint venture is owned 50% by MarkWest and 50% by Antero and is supported by a long-term, fee-based agreement.

Wednesday, March 1, 2017

(Flanders, NJ) February 28, 2017 – Advanced Digital Data, Inc. (ADD Systems), the leading supplier of software solutions to the energy distribution industry, announces the launch of the Raven software mobile delivery solution on a Panasonic® Toughpad® tablet. Raven, originally launched in 1995, is deployed today in 6,500 trucks across North America. The new Raven tablet has been redesigned to take advantage of the larger rugged touchscreen display and boasts a new intuitive user experience, which makes deploying Raven even simpler.

Monday, February 27, 2017

(February 27, 2017) — The Energy Information Administration’s (EIA) recently released Annual Energy Outlook 2017 projects that U.S. tight oil production will increase to more than 6 MMbbld in the coming decade, making up most of total U.S. oil production. After 2016, tight oil production remains relatively constant through 2040 in the reference case as tight oil development moves into less productive areas and as well productivity decreases. Side cases with different resource and technology assumptions result in different tight oil and total U.S.

Monday, February 27, 2017

The big question for the gas market in 2017 is whether strong signs of the emergence of a truly global gas market will evolve further, maintains S&P Global Platts, pointing to a large degree of price convergence between regional markets in 2016. Traditional pricing in international gas trade has been based on oil indexation, but the oil price rollercoaster of the last few years, increasing LNG production, and growing competition between LNG and pipeline gas have led to a rethinking of oil indexation.

Thursday, February 23, 2017

Houston, TX (February 23, 2017) — Phillips 66 (Houston) has ramped up its LPG exports out of Texas, and bigger plans for its LPG production and operations could be on the horizon, reports Tank-Terminals. Phillips 66’s Freeport, Texas export terminal has been exporting and will continue to export near maximum capacity at about eight cargos a month, senior executives said during the company’s fourth-quarter earnings call.

Thursday, February 16, 2017

(January 16, 2017) The National Propane Gas Association (NPGA) in its Winter 2017 Director's Update summarized propane industry efforts in 2016 to battle against subsidized natural gas expansion efforts, resulting in victories in Maryland, Michigan, New Mexico, North Dakota, Virginia and West Virginia. In this new year, NPGA expects the natural gas forces to push even harder, so it is adjusting its communication and political tactics and finding new ways to tell the industry's story to legislators and regulators.

State Engagement Initiative Programs:

State Engagement Initiative Programs:

Wednesday, February 15, 2017

"Duty to warn” is an annual risk-mitigation process for propane marketers to inform customers of important propane safety information. Educating customers about the proper use and storage of propane, as well as how to detect warning signs of a gas leak, can significantly reduce the risk of propane-related hazards — thereby reducing your company’s risk. If you’re not sending out this annual communication, who is?

Friday, February 10, 2017

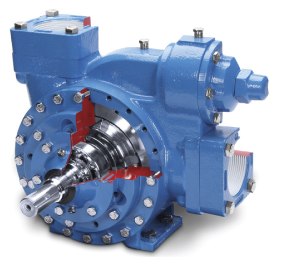

SLIDING VANE PUMPS. The new Blackmer SGLWD Series sliding vane pumps with double mechanical seals provide protection against unforeseen leakage of volatile liquids. Available in two sizes, the SGLWD3 and SGLWD4, the pumps have been specifically developed to provide zero leakage by the use of an exclusive cartridge type, double radial seal design.

SLIDING VANE PUMPS. The new Blackmer SGLWD Series sliding vane pumps with double mechanical seals provide protection against unforeseen leakage of volatile liquids. Available in two sizes, the SGLWD3 and SGLWD4, the pumps have been specifically developed to provide zero leakage by the use of an exclusive cartridge type, double radial seal design.Friday, February 10, 2017

In Memorium: It is with great sadness to report Daryl Ingalsbe, president and CEO of Independent Technologies Inc. (Blair, Neb.) died in a plane crash near his home in Spruce Creek, Fla. on Dec. 27, 2016. He was 67. Ingalsbe founded the company in 1991.

Monday, February 6, 2017

Washington, DC (February 6, 2017) — President Donald Trump has signed a series of executive orders and presidential memoranda aimed at expediting priority energy and infrastructure projects, among them construction of the Keystone XL pipeline and the remaining portions of the Dakota Access Pipeline, both of which were rejected by the Obama administration. Trump said the actions were in keeping with his campaign promise to reduce regulatory burdens and streamline projects that will create jobs and increase national security.

Monday, February 6, 2017

Crocker, MO (February 6, 2017) — It is with great sadness that BPN announces the passing of long-time propane industry member, Geneva Goodrich. The Missouri State Highway Patrol reported Saturday that Geneva, 86, died of injuries sustained when the vehicle she and husband, Bob Goodrich, crashed while traveling on State Highway U, seven miles west of Crocker, Mo. Mr. Goodrich sustained moderate injuries.

Wednesday, February 1, 2017

(January 31, 2017) — The Propane Education & Research Council (PERC) has announced the appointment of Paula Wilson as its new Director of Industry Engagement. For nearly 25 years, Ms. Wilson served as director of marketing at AmeriGas Propane (Valley Forge, Penn.), one of the largest propane companies in the United States. Wilson lead marketing strategy and consumer engagement for AmeriGas for its business-to-consumer and business-to-business sectors.

Tuesday, January 31, 2017

(January 31, 2017) — The Missouri Propane Education and Research Council (MOPERC) announced recently the election of several local propane professionals to serve as 2017 Directors and Officers.

The Council recently installed its new leadership at the group’s winter meeting in Ridgedale, Mo. The slate was approved following elections at the MOPERC fall meeting in Jefferson City, Mo., and includes representatives from across the state who serve in various capacities and includes:

• Chair –Eric Kolkmeyer, Energy Transport Solutions, Bates City, Mo.

The Council recently installed its new leadership at the group’s winter meeting in Ridgedale, Mo. The slate was approved following elections at the MOPERC fall meeting in Jefferson City, Mo., and includes representatives from across the state who serve in various capacities and includes:

• Chair –Eric Kolkmeyer, Energy Transport Solutions, Bates City, Mo.

Friday, January 27, 2017

The Environmental Protection Agency (EPA) posted a Federal Register notice Jan. 6, 2017, proposing to add natural gas processing facilities to industrial sectors covered by reporting requirements of the Emergency Planning and Community Right-to-Know Act (EPCRA), commonly known as the Toxics Release Inventory (TRI) and section 6607 of the Pollution Prevention Act (PPA).

Thursday, January 26, 2017

JEFFERSON CITY, Mo. (January 26, 2017) — In the Missouri first regular legislative session, a bill was filed by Rep. Craig Redmon, Missouri's first attempt to allow unattended propane refueling for dispensing stations that have the new quick-connect nozzle.

Wednesday, January 25, 2017

DES MOINES, Iowa (January 25, 2017) — The State of Iowa has adopted [661—201.2(1)] the 2015 edition of the International Fire Code (IFC), which within Section 2307 (Liquefied Petroleum Gas Motor Fuel-Dispensing Facilities) provides requirements for public fueling of motor vehicles (2307.7).