Tuesday, February 14, 2017

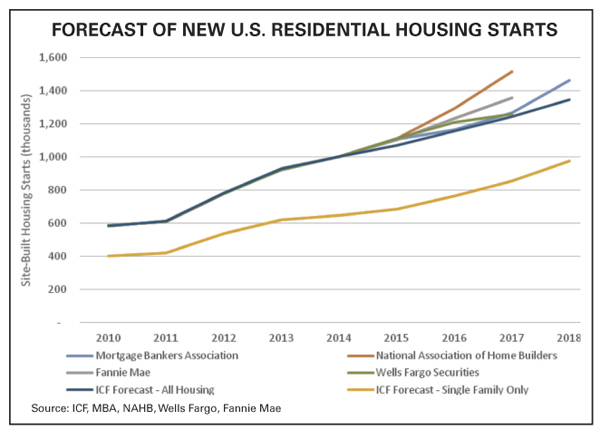

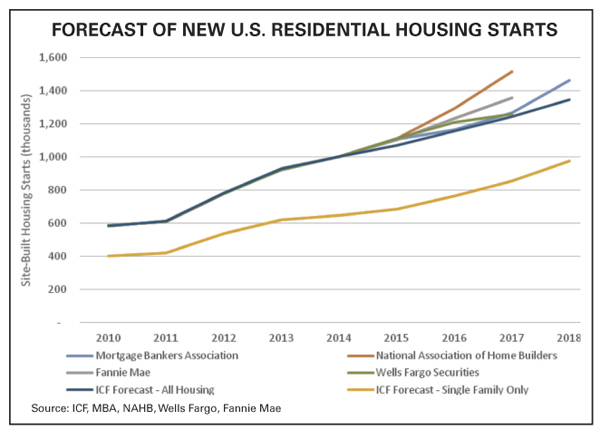

Mike Sloan of ICF (Fairfax, Va.) has noticed some positive developments in the residential market for propane after several years of struggle for that sector. Sloan and ICF have witnessed continued growth in the housing market, including propane housing starts in some regions. He expects to see further growth in propane’s market share of home heating as propane prices remain at low levels and competitive to other options.

“The headline is, it’s a good time to be marketing propane in the residential and commercial markets,” Sloan said. He will expand on those comments in a presentation titled “2017 Propane Market Outlook” at the National Propane Gas Association (NPGA) Southeastern Convention & International Expo in Nashville in April.

During his session, he will discuss his belief that although the natural gas market is a challenge for propane, especially regarding that industry’s efforts to expand into rural propane territory, electricity is the biggest threat to conventional propane markets. However, lower propane prices over the past couple of years has set the stage for propane to be much more competitive than it was three or four years ago. At that time, propane was rapidly losing market share to electricity.

The propane industry’s marketing efforts comparing it favorably to electricity can be successful because of lower propane prices, and Sloan expects that to lead to growth in the number of propane heated households nationally.

However, the national picture remains a bit mixed as space heating in the southern part of the country will probably continue to decline, although at a slower rate, Sloan explained. “Propane use in the northern half of the country will be increasing, and the increase should more than offset the decrease in the southern portion of the country.” The continued improvement in heat pump technologies and their penetration into the residential market is a main reason for propane’s decline in the southern U.S. states. But that decline is expected to slow given lower propane prices, while propane will be more competitive in areas where electricity prices are higher and where the weather is colder.

Lower propane prices are also helping the industry penetrate the water heating market, primarily as a result of efficiency standards that have increased the cost of conventional water heaters.

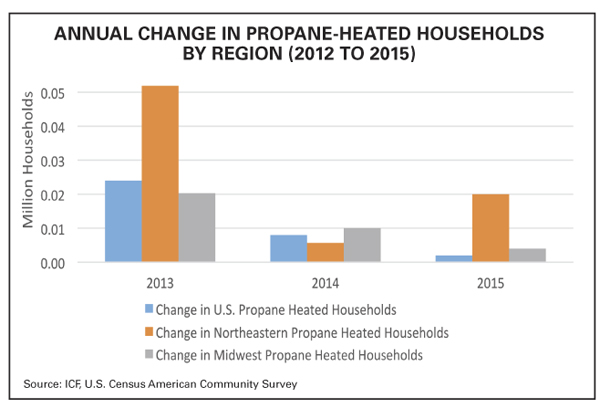

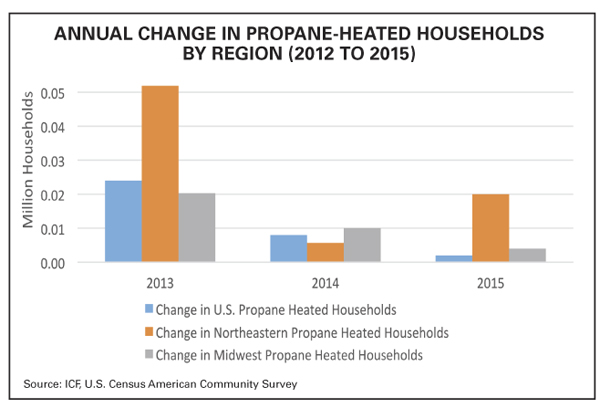

At the November 2016 meeting of the Propane Education & Research Council (PERC), Sloan discussed 2015 housing data from the American Community Survey, the most recent year available (BPN, December 2016, p. 26). His Southeastern Conference presentation in April will include updated numbers to that survey. The update shows the third annual increase in propane heated households, which moved from 5.54 million in 2012 to 5.58 million in 2015. The national market share for propane heated households remained constant at 4.7%.

Sloan adds that the Northeastern states experienced the largest absolute gain in propane-heated households, supported by a market share of more than 50% in the New England states, with an increase of 19,965 households in 2015 and a total gain of 130,045 households from 2010 to 2015. The Southern region and portions of the Midwest experienced year-on-year declines in propane-heated households. Sloan noted that the new construction market share for 2015 dropped slightly, possibly because of the propane industry’s struggles during the Polar Vortex winter of 2013-2014.

A receptive market for increasing propane customers supported by lower propane prices, along with several winters without challenges and a PERC consumer education campaign, has led to optimism among some. “My expectation is we will see growth in market share but we won’t know that until we start to see the 2016 numbers, which is probably around May,” Sloan stated.

His Southeastern presentation will also cover market potential in engine fuel applications, for which he sees significant opportunities. Outcompeting diesel as an engine fuel source in a low oil price environment is a challenge. But assuming oil prices will continue to increase and don’t drop back down again, the propane engine fuel market “continues to be the area with the most gallon potential for consumer propane sales.”

The propane industry is successfully advancing in the school bus market and improving its penetration of the small fleet market, including small delivery vehicles and commercial fleet vehicles. Natural gas is a strong competitor for large fleets that are looking at alternative fuels as an option, but Sloan sees a significant window in which propane is quite a bit more economical than CNG or LNG for small- to medium-sized fleets. For most of those fleets, propane is more cost-effective because of the substantial upfront investment necessary for a natural gas fueling station.

“You can put in a propane fueling station for $50,000 or less, $100,000 for a very sophisticated system,” Sloan stated. “Natural gas, you’re going to start at $250,000 and up into the multiple millions just for the infrastructure to fuel the vehicles.” He added that although natural gas prices are currently low, as long as propane prices stay relatively low, the high infrastructure cost associated with refueling for natural gas will help convince fleets to go with propane. “For a small- to medium-sized fleet, it’s really hard to recover the cost of the natural gas refueling infrastructure.”

He also plans to discuss the U.S. government changes and the impact of policies under President Trump. Sloan foresees the new administration as providing various possible positives and negatives for the propane industry. Lower regulatory barriers would be among the possible plusses.

“It may take time to roll back existing regulations, but the implementation of new regulations is likely to be significantly slowed. We’ll see less resistance to natural gas and natural gas liquids development, so potentially more supply, although that is really going to be driven more by price, and price is affected by a lot of issues.”

The tax proposals from the Trump Administration might result in some plusses and minuses for the propane industry, as well. The proposal to reduce the corporate tax rate from 35% to 20% would have a strong positive impact on all industries, Sloan noted. On the possible negative side is a Republican proposal to tax imports and domestic consumption while removing the tax on exports.

“For products like propane and for other petroleum markets, the price is going to be set by the international propane price,” Sloan stated. “What that means with the new proposals is the price of propane in the U.S. will be set by the world market without export taxes. The price of domestic propane could increase noticeably due to the change in tax treatment. If you accept the argument that some economists are making that change will be reflected in U.S. exchange rates, then maybe some of that goes away, but that’s a very complicated question and I’m not sure anyone has a good answer for how much exchange rates will be impacted yet.”

Sloan will also address current propane production, inventories, and exports in his presentation, and he noted in January that he has seen a sharp drawdown in inventory over the past month as exports have increased at the same time as winter heating demand, as well as a stabilization of propane production. “Depending on what happens in world oil markets and U.S. natural gas markets, you could see a fairly significant inventory squeeze going forward, leading to somewhat higher propane prices relative to natural gas and oil. But regardless of that…It’s still a very attractive opportunity for marketing propane.”

—Daryl Lubinsky

“The headline is, it’s a good time to be marketing propane in the residential and commercial markets,” Sloan said. He will expand on those comments in a presentation titled “2017 Propane Market Outlook” at the National Propane Gas Association (NPGA) Southeastern Convention & International Expo in Nashville in April.

During his session, he will discuss his belief that although the natural gas market is a challenge for propane, especially regarding that industry’s efforts to expand into rural propane territory, electricity is the biggest threat to conventional propane markets. However, lower propane prices over the past couple of years has set the stage for propane to be much more competitive than it was three or four years ago. At that time, propane was rapidly losing market share to electricity.

The propane industry’s marketing efforts comparing it favorably to electricity can be successful because of lower propane prices, and Sloan expects that to lead to growth in the number of propane heated households nationally.

However, the national picture remains a bit mixed as space heating in the southern part of the country will probably continue to decline, although at a slower rate, Sloan explained. “Propane use in the northern half of the country will be increasing, and the increase should more than offset the decrease in the southern portion of the country.” The continued improvement in heat pump technologies and their penetration into the residential market is a main reason for propane’s decline in the southern U.S. states. But that decline is expected to slow given lower propane prices, while propane will be more competitive in areas where electricity prices are higher and where the weather is colder.

Lower propane prices are also helping the industry penetrate the water heating market, primarily as a result of efficiency standards that have increased the cost of conventional water heaters.

At the November 2016 meeting of the Propane Education & Research Council (PERC), Sloan discussed 2015 housing data from the American Community Survey, the most recent year available (BPN, December 2016, p. 26). His Southeastern Conference presentation in April will include updated numbers to that survey. The update shows the third annual increase in propane heated households, which moved from 5.54 million in 2012 to 5.58 million in 2015. The national market share for propane heated households remained constant at 4.7%.

Sloan adds that the Northeastern states experienced the largest absolute gain in propane-heated households, supported by a market share of more than 50% in the New England states, with an increase of 19,965 households in 2015 and a total gain of 130,045 households from 2010 to 2015. The Southern region and portions of the Midwest experienced year-on-year declines in propane-heated households. Sloan noted that the new construction market share for 2015 dropped slightly, possibly because of the propane industry’s struggles during the Polar Vortex winter of 2013-2014.

A receptive market for increasing propane customers supported by lower propane prices, along with several winters without challenges and a PERC consumer education campaign, has led to optimism among some. “My expectation is we will see growth in market share but we won’t know that until we start to see the 2016 numbers, which is probably around May,” Sloan stated.

His Southeastern presentation will also cover market potential in engine fuel applications, for which he sees significant opportunities. Outcompeting diesel as an engine fuel source in a low oil price environment is a challenge. But assuming oil prices will continue to increase and don’t drop back down again, the propane engine fuel market “continues to be the area with the most gallon potential for consumer propane sales.”

The propane industry is successfully advancing in the school bus market and improving its penetration of the small fleet market, including small delivery vehicles and commercial fleet vehicles. Natural gas is a strong competitor for large fleets that are looking at alternative fuels as an option, but Sloan sees a significant window in which propane is quite a bit more economical than CNG or LNG for small- to medium-sized fleets. For most of those fleets, propane is more cost-effective because of the substantial upfront investment necessary for a natural gas fueling station.

“You can put in a propane fueling station for $50,000 or less, $100,000 for a very sophisticated system,” Sloan stated. “Natural gas, you’re going to start at $250,000 and up into the multiple millions just for the infrastructure to fuel the vehicles.” He added that although natural gas prices are currently low, as long as propane prices stay relatively low, the high infrastructure cost associated with refueling for natural gas will help convince fleets to go with propane. “For a small- to medium-sized fleet, it’s really hard to recover the cost of the natural gas refueling infrastructure.”

He also plans to discuss the U.S. government changes and the impact of policies under President Trump. Sloan foresees the new administration as providing various possible positives and negatives for the propane industry. Lower regulatory barriers would be among the possible plusses.

“It may take time to roll back existing regulations, but the implementation of new regulations is likely to be significantly slowed. We’ll see less resistance to natural gas and natural gas liquids development, so potentially more supply, although that is really going to be driven more by price, and price is affected by a lot of issues.”

The tax proposals from the Trump Administration might result in some plusses and minuses for the propane industry, as well. The proposal to reduce the corporate tax rate from 35% to 20% would have a strong positive impact on all industries, Sloan noted. On the possible negative side is a Republican proposal to tax imports and domestic consumption while removing the tax on exports.

“For products like propane and for other petroleum markets, the price is going to be set by the international propane price,” Sloan stated. “What that means with the new proposals is the price of propane in the U.S. will be set by the world market without export taxes. The price of domestic propane could increase noticeably due to the change in tax treatment. If you accept the argument that some economists are making that change will be reflected in U.S. exchange rates, then maybe some of that goes away, but that’s a very complicated question and I’m not sure anyone has a good answer for how much exchange rates will be impacted yet.”

Sloan will also address current propane production, inventories, and exports in his presentation, and he noted in January that he has seen a sharp drawdown in inventory over the past month as exports have increased at the same time as winter heating demand, as well as a stabilization of propane production. “Depending on what happens in world oil markets and U.S. natural gas markets, you could see a fairly significant inventory squeeze going forward, leading to somewhat higher propane prices relative to natural gas and oil. But regardless of that…It’s still a very attractive opportunity for marketing propane.”

—Daryl Lubinsky