Friday, May 6, 2016

Sales of odorized propane in the U.S. climbed nearly 5.8% in 2014 compared to a year earlier, marking the second year in a row sales accelerated and reversed a years-long sales decline.o The “2014 Sales of Natural Gas Liquids and Liquefied Refinery Gases” survey, prepared by the American Petroleum Institute’s (API) statistics department, shows year-on-year propane sales gaining almost 5.1 million gallons to stand at more than 9.3 billion gallons for the latest reporting period. Further, all end-use categories measured—residential, commercial, sales to retailers, internal combustion, industrial, and agricultural—showed improvement over 2013 tallies.

The increase follows sales jumping by double digits in 2013 compared to 2012. In 2013, sales were a significant 14.1% higher, bringing the total to more than 8.83 billion gallons sold and breaking a long losing streak. From 2008 through 2012, API shows U.S. propane sales eroded by more than 2.2 billion gallons, representing a steep 22.2% retreat. That trend has finally been reversed. Prior to 2013, the last time year-over-year sales gains were experienced was in 2007.

Residential propane sales, which include recreational vehicle sales, grew 4.65% in 2014, rising from 4.84 billion gallons in 2013 to nearly 5.1 billion gallons. Commercial sales, at about 1.75 billion gallons, moved up 5.8%, while sales to retailers, dispensers, bottle fillers, cylinder exchanges, campgrounds, and hardware stores, among others, were nearly 26.6% higher at 283,216,000 gallons. Internal combustion sales surged nearly 10.3% and stood at 631,777,000 gallons. Industrial sector sales posted a 2.6% improvement and were at 488,236,000 gallons. Finally, agricultural sales advanced nearly 5.4% over 2013 and stood at 1,116,574,000 gallons.

States leading residential odorized propane sales for the most recent reporting period were Michigan with 420,520,000 gallons and an 8.3% share of the U.S. market, followed by Wisconsin with 292,979,000 gallons sold and a 5.8% share. New York was next with 252,950 gallons and a 5% share; Minnesota, 250,909,000 gallons and 4.9% of the market; and Illinois, 219,080,000 gallons residential gallons sold and a 4.3% share. Together, the five states sold 1,436,438,000 gallons and captured 28.3% of the residential market.

Commercial sector leaders were California, North Carolina, Pennsylvania, Florida, and Texas, which sold 466,029,000 gallons and captured 26.6% of the market. API reports California sold 106,301,000 gallons and held a 6.1% share; North Carolina, 93,557,000 gallons, 5.3%; Pennsylvania, 89,988,000 gallons, 5.1%; Florida, 88,233,000 gallons, 5%; and Texas, 87,950,000 gallons, 5%.

Iowa once again led agricultural sector sales with 189,277,000 gallons sold and held a 17% market share. Minnesota was next with 142,873,000 gallons and a 12.8% share. North Carolina sold 99,239,000 gallons and held 8.9% of the market; Illinois, 80,602,000 gallons, 7.2%; and California, 55,499,000 gallons, 5%. Together the states sold 567,490,000 gallons and represented 50.8% of the agricultural sales market.

State and PADD totals showed California in the number one spot for internal combustion sales with 71,695,000 gallons sold, followed by Texas, which sold 63,194,000 gallons. Trailing was Illinois, 38,182,000 gallons; Georgia, 29,637,000 gallons; and Wisconsin, 25,930,000 gallons sold. PADD 2, the Midwest, led the nation in internal combustion sector sales with 224,073,000 gallons sold in 2014.

Missouri was the industrial sector sales leader with 38,292,000 gallons sold, followed by Wisconsin with 30,667,000 sold. California, Texas, Illinois, and Pennsylvania were next with sales of 30,034,000, 26,051,000, 25,040,000, and 22,349,000 gallons, respectively.

The API survey shows the average residential account in 2014 used 406 gallons of propane, up from 394 in 2013 for a 3% gain. Leading states were North Dakota, with 1101 average residential gallons sold; Nebraska, 963 gallons; Iowa, 933 gallons; Illinois, 901 gallons; and Minnesota, 805 residential gallons. U.S. average commercial gallons sold came in at 1973 gallons, off 0.5% from the 1984 gallons sold a year earlier. Top states were Hawaii, 5945 average gallons; North Dakota, 5741 gallons; Wyoming, 4095 gallons; Utah, 3608 gallons; and South Dakota, 3578 gallons.

Average sales to retailers climbed 22.2% year on year, rising from 1134 gallons in 2013 to 1386 gallons in 2014, according to API. Leaders were Hawaii, 42,399 gallons; Rhode Island, 8213 gallons; New York, 7034 gallons; New Jersey, 6365 gallons; and Massachusetts, 5277 gallons. Average internal combustion customer sales rose from 3180 to 3271 gallons year on year for a 2.9% move higher. By far, California led that category with an average 179,508 gallons sold. Following were Nebraska, 15,192 gallons; North Dakota, 11,617 gallons; New Mexico, 11,363 gallons; and West Virginia, 6127 gallons.

For industrial, average sales totaled 3095 gallons sold in 2014 compared to 3021 gallons the previous year, a 2.4% improvement. Out front was New Hampshire with 12,517 average gallons sold; Utah, 8072 gallons; Rhode Island, 8014 gallons; North Dakota, 7491 gallons; and Nevada, 6468 gallons. Average agricultural sales per customer were at 3141 gallons, down 6.6% from 2013’s 3364 gallons. North Dakota’s agricultural customers used an average 9208 gallons; South Carolina, 7403 gallons; Georgia, 6375 gallons; Maine, 6175 gallons; and Washington, 5951 gallons.

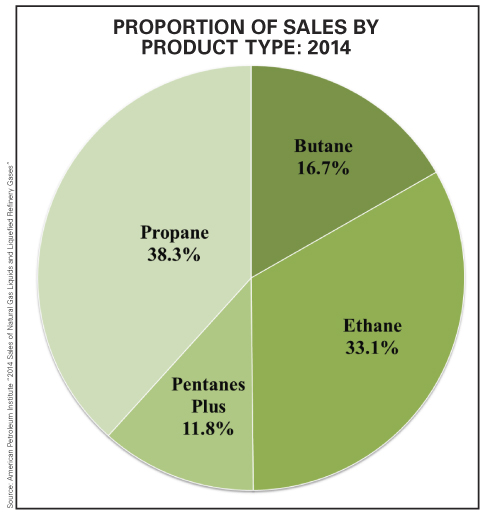

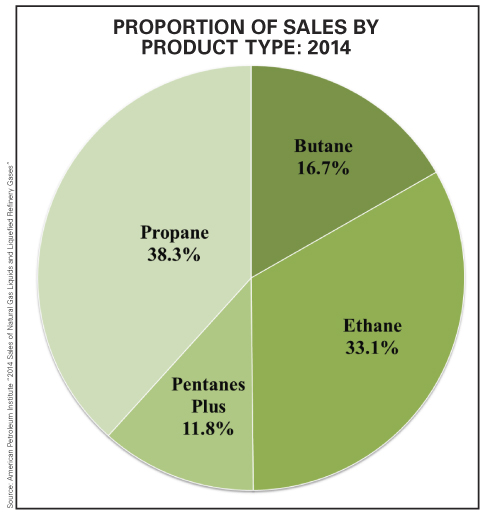

Overall, API reports that total 2014 sales of natural gas liquids and liquefied refinery gas totaled 49.4 billion gallons, representing a 5.6% increase over 2013. Propane of all types, at 18.9 billion gallons sold, dipped 1.6%, or 300,089,000 gallons, from the 19.2 billion gallons sold in 2013. Butane sales jumped 6.6%, from 7.7 billion gallons sold to 8.25 billion gallons. Ethane sales were up 1.5%, rising from 16.1 billion gallons to nearly 16.4 billion gallons. Finally, pentanes plus scored a marked 59.2% sales increase, going from 3.7 billion gallons to more than 5.8 billion gallons. Propane represented 38.3% of the 2014 market, followed by ethane with 33.1%. Butane captured 16.7%, and pentanes plus held 11.8%.

The annual “Sales of Natural Gas Liquids and Liquefied Refinery Gases” survey is jointly sponsored by API, the GPA Midstream Association (formerly the Gas Processors Association), the National Propane Gas Association, and the Propane Education & Research Council (PERC). Under the Propane Education and Research Act, congressional legislation that created PERC, 20% of assessment collections are eligible for rebate back to states. Each state’s allocation of PERC rebate funds is based on the latest API data for residential, commercial, industrial, internal combustion engine fuel, and agricultural uses and sales to retail dispensers that are compiled using responses to the survey.

The increase follows sales jumping by double digits in 2013 compared to 2012. In 2013, sales were a significant 14.1% higher, bringing the total to more than 8.83 billion gallons sold and breaking a long losing streak. From 2008 through 2012, API shows U.S. propane sales eroded by more than 2.2 billion gallons, representing a steep 22.2% retreat. That trend has finally been reversed. Prior to 2013, the last time year-over-year sales gains were experienced was in 2007.

Residential propane sales, which include recreational vehicle sales, grew 4.65% in 2014, rising from 4.84 billion gallons in 2013 to nearly 5.1 billion gallons. Commercial sales, at about 1.75 billion gallons, moved up 5.8%, while sales to retailers, dispensers, bottle fillers, cylinder exchanges, campgrounds, and hardware stores, among others, were nearly 26.6% higher at 283,216,000 gallons. Internal combustion sales surged nearly 10.3% and stood at 631,777,000 gallons. Industrial sector sales posted a 2.6% improvement and were at 488,236,000 gallons. Finally, agricultural sales advanced nearly 5.4% over 2013 and stood at 1,116,574,000 gallons.

States leading residential odorized propane sales for the most recent reporting period were Michigan with 420,520,000 gallons and an 8.3% share of the U.S. market, followed by Wisconsin with 292,979,000 gallons sold and a 5.8% share. New York was next with 252,950 gallons and a 5% share; Minnesota, 250,909,000 gallons and 4.9% of the market; and Illinois, 219,080,000 gallons residential gallons sold and a 4.3% share. Together, the five states sold 1,436,438,000 gallons and captured 28.3% of the residential market.

Commercial sector leaders were California, North Carolina, Pennsylvania, Florida, and Texas, which sold 466,029,000 gallons and captured 26.6% of the market. API reports California sold 106,301,000 gallons and held a 6.1% share; North Carolina, 93,557,000 gallons, 5.3%; Pennsylvania, 89,988,000 gallons, 5.1%; Florida, 88,233,000 gallons, 5%; and Texas, 87,950,000 gallons, 5%.

Iowa once again led agricultural sector sales with 189,277,000 gallons sold and held a 17% market share. Minnesota was next with 142,873,000 gallons and a 12.8% share. North Carolina sold 99,239,000 gallons and held 8.9% of the market; Illinois, 80,602,000 gallons, 7.2%; and California, 55,499,000 gallons, 5%. Together the states sold 567,490,000 gallons and represented 50.8% of the agricultural sales market.

State and PADD totals showed California in the number one spot for internal combustion sales with 71,695,000 gallons sold, followed by Texas, which sold 63,194,000 gallons. Trailing was Illinois, 38,182,000 gallons; Georgia, 29,637,000 gallons; and Wisconsin, 25,930,000 gallons sold. PADD 2, the Midwest, led the nation in internal combustion sector sales with 224,073,000 gallons sold in 2014.

Missouri was the industrial sector sales leader with 38,292,000 gallons sold, followed by Wisconsin with 30,667,000 sold. California, Texas, Illinois, and Pennsylvania were next with sales of 30,034,000, 26,051,000, 25,040,000, and 22,349,000 gallons, respectively.

The API survey shows the average residential account in 2014 used 406 gallons of propane, up from 394 in 2013 for a 3% gain. Leading states were North Dakota, with 1101 average residential gallons sold; Nebraska, 963 gallons; Iowa, 933 gallons; Illinois, 901 gallons; and Minnesota, 805 residential gallons. U.S. average commercial gallons sold came in at 1973 gallons, off 0.5% from the 1984 gallons sold a year earlier. Top states were Hawaii, 5945 average gallons; North Dakota, 5741 gallons; Wyoming, 4095 gallons; Utah, 3608 gallons; and South Dakota, 3578 gallons.

Average sales to retailers climbed 22.2% year on year, rising from 1134 gallons in 2013 to 1386 gallons in 2014, according to API. Leaders were Hawaii, 42,399 gallons; Rhode Island, 8213 gallons; New York, 7034 gallons; New Jersey, 6365 gallons; and Massachusetts, 5277 gallons. Average internal combustion customer sales rose from 3180 to 3271 gallons year on year for a 2.9% move higher. By far, California led that category with an average 179,508 gallons sold. Following were Nebraska, 15,192 gallons; North Dakota, 11,617 gallons; New Mexico, 11,363 gallons; and West Virginia, 6127 gallons.

For industrial, average sales totaled 3095 gallons sold in 2014 compared to 3021 gallons the previous year, a 2.4% improvement. Out front was New Hampshire with 12,517 average gallons sold; Utah, 8072 gallons; Rhode Island, 8014 gallons; North Dakota, 7491 gallons; and Nevada, 6468 gallons. Average agricultural sales per customer were at 3141 gallons, down 6.6% from 2013’s 3364 gallons. North Dakota’s agricultural customers used an average 9208 gallons; South Carolina, 7403 gallons; Georgia, 6375 gallons; Maine, 6175 gallons; and Washington, 5951 gallons.

Overall, API reports that total 2014 sales of natural gas liquids and liquefied refinery gas totaled 49.4 billion gallons, representing a 5.6% increase over 2013. Propane of all types, at 18.9 billion gallons sold, dipped 1.6%, or 300,089,000 gallons, from the 19.2 billion gallons sold in 2013. Butane sales jumped 6.6%, from 7.7 billion gallons sold to 8.25 billion gallons. Ethane sales were up 1.5%, rising from 16.1 billion gallons to nearly 16.4 billion gallons. Finally, pentanes plus scored a marked 59.2% sales increase, going from 3.7 billion gallons to more than 5.8 billion gallons. Propane represented 38.3% of the 2014 market, followed by ethane with 33.1%. Butane captured 16.7%, and pentanes plus held 11.8%.

The annual “Sales of Natural Gas Liquids and Liquefied Refinery Gases” survey is jointly sponsored by API, the GPA Midstream Association (formerly the Gas Processors Association), the National Propane Gas Association, and the Propane Education & Research Council (PERC). Under the Propane Education and Research Act, congressional legislation that created PERC, 20% of assessment collections are eligible for rebate back to states. Each state’s allocation of PERC rebate funds is based on the latest API data for residential, commercial, industrial, internal combustion engine fuel, and agricultural uses and sales to retail dispensers that are compiled using responses to the survey.