Monday, June 26, 2017

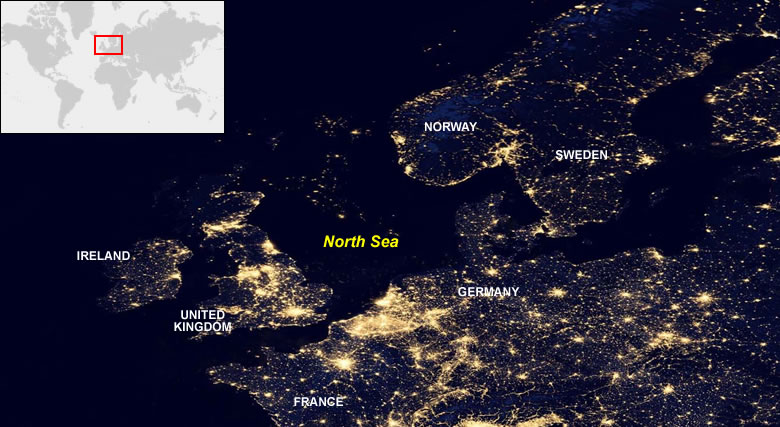

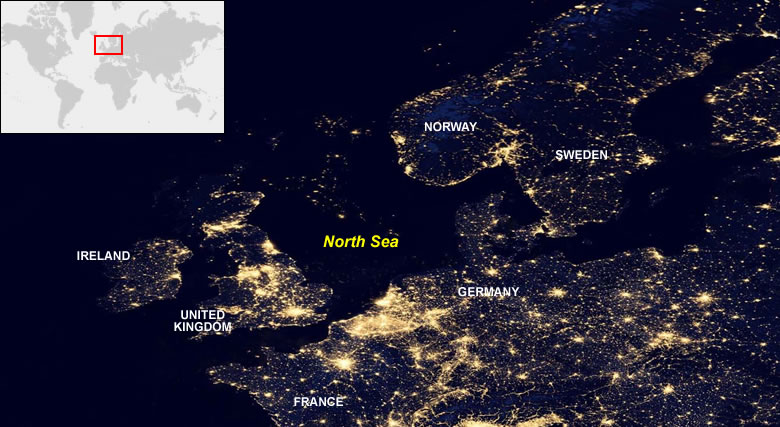

(June 26, 2017) Ineos recently purchased £800 million of oil and gas assets in the North Sea, as well as buying Danish company Dong Energy’s oil and gas business with access to a further potential 570 MMbbl of gas and oil reserves across 10 fields in Denmark, Norway, and the U.K. It makes Ineos the largest private producer in the North Sea and moves the company into off-shore oil and gas after buying fields from Fairfield Energy and the German Group DEA. Jim Ratcliffe, owner of Ineos, previously boosted control over the North Sea by buying BP’s Forties pipeline system, which links 84 North Sea oil and gas assets to the U.K. mainland, including Ineos’ chemical facility in Grangemouth.

With Brent crude oil, the international benchmark, having decreased in price to just less than $50/bbl, LPG prices are also likely to reduce in price. Propane prices for large, fully refrigerated cargos are at $301 per tonne cif Amsterdam/Rotterdam/ Antwerp (ARA) and prices for butane are at $315 per tonne cif ARA. Both prices have decreased, by $48 per tonne for propane and by $17 per tonne for butane. The coaster markets have been more active, with most of the petchems currently covered for both propane and butane. The latest indication of propane swap deals are July $338-$342 per tonne cif Northwest Europe and August $341-$345 per tonne cif Northwest Europe. North Sea prices for June are at $350 per tonne fob North Sea terminals for propane and at $327 per tonne fob for butane. Propane has hardened by $23.50 per tonne and butane has softened by $1 per tonne.

In the Mediterranean, the large propane and butane markets have been quiet with supplies of both products remaining tight. Fully refrigerated cargos of propane now stand at $410 per tonne cif Lavera, south of France and at $361 per tonne cif Lavera for butane. Both grades of LPG have weakened, by $49 per tonne for propane and by $90 per tonne for butane.

The Algerian national oil company, Sonatrach, has posted new LPG contract prices for June at $355 per tonne fob Skikda and Bethouia for propane and at $355 per tonne fob Bethouia for butane, with both products having hardened by $5 per tonne. The Saudi Arabians have negotiated new June LPG contract prices at $385 per tonne fob Middle Eastern (ME) terminals for propane and at $390 per tonne fob ME terminals for butane. In the Far East, Chinese buyers are quietly waiting and attempting to hold back their requirements because of the bearish domestic market. The VLGC (very large gas carrier) market has gradually eased off but is expected to return shortly.

Large shipping fixtures include: the Jag Vishu, 78,503 cu meter capacity, has been chartered by the Indian Oil Corp. (New Delhi) to load 44,000 tonnes of LPG from the Middle East Gulf (MEG) for delivery India. The BW Denis, 78,550 cu meter capacity, has been fixed by BP (London) to load 44,000 tonnes of LPG from the MEG for delivery options east. The Progress, 82,200 cu. meter capacity, has been taken by Kuwait Petroleum Corp. (Kuwait City) to load 44,000 tonnes of LPG from the MEG for delivery options east. The Cheyenne, 84,000 cu meter capacity, has been chartered by Statoil (Stavanger, Norway) to load 44,000 tonnes of LPG from Kaarstoe for delivery to Turkey. The Mistral, 83,000 cu meter capacity, has been fixed by Vitol (Rotterdam) to load 44,000 tonnes of LPG from West Africa for options east.

(SOURCE: The Weekly Propane Newsletter, 06/26/17) (Photo: Geology.com)

With Brent crude oil, the international benchmark, having decreased in price to just less than $50/bbl, LPG prices are also likely to reduce in price. Propane prices for large, fully refrigerated cargos are at $301 per tonne cif Amsterdam/Rotterdam/ Antwerp (ARA) and prices for butane are at $315 per tonne cif ARA. Both prices have decreased, by $48 per tonne for propane and by $17 per tonne for butane. The coaster markets have been more active, with most of the petchems currently covered for both propane and butane. The latest indication of propane swap deals are July $338-$342 per tonne cif Northwest Europe and August $341-$345 per tonne cif Northwest Europe. North Sea prices for June are at $350 per tonne fob North Sea terminals for propane and at $327 per tonne fob for butane. Propane has hardened by $23.50 per tonne and butane has softened by $1 per tonne.

In the Mediterranean, the large propane and butane markets have been quiet with supplies of both products remaining tight. Fully refrigerated cargos of propane now stand at $410 per tonne cif Lavera, south of France and at $361 per tonne cif Lavera for butane. Both grades of LPG have weakened, by $49 per tonne for propane and by $90 per tonne for butane.

The Algerian national oil company, Sonatrach, has posted new LPG contract prices for June at $355 per tonne fob Skikda and Bethouia for propane and at $355 per tonne fob Bethouia for butane, with both products having hardened by $5 per tonne. The Saudi Arabians have negotiated new June LPG contract prices at $385 per tonne fob Middle Eastern (ME) terminals for propane and at $390 per tonne fob ME terminals for butane. In the Far East, Chinese buyers are quietly waiting and attempting to hold back their requirements because of the bearish domestic market. The VLGC (very large gas carrier) market has gradually eased off but is expected to return shortly.

Large shipping fixtures include: the Jag Vishu, 78,503 cu meter capacity, has been chartered by the Indian Oil Corp. (New Delhi) to load 44,000 tonnes of LPG from the Middle East Gulf (MEG) for delivery India. The BW Denis, 78,550 cu meter capacity, has been fixed by BP (London) to load 44,000 tonnes of LPG from the MEG for delivery options east. The Progress, 82,200 cu. meter capacity, has been taken by Kuwait Petroleum Corp. (Kuwait City) to load 44,000 tonnes of LPG from the MEG for delivery options east. The Cheyenne, 84,000 cu meter capacity, has been chartered by Statoil (Stavanger, Norway) to load 44,000 tonnes of LPG from Kaarstoe for delivery to Turkey. The Mistral, 83,000 cu meter capacity, has been fixed by Vitol (Rotterdam) to load 44,000 tonnes of LPG from West Africa for options east.

(SOURCE: The Weekly Propane Newsletter, 06/26/17) (Photo: Geology.com)