Thursday, January 19, 2017

Attracting new residential customers is a continuing challenge for propane marketers. Noting that sound market intelligence is important in helping propane marketers appeal to those customers, the Propane Education & Research Council (PERC) and Metrostudy began the Residential Opportunity Insights program.

The Residential Opportunity Insights reports provide propane marketers with information about current residential market conditions in various areas of the country and also shows them where the most home building and remodeling activity is taking place, how much of it is occurring away from the natural gas mains, projections of market conditions over the next few years, and where propane marketers should focus their marketing and sales efforts.

Metrostudy and PERC launched the Residential Opportunity Insights reports last April at the National Propane Gas Association Southeastern Conference in Nashville, with a fourth quarter 2015 to fourth quarter (forecast) 2016 webinar showing propane activity in the Nashville-Davidson, Tenn. area.

PERC and Metrostudy hold quarterly webinars focusing on a different geographic region. In addition, data in the Residential Opportunity Insights reports are also updated on a quarterly basis and include all geographic regions in the U.S. The next Residential Opportunity Insights webinars focused on target areas in Tennessee and Illinois.

The next Residential Opportunity Insights webinars focused on target areas in Tennessee and Illinois.

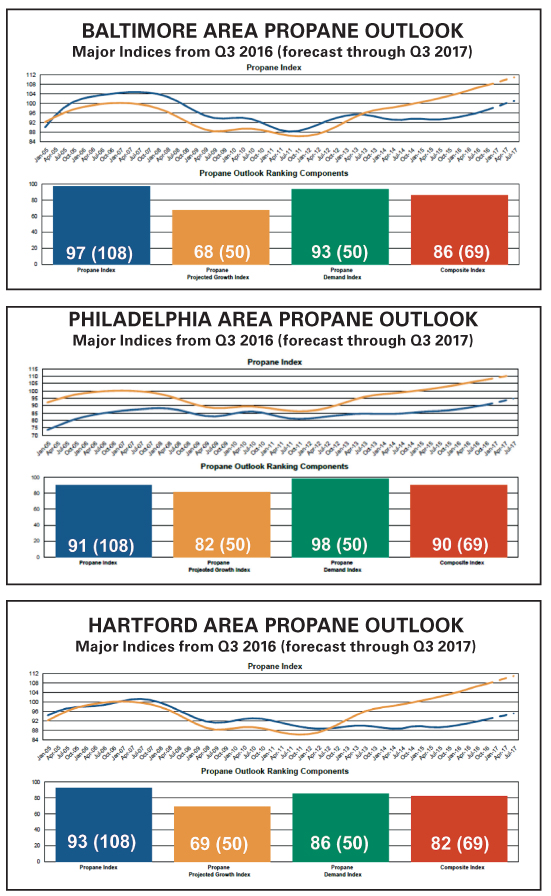

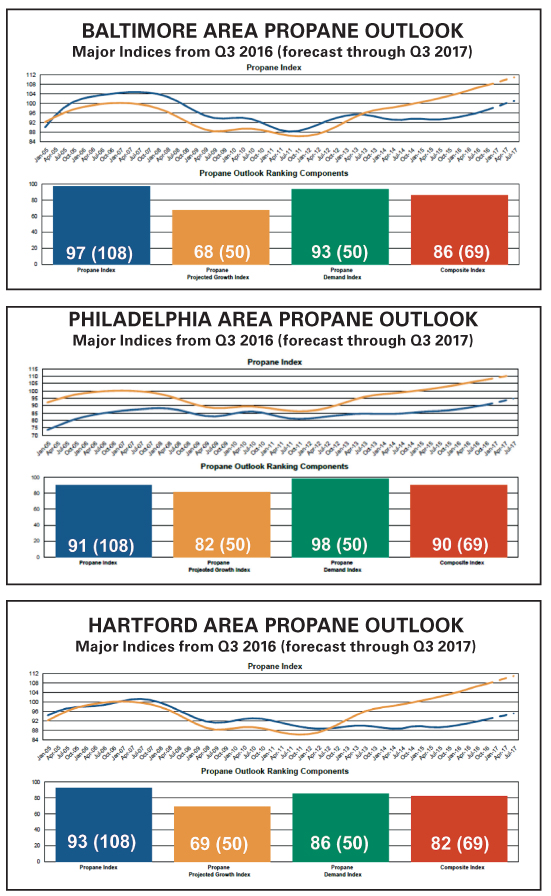

Baltimore, Philadelphia, Hartford, Conn., and the surrounding areas made up the highlighted geographic region in the third quarter webinar on Dec. 8.

Simon Hyoun, Metrostudy’s director of marketing services, noted that the study’s normal rate of growth is 50. Its projected growth index is a score that indicates whether propane project activity will go up in the next three years for a specific area. Baltimore, with a score of 68, shows a strong indication of growth compared to the study’s norm.

The propane index reflects a total of scores in the following areas: the distance from natural gas; consumer preference for gas appliances over other energies such as electricity; and the prevalence of propane appliances in the home vs. natural gas.

The study’s consumer demand index, or propane demand index, measures the likelihood of whether three strong consumer target groups for propane—which the study refers to as “simple life,” “entry level,” and “transitional group” — reside in that specific market. The higher the number of those people residing in a market means a higher metropolitan study area, or MSA, score.

Consumers in those three categories are more likely to live in propane homes or choose propane when it is available as an option.

“These are the three that we always associate and are looking for [when] considering types of consumers that we would want to go after with…marketing or advertising,” Hyoun said. He described “simple life” consumers as those earning an average of $78,072 annually, which he noted were “earning above average but still middle income folks. They indicate a lot of favorability toward home improvement projects, they’re interested in investing in their current homes, and they are primarily living in suburban, ‘exurban,’ and rural locations. They love the outdoors.”

Metrostudy defined the “entry level” segment as “a strong target for propane marketers due to typical distance from a pipeline and desire to own energy-efficient appliances.” Those consumers have an average income of $44,612 and carry “a high propensity for home improvement projects,” according to Metrostudy. The Hispanic population is highest in this group.

Those in the third segment, transitional consumers, have average earnings of $30,138. This group includes millennials holding their first job, and many are in the market for their first home, Hyoun stated. “We like to identify this group as [one] that we should always keep an eye on for messaging and advertising.” By targeting people who are considering purchasing a home for the first time, it is a good idea to be a part of their decision-making process with a positive message about propane and appliances that are fueled by propane as opposed to another choice.”

The outer suburbs of the Baltimore, Md. area are a good prospect for propane marketers looking to sell to the residential builders market. The most recent webinar reported that the rural-urban fringe around Baltimore scores well in those areas.

Hyoun provided a Baltimore Area Heat Map By Composite Index, which he said shows propane marketers the zip codes that offer the best sales opportunities. He highlighted one zip code, 21784, which is Sykesville, Md., as having the highest composite ranking score of 100 for the entire Baltimore market area. The study indicated Sykesville has 1941 “simple life” households, 980 “entry level,” and 932 “transitional.”

The Metrostudy webinar also included a summary of the Baltimore area’s overall economy, stating that job growth is strong. For the residential market, the apartment sector remains strong in terms of “starts and absorption,” but it is expected to slow as multi-family financing tapers off.

The webinar also focused on areas surrounding Philadelphia as a key northeast housing market. Its projected propane growth index is 82, even stronger than Baltimore’s 68. As he did with Sykesville, Md., Hyoun highlighted a strong market in the Philadelphia area, Wayne, Pa., which also had the highest composite ranking score of 100 for the area.

Areas surrounding Hartford, Conn. were the third area of focus for the third quarter 2016 webinar, with a strong propane index of 93. Tolland, Conn. had a 100 composite ranking score.

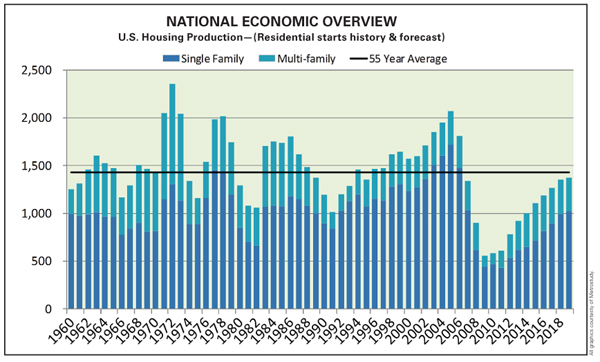

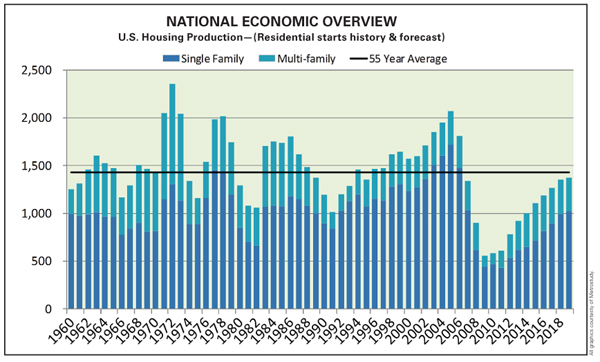

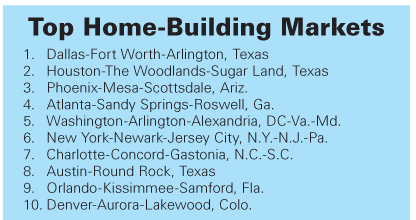

Also included in the report was a national economic and housing overview, with Metrostudy’s vice president of sales Robb Coltrin pointing out that year-over-year job growth from 2008 to 2016 has been steady. He noted that “most of the folks in the home-building business are absolutely thrilled with a slow, steady, sustainable growth rate.” He added that types of jobs created are also important to the home building industry, and the growth in high-wage sectors such as professional and business services, education, and healthcare is a good sign for home builders because people in those professions tend to be new home buyers.

According to Coltrin, the 55-year average for new home residential starts is about 1.4 million. “Obviously, we were exuberant in 2002 to 2006, it dropped off in ’08 and precipitously after that, but we’re on a steady climb back. We feel confident we’re going to cross over that 55-year average in 2020, and all of the economic underpinnings and…indicators do show that we’re going to get back to that 55-year average, which is a mental spot that a lot of the market, a lot of builders and people who fund the builders, have been waiting to happen for some time.” —Daryl Lubinsky

The Residential Opportunity Insights reports provide propane marketers with information about current residential market conditions in various areas of the country and also shows them where the most home building and remodeling activity is taking place, how much of it is occurring away from the natural gas mains, projections of market conditions over the next few years, and where propane marketers should focus their marketing and sales efforts.

Metrostudy and PERC launched the Residential Opportunity Insights reports last April at the National Propane Gas Association Southeastern Conference in Nashville, with a fourth quarter 2015 to fourth quarter (forecast) 2016 webinar showing propane activity in the Nashville-Davidson, Tenn. area.

PERC and Metrostudy hold quarterly webinars focusing on a different geographic region. In addition, data in the Residential Opportunity Insights reports are also updated on a quarterly basis and include all geographic regions in the U.S.

Baltimore, Philadelphia, Hartford, Conn., and the surrounding areas made up the highlighted geographic region in the third quarter webinar on Dec. 8.

Simon Hyoun, Metrostudy’s director of marketing services, noted that the study’s normal rate of growth is 50. Its projected growth index is a score that indicates whether propane project activity will go up in the next three years for a specific area. Baltimore, with a score of 68, shows a strong indication of growth compared to the study’s norm.

The propane index reflects a total of scores in the following areas: the distance from natural gas; consumer preference for gas appliances over other energies such as electricity; and the prevalence of propane appliances in the home vs. natural gas.

The study’s consumer demand index, or propane demand index, measures the likelihood of whether three strong consumer target groups for propane—which the study refers to as “simple life,” “entry level,” and “transitional group” — reside in that specific market. The higher the number of those people residing in a market means a higher metropolitan study area, or MSA, score.

Consumers in those three categories are more likely to live in propane homes or choose propane when it is available as an option.

“These are the three that we always associate and are looking for [when] considering types of consumers that we would want to go after with…marketing or advertising,” Hyoun said. He described “simple life” consumers as those earning an average of $78,072 annually, which he noted were “earning above average but still middle income folks. They indicate a lot of favorability toward home improvement projects, they’re interested in investing in their current homes, and they are primarily living in suburban, ‘exurban,’ and rural locations. They love the outdoors.”

Metrostudy defined the “entry level” segment as “a strong target for propane marketers due to typical distance from a pipeline and desire to own energy-efficient appliances.” Those consumers have an average income of $44,612 and carry “a high propensity for home improvement projects,” according to Metrostudy. The Hispanic population is highest in this group.

Those in the third segment, transitional consumers, have average earnings of $30,138. This group includes millennials holding their first job, and many are in the market for their first home, Hyoun stated. “We like to identify this group as [one] that we should always keep an eye on for messaging and advertising.” By targeting people who are considering purchasing a home for the first time, it is a good idea to be a part of their decision-making process with a positive message about propane and appliances that are fueled by propane as opposed to another choice.”

The outer suburbs of the Baltimore, Md. area are a good prospect for propane marketers looking to sell to the residential builders market. The most recent webinar reported that the rural-urban fringe around Baltimore scores well in those areas.

Hyoun provided a Baltimore Area Heat Map By Composite Index, which he said shows propane marketers the zip codes that offer the best sales opportunities. He highlighted one zip code, 21784, which is Sykesville, Md., as having the highest composite ranking score of 100 for the entire Baltimore market area. The study indicated Sykesville has 1941 “simple life” households, 980 “entry level,” and 932 “transitional.”

The Metrostudy webinar also included a summary of the Baltimore area’s overall economy, stating that job growth is strong. For the residential market, the apartment sector remains strong in terms of “starts and absorption,” but it is expected to slow as multi-family financing tapers off.

The webinar also focused on areas surrounding Philadelphia as a key northeast housing market. Its projected propane growth index is 82, even stronger than Baltimore’s 68. As he did with Sykesville, Md., Hyoun highlighted a strong market in the Philadelphia area, Wayne, Pa., which also had the highest composite ranking score of 100 for the area.

Areas surrounding Hartford, Conn. were the third area of focus for the third quarter 2016 webinar, with a strong propane index of 93. Tolland, Conn. had a 100 composite ranking score.

Also included in the report was a national economic and housing overview, with Metrostudy’s vice president of sales Robb Coltrin pointing out that year-over-year job growth from 2008 to 2016 has been steady. He noted that “most of the folks in the home-building business are absolutely thrilled with a slow, steady, sustainable growth rate.” He added that types of jobs created are also important to the home building industry, and the growth in high-wage sectors such as professional and business services, education, and healthcare is a good sign for home builders because people in those professions tend to be new home buyers.

According to Coltrin, the 55-year average for new home residential starts is about 1.4 million. “Obviously, we were exuberant in 2002 to 2006, it dropped off in ’08 and precipitously after that, but we’re on a steady climb back. We feel confident we’re going to cross over that 55-year average in 2020, and all of the economic underpinnings and…indicators do show that we’re going to get back to that 55-year average, which is a mental spot that a lot of the market, a lot of builders and people who fund the builders, have been waiting to happen for some time.” —Daryl Lubinsky