Wednesday, September 20, 2017

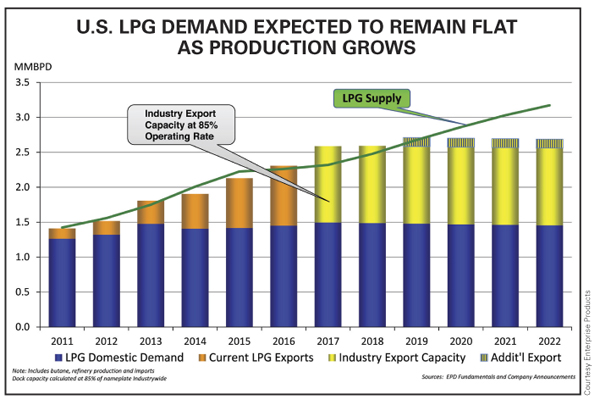

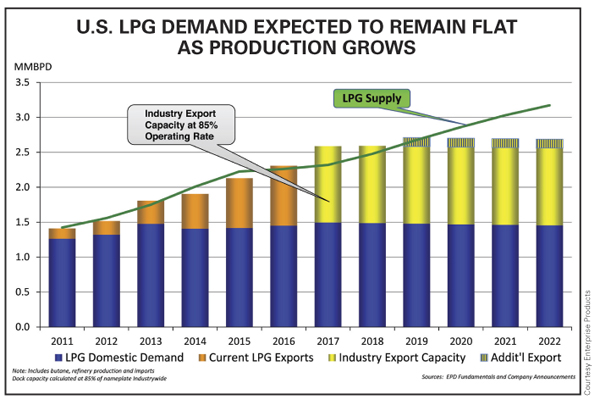

Most growth in U.S. propane supply will be exported. Domestic demand is expected to remain flat as production grows. Those observations, by ICF International and Enterprise Products Partners, respectively, lay out a disruptive roadmap for the nation’s propane retailers who must now compete to secure fuel for their customers in a world market and at prices increasingly influenced by global benchmarks.

The U.S. is the world’s leading exporter of LPG as many developing countries transition to the more efficient and cleaner fuel. The World Health Organization reports that nearly three billion people cook and heat their homes using agricultural waste, firewood, charcoal, and animal dung, collectively known along with other fuels as biomass. The resulting indoor pollution is estimated to cause about four million premature deaths each year, along with severe deforestation and other environmental degradation, which is incentivizing governments to encourage the switch to LPG. A larger factor driving demand is China’s burgeoning petrochemical sector and Japan’s and South Korea’s eagerness to source LPG from their American ally, this in order to boost supply security and diversification. Further, the Asia-Pacific region is coming off a three-year period during which LPG demand increased 230,000 bbld annually, according to ESAI Energy.

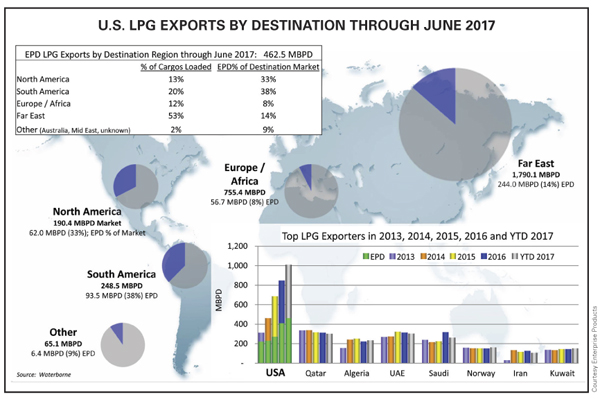

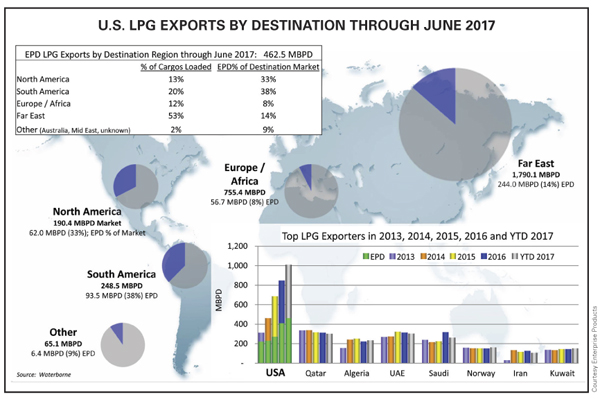

As noted by the financial content service provider Seeking Alpha, in the U.S. the implications for growing global LPG demand have been clear. In 2012 the U.S. became a net exporter, and the country is now the largest exporter in the world. As production has grown — to 2.1 MMbbld in 2016 for propane and butane, according to the Energy Information Administration — exports increased to 45% of total supply last year. Propane exports will exceed 50% of supply by 2019, ICF forecasts.

The Paris-based International Energy Agency (IEA) projects Chinese LPG demand, primarily from the residential sector, could increase by 250,000 bbld through 2022, largely due to the availability of U.S. supplies. Chinese petrochemical demand is also expected to grow. IEA in 2014 estimated that 78% — 1 MMbbld — of China’s demand and 95% — 575,000 bbld — of India’s was residential. The agency estimates India’s LPG demand could increase by 350,000 bbld between 2016 and 2022 as the South Asian nation’s Ujjwala program adds more than 100 million new residential LPG connections through 2019. “China and India LPG demand, most for residential, is price insensitive,” Enterprise Products commented at an August midstream infrastructure conference, while pointing out that “the population of just India and China together is eight times that of the U.S.”

U.S. propane output from natural gas processing plants more than doubled between 2010 and 2015 as a result of the shale boom, observes Morningstar Commodities Research. “With domestic demand effectively static, the surplus is largely destined for overseas markets, and exports have jumped fivefold over the same five-year period.” However, Morningstar notes that export terminal capacity now looks overbuilt, and shipper commitments have bid up U.S. propane prices to uncompetitive levels, leading to cargo cancelations. That may signal some good news for U.S. marketers looking for a significant primary inventory build ahead of this winter’s heating season.

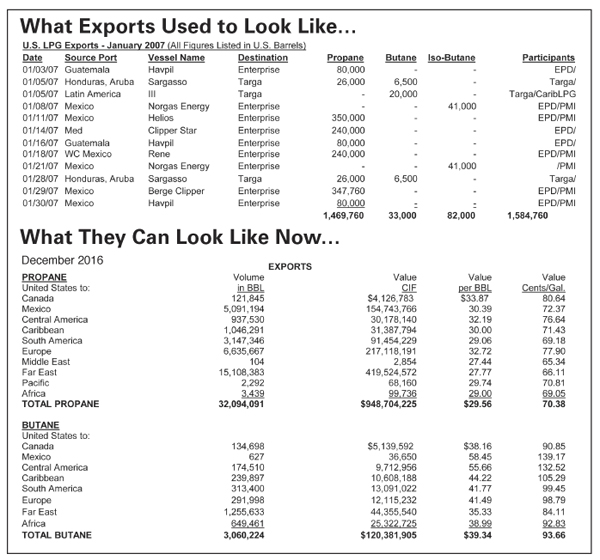

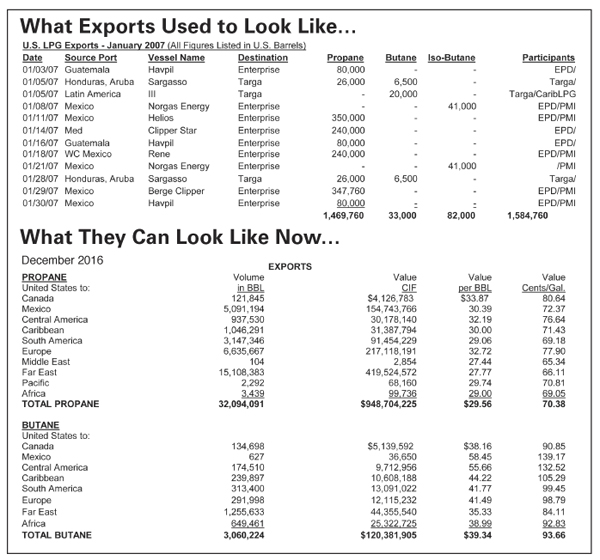

Energy Information Administration (EIA) data shows exports of propane, and smaller quantities of its petrochemical derivative, propylene, tallied together jumped fivefold from an average 109,000 bbld in 2010 to 616,000 bbld in 2015. That total climbed to an average 787,000 bbld in 2016, and the run-up in propane exports has accelerated, peaking during the third week of December 2016 at more than 1.3 MMbbld and averaging more than 1 MMbbld in January 2017. Volumes have since backed off, with the agency’s four-week export average as of mid-August standing at a robust but lower 743,000 bbld.

“LPG exports are largely waterborne and are typically transported on specialized vessels that use refrigeration to maintain cargos in a liquid state, which allows a greater volume to be carried,” Morningstar explains. “The biggest very large gas carriers, or VLGCs, hold from 60,000 to 85,000 cubic meters, the equivalent of 375,000 to 530,000 barrels. The June 2016 expansion of the Panama Canal now accommodates VLGCs, cutting the journey time from the Gulf Coast to Japan almost by half and reducing the cost of exports to Asia.”

LPG for All

India’s LPG imports are expected to rebound over the second half of this year and next for a 10% annual increase, reports S&P Global Platts. India, which is competing with China and Japan to be the world’s largest importer, took in 597,000 metric tonnes in June, which was down about 25% year on year. But India’s domestic LPG production is not rising at the same pace as consumption, so imports will go up by at least 10%, trade sources tell the consultancy.

India is one of the biggest buyers of butane in Asia, and the butane-propane mix that makes up the national consumption is now about even, compared to 60% butane and 40% propane earlier. India’s imports, which are mainly used for cooking, rose by 23% year on year in fiscal 2016-2017 to about 11 million tonnes. In April, India overtook Japan as the world’s second-largest importer as Prime Minister Narendra Modi pledged in May 2016 to provide cooking gas cylinders to every household, especially to energy-poor consumers.

China stands as the No. 1 importer, and China and Japan are major destinations for U.S. LPG, whereas direct imports by India of U.S. product have yet to emerge. Prime Minister Modi’s program, known in full as the Pradhan Mantri Ujjwala Yojana, led to a record 31.6 million new cooking gas connections during fiscal 2015-2016. As of August this year, total LPG consumption had increased for 46 months in a row, with a 15.9% rise in June from May.

Meanwhile, China’s LPG demand is expected to continue growing, driven by strong petrochemical and industrial consumption, but at a slower rate because fewer propane dehydrogenation (PDH) plants are scheduled to start up this year, notes S&P Global Platts. The consultancy forecasts LPG demand growth this year of about 10%, well below last year’s 24%. Demand in 2016 — comprising domestic production and net imports — was estimated by Platts Analytics at around 49 million tonnes, up 24% from about 39.55 million tonnes in 2015 based on calculations from data provided by the General Administration of Customs and the National Bureau of Statistics. A source from Chinese importer Oriental Energy said it is expected that LPG imports will rise by about 3 million tonnes year on year to nearly 18 million tonnes in 2017.

Platts estimates China imported about 16 million tonnes and exported around 1.4 million tonnes in 2016, the equivalent of about 14.6 million tonnes of net imports, up 40% for the year. Growth in both 2016 demand and imports were higher than market expectations. Market sources attributed last year’s strong growth to increasing demand from petrochemical plants, including PDH facilities, industrial users, and residential users. “PDH plants are expected to run at their maximum rates in 2017, given profitable processing margins,” a source with one PDH plant in east China told Platts.

Arbitrage Crush

But the arbitrage (the practice of taking advantage of a price difference between two or more markets) for U.S. exports is not constant. Sometimes American exports, unless under contract, just don’t make economic sense. This was highlighted by Argus Media in July when it reported that strong exports during the first half of this year tightened U.S. supplies and crushed the arbitrage to Asia, forcing cargo cancelations and at the same time spurring concerns about domestic inventory levels heading into the 2017-2018 heating season. Propane exports hit an all-time high of 1.3 MMbbld in late December 2016, according to EIA, just as Enterprise Products’ expanded terminal capacity opened on the Houston Ship Channel. Again, during the first quarter of 2017 exports averaged just over 1 MMbbld.

“But as propane exports flowed in to the national market, no longer constrained by domestic infrastructure, prices at Mont Belvieu, Texas rose,” Argus observes. “During the first half of 2017, LST propane prices averaged 56.1% of WTI [West Texas Intermediate crude oil], up from 47% of WTI during the first half of 2016. The higher prices relative to the international market slowed the pace of propane loadings and even let to cancelations in May, June, July, and August as the arbitrage to Asia remained poor. The pace of exports slowed to 792,000 bbld, on average, during the second quarter.”

Argus comments further that with more U.S. propane hitting the international market, U.S. prices began to align themselves more closely to prices in Asia. “The Far East Index’s premium to U.S. prices on a Houston-Chiba-delivered basis narrowed from an average of $37/tonne during the first quarter to an average $3/tonne discount to U.S. prices during the second quarter. The premium of U.S.-delivered propane into Asia on a spot fob (free on board) basis grew as wide as $19/tonne on May 17; during May U.S. market participants canceled at least a dozen June-loading cargos.”

The market data provider adds that U.S. market players hope additional cancelations will bolster inventories ahead of the winter heating season. Propane inventories stood at 69.2 MMbbl the week ended Aug. 11, 24.5 MMbbl, or 26.1%, lower than a year earlier, according to EIA. It is estimated that volumes will have to build to at least 80 MMbbl ahead of the winter heating season to accommodate both steady-term exports and domestic heating demand. Enterprise Products reported at the August infrastructure conference that it had 1150 cargos contracted from 2017 to 2020. The partnership’s LPG export capacity stands at 14 MMbbl a month.

Enterprise also outlines that the chemicals industry is making large investments based on U.S. shales. The company, citing the American Chemistry Council analysis, shows $164 billion in capital spending could lead to $105 billion in new chemical output a year. Much of the new investment is geared toward export markets, helping to improve the U.S. trade balance. In addition, Enterprise is currently commissioning its Mont Belvieu PDH facility, which is 100% subscribed under contracts averaging 15 years. Expected to be in service this quarter, the plant is designed to produce 1.65 billion pounds of polymer grade propylene and consume 35,000 bbld of propane.

Overall, U.S. exports of petroleum products and crude oil have more than doubled since 2010, rising from 2.4 MMbbld six years ago to 5.2 MMbbld in 2016, EIA reports. Exports of distillate, gasoline, LPG, and crude oil have all increased, but at different paces and for different reasons. And unlike the recently slowing increases in other U.S. exports, propane export growth has accelerated, notes the agency. Propane exports are shipped to different destinations than other U.S. petroleum exports. Most head for Asia, namely Japan and China. In addition, propane is a versatile fuel with many end uses, including in the residential, commercial, transportation, industrial, and petrochemical sectors.

That versatility, the world’s thirst, and America’s abundant LPG surplus and robust export infrastructure led to U.S. primary propane inventories tumbling by 59 MMbbl from the beginning of October 2016 through early March 2017, the largest decline on record for the period. And the sharp draw occurred despite unseasonably mild winter temperatures for the U.S. as a whole. Previously, EIA observes, U.S. propane inventories had been above historical norms since mid-2014, and stocks at the beginning of October 2016 were nearly 29 MMbbl above the prior five-year average. However, by March 3 they fell to just slightly below the preceding five-year average for the first time since May 2014. The record winter draw was a direct result of rapid growth in propane exports, not heating demand.

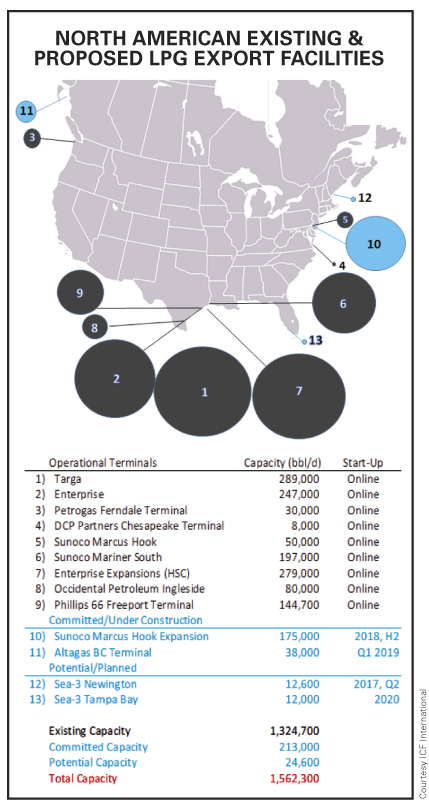

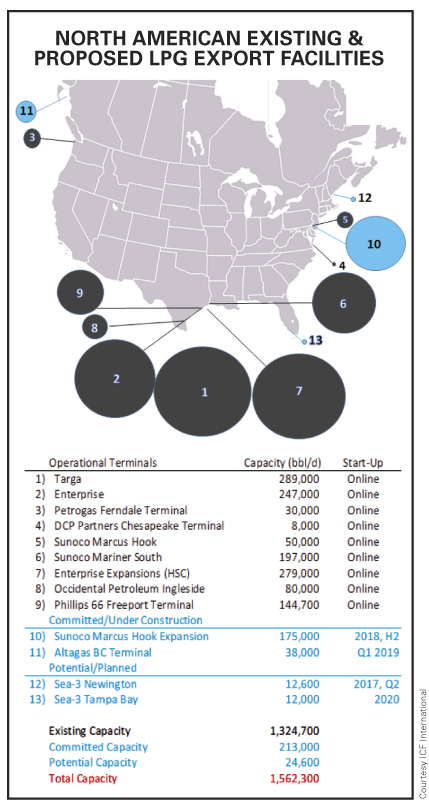

“As domestic propane consumption has remained relatively flat or declined on an annual basis, U.S. exports have continued to increase,” the agency comments. “Rising production and lower seasonal heating demand over the past two winters, in particular, have meant that more propane has been available for export.” EIA adds that over the past four years, new and expanded export terminals and a growing shipping fleet have boosted U.S. capacity, which is far and away located on the Gulf Coast.

IHS Markit sees global LPG demand growth continuing to be led by Asia and the Middle East, adding that while residential/commercial demand is growing steadily, chemicals demand is growing faster. Roughly half of world demand is in five countries: China, India, Japan, Saudi Arabia, and the U.S.

Again, China and India are the major drivers of global demand growth. China’s LPG demand growth will be a mixture of residential/commercial and chemical end uses. India’s demand growth will be nearly all for residential/commercial uses. Saudi Arabia’s demand is dominated by chemicals. Japan’s demand is likely to decline, driven by a gradual fading in residential/commercial demand. Finally, the U.S. must export propane because domestic demand can’t keep up with shale-based production, even at lower oil prices. And U.S. butane exports will also increase as domestic demand is saturated and export terminal capacity becomes available. “If U.S. export terminal capacity keeps up with export demand, U.S. LPG price trends are likely to more closely follow the price trends of the other international LPG benchmarks,” IHS concludes. —John Needham

The U.S. is the world’s leading exporter of LPG as many developing countries transition to the more efficient and cleaner fuel. The World Health Organization reports that nearly three billion people cook and heat their homes using agricultural waste, firewood, charcoal, and animal dung, collectively known along with other fuels as biomass. The resulting indoor pollution is estimated to cause about four million premature deaths each year, along with severe deforestation and other environmental degradation, which is incentivizing governments to encourage the switch to LPG. A larger factor driving demand is China’s burgeoning petrochemical sector and Japan’s and South Korea’s eagerness to source LPG from their American ally, this in order to boost supply security and diversification. Further, the Asia-Pacific region is coming off a three-year period during which LPG demand increased 230,000 bbld annually, according to ESAI Energy.

As noted by the financial content service provider Seeking Alpha, in the U.S. the implications for growing global LPG demand have been clear. In 2012 the U.S. became a net exporter, and the country is now the largest exporter in the world. As production has grown — to 2.1 MMbbld in 2016 for propane and butane, according to the Energy Information Administration — exports increased to 45% of total supply last year. Propane exports will exceed 50% of supply by 2019, ICF forecasts.

The Paris-based International Energy Agency (IEA) projects Chinese LPG demand, primarily from the residential sector, could increase by 250,000 bbld through 2022, largely due to the availability of U.S. supplies. Chinese petrochemical demand is also expected to grow. IEA in 2014 estimated that 78% — 1 MMbbld — of China’s demand and 95% — 575,000 bbld — of India’s was residential. The agency estimates India’s LPG demand could increase by 350,000 bbld between 2016 and 2022 as the South Asian nation’s Ujjwala program adds more than 100 million new residential LPG connections through 2019. “China and India LPG demand, most for residential, is price insensitive,” Enterprise Products commented at an August midstream infrastructure conference, while pointing out that “the population of just India and China together is eight times that of the U.S.”

U.S. propane output from natural gas processing plants more than doubled between 2010 and 2015 as a result of the shale boom, observes Morningstar Commodities Research. “With domestic demand effectively static, the surplus is largely destined for overseas markets, and exports have jumped fivefold over the same five-year period.” However, Morningstar notes that export terminal capacity now looks overbuilt, and shipper commitments have bid up U.S. propane prices to uncompetitive levels, leading to cargo cancelations. That may signal some good news for U.S. marketers looking for a significant primary inventory build ahead of this winter’s heating season.

Energy Information Administration (EIA) data shows exports of propane, and smaller quantities of its petrochemical derivative, propylene, tallied together jumped fivefold from an average 109,000 bbld in 2010 to 616,000 bbld in 2015. That total climbed to an average 787,000 bbld in 2016, and the run-up in propane exports has accelerated, peaking during the third week of December 2016 at more than 1.3 MMbbld and averaging more than 1 MMbbld in January 2017. Volumes have since backed off, with the agency’s four-week export average as of mid-August standing at a robust but lower 743,000 bbld.

“LPG exports are largely waterborne and are typically transported on specialized vessels that use refrigeration to maintain cargos in a liquid state, which allows a greater volume to be carried,” Morningstar explains. “The biggest very large gas carriers, or VLGCs, hold from 60,000 to 85,000 cubic meters, the equivalent of 375,000 to 530,000 barrels. The June 2016 expansion of the Panama Canal now accommodates VLGCs, cutting the journey time from the Gulf Coast to Japan almost by half and reducing the cost of exports to Asia.”

LPG for All

India’s LPG imports are expected to rebound over the second half of this year and next for a 10% annual increase, reports S&P Global Platts. India, which is competing with China and Japan to be the world’s largest importer, took in 597,000 metric tonnes in June, which was down about 25% year on year. But India’s domestic LPG production is not rising at the same pace as consumption, so imports will go up by at least 10%, trade sources tell the consultancy.

India is one of the biggest buyers of butane in Asia, and the butane-propane mix that makes up the national consumption is now about even, compared to 60% butane and 40% propane earlier. India’s imports, which are mainly used for cooking, rose by 23% year on year in fiscal 2016-2017 to about 11 million tonnes. In April, India overtook Japan as the world’s second-largest importer as Prime Minister Narendra Modi pledged in May 2016 to provide cooking gas cylinders to every household, especially to energy-poor consumers.

China stands as the No. 1 importer, and China and Japan are major destinations for U.S. LPG, whereas direct imports by India of U.S. product have yet to emerge. Prime Minister Modi’s program, known in full as the Pradhan Mantri Ujjwala Yojana, led to a record 31.6 million new cooking gas connections during fiscal 2015-2016. As of August this year, total LPG consumption had increased for 46 months in a row, with a 15.9% rise in June from May.

Meanwhile, China’s LPG demand is expected to continue growing, driven by strong petrochemical and industrial consumption, but at a slower rate because fewer propane dehydrogenation (PDH) plants are scheduled to start up this year, notes S&P Global Platts. The consultancy forecasts LPG demand growth this year of about 10%, well below last year’s 24%. Demand in 2016 — comprising domestic production and net imports — was estimated by Platts Analytics at around 49 million tonnes, up 24% from about 39.55 million tonnes in 2015 based on calculations from data provided by the General Administration of Customs and the National Bureau of Statistics. A source from Chinese importer Oriental Energy said it is expected that LPG imports will rise by about 3 million tonnes year on year to nearly 18 million tonnes in 2017.

Platts estimates China imported about 16 million tonnes and exported around 1.4 million tonnes in 2016, the equivalent of about 14.6 million tonnes of net imports, up 40% for the year. Growth in both 2016 demand and imports were higher than market expectations. Market sources attributed last year’s strong growth to increasing demand from petrochemical plants, including PDH facilities, industrial users, and residential users. “PDH plants are expected to run at their maximum rates in 2017, given profitable processing margins,” a source with one PDH plant in east China told Platts.

Arbitrage Crush

But the arbitrage (the practice of taking advantage of a price difference between two or more markets) for U.S. exports is not constant. Sometimes American exports, unless under contract, just don’t make economic sense. This was highlighted by Argus Media in July when it reported that strong exports during the first half of this year tightened U.S. supplies and crushed the arbitrage to Asia, forcing cargo cancelations and at the same time spurring concerns about domestic inventory levels heading into the 2017-2018 heating season. Propane exports hit an all-time high of 1.3 MMbbld in late December 2016, according to EIA, just as Enterprise Products’ expanded terminal capacity opened on the Houston Ship Channel. Again, during the first quarter of 2017 exports averaged just over 1 MMbbld.

“But as propane exports flowed in to the national market, no longer constrained by domestic infrastructure, prices at Mont Belvieu, Texas rose,” Argus observes. “During the first half of 2017, LST propane prices averaged 56.1% of WTI [West Texas Intermediate crude oil], up from 47% of WTI during the first half of 2016. The higher prices relative to the international market slowed the pace of propane loadings and even let to cancelations in May, June, July, and August as the arbitrage to Asia remained poor. The pace of exports slowed to 792,000 bbld, on average, during the second quarter.”

Argus comments further that with more U.S. propane hitting the international market, U.S. prices began to align themselves more closely to prices in Asia. “The Far East Index’s premium to U.S. prices on a Houston-Chiba-delivered basis narrowed from an average of $37/tonne during the first quarter to an average $3/tonne discount to U.S. prices during the second quarter. The premium of U.S.-delivered propane into Asia on a spot fob (free on board) basis grew as wide as $19/tonne on May 17; during May U.S. market participants canceled at least a dozen June-loading cargos.”

The market data provider adds that U.S. market players hope additional cancelations will bolster inventories ahead of the winter heating season. Propane inventories stood at 69.2 MMbbl the week ended Aug. 11, 24.5 MMbbl, or 26.1%, lower than a year earlier, according to EIA. It is estimated that volumes will have to build to at least 80 MMbbl ahead of the winter heating season to accommodate both steady-term exports and domestic heating demand. Enterprise Products reported at the August infrastructure conference that it had 1150 cargos contracted from 2017 to 2020. The partnership’s LPG export capacity stands at 14 MMbbl a month.

Enterprise also outlines that the chemicals industry is making large investments based on U.S. shales. The company, citing the American Chemistry Council analysis, shows $164 billion in capital spending could lead to $105 billion in new chemical output a year. Much of the new investment is geared toward export markets, helping to improve the U.S. trade balance. In addition, Enterprise is currently commissioning its Mont Belvieu PDH facility, which is 100% subscribed under contracts averaging 15 years. Expected to be in service this quarter, the plant is designed to produce 1.65 billion pounds of polymer grade propylene and consume 35,000 bbld of propane.

Overall, U.S. exports of petroleum products and crude oil have more than doubled since 2010, rising from 2.4 MMbbld six years ago to 5.2 MMbbld in 2016, EIA reports. Exports of distillate, gasoline, LPG, and crude oil have all increased, but at different paces and for different reasons. And unlike the recently slowing increases in other U.S. exports, propane export growth has accelerated, notes the agency. Propane exports are shipped to different destinations than other U.S. petroleum exports. Most head for Asia, namely Japan and China. In addition, propane is a versatile fuel with many end uses, including in the residential, commercial, transportation, industrial, and petrochemical sectors.

That versatility, the world’s thirst, and America’s abundant LPG surplus and robust export infrastructure led to U.S. primary propane inventories tumbling by 59 MMbbl from the beginning of October 2016 through early March 2017, the largest decline on record for the period. And the sharp draw occurred despite unseasonably mild winter temperatures for the U.S. as a whole. Previously, EIA observes, U.S. propane inventories had been above historical norms since mid-2014, and stocks at the beginning of October 2016 were nearly 29 MMbbl above the prior five-year average. However, by March 3 they fell to just slightly below the preceding five-year average for the first time since May 2014. The record winter draw was a direct result of rapid growth in propane exports, not heating demand.

“As domestic propane consumption has remained relatively flat or declined on an annual basis, U.S. exports have continued to increase,” the agency comments. “Rising production and lower seasonal heating demand over the past two winters, in particular, have meant that more propane has been available for export.” EIA adds that over the past four years, new and expanded export terminals and a growing shipping fleet have boosted U.S. capacity, which is far and away located on the Gulf Coast.

IHS Markit sees global LPG demand growth continuing to be led by Asia and the Middle East, adding that while residential/commercial demand is growing steadily, chemicals demand is growing faster. Roughly half of world demand is in five countries: China, India, Japan, Saudi Arabia, and the U.S.

Again, China and India are the major drivers of global demand growth. China’s LPG demand growth will be a mixture of residential/commercial and chemical end uses. India’s demand growth will be nearly all for residential/commercial uses. Saudi Arabia’s demand is dominated by chemicals. Japan’s demand is likely to decline, driven by a gradual fading in residential/commercial demand. Finally, the U.S. must export propane because domestic demand can’t keep up with shale-based production, even at lower oil prices. And U.S. butane exports will also increase as domestic demand is saturated and export terminal capacity becomes available. “If U.S. export terminal capacity keeps up with export demand, U.S. LPG price trends are likely to more closely follow the price trends of the other international LPG benchmarks,” IHS concludes. —John Needham