Wednesday, February 4, 2015

By John Needham

In what must be one of the starkest examples of the energy commodity price collapse on the propane side this winter, Edmonton spot propane was mowed down to a dime a gallon as mid-January rolled up. One Canadian player only half-jokingly observed that the unthinkable was looming—that sellers would have to pay retailers to haul product away. In fact, at 10 cents/gal. western Canadian propane drew close to going negative, right in the middle of the winter heating season. Edmonton values have improved somewhat since, and as of Jan. 22 the bid and offer were at 16.00-17.25 cents/gal.

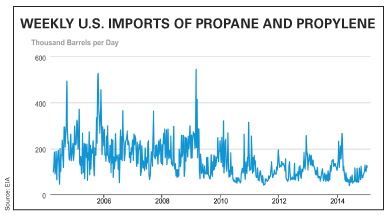

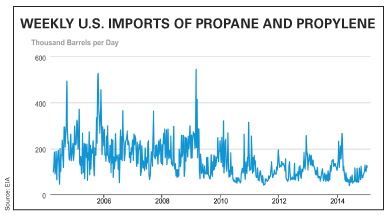

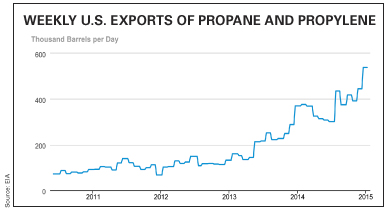

Nonetheless, those numbers remain astonishingly low. Compare them to last winter, when trading was at 164.00-164.50 cents/gal. Furthermore, while the U.S. has been a historical importer of Canadian propane, it has now has enough of its own supply. Lacking meaningful export opportunities elsewhere to date, and with planned West Coast export projects years on the far horizon, Canadian propane in the West is experiencing severe downward price pressure.

Price comparisons to winter 2013-2014 in any market probably aren’t advisable in light of that difficult season’s singularity, characterized by a Polar Vortex and sustained freezing temperatures, startlingly low inventories in the Midwest, knotty logistics struggles that boggled, and ramped-up exports running apace. However, as market watchers underscore, this winter the Canadian and U.S. propane markets are once again in alien territory, but for reasons diametrically counter to last winter. This year, surging production and weak end-use demand has left both U.S. and Canadian propane markets overrun with propane supply.

Lacking the hefty draws of last winter’s heating season due to milder temperatures, U.S. inventories in mid-January remained 102%, or 36 MMbbl above year-ago levels, while Canadian stocks were 123% higher as of Jan. 1 with 10.6 MMbbl in underground storage. Analysts caution that under this scenario it is much less likely that cold weather will cause propane to begin trading significantly higher on its own fundamentals as it did last year.

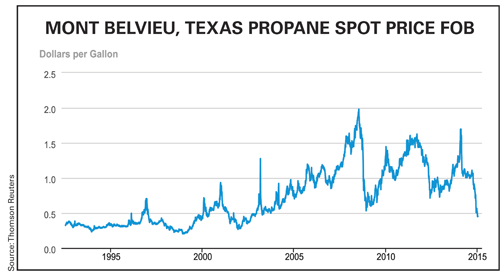

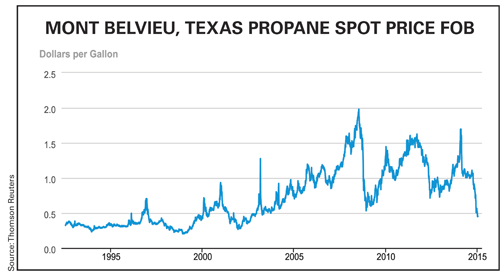

That left Mont Belvieu spot propane trading in the low 50-cent range and Conway at about 47 cents as January was drawing to a close. As a percentage to crude on a per-gallon basis, Belvieu propane was at about 47% and Conway was at 43.3%, significantly weak percentages considering winter trading typically is at 70% or more.

Pointedly, sinking crude oil prices have taken propane and other NGLs down. Crude futures have plunged more than 50% since June amid rising world output coupled with lackluster demand growth, with the latest losing streak the biggest since the 2008 financial crisis. Stored supplies of crude oil and petroleum products in the U.S. hit the highest level on record in early January, according to the Energy Information Administration (EIA).

Mounting fears are that the market will be awash in oil for the foreseeable future absent a call by OPEC leader Saudi Arabia for a cut in production in order to stabilize prices, a move the leading Middle Eastern producer has been reluctant to do. Instead, the Saudis are focusing on shoring up their market share and offering discounts to international buyers even as the commodity drifts ever lower.

A six-month sell-off in the oil market accelerated in the new year. Previously, price declines were mainly driven by strong U.S. output, but the outlook for the struggling economies of Europe and Asia increasingly suggest they will consume less crude than expected, worsening the global glut. The International Energy Agency continues to cut its forecast for global oil demand, signaling to investors that the world economy will struggle this year. While consumers reap the benefits of steeply lower gasoline prices, oil-exporting nations are struggling to balance their budgets and oil companies are seeing their stock prices slump. Energy industry layoffs are building and development projects are on hold.

Prices for NGLs, including propane, are closely linked to oil, so a sharp drop in crude prices has exerted downward pressure. According to the Oil Price Information Service, propane and butane are at more than 10-year lows, down by nearly half since the start of September. Noted is that the low cost of propane will help the roughly 5% of American households that use the fuel for heating, saving them from 20% to 34% this winter, EIA said recently.

Residential prices moved up and down in a fairly narrow range throughout the rest of 2009 as the nation remained mired in recession, and by March it was at 224.6 cents/gal. The low hit in early October when the average moved down to 194.0 cents, and then gained steam to rise back above $2 to 200.6 cents by the end of the month. The close of 2009 had it at 238.4 cents. January 2010 saw the residential average up to 246.0 cents, and by the end of the year it stood 11 cents higher at 257.2 cents. It was both up and downhill from there. January 2011 began at 260.3 cents and the year ended at 271.2 cents. Prices held in that range at the beginning of 2012 and well into spring. Surprisingly, by fall the average had fallen to 221.6 cents and ended the year at 226.2 cents.

In what must be one of the starkest examples of the energy commodity price collapse on the propane side this winter, Edmonton spot propane was mowed down to a dime a gallon as mid-January rolled up. One Canadian player only half-jokingly observed that the unthinkable was looming—that sellers would have to pay retailers to haul product away. In fact, at 10 cents/gal. western Canadian propane drew close to going negative, right in the middle of the winter heating season. Edmonton values have improved somewhat since, and as of Jan. 22 the bid and offer were at 16.00-17.25 cents/gal.

Nonetheless, those numbers remain astonishingly low. Compare them to last winter, when trading was at 164.00-164.50 cents/gal. Furthermore, while the U.S. has been a historical importer of Canadian propane, it has now has enough of its own supply. Lacking meaningful export opportunities elsewhere to date, and with planned West Coast export projects years on the far horizon, Canadian propane in the West is experiencing severe downward price pressure.

Price comparisons to winter 2013-2014 in any market probably aren’t advisable in light of that difficult season’s singularity, characterized by a Polar Vortex and sustained freezing temperatures, startlingly low inventories in the Midwest, knotty logistics struggles that boggled, and ramped-up exports running apace. However, as market watchers underscore, this winter the Canadian and U.S. propane markets are once again in alien territory, but for reasons diametrically counter to last winter. This year, surging production and weak end-use demand has left both U.S. and Canadian propane markets overrun with propane supply.

Lacking the hefty draws of last winter’s heating season due to milder temperatures, U.S. inventories in mid-January remained 102%, or 36 MMbbl above year-ago levels, while Canadian stocks were 123% higher as of Jan. 1 with 10.6 MMbbl in underground storage. Analysts caution that under this scenario it is much less likely that cold weather will cause propane to begin trading significantly higher on its own fundamentals as it did last year.

That left Mont Belvieu spot propane trading in the low 50-cent range and Conway at about 47 cents as January was drawing to a close. As a percentage to crude on a per-gallon basis, Belvieu propane was at about 47% and Conway was at 43.3%, significantly weak percentages considering winter trading typically is at 70% or more.

Pointedly, sinking crude oil prices have taken propane and other NGLs down. Crude futures have plunged more than 50% since June amid rising world output coupled with lackluster demand growth, with the latest losing streak the biggest since the 2008 financial crisis. Stored supplies of crude oil and petroleum products in the U.S. hit the highest level on record in early January, according to the Energy Information Administration (EIA).

Mounting fears are that the market will be awash in oil for the foreseeable future absent a call by OPEC leader Saudi Arabia for a cut in production in order to stabilize prices, a move the leading Middle Eastern producer has been reluctant to do. Instead, the Saudis are focusing on shoring up their market share and offering discounts to international buyers even as the commodity drifts ever lower.

A six-month sell-off in the oil market accelerated in the new year. Previously, price declines were mainly driven by strong U.S. output, but the outlook for the struggling economies of Europe and Asia increasingly suggest they will consume less crude than expected, worsening the global glut. The International Energy Agency continues to cut its forecast for global oil demand, signaling to investors that the world economy will struggle this year. While consumers reap the benefits of steeply lower gasoline prices, oil-exporting nations are struggling to balance their budgets and oil companies are seeing their stock prices slump. Energy industry layoffs are building and development projects are on hold.

Prices for NGLs, including propane, are closely linked to oil, so a sharp drop in crude prices has exerted downward pressure. According to the Oil Price Information Service, propane and butane are at more than 10-year lows, down by nearly half since the start of September. Noted is that the low cost of propane will help the roughly 5% of American households that use the fuel for heating, saving them from 20% to 34% this winter, EIA said recently.

Among the immediate losers under the NGL price retreat are producers in the U.S. Northeast, according to analysts. Companies in the liquids-rich Marcellus and Utica plays in Ohio and Pennsylvania counted on higher-priced NGLs to add value to their natural gas production. In addition, chemical companies were relying on a cheaper supply of NGLs to give them a competitive advantage over companies abroad that rely on the oil derivative naphtha. But as crude has fallen, naphtha has also become cheaper, eroding some of the competitive advantage. Chemical companies had budgeted billions for expansion projects premised on cheaper NGL prices compared to naphtha.

The unfolding scenario for energy harkens back to another surprising retreat 30 years ago, market watchers note. Between November 1985 and March 1986 the price of crude plunged by 67%. Between June 2014 and mid-January 2015, crude prices fell 57%, and could head lower. Alarmingly, after the freefall in the 1980s it took nearly 20 years for oil prices to rebound. Few, however, expect a replay of that torturous turnaround. Shale technology has slashed startup costs and streamlined production, taking project-to-profit times down to years, not decades. And while a year of low prices is better than a decade, market watchers comment that doesn’t mean prices will rebound soon or return to the triple-digit levels seen just months ago.

But it is unclear exactly what will happen next. Shale output has boomed only in the past five years, and it is now facing its first stress test. Veteran oil hands predict prices will recover within a year, explaining that sustained low prices will ultimately bring the market into balance. Economists are calling for higher energy prices by the end of the year, with the global benchmark crude, Brent, climbing from its current $46.59/bbl to the $70/bbl range.

Meanwhile, oil majors are stating they can still make a profit on their U.S. shale wells at $40/bbl for WTI, adding that costs for production and transportation have fallen by about 15%, despite intense competition for rigs, truck drivers, and oilfield services. For the time being, production is continuing at full bore. Factoring the decreasing costs of drilling, it is not clear when, and if, shale output in the U.S. will fall.

Reviewing propane prices, Mont Belvieu spot propane began September 2014 at 101.75-102.00 cents/gal., while Conway was also above a dollar at 100.50-101.50 cents. Posted averages were at 108.153 and 104.77 cents, respectively. The WTI fuel oil contract was at $92.28/bbl for the week. Spots ended the month with Mont Belvieu at 103.50-103.875 cents/gal. and Conway at 102.75-103.50 cents. Posted averages were also up, with Belvieu at 113.719 cents and Conway at 108.833 cents, but crude oil ended the week at $87.26/bbl.

October started with Mont Belvieu spots a bit higher at 104.50-105.75 cents/gal. Conway was ahead of the Texas trading hub at 106.50-107.875 cents, and posted averages jumped to 114.969 and 110.645 cents. Crude oil, however, continued to decline and was at $84.46/bbl. But that marked the beginning of the huge moves lower for propane and shading of the dollar benchmark. Just a week into October propane spots dived in both markets, with Texas giving up 8 cents and Conway more than 7.5 cents. Belvieu dropped to 97.25-99.00 cents/gal. and Conway was at 100.00-101.50 cents. The bloodletting continued, and by the end of October Mont Belvieu was off 20.75 cents from Oct. 6 and Conway was nearly 20 cents lower. Crude was down to $80.31/bbl.

However, as November arrived, spots experienced a bump and Mont Belvieu rose nearly 7 cents and Conway 3 cents, bringing the bids and offers to 89.875-90.50 cents/gal. and 93.50-95.75 cents. That spurt was short-lived, and just a week later both markets had shrugged off a nickel or more. Belvieu was at 83.50-84.25 cents/gal. and Conway 90.50-91.50. By month’s end Texas spots were down to 75.00-76.25 cents and the Midwest to 78.00-79.50 cents, while oil traded at $73.90 cents/bbl.

December brought more steep declines for propane and trading was at 60 cents in both markets. Mid-month saw Belvieu and Conway drop to the mid-50-cent range and end December at 54.50-55.75 cents/gal. in Texas and 51.50-52.25 cents in the Midwest. Oil tumbled to $56.11/bbl.

And then began 2015, with Mont Belvieu now down to 50.375-51.00 cents and Conway below 50 cents at 44.25-47.00 cents. Spots bottomed out a week into the new year and saw Belvieu at 44.25-44.875 cents/gal. and Conway under 40 cents at 39.25-40.25 cents. Markets did gain some traction by mid-January along with a one-day jump in crude oil prices. However, late-week trading saw the commodity turn south again. Nonetheless, as the month drew to a close propane spots had rebounded to 51.50-52.375 cents/gal. at Mont Belvieu and to 46.25-47.375 cents at Conway. Crude oil, meanwhile, had dropped to under $47/bbl.

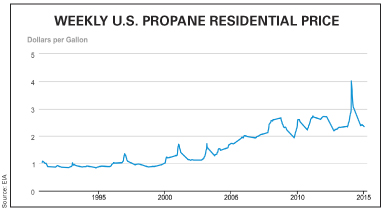

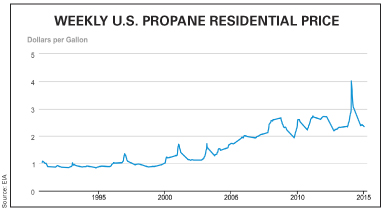

Along with steeply lower gasoline prices, consumers of propane are also enjoying the deep discounts accompanying crude oil’s fall. EIA reported Jan. 22 that U.S. residential propane prices averaged less than 239.00 cents/gal., 57 cents less than the price at the same time a year earlier. A review of EIA numbers shows that residential averages last hovered in that range during the 2008 financial crisis, when crude oil futures also plunged below $50/bbl. December 2008 had the average at 234.1 cents, and by February 2009 it was at 232.0 cents.

Residential prices moved up and down in a fairly narrow range throughout the rest of 2009 as the nation remained mired in recession, and by March it was at 224.6 cents/gal. The low hit in early October when the average moved down to 194.0 cents, and then gained steam to rise back above $2 to 200.6 cents by the end of the month. The close of 2009 had it at 238.4 cents. January 2010 saw the residential average up to 246.0 cents, and by the end of the year it stood 11 cents higher at 257.2 cents. It was both up and downhill from there. January 2011 began at 260.3 cents and the year ended at 271.2 cents. Prices held in that range at the beginning of 2012 and well into spring. Surprisingly, by fall the average had fallen to 221.6 cents and ended the year at 226.2 cents.

Prices were little changed as 2013 rolled in, and between January and March they ranged from 226.7 cents and 231.1 cents/gal. But big moves higher were coming. Early December it was up to 256.6 cents, and by month’s end it had jumped nearly 24 cents to 280.2 cents/gal. January 2014 started at 282.9, and then the residential average spiked and topped out at 400.1 cents/gal. at the end of the month. Prices then gradually tapered off, falling from 389.1 cents to 347.7 cents during February. As spring arrived, however, the average was still just above $3 at 307.9 cents/gal. Headed into fall prices fell off to 237.6 cents in October and then to 240.1 cents in November.

On the bright side, it appears that even without crude oil price supports cratering, propane industry preparations for this winter were spot on. The Midwest started the 2014-2015 heating season in a much better inventory situation than the 2013-2014 season. Primary stocks were about 15%, or about 3.6 MMbbl, higher at the start of the winter season compared to a year earlier as of October 2014. While PADD 2 volumes started the heating season last year at the lowest level in the last five years, this year they were on par with the five-year average and 18% above the previous year as of the end of October. National inventory levels on Oct. 30 were above the five-year historical range and surpassed the 10-year high.