Thursday, August 24, 2017

Propane forklifts have been losing ground to electricity over the last decade, despite their dominance of the market since the 1950s. What happened, and what can be done? There’s no simple answer to why it happened, but experts walked us through the issues, and they have a few solutions on how to fix the problem.

According to the Propane Education & Research Council’s (PERC) deputy director of business development, Jeremy Wishart, forklifts have been around for more than 100 years, though the modern forklift began with the 1917 Clark Tructractor, according to most sources. “It had an internal combustion engine, I’d assume gasoline, simply based on what was popular at the time,” said Wishart. Propane-powered forklifts came about in the 1950s, and quickly commanded the market until the 1990s.

“Electric lift trucks are nothing new, and propane was a dominant fuel choice from basically the late '50s, early '60s through the 1990s,” says Wishart. “However, emissions regulations began to become a significant factor in the late '90s and a shift in the U.S. forklift marketplace began to take shape — it has steadily moved from a manufacturing of materials or goods to a warehousing or distribution center business model.

“Aisles have become narrower and higher, loads/demands have become less intense, operations have moved from two- or three-shifts, to a single-shift application, and much of the warehousing market is indoors-only, so tailpipe emissions and engine noise and heat are issues for internal combustion-driven forklifts, i.e., propane,” Wishart says.

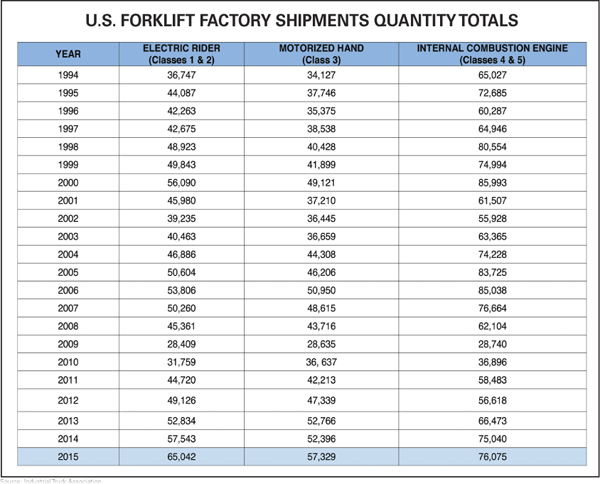

Today, propane holds an 85% to 90% market share for Class 4 and 5 lift trucks, which have internal combustion engines, solid/cushion tires, or pneumatic tires. Diesel makes up most of the remaining 10% to 15%, says Wishart.

Meanwhile, electric dominates Class 1 through 3 lifts. Currently, propane doesn’t have a narrow-aisle or pallet jack/motorized hand truck unit on the market. Overall, say Wishart and Industrial Truck Association (ITA) president Brian Feehan, electric units make up about two-thirds of the market.

“The overall size of the pie (forklift market/sales) is growing, but propane’s slice is staying the same,” says Wishart. “Electric forklifts are playing in the space previously owned by propane as the battery and recharging manufacturers have made significant technological advancements in the last 10 to 15 years. Electric forklifts can match propane load capacities; run times on a single charge are a wash with propane on a single 33-pound cylinder; and the battery manufacturers are far more engaged with the market and are aggressively going after customers with a complete sales solution.”

“The breakdown of counterbalance lift trucks, or Class 1, 4, and 5, compared to warehouse lift trucks, which are Class 2 and 3, shows an increasing popularity in warehouse lift trucks, which can be related to the shift to electric lift trucks,” says Feehan. “This change could also indicate a general shift in our economic landscape to less manufacturing applications and more distribution or warehousing environments, especially thanks to the growth in e-commerce and companies like Amazon.

“There has been a slow increase in the popularity of electric lift trucks over the years,” says Feehan. “It is interesting to note during recent recession periods that sales of electric lift trucks pick up significantly during tough economic times. This makes sense, as consumers will cut back on some items during a recession, but generally not cut back on food and beverages, which is a strong market for electric lift trucks.”

ITA recently completed a study with Oxford Economics to determine the industry’s direct, indirect, and induced economic impact in the U.S., says Feehan. Called “Lifting America: The Economic Impact of Industrial Truck Manufacturers, Distributors and Dealers,” it found the following:

• Globally there are more than 1 million units sold annually.

• In the U.S. for 2016, more than 230,000 units sold.

• The industry’s economic contribution to the U.S. GDP was $25.7 billion in 2015.

• It supports 209,000 employees.

• It paid $5.3 billion in taxes to local, state, and federal governments in 2015.

• For every one job in the forklift industry, another 2.5 jobs are created.

Propane gets a bit of a bad rap when it comes to cost, in part due to fuel costs. “Generally speaking, the base forklift is the same cost between a propane and an electric forklift,” says Wishart. “Where an electric forklift has added cost is in the battery purchase, as well as the recharging equipment needed for the battery, which can be up to 20% of the cost of the electric lift truck.”

Propane forklifts are less expensive at acquisition, but because an internal combustion engine has many moving parts and wear items compared to an electric lift truck, the maintenance costs are higher over the lifespan of the truck.

“Within the forklift market, it’s generally accepted that propane is a ‘pay as you go’ fuel and electric is a ‘pay for the fuel up front.’ In that respect, many forklift fleet operators have come to think of electric [forklifts] as zero-cost of operation after the initial acquisition. We know this isn’t true, but it’s how it was sold to them and they bought in — hook, line, and sinker,” says Wishart.

What can be done? PERC has a few answers. “For propane, we’re investing in new technology, telling the propane story, and re-engaging with customers and equipment dealers and distributors to drive propane sales,” says Wishart. Manufacturers of electric forklifts “will continue to advance battery and recharging technology, going after the remaining slices of the pie that propane and other fuels hold.”

There are a few possible solutions to defending and/or growing propane’s market share:

• Re-energize forklift fleet customers and even the propane industry — awareness, training, etc.

• Continue investing in, and updating, propane forklift technology (i.e., next- generation propane forklifts).

• Develop relationships with equipment dealers/distributors—selling as a team with the total solution (lift truck + fuel as one package).

Also, PERC is investing in a few technology development programs, “but it’s too early to reveal those programs or talk about specifics at this point. We’re certainly looking to the future in both emissions reductions and power generation for tomorrow’s forklifts,” says Wishart.

According to the Propane Education & Research Council’s (PERC) deputy director of business development, Jeremy Wishart, forklifts have been around for more than 100 years, though the modern forklift began with the 1917 Clark Tructractor, according to most sources. “It had an internal combustion engine, I’d assume gasoline, simply based on what was popular at the time,” said Wishart. Propane-powered forklifts came about in the 1950s, and quickly commanded the market until the 1990s.

“Electric lift trucks are nothing new, and propane was a dominant fuel choice from basically the late '50s, early '60s through the 1990s,” says Wishart. “However, emissions regulations began to become a significant factor in the late '90s and a shift in the U.S. forklift marketplace began to take shape — it has steadily moved from a manufacturing of materials or goods to a warehousing or distribution center business model.

“Aisles have become narrower and higher, loads/demands have become less intense, operations have moved from two- or three-shifts, to a single-shift application, and much of the warehousing market is indoors-only, so tailpipe emissions and engine noise and heat are issues for internal combustion-driven forklifts, i.e., propane,” Wishart says.

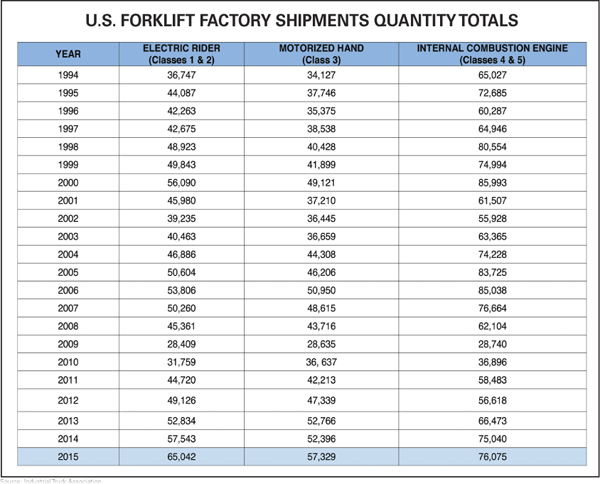

Today, propane holds an 85% to 90% market share for Class 4 and 5 lift trucks, which have internal combustion engines, solid/cushion tires, or pneumatic tires. Diesel makes up most of the remaining 10% to 15%, says Wishart.

Meanwhile, electric dominates Class 1 through 3 lifts. Currently, propane doesn’t have a narrow-aisle or pallet jack/motorized hand truck unit on the market. Overall, say Wishart and Industrial Truck Association (ITA) president Brian Feehan, electric units make up about two-thirds of the market.

“The overall size of the pie (forklift market/sales) is growing, but propane’s slice is staying the same,” says Wishart. “Electric forklifts are playing in the space previously owned by propane as the battery and recharging manufacturers have made significant technological advancements in the last 10 to 15 years. Electric forklifts can match propane load capacities; run times on a single charge are a wash with propane on a single 33-pound cylinder; and the battery manufacturers are far more engaged with the market and are aggressively going after customers with a complete sales solution.”

“The breakdown of counterbalance lift trucks, or Class 1, 4, and 5, compared to warehouse lift trucks, which are Class 2 and 3, shows an increasing popularity in warehouse lift trucks, which can be related to the shift to electric lift trucks,” says Feehan. “This change could also indicate a general shift in our economic landscape to less manufacturing applications and more distribution or warehousing environments, especially thanks to the growth in e-commerce and companies like Amazon.

“There has been a slow increase in the popularity of electric lift trucks over the years,” says Feehan. “It is interesting to note during recent recession periods that sales of electric lift trucks pick up significantly during tough economic times. This makes sense, as consumers will cut back on some items during a recession, but generally not cut back on food and beverages, which is a strong market for electric lift trucks.”

ITA recently completed a study with Oxford Economics to determine the industry’s direct, indirect, and induced economic impact in the U.S., says Feehan. Called “Lifting America: The Economic Impact of Industrial Truck Manufacturers, Distributors and Dealers,” it found the following:

• Globally there are more than 1 million units sold annually.

• In the U.S. for 2016, more than 230,000 units sold.

• The industry’s economic contribution to the U.S. GDP was $25.7 billion in 2015.

• It supports 209,000 employees.

• It paid $5.3 billion in taxes to local, state, and federal governments in 2015.

• For every one job in the forklift industry, another 2.5 jobs are created.

Propane gets a bit of a bad rap when it comes to cost, in part due to fuel costs. “Generally speaking, the base forklift is the same cost between a propane and an electric forklift,” says Wishart. “Where an electric forklift has added cost is in the battery purchase, as well as the recharging equipment needed for the battery, which can be up to 20% of the cost of the electric lift truck.”

Propane forklifts are less expensive at acquisition, but because an internal combustion engine has many moving parts and wear items compared to an electric lift truck, the maintenance costs are higher over the lifespan of the truck.

“Within the forklift market, it’s generally accepted that propane is a ‘pay as you go’ fuel and electric is a ‘pay for the fuel up front.’ In that respect, many forklift fleet operators have come to think of electric [forklifts] as zero-cost of operation after the initial acquisition. We know this isn’t true, but it’s how it was sold to them and they bought in — hook, line, and sinker,” says Wishart.

What can be done? PERC has a few answers. “For propane, we’re investing in new technology, telling the propane story, and re-engaging with customers and equipment dealers and distributors to drive propane sales,” says Wishart. Manufacturers of electric forklifts “will continue to advance battery and recharging technology, going after the remaining slices of the pie that propane and other fuels hold.”

There are a few possible solutions to defending and/or growing propane’s market share:

• Re-energize forklift fleet customers and even the propane industry — awareness, training, etc.

• Continue investing in, and updating, propane forklift technology (i.e., next- generation propane forklifts).

• Develop relationships with equipment dealers/distributors—selling as a team with the total solution (lift truck + fuel as one package).

Also, PERC is investing in a few technology development programs, “but it’s too early to reveal those programs or talk about specifics at this point. We’re certainly looking to the future in both emissions reductions and power generation for tomorrow’s forklifts,” says Wishart.