Wednesday, April 10, 2019

Every year brings new challenges to retail energy marketers. For propane marketers this past year has seen the cost of tanks skyrocket and the pool of qualified CDL drivers shrink with upward pressure on wages. Natural gas competition continues, and heat pumps and geothermal remain a threat to market share. So, what’s a propane marketer to do?

A good place to start is in understanding your financial results. The four basic areas of a financial analysis are revenues, cost of goods sold, operating expenses, and capital expenditures. Because we are in a commodity-based business, we like to look at gross profit (GP) as it is better to analyze trends in GP than revenue.

Gross profit

We define GP as what you sold the propane to your customers for minus what the propane cost (with or without transportation). Accountants may define GP differently and many include direct operating expenses such as driver and truck expense.

I think it is important to know the difference between a financial analyst and an accountant. Here is one definition I was given: “An accountant is someone who solves a problem you didn’t know you had in a way you don’t understand. A financial analyst is an expert who will know tomorrow why the things they projected yesterday didn’t happen today.”

All kidding aside, most accountants report on results and financial analysts look at trends. Trend analysis is the first step in better understanding your business. Gallons are a great place to start and normalized gallons is the best first step. Normalization could mean normalizing gallons by taking out extraordinary events like hurricanes, however, for many marketers it involves weather normalization based on degree days.

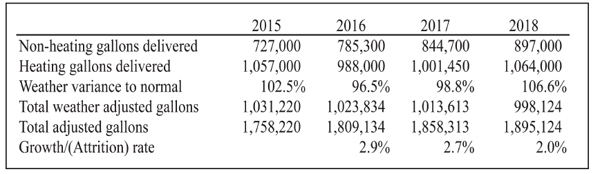

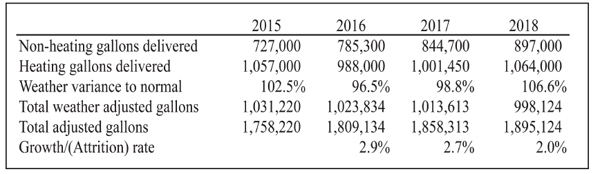

The table below shows a gallon trend for a propane marketer. This marketer is losing gallons for heating accounts and gaining gallons overall. Understanding where you are growing and shrinking helps determine your plan of action.

Analyze Margins

The next step would be to analyze margins as Gallons X Margin = GP. If margins are decreasing in the example above, then you may be selling more gallons and achieving a lower GP. Even if GP were flat, it typically costs more to deliver more gallons so in that case profits would be down. The old adage of “We are losing money but we are making it up in volume” was never a sustainable plan.

The next area of examination is operating expenses. We use a four- or five-year comparative income statement. Several different metrics can be used depending on the expenses. Cents per gallon is good for driver wages, truck fuel, and vehicle maintenance. Percentage of revenue is used for credit card processing fees, bank fees, bad debt, and working capital interest. Benefit expenses such as medical insurance, payroll taxes, 401(k), workman’s comp, etc. should be measured as a percentage of total payroll. Percentage of gross profit can be used for office wages and expenses, insurance, etc. Comparing these metrics over a period of a few years will help guide you to managing expenses.

capital expenditures

The last area to analyze is your capital expenditures. This includes vehicles (new and major repairs), propane tanks, computer systems, tank monitoring systems, and major building expansions/renovations. The good news is that the new tax laws have provided expanded Section 179 deductions (accelerated depreciation). Check with your accountant on specifics, however, the consensus is that you can now write off 100% of the first $1 million in the first year. That is a cash flow savings of $340,000 if you are in a 34% tax bracket. That’s a great incentive to invest in money-saving systems. We always recommend a cost-benefit analysis showing payback before choosing what system to invest in.

Recommendations

With the increased cost of propane tanks and driver wages, analyzing your return on investment for setting a customer tank has never been more important. Our recommendation to clients is to take a hard look at the return on investment and price accordingly.

A good place to start is in understanding your financial results. The four basic areas of a financial analysis are revenues, cost of goods sold, operating expenses, and capital expenditures. Because we are in a commodity-based business, we like to look at gross profit (GP) as it is better to analyze trends in GP than revenue.

Gross profit

We define GP as what you sold the propane to your customers for minus what the propane cost (with or without transportation). Accountants may define GP differently and many include direct operating expenses such as driver and truck expense.

I think it is important to know the difference between a financial analyst and an accountant. Here is one definition I was given: “An accountant is someone who solves a problem you didn’t know you had in a way you don’t understand. A financial analyst is an expert who will know tomorrow why the things they projected yesterday didn’t happen today.”

All kidding aside, most accountants report on results and financial analysts look at trends. Trend analysis is the first step in better understanding your business. Gallons are a great place to start and normalized gallons is the best first step. Normalization could mean normalizing gallons by taking out extraordinary events like hurricanes, however, for many marketers it involves weather normalization based on degree days.

The table below shows a gallon trend for a propane marketer. This marketer is losing gallons for heating accounts and gaining gallons overall. Understanding where you are growing and shrinking helps determine your plan of action.

Analyze Margins

The next step would be to analyze margins as Gallons X Margin = GP. If margins are decreasing in the example above, then you may be selling more gallons and achieving a lower GP. Even if GP were flat, it typically costs more to deliver more gallons so in that case profits would be down. The old adage of “We are losing money but we are making it up in volume” was never a sustainable plan.

The next area of examination is operating expenses. We use a four- or five-year comparative income statement. Several different metrics can be used depending on the expenses. Cents per gallon is good for driver wages, truck fuel, and vehicle maintenance. Percentage of revenue is used for credit card processing fees, bank fees, bad debt, and working capital interest. Benefit expenses such as medical insurance, payroll taxes, 401(k), workman’s comp, etc. should be measured as a percentage of total payroll. Percentage of gross profit can be used for office wages and expenses, insurance, etc. Comparing these metrics over a period of a few years will help guide you to managing expenses.

capital expenditures

The last area to analyze is your capital expenditures. This includes vehicles (new and major repairs), propane tanks, computer systems, tank monitoring systems, and major building expansions/renovations. The good news is that the new tax laws have provided expanded Section 179 deductions (accelerated depreciation). Check with your accountant on specifics, however, the consensus is that you can now write off 100% of the first $1 million in the first year. That is a cash flow savings of $340,000 if you are in a 34% tax bracket. That’s a great incentive to invest in money-saving systems. We always recommend a cost-benefit analysis showing payback before choosing what system to invest in.

Recommendations

With the increased cost of propane tanks and driver wages, analyzing your return on investment for setting a customer tank has never been more important. Our recommendation to clients is to take a hard look at the return on investment and price accordingly.