Thursday, April 30, 2020

(April 29, 2020) — Large and small companies looking to acquire propane companies each have their advantages and disadvantages. Large companies typically have good financial resources, a dedicated acquisition team, and advancement opportunities for employees. Smaller companies typically offer more employee input in decisions, fewer operational changes, and more flexibility regarding company policies.

LARGER MARKETERS DOMINATE

LARGER MARKETERS DOMINATE

While both large and small have their advantages and disadvantages, larger marketers dominate the acquisition market. Small or mid-size marketers competing for acquisitions against large multi-state marketers, can face some challenges. Understanding and improving on acquisition capabilities is one area a smaller acquirer should focus on. Knowing your competition and what they can and can’t offer is another important aspect. Ultimately, the decision is in the seller’s hands, so the most important aspect is meeting the seller’s needs and wants for the transition of the business to new ownership.

Regardless of buyer size, for an acquisition program to be successful, the buyer will need to convince the seller that they are the best buyer. The first consideration is always the purchase price, but there are many other aspects to consider such as asset allocation for taxes, financial abilities of buyer, due diligence process, legal negotiations (indemnifications, reps and warranties, etc.), employee retention, and the overall reputation of the buyer, to name a few.

As a buyer, the first item to address is the financial ability to complete a transaction. Every seller and advisors to sellers will want the transaction to be an all cash at closing deal. The reason is that if the seller is not paid at closing, there is risk. Typically, the buyer’s bank will have first position on all the assets and any seller financing or earn-outs fall into second position, or lower.

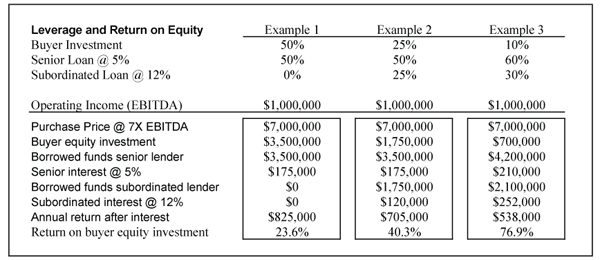

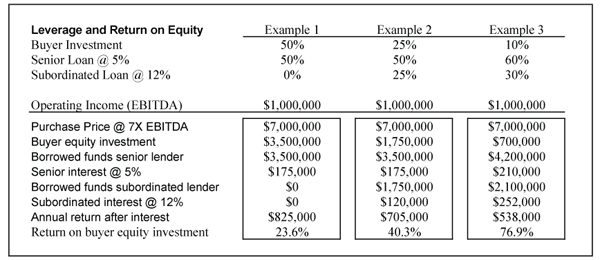

As a buyer, finding a bank to support your acquisition program is extremely important. Borrowing cash to fund an acquisition increases the buyer’s return on equity. Seller financing is always an option and it may have some tax advantages for the seller. The chart on this page shows how buyers can increase their return on their equity investment by using leverage. This is a major reason why private equity companies invest in acquisitions.

QUALITY OF EARNINGS REVIEW

All lenders will want a buyer to have money invested and all will want to review financial information on the seller. Many sellers do not have the level of detail most lenders and larger companies require. As an example, smaller companies usually do not have audited financial statements and some only have compiled statements. Many larger companies and private equity-backed buyers require a Quality of Earnings Review, which can be very time consuming.

Taxes play a big role in most transactions, especially if the seller is a C-corp. We have found that many accountants who do not handle transactions are unaware that tax strategies such as personal goodwill can be used for more than just C-corp transactions. The increase in the cost of steel has made it important to negotiate the allocation of purchase price more carefully. We have seen larger buyers insist on replacement cost allocations for propane tanks and some insist on including the labor in the allocation. A $1-million swing in propane tank allocation can mean $120,000 to $150,000 higher tax burden for a seller. As a seller, it is important that you are educated on tax consequences; as a buyer, educating a seller and structuring your offer accordingly may give you an advantage.

OTHER CONSIDERATIONS

There are many other considerations in creating an acquisition program for your company. They include: 1) Finding a company to acquire; 2) Valuing a business in a way that that makes sense for buyer and seller; 3) Raising funds to complete cash at closing transactions and why that is important for a seller; 4) How to structure a transaction for maximum tax benefits; 5) Performing smart due diligence; 6) Understanding legal terms and negotiating items such as indemnifications; 7) Closing documents including purchase agreement, non-compete agreements, consulting agreements, and other transaction documents; 8) Post closing announcement to employees and customers; and 9) Successful employee and system integration.

Please let us know if we can help.

Steven Abbate is managing director of Cetane Associates LLC, a provider of hands-on merger and acquisition advisory services for privately held companies. He may be contacted at This email address is being protected from spambots. You need JavaScript enabled to view it..

LARGER MARKETERS DOMINATE

LARGER MARKETERS DOMINATEWhile both large and small have their advantages and disadvantages, larger marketers dominate the acquisition market. Small or mid-size marketers competing for acquisitions against large multi-state marketers, can face some challenges. Understanding and improving on acquisition capabilities is one area a smaller acquirer should focus on. Knowing your competition and what they can and can’t offer is another important aspect. Ultimately, the decision is in the seller’s hands, so the most important aspect is meeting the seller’s needs and wants for the transition of the business to new ownership.

Regardless of buyer size, for an acquisition program to be successful, the buyer will need to convince the seller that they are the best buyer. The first consideration is always the purchase price, but there are many other aspects to consider such as asset allocation for taxes, financial abilities of buyer, due diligence process, legal negotiations (indemnifications, reps and warranties, etc.), employee retention, and the overall reputation of the buyer, to name a few.

As a buyer, the first item to address is the financial ability to complete a transaction. Every seller and advisors to sellers will want the transaction to be an all cash at closing deal. The reason is that if the seller is not paid at closing, there is risk. Typically, the buyer’s bank will have first position on all the assets and any seller financing or earn-outs fall into second position, or lower.

As a buyer, finding a bank to support your acquisition program is extremely important. Borrowing cash to fund an acquisition increases the buyer’s return on equity. Seller financing is always an option and it may have some tax advantages for the seller. The chart on this page shows how buyers can increase their return on their equity investment by using leverage. This is a major reason why private equity companies invest in acquisitions.

QUALITY OF EARNINGS REVIEW

All lenders will want a buyer to have money invested and all will want to review financial information on the seller. Many sellers do not have the level of detail most lenders and larger companies require. As an example, smaller companies usually do not have audited financial statements and some only have compiled statements. Many larger companies and private equity-backed buyers require a Quality of Earnings Review, which can be very time consuming.

Taxes play a big role in most transactions, especially if the seller is a C-corp. We have found that many accountants who do not handle transactions are unaware that tax strategies such as personal goodwill can be used for more than just C-corp transactions. The increase in the cost of steel has made it important to negotiate the allocation of purchase price more carefully. We have seen larger buyers insist on replacement cost allocations for propane tanks and some insist on including the labor in the allocation. A $1-million swing in propane tank allocation can mean $120,000 to $150,000 higher tax burden for a seller. As a seller, it is important that you are educated on tax consequences; as a buyer, educating a seller and structuring your offer accordingly may give you an advantage.

OTHER CONSIDERATIONS

There are many other considerations in creating an acquisition program for your company. They include: 1) Finding a company to acquire; 2) Valuing a business in a way that that makes sense for buyer and seller; 3) Raising funds to complete cash at closing transactions and why that is important for a seller; 4) How to structure a transaction for maximum tax benefits; 5) Performing smart due diligence; 6) Understanding legal terms and negotiating items such as indemnifications; 7) Closing documents including purchase agreement, non-compete agreements, consulting agreements, and other transaction documents; 8) Post closing announcement to employees and customers; and 9) Successful employee and system integration.

Please let us know if we can help.

Steven Abbate is managing director of Cetane Associates LLC, a provider of hands-on merger and acquisition advisory services for privately held companies. He may be contacted at This email address is being protected from spambots. You need JavaScript enabled to view it..