It has now been more than two years since Russia invaded Ukraine, resulting in the displacement of millions of Ukrainians and thousands of deaths. The conflict is also changing the liquefied petroleum gas (LPG) market, both within the borders of Ukraine and in the broader European economy. Ahead, European LPG business operators and marketers share their thoughts on the current shape of the Ukrainian autogas market and the ripple effects the conflict is causing in surrounding countries. Alexander Pokormiako, owner and technical director at ProGas Alternative Fuels Center in Kyiv, Ukraine, and Mikhail Shuban, an LPG marketer based in Ukraine, provide an overview of the innovations and advantages of LPG as a fuel source amid the challenges facing the industry in war-torn Ukraine.

A Look at the Ukrainian Market

Pokormiako: This year marks 20 years since I started working in the LPG business. This industry continues to amaze me with its ongoing various discoveries, challenges and its unexpected achievements.

As it often happens, my professional journey began quite accidentally. In 2002, my car was converted, and I personally fine-tuned it to acceptable standards. This experience inspired me to start my own business, which I have been engaged in for 20 years now, implementing various solutions for the use of alternative fuels in everyday life.

My work involves developing technical solutions, diagnosing and solving problems, fine-tuning fuel equipment, and creating specialized content on social media. The aim of this activity is to cultivate a culture of service consumption, informing end-users about the real advantages and disadvantages of each solution.

As a result, in Ukraine, a very positive and realistic reputation has been formed for alternative fuels, even in the face of large-scale military actions due to Russian aggression.

The name of my business — ProGas Alternative Fuels Center — was not chosen by chance. Over time, it became clear that there is no strict attachment to one type of fuel for a specific engine. We can combine, blend and achieve incredible results. For example, we are converting gasoline engines with the latest injection systems to use LPG and achieving characteristics identical to gasoline — and sometimes even higher.

Autogas in Ukraine

Ukraine stands as an extraordinary country, characterized by a tapestry of contradictions and unique conditions for development. Within this dynamic landscape, the evolution of LPG use in vehicles unfolds as a compelling narrative. From the stifling bureaucracy of the 1990s to a liberalized market where certification procedures now take mere hours, the journey of LPG development in Ukraine is one of perseverance and innovation.

My path in the LPG business was intricate and unpredictable. Various schemes and equipment were experimented with, complex research conducted and methodologies developed to ensure maximum compatibility of gas systems. There were many difficulties and challenges to overcome in the early days of this endeavor, including combustion properties research, engine mechanics, electronics and diagnostic techniques with a total absence of a systemized library where necessary knowledge could be obtained. I had to collect the data and knowledge in small portions, bit by bit.

This dedication paid off, leading to the successful retrofitting of cutting-edge vehicles imported from different continents to run on LPG. What seemed unfeasible just five years ago is now a reality in 2024.

The advancements in automotive engineering and technology have shed light on the efficiency of LPG compared to traditional gasoline engines. With its high-octane rating, perfect mixability and clean combustion, LPG has proven to be a more efficient option. Over the past two years, developers and manufacturers of gas equipment have refined LPG gas injection technology to an almost perfect status.

Despite adversities such as wide-scale war and regional obstacles, the development of alternative fuels in Ukraine persists. Liquefied petroleum gas emerged as the first choice in the market during a fuel crisis when fuel depots were destroyed amid Russian attacks. Electric vehicles relying on diesel generators for charging suffered the most. Over the course of a severe fuel crisis that lasted for eight months, many — including myself — relied solely on LPG, highlighting its reliability even in tumultuous times.

Furthermore, LPG boasts superior safety characteristics, with ease of storage and transport, stability at various temperatures, and minimal risk of soil and water contamination. The ability to remotely convert models from the U.S. market to run on LPG underscores its adaptability and efficiency. This streamlined process hints at further advancements and widespread adoption of LPG as a viable alternative fuel option. Active engagement in social media has been key for dispelling misconceptions and showcasing the benefits of LPG. Clients now view installing gas equipment as an investment, knowing that modern approaches make gas usage seamless, all without loss of power, errors or noticeable odors.

However, these advancements weren’t achieved overnight. They evolved as complex questions, and problems were tackled step by step. Through perseverance, our work has been elevated to a new level, and it’s this experience that I share with you. The journey of LPG development in Ukraine serves as a testament to the power of innovation and resilience in overcoming challenges, inspiring other nations to embrace alternative fuels and transition toward a more sustainable future.

Shuban: The wholesale LPG market in Ukraine continues its transformation. At the onset of the war, there was a 100% change in supply chains and logistics of imports. Prior to the conflict, the majority of the LPG in Ukraine came from Belarus. Since last autumn, blockades at the Polish-Ukrainian border, which intensified recently, blocked not only road transport but also railways, which is important since most LPG is supplied by rail.

Another problematic issue in the market now is the supply of Russian resources through third countries and the replacement of certificate of origin documents. The 12th package of European Union sanctions, which will come into full effect at the end of the year for LPG, should significantly address this issue.

Another problematic issue in the market now is the supply of Russian resources through third countries and the replacement of certificate of origin documents. The 12th package of European Union sanctions, which will come into full effect at the end of the year for LPG, should significantly address this issue.

Due to the issues mentioned above, wholesale LPG prices have reached their peak prices. In February 2024, at the Ukrainian producers auction, the price of LPG almost reached 50,000 Ukranian hryvnia per ton (US$1,300).

Despite the challenges, the people behind the LPG industry in Ukraine persevere and continue to work and fill the market.

A View of the European Autogas Market

Angelique Berden, marketing and communications director at the Netherlands-based Prins Alternative Fuels Systems, and Bartosz Kwiatkowski, director general with the Polish Liquid Gas Association, responded to a line of questions about the conditions and outlook of the larger European autogas market. See their responses below.

Can you provide an overview of the European autogas market?

Berden: Autogas is the most popular alternative fuel for vehicles. It is the most affordable option, at about 50% of the cost of petrol, and it is more environmentally friendly than petrol and diesel with up to 21% less CO2 emissions and 95% less particulate emissions. Plus, autogas is readily available, and the technology is there for new cars and for cars already on the road.

The European autogas market is a well-established market that has been active since the 1950s. The sector has survived through changing regulations, safety standards and incentive policies. Autogas is a proven solution that benefits consumers and enterprises for their sustainable performance.

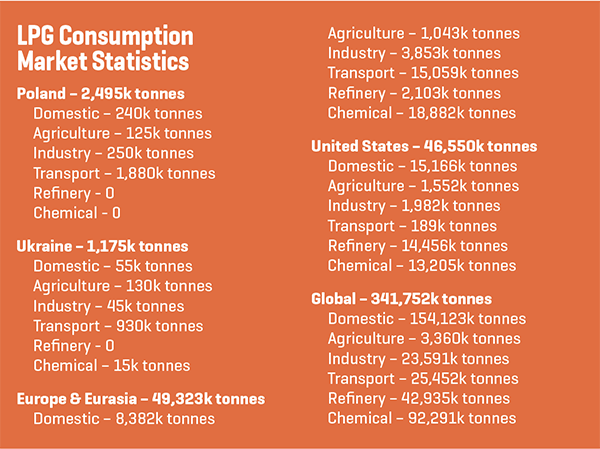

Kwiatkowski: According to the European Automobile Manufacturers Association, 2.5% of passenger cars registered in the EU are powered by autogas, which is on par with hybrid electric vehicles and three times more than battery electric vehicles. This volume is largely driven by two member states, Poland and Italy, which account for about 6 million autogas vehicles between them.

The autogas market in Poland is significant. Can you put it into context? How has the conflict in Ukraine impacted the Polish autogas market?

Kwiatkowski: The transportation sector in Poland is responsible for 75% of total domestic LPG consumption, so it is a very important market. There are about 3.4 million registered autogas passenger cars in Poland, which includes about 800,000 vehicles that do not have valid insurance, so we assume they are not on the road. This accounts for about 13% of all passenger vehicles in Poland. More than 80% of the fuel stations in Poland sell autogas, and it is worth noting that the introduction of regulations allowing for self-service refueling was a turning point in the adoption of autogas in Poland.

It is also worth noting that the Polish automotive fleet is among the oldest in Europe. Secondhand cars brought from Western Europe account for most new registrations. Automotive vendors rarely offer new vehicles equipped with gas installations — a notable exception is Renault/Dacia — so many of these [imported] cars are converted to autogas. The autogas industry in Poland grew from scratch from domestic small- and medium-sized enterprises developing their technologies in the 1990s on the basis of Dutch and Italian expertise. Since then, these Polish enterprises have gone global.

Prior to the Russian invasion, the Ukrainian autogas market was similar to the Polish market in size with very similar drivers of growth over the past 20 years — particularly the availability and affordability of autogas — as well as similar challenges with disposable incomes. However, according to our estimates, since 2022, as many as 1 million autogas-powered vehicles have relocated from Ukraine to Poland.

What is your outlook for the autogas sector?

Kwiatkowski: A new phenomenon in Poland is the growing popularity of autogas-powered hybrid electric vehicles (EV), primarily adopted in used cars like taxi fleets. These vehicles won the acclaim of professional drivers as the most affordable and most convenient solution for mixed-cycle driving.

Central Europe (including Poland) and Eastern Europe (Belarus, Ukraine and Russia) import many secondhand cars from Western European countries. As Western Europe switches to EVs, we expect more internal combustion vehicles to arrive in Poland that will be converted to autogas, and these vehicles will remain in service into the 2040s. Also, we are exploring the possibility for the approval of autogas installations for agricultural tractors as diesel is becoming more expensive.

Berden: The autogas market in Western Europe is facing challenges. The EU and several individual countries have announced plans to ban internal combustion engines by 2035. It is critical that we continue to educate consumers, policymakers and regulators about the advantages of autogas in the face of growing concerns about the electrical infrastructure, safety, affordability and life cycle emissions of EVs.

On a global scale, there are growing opportunities in new markets like South America, Asia and Africa. And globally there are opportunities with hard-to-electrify fleets, such as medium-duty trucks. In many markets, there is inadequate infrastructure for EV charging and the total costs for EV adoption are far too high. Autogas is the solution, as it is a clean alternative fuel and the infrastructure is affordable.

A key for the autogas market is that more renewables come online to meet regulatory standards. This will require a coordinated effort within the industry to get the right regulations and policies in place while the market develops the projects to reach necessary volumes.