We’re never sure what hand Mother Nature will deal,” said Steve Kossuth, vice president of global LPG supply at UGI Corporation. Kossuth also serves as chairman of the National Propane Gas Association’s (NPGA) Propane Supply and Logistics Committee. “NPGA and the Propane Education & Research Council (PERC) have been working with the agriculture industry to talk to farmers, monitor moisture content and evaluate what crop drying demand will be as the growing season progresses. This year, crop drying appeared to be a non-event, and this was a year where the forecasts aligned with what happened.”

Kossuth noted higher propane prices, as well as dryer weather conditions, may have been a factor causing farmers to let crops dry more in the field.

“I’m not as concerned as I was six to eight weeks ago,” said Jeff Thompson, supply consultant at Propane Resources. “Nominations appear to be down along the pipeline for propane from Conway, Kansas, for PADD 2.”

At 3Eight Energy, director Phil Farris observed in mid-November that harvest and drying for the season appeared to be nearly complete. “Dry conditions meant few propane-related issues and below average usage,” Farris said. “In our Southeast region … the summer tobacco curing season used to move so much propane it affected supply ratios, allocation, trucking, etc. But no longer. The southeast agricultural drying season for propane now works its way through the summer in a variety of crops — tobacco, corn, peanuts, cotton. And while it does help with summer demand, the effect is nothing like the old 1:1 winter/summer ratios of big tobacco days. This year most applications were close to normal, but the effect on winter supply is minimal.”

Supply Issues the Next Few Months

With U.S. propane inventory lower than in previous years and exports flowing at high rates, experts agree there is cause for concern as winter continues. Average U.S. wholesale prices on Nov. 8, 2021, were $1.51/gal., while average residential prices were $2.73/gal. according to the Energy Information Administration (EIA). These numbers were much lower last year when average wholesale prices were 70.8 cents per gallon (cpg) and average residential prices were $1.84/gal. A decline in inventory, due in large part to continued strong exports, has propane on Nov. 5, 2021, at 74.8 MMbbl — 20 MMbbl less than the 94.9 MMbbl a year ago.

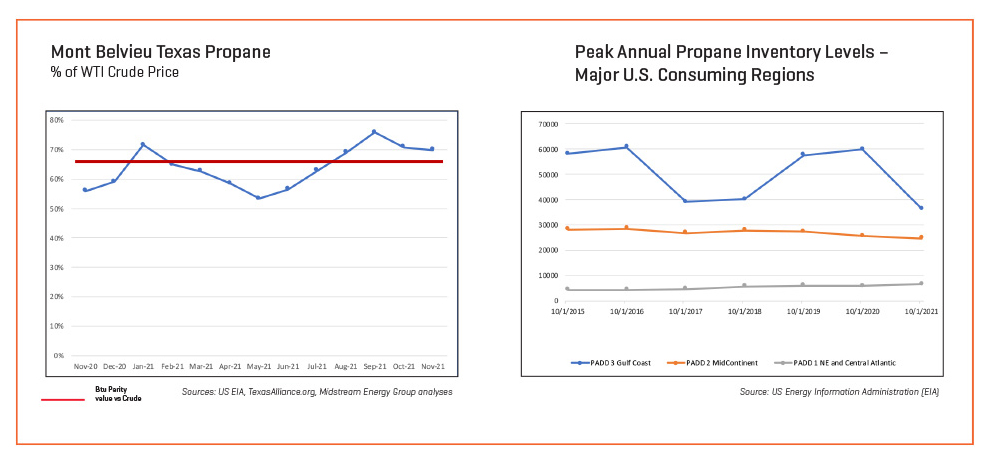

Anne Keller, managing director at Midstream Energy Group, shared Chart A (below), showing that winter propane prices indicate the U.S. shale surplus is being absorbed by demand growth. “Price trends are moving toward ‘pre-shale’ relationships when the U.S. was an importer,” Keller said. “A ‘hot’ topic this year is that shortages of heating fuels worldwide are causing concerns around propane shortages here. Inventory trends indicate that U.S. retailers in colder regions have stocked up for the winter, but don’t count on Gulf Coast or Canadian supplies for relief. There will be bidding against exports there.”

Keller also shared Chart B (below), which shows PADD 1 (Northeast) and PADD 2 (Midwest) are the primary markets for winter and appear to have ample supply; PADD 3 (Gulf Coast) is low. “Prices could spike if international buyers bid on more cargo to use for blending to LNG in Japan, but these buyers are taking volumes from Canada to avoid the freight costs,” she said. “Prices in Western Canada have risen 300% in the past year in response to increased exports and higher crude prices.”

Kossuth said the big surprise has been how much Asia is willing to pay for U.S. propane to make plastics. “Our inventories are at the low end of the five-year band,” he said. “We are in a period of backwardation, which means current month pricing is higher than prices for barrels just a few months from now. The prices are so much higher that anyone with $1.50/gal. propane in storage is faced with the fact that propane for just a few months from now at the tail end of the heating season is worth 90 cpg. That has inventory low and a lack of incentive for midstream companies to store propane for selling later.”

“We must now look at supply through an international lens,” Kossuth said. “We now produce much more propane in the U.S., and we distribute approximately 25% to the U.S. petrochemical market, 25% to the U.S. residential/commercial market and 50% is distributed as exports.”

“If there are continued high exports and higher domestic demand than normal, then there will certainly be challenges in the two areas everyone is watching — inventory levels and price,” Farris said. “Price would help curtail propane exports if it hasn’t already. A significant price move down would need some catalyst — acceptable inventories, moderating winter temps, economic news, etc. A big drop in price prior to the core winter months would feel good, but I think it also sets up for a big spike if there are problems in Q1.” Most of Farris’ customers in the Southeast are not expressing concern about shortages in the region this winter, but rather product cost, which can be influenced by supply issues in other regions.

“In the Southeast … we are always looking for an early tip or clue to what the weather will do, and it can change quickly,” Farris said. “As we saw last year in the Southeast, a La Niña winter’s real effects are very hard to predict, and the mild conditions usually associated with La Niña don’t always materialize.”

Farris noted that in the lower, mid-Atlantic area, “normal” temps are usually around 30 at night and 50 during the day. “Several days in the 70s can put a stop to everything,” he said. “Several days in the teens can escalate transportation and distribution problems quickly. A streak of consecutive cold days and nights can trigger natural gas curtailment, which itself presents problems and opportunities alike.”

Thompson said that although he is not as concerned as six to eight weeks ago, he will be watching export volumes, weather and other key factors in the coming weeks and months. It’s possible that wholesale prices at major hubs could dip to $1.20 on lower demand in the fourth quarter but bounce back up on higher demand in January and February.

JD Buss, trading and risk management advisor at Twin Feathers, agrees the amount of propane to be exported from North America is the largest concern for retail propane marketers. “During the year of 2020, propane exports continued to grow and kept that trend going in 2021,” he said. “When we evaluate the average daily exports (per the EIA) for 2021 versus 2020, there is a 5%-plus growth (at a minimum) rate for this year.”

Buss acknowledges propane production has seen a 4% increase year over year. “This may appear to be a minimal difference, but the fact that the U.S. exited winter 2020-21 with lower inventory levels means the production-to-export deficit has not allowed for inventory levels to rebuild and match those of 2020.”

“With inventory levels running near the five-year low point and when we consider the production-to-export data — higher exports that exceed production gains — it certainly creates the possibility for a very bullish price scenario this winter,” Buss said. He encourages retail distributors to watch these factors this winter:

- Level of weekly exports — As this rises, propane inventory levels could be depleted even faster. In addition to following export data, watching global weather trends will also help prepare for tight supply.

- International price spreads and logistics — Wider international price spreads between the U.S. and other nations open the door for additional exports. But one key is to also be aware of logistical issues that may be hindering or slowing the export flows, such as time through the Panama Canal and the current situation in British Columbia, where flooding is affecting rail shipments to the Port of Vancouver.

- Regional spot prices — Higher exports and lower inventory levels at Mont Belvieu and Conway do not always mean regional supply will be threatened. It is vital to maintain an active knowledge base of your region’s spot prices and availability.

Transportation & Logistics Concerns

“Our industry’s supply infrastructure is not a church that was built for Easter Sunday,” Kossuth said, noting that supply chain tightness can cause some pricing variability that can get quite volatile, especially in off-market locations far from the major supply hubs. “Trucks can often be pulled from major market hubs to feed areas of strong demand. Truck drivers are scarce resources and our industry is part of the trucking economy.”

Buss remarked, “In prior years, distributors in parts of North Carolina could rapidly tell that supply issues were coming by the number of out-of-state license plates coming into the Apex, North Carolina, terminal.” He said this was the same for storage facilities in Michigan. “The advent of the Marcus Hook trucking racks has helped to delay those movements to the deep south. However, the adage still stands: When a large quantity of out-of-state transport firms start loading in other locations, there could be reason for concern.”

“Transportation turnaround times — or in other words, ‘how long from the time I order the transport does the gas get here?’ — are a big factor,” Farris said. “As (or if) this period extends from one or two days out to five or six days, pressure mounts for retailers to monitor storage and time this transport lag with deliveries to customers. Carriers also have to manage their crew and usually have to rely on temporary Hours of Service (HOS) waivers to maintain the supply chain effectively.”

“Truck lines and wait times are another indication and a cause for delay in turn-around time,” Farris said. “As the number of trucks in line waiting to load grows, it’s a sign that retailer demand is starting to surge past the supply point’s ability to load trucks and turn them around. If this escalates to hours and hours or to the point where retailers need to delay loading bobtails and make deliveries, alternative supply points are looked at and HOS waivers have to enter the discussion.”

The propane industry will be one of many with too few active drivers. “Many firms in the New England area have a bulk plant storage that represents 1% to 3% of their total demand, which means they rely heavily on the transportation market to make sure they have ample supply. Ensuring that you have a transportation solution that is committed to your business will be vital during the coming winter.”

Another issue during a winter of high-price propane and high-price steel is when customers begin calling to switch suppliers or “hunt” for the lower cost product.

Buss agreed companies don’t want to discourage taking on new customers, but he urged caution to protect current clients. “If demand increases due to colder weather and supply tightness due to other factors we’ve discussed, there may be limited excess supply to facilitate new clients with new demand,” he said.

“Every winter it seems there is a slightly different twist or circumstance to create a challenge unique to that winter,” Buss continued. “Hopefully these tips will help you be better prepared to handle whatever twist or turn comes your way.”

Kossuth stressed the importance of communicating early and often with suppliers, transportation providers and secondary suppliers who may be needed during supply chain tightness.

“We need to go into the rest of the winter with eyes wide open! We have a lot of challenges, but production is up, and our supply distribution asset base is stronger than ever. Despite higher prices and tighter supply, we still have a safe, clean and affordable product to distribute everywhere, especially beyond the mains.”