Wednesday, February 4, 2015

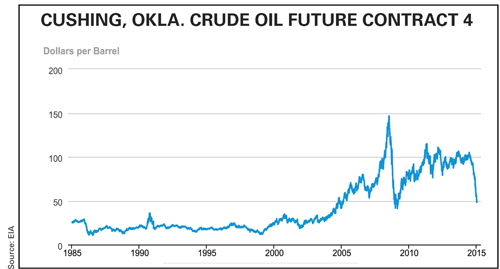

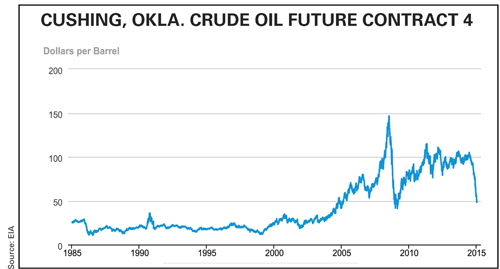

EIA reported Jan. 26 that the sharp decline in oil prices over the last quarter of 2014, which continued in January, is already having a significant effect on drilling activity in the U.S., as shown by the 16% drop in the number of active onshore drilling rigs in the Lower 48 states between the weeks ending Oct. 31, 2014 and Jan. 23, 2015. The agency notes that moving from what has happened to forecasting the future is challenging, in part because market expectations of uncertainty in the price outlook have increased as reflected in the current values of futures and options contracts.  When EIA’s monthly Short-Term Energy Outlook was issued on Jan. 13, the 95% confidence interval for market expectations for prices in December 2015 was extremely wide, with upper and lower limits of $38/bbl and $112/bbl, respectively. The growing uncertainty surrounding oil prices presents a major challenge to all price forecasts. EIA January Outlook forecasts Brent crude oil prices averaging $58/bbl in 2015 and $75/bbl in 2016, with annual average WTI prices expected to be $3/bbl to $4/bbl lower.

When EIA’s monthly Short-Term Energy Outlook was issued on Jan. 13, the 95% confidence interval for market expectations for prices in December 2015 was extremely wide, with upper and lower limits of $38/bbl and $112/bbl, respectively. The growing uncertainty surrounding oil prices presents a major challenge to all price forecasts. EIA January Outlook forecasts Brent crude oil prices averaging $58/bbl in 2015 and $75/bbl in 2016, with annual average WTI prices expected to be $3/bbl to $4/bbl lower.

Should its price forecast be realized, EIA expects that the number of operating rigs will decrease by about 24% from January to October 2015 before beginning to rebound in November 2015. However, the outlook for Lower 48 production reflects more than just the rig count. Other key factors include the efficiency of drilling, which EIA tracks in its Drilling Productivity Report, the rate of decline in production from existing wells, and changes in the amount of time between the start of drilling—spudding—and the completion of the well.EIA comments that the effect of declining crude oil prices on U.S. production, permits, and drilling in North Dakota declined during the financial downturn of 2008-2009, but production rates did not decline as substantially. At the time of the July 2008 oil price peak, drilling activity in the Bakken-Three Forks formations outpaced well completion activity as increasing numbers of wells were drilled. Averaging about 70 days before the oil price peak, spud-to-completion times almost doubled within two months, reaching more than 130 days. This increase created a backlog of wells that had been drilled but not yet completed. As fewer wells were drilled during the subsequent drop in oil prices, the spud-to-completion times decreased. Increased drilling activity in the Bakken since 2011 has once again increased spud-to-completion times, which have stabilized at more than 120 wells per day, almost twice previous minimum levels.

This backlog of wells acts as a cushion for production rates, EIA explains, offsetting the more immediate decreases in drilling and permitting activity. At most major plays in the U.S., the backlog currently ranges from three to seven months. When drilling activity remains at reduced levels long enough to outlast the cushioning effect of the well-completion backlog, the number of new wells brought online will begin to decrease, which can eventually reduce production rates.

While the cushion provided by the well-completion backlog changes from formation to formation, EIA’s forecast of rising crude oil prices in the second half of 2015, if realized, is expected to be companied by a stabilization of drilling activity that would be sufficient to prevent a substantial production decline in the Lower 48 region. Different outcomes are entirely possible under other price scenarios.

Should its price forecast be realized, EIA expects that the number of operating rigs will decrease by about 24% from January to October 2015 before beginning to rebound in November 2015. However, the outlook for Lower 48 production reflects more than just the rig count. Other key factors include the efficiency of drilling, which EIA tracks in its Drilling Productivity Report, the rate of decline in production from existing wells, and changes in the amount of time between the start of drilling—spudding—and the completion of the well.EIA comments that the effect of declining crude oil prices on U.S. production, permits, and drilling in North Dakota declined during the financial downturn of 2008-2009, but production rates did not decline as substantially. At the time of the July 2008 oil price peak, drilling activity in the Bakken-Three Forks formations outpaced well completion activity as increasing numbers of wells were drilled. Averaging about 70 days before the oil price peak, spud-to-completion times almost doubled within two months, reaching more than 130 days. This increase created a backlog of wells that had been drilled but not yet completed. As fewer wells were drilled during the subsequent drop in oil prices, the spud-to-completion times decreased. Increased drilling activity in the Bakken since 2011 has once again increased spud-to-completion times, which have stabilized at more than 120 wells per day, almost twice previous minimum levels.

This backlog of wells acts as a cushion for production rates, EIA explains, offsetting the more immediate decreases in drilling and permitting activity. At most major plays in the U.S., the backlog currently ranges from three to seven months. When drilling activity remains at reduced levels long enough to outlast the cushioning effect of the well-completion backlog, the number of new wells brought online will begin to decrease, which can eventually reduce production rates.

While the cushion provided by the well-completion backlog changes from formation to formation, EIA’s forecast of rising crude oil prices in the second half of 2015, if realized, is expected to be companied by a stabilization of drilling activity that would be sufficient to prevent a substantial production decline in the Lower 48 region. Different outcomes are entirely possible under other price scenarios.