Editor’s Note: Due to the volatility of material pricing in today’s market, please note that the steel price examples listed in this article were valid as this issue went to print in late March.

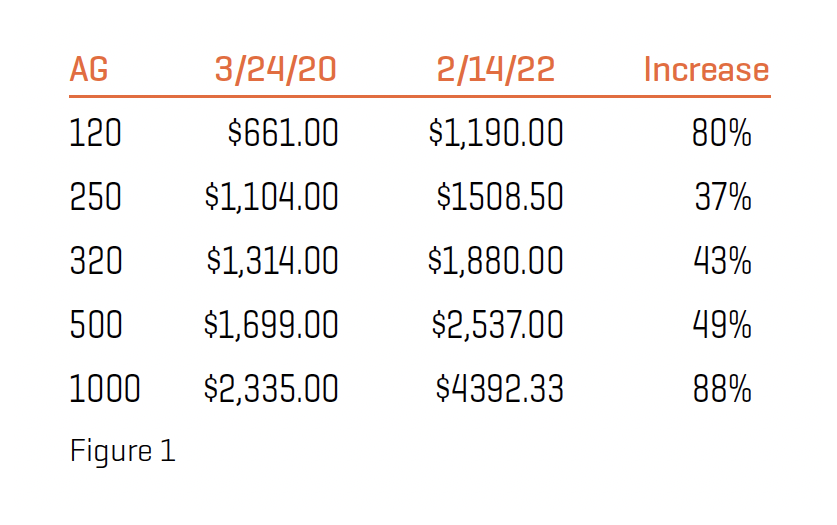

We all know what has happened to steel prices in the last year. The high cost has impacted propane marketers, and the price of some of the more popular propane tank sizes are up more than 80% from two years prior. In addition, wait times for truck loads are more than a year in some locations. Every couple years, Cetane surveys tank prices for completing our clients’ business valuations. Figure 1 is a comparison of 2020 to 2022.

We all know what has happened to steel prices in the last year. The high cost has impacted propane marketers, and the price of some of the more popular propane tank sizes are up more than 80% from two years prior. In addition, wait times for truck loads are more than a year in some locations. Every couple years, Cetane surveys tank prices for completing our clients’ business valuations. Figure 1 is a comparison of 2020 to 2022.

Bobtails are also in short supply. Tracy Timmerman, president of bobtail manufacturer Jarco, confirmed that cold rolled steel prices have gone from around 30 cents a pound in early 2019 to more than 80 cents in 2022. Coupled with supply chain issues, truck prices are up an estimated 30% to 40% — if you can find a vehicle for sale. Timmerman also said, “Planning is key in this environment; axles, electronics and specialty steel or stainless all have lead times in excess of six months. Without aggressive forecasting, the shelves would be bare.”

Regarding costs, he pointed out, “Some suppliers have raised their prices … three times in the last year by multiple [percentages] each time instead of the more traditional 2% to 3% once per year that we had become accustomed to in a more stable environment.”

The Wall Street Journal reported that in some cases, three-year-old used vehicles were selling for their original price. Throw in the cost of propane, inflation and difficulty in finding drivers, and our industry is facing some challenging times.

It might be a comfort that your competitors are in the same position you are. The first step in addressing these challenges from a financial perspective is to quantify them and understand the impact on the bottom line. Smart marketers will review their income statement and make appropriate adjustments; they will likely track down any unused tanks and keep their trucks longer than they may have in the past.

The valuation of a business plays a key role in a sale transaction. The traditional method to value a business is to determine an adjusted EBITDA (earnings before interest, taxes, depreciation and amortization) and multiply it by a factor based on the quality of the business using industry-accepted value drivers, such as percentage of company-owned tanks (tank control), age of vehicle fleet, and real estate, to mention just a few. The multiplier is also affected by factors in the financial markets, which we will explore here.

EBITDA measures cash in (gross profit) and cash out (operating expenses). That is why it is sometimes referred to as cash flow. In 2002, the tax code was changed to allow for what is known as accelerated or bonus depreciation. The code has since been modified to include more assets, and in many cases, it includes vehicles and propane tanks. The challenge for valuators is that the capital expense needed to run a business has increased substantially.

For example, if a company had a $1 million EBITDA three years ago, purchased 200 tanks a year for a $1,000 average cost, and purchased a new bobtail for $140,000, they would have $660,000 — or 66% — left to distribute to their owners before taxes. This is the concept of distributable cash flow (DCF). Public companies set up as master limited partnerships (MLPs) focus on DCF, as do other companies that focus on pretax distribution to shareholders.

If the same company had a $1 million EBITDA with an average tank cost of $1,800 and a bobtail cost of $200,000, that same company with the same earnings would now distribute $440,000 — or 44% — to their owners, or a 33% cut in pay before taxes.

You would think the high price of steel would negatively affect business value; as distributions to shareholders have gone down, so the return on investment has gone down. However, we are seeing the opposite. There are several financial factors keeping business values strong.

Low interest rates is an obvious one, and in addition, the higher values of propane tanks, real estate and vehicles allow acquirers to leverage those assets and borrow at favorable rates. If a buyer can borrow money at 4%, they can buy a company with 12% earnings and come out ahead.

In addition, the continued bonus depreciation has tax advantages that can produce more cash on an after-tax basis. You can even amend your return from last year and carry the depreciation back and receive cash refunds back. As we keep hearing from investors, there is a lot of cash out there looking for a home, and we see this driving up values and activity levels. Another major factor pushing up values is the continued interest in essential businesses by investors as a safe haven for funds.

Many marketers think their company value has risen because the value of the propane tanks they own has increased. They are correct that company values are up, and that the value of their tanks has gone up; but it may not be just because of the price of steel.