If you still do everything in-house, like printing bills, folding and inserting them into envelopes, metering stamps on envelopes and running to the post office, you are handicapping the office efficiencies for these billing functions.

In addition to each step being cumbersome, there are costs involved for the upkeep and maintenance of your equipment for everything you print, for stamp metering and for managing extended mail delivery times. It requires a great deal of time and effort for your employees to perform these mundane tasks which, with the use of technology platforms, can be migrated to a digital environment.

Even if you are sending bills electronically, you may be using antiquated systems for emailing your accounts receivable (AR) communications to your customers each month. You may be taking advantage of volume discounts to qualify for presorted postage, which could reduce the cost of a first-class stamp from 58 cents per unit by 10 cents or more.

Certainly, the labor and time spent for these functions could be better used in more valuable ways. Your customer service and accounting teams could be streamlining processes rather than performing daily accounts receivable functions.

By freeing up the accounting team, you allow them to spend more time interacting with your customers, problem-solving for known issues, delivering value-added services and making additional customer touch points to your client base.

What Benefits Are You Missing Out On?

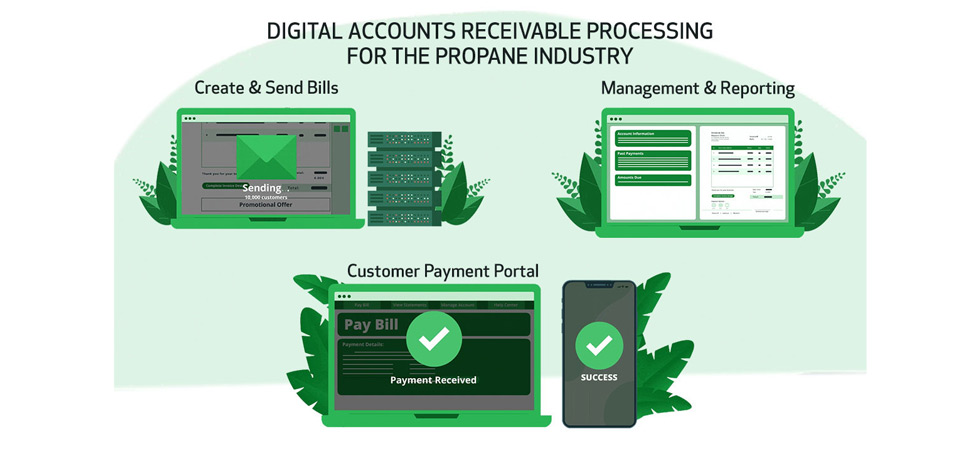

In today’s propane and butane business, efficiency is the key to business success and increased profit margins. Fortunately, there are many digital resources available that can lower your accounts receivable costs, including one-stop solutions platforms that create customized invoices, statements and letters to electronically invoice your customers online.

This will allow you to incorporate digital payments into your billing workflow where your customers can make immediate payments upon receipt of the electronic bill. This is critical in today’s world as it provides prompt payment options while also eliminating the cost associated for paper bills, the potential for your bill to be “lost in the mail,” delivery to an old or incorrect address, or having to wait for weeks to collect payment while traveling through the United States Postal Service system.

Secondly, having a wide array of payment options is incredibly important to your customers. Offering ease of access to accept different consumer-based payment options like PayPal, Apple Pay, Google Pay, SMS Text-to-Pay, e-Wallets or cryptocurrency provide an experience that makes “payments” effortless.

There is also the ability to utilize QR codes on the printed statement to direct them to an immediate electronic payments page from their mobile phone, which encourages adoption of paperless billing with automated billing reminders and payment status updates. With a younger generation of homeowners and business leaders, digital payment options are critical to minimizing days sales outstanding (DSO) and strengthening your cash flow position.

A single solution digital platform will incorporate all of these service options seamlessly into your AR process — and you will not only save money by increasing workflow efficiency, but you may also uncover additional discounts and rate benefits by consolidating your print and mail activities.

How It Works

- You import your data file — automated or manual — to a secure servicing portal where your data files are uploaded to a cloud-based billing platform.

- From your dashboard, you control billing, payment and merchant processor options. Choose which billing methods you want to integrate for your traditional print and mail functions, email, and/or mobile phone using SMS text or notifications. (New billing and payment options become available through the integrations marketplace.)

- Your customers are notified of an open invoice and receive access to a billing portal or guest checkout link where they complete their payment using their preferred payment option. (Customers can also view their payment history and outstanding bills, as well as enroll in autopay to complete their payments.)

- Daily payment reports can be automatically posted to your accounting software through API (application programming interface) or SFTP (SSH file transfer protocol) connection.

When & Why Should You Consider Outsourcing?

If you have 500 or more pieces of mail a month, using a digital solutions platform to manage your accounts receivable workflow can reap significant benefits. You may want to outsource because of the potential savings, in that you will:

- Reduce or eliminate your print and mail expenses

- Reduce lock-box processing fees and service charges

- Access volume discounts for all your mailings

- Free up employees’ time previously spent on AR functions

- Receive faster payments with flexible payment options

- Increase cash flow because of faster AR delivery

- Efficiently service your customers, expand your customer base and thus increase profitability

The best news is that there’s no need to upgrade your current hardware; using digital AR, functions can be set up with your existing infrastructure and technology stack.

The trend in the age of COVID-19 is that today’s propane marketer needs increased accessibility from wherever they are — whether they are working from home or at the corporate office. The beauty of this technology is it works for you and is not dependent on whether you or your staff are present in a physical office space.

So, if you have been hesitating to move your accounts receivable functions to a digital system for fear of losing control over the process or worrying about the expense, it is now both easily accessible and cost-efficient for most businesses.